Running a business comes with its fair share of risks, and insurance claims can be both time-consuming and financially draining.

In this blog post, we’ll explore the most common types of business insurance claims, including property damage, liability, employee-related issues, and more.

We’ll also provide practical advice for business owners on how to avoid these claims and mitigate potential risks.

By understanding the various scenarios that can lead to insurance claims and implementing the right prevention strategies, you can safeguard your business and its long-term success.

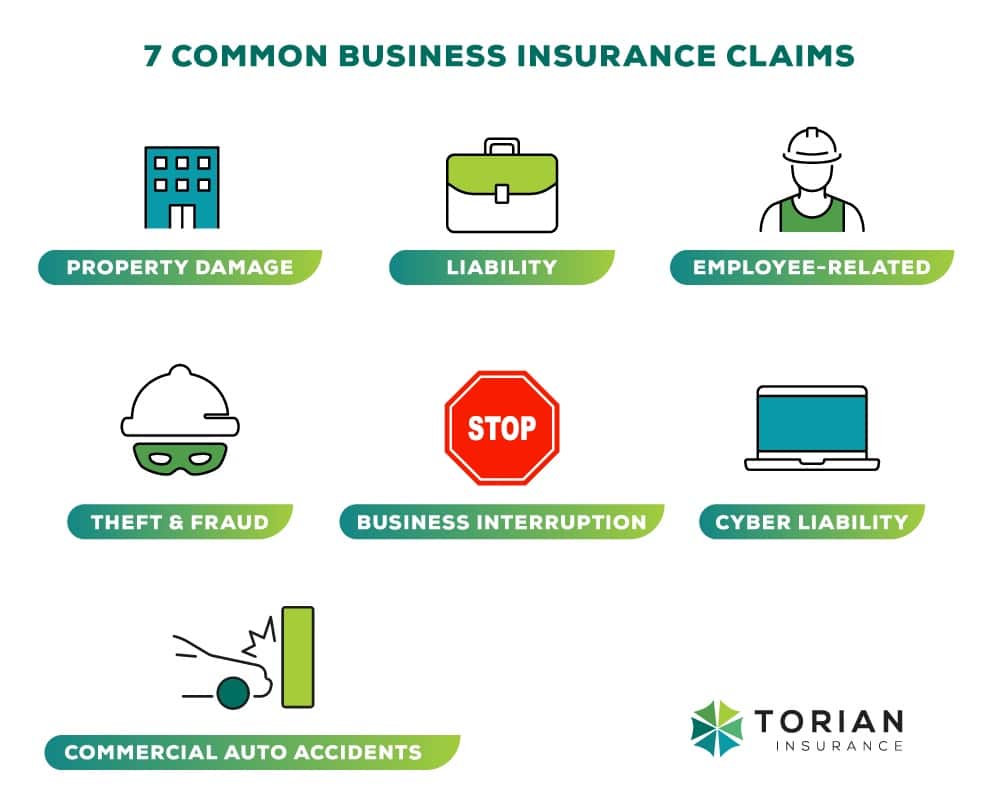

7 Common Types of Business Insurance Claims

Business insurance is an essential part of any business’s risk management plan. Insurance can help protect a company from financial losses due to unexpected events.

By having the right insurance coverage in place, businesses can safeguard their assets and ensure their long-term success.

Here are 7 common types of business insurance claims and how to avoid them:

Property Damage Claims

Property damage claims account for a significant portion of business insurance claims.

These claims can arise from various causes, such as natural disasters (e.g., floods, storms, or fires), vandalism, and accidents.

To prevent property damage, business owners should prioritize regular maintenance of their facilities, install appropriate security measures to deter vandalism and develop disaster preparedness plans to minimize damage in case of unforeseen events.

Security measures, such as surveillance cameras, alarm systems, and secure locks, can help protect your property against vandalism and unauthorized access.

Additionally, a comprehensive disaster preparedness plan should outline procedures for protecting your property, employees, and business operations in the event of a natural disaster or other catastrophic events.

Liability Claims

Liability claims are another common type of business insurance claim that can arise due to various circumstances.

General liability claims can result from customer injuries, 3rd party property damage, or advertising errors.

For example, a customer may slip and fall on your premises or your business may inadvertently infringe on another company’s trademark, resulting in a claim.

Professional liability claims, on the other hand, stem from errors and omissions or malpractice in the course of providing professional services. These claims can occur if a business provides incorrect advice or fails to meet the expected standard of care in their industry.

To minimize the risk of liability claims, businesses should invest in employee training, implement safety protocols, and adhere to professional standards.

Regularly reviewing and updating company policies, as well as ensuring that employees are well-versed in these guidelines, can help reduce the likelihood of such claims. In addition, maintaining a safe and secure environment for customers and clients, along with promptly addressing any identified hazards, can further mitigate potential liability issues.

Employee-related Claims

Employee-related claims happen all the time in different areas of business. Workers’ compensation claims arise when employees experience injuries, illnesses, or accidents while on the job. These claims can be costly for businesses and may result in increased insurance premiums or even legal action.

Employment practices liability claims involve allegations of discrimination, harassment, or wrongful termination. These claims can be damaging to a business’s reputation and may lead to significant financial losses if not properly addressed.

To prevent employee-related claims, implement comprehensive employee training programs focused on safety, communication, and adherence to company policies.

Establish strong HR policies that outline expectations for employee behavior, and create a safe and inclusive work environment for all staff members. By fostering a culture of respect and safety, businesses can reduce the risk of employee-related claims and maintain a positive work atmosphere.

Auto Accidents Involving Company Vehicles

Auto accidents involving company vehicles are another common type of business insurance claim. These accidents can result from driver error, poor vehicle maintenance, or the actions of third parties.

Business owners are responsible for any damages or injuries caused by their company vehicles, making it essential to take preventative measures to minimize risk.

One way to prevent auto accidents is by ensuring regular maintenance of company vehicles. This includes checking tire pressure, fluid levels, and brake systems, as well as scheduling routine tune-ups.

Proper vehicle maintenance not only reduces the likelihood of accidents but also extends the lifespan of the vehicles.

Another critical prevention measure is providing driver training for all employees who operate company vehicles. Training should emphasize safe driving practices, defensive driving techniques, and adhering to traffic laws.

Establishing and enforcing safe driving policies can also help reduce the risk of accidents involving company vehicles. Talk to your insurance agent about a plan for commercial auto insurance and what they recommend for coverage options.

Business Interruption Claims

Business interruption claims are often filed when a company’s operations are disrupted due to unforeseen events.

Common causes for these claims include natural disasters, equipment malfunctions, and supply chain disruptions. These interruptions can lead to significant financial losses, as businesses may be unable to operate without generating revenue during downtime.

To prevent business interruption claims, it’s essential to have a robust business continuity plan in place.

This plan should outline the steps your company will take to resume operations as quickly as possible following a disruption.

Additionally, consider establishing relationships with backup suppliers to ensure the availability of essential resources in case of supply chain disruptions.

Lastly, setting aside emergency funds can provide a financial buffer to help your business stay afloat during challenging times.

Cyber Liability Claims

Cyber liability claims are becoming increasingly common as businesses rely more on digital technology and online transactions.

These claims can arise due to various incidents, such as data breaches, hacking, and phishing attacks. When sensitive information is compromised, businesses may face significant financial losses and reputational damage.

To prevent cyber liability claims, it is essential to implement robust cybersecurity measures that protect your business’s digital assets. This can include firewalls, antivirus software, and secure password practices.

Additionally, employee training on cybersecurity best practices is crucial to help staff recognize and avoid potential threats.

Finally, having a well-defined incident response plan in place will allow your business to react quickly and effectively in the event of a cyber attack, minimizing potential damage and the likelihood of a claim.

Theft and Fraud Claims

Theft and fraud claims can lead to significant financial losses. These claims typically arise from situations involving employee theft, third-party fraud, or embezzlement.

Businesses of all sizes can fall victim to these threats, highlighting the importance of having adequate insurance coverage in place to protect against potential losses.

There are several proactive steps business owners can take to reduce the likelihood of theft and fraud claims.

Implementing internal controls, such as the segregation of duties and access restrictions, can help prevent unauthorized transactions and safeguard company assets.

Conducting thorough background checks on potential employees and implementing regular audits can further minimize the risk of internal theft or fraud.

Additionally, investing in surveillance technology and utilizing robotic processing solutions can help further reduce these risks.

By focusing on prevention strategies when developing your business insurance plan, you can take proactive steps to protect against potential claims.

Tips for Handling Business Insurance Claims

When faced with a business insurance claim, it’s crucial to have a plan in place to handle the situation effectively.

One key aspect is documenting incidents and losses thoroughly. Maintaining accurate records, including photos, videos, and written descriptions, can help support your claim and provide evidence for the insurance adjuster.

Another essential step is reporting the incident to your insurance provider as soon as possible. Early communication with your insurer can facilitate a smoother claims process and help you receive the support you need more quickly.

In almost all cases, the insurance company will also choose an experienced adjuster to handle the claim. A reputable insurance company will work with an adjuster that understands the specific complexities and can address any concerns you may have.

Mitigating Risks Through Customized Insurance Solutions

Each industry has distinct risks, which need to be addressed by specific coverages.

For example, a construction company may require special coverage for equipment and materials, while a healthcare provider might need additional protection for patient data breaches.

Customized insurance solutions play a crucial role in mitigating risks for your business.

Tailored coverage ensures that you have adequate protection for your unique business needs, preventing gaps in coverage that could leave you vulnerable to financial loss.

By partnering with an experienced insurance provider like Torian Insurance, you can ensure that your business is prepared for any potential claims.

Torian Insurance understands the nuances of various industries and can help guide you in selecting the appropriate coverages to protect your business from common insurance claims.

Torian Insurance's Expertise in Business Insurance

Our team of knowledgeable and approachable professionals understands the unique challenges that businesses face and is dedicated to helping them thrive by offering comprehensive and reliable insurance coverage.

Our expertise in business insurance extends beyond standard policies.

We work closely with our clients to understand their specific needs and tailor coverage that addresses their unique risks.

From industry-specific coverages to guidance on minimizing risks and handling claims, Torian Insurance is a trusted partner that empowers businesses to focus on growth while feeling confident that they are protected.

Protect Your Business from Potential Losses with the Help of Torian Insurance

As a business owner, understanding the most common types of business insurance claims and implementing strategies to avoid them is crucial for protecting your legacy and ensuring your company thrives.

By focusing on prevention and having tailored insurance coverage in place, you can minimize risks and create a more secure foundation for your business.

At Torian Insurance, we specialize in providing customized insurance solutions for businesses in the tri-state area of Indiana, Illinois, and Kentucky. Our expertise in business insurance, coupled with our commitment to personalized customer service, ensures you receive the right coverage for your specific needs.

Contact Torian Insurance today. We’ll help you navigate the complexities of business insurance and create a customized plan designed to protect your company’s future.