Liability refers to the legal responsibility that a person or business has for another party. Professional liability insurance (PLI), also called errors and omissions insurance (E&O insurance), is a type of coverage that businesses can purchase to financially protect themselves from risks caused by the professional services they provide.

But before you opt for professional liability insurance coverage, you need to understand how it works. What does a professional liability insurance plan cover? What does it not cover?

Below, we explain the importance, benefits, and use of professional liability insurance. Plus, we explain what is included and not included in your insurance plan.

What Is Professional Liability Insurance?

Professional liability insurance protects individuals and organizations from legal liability associated with their professional activities. In addition, it can help cover the cost of legal defense and any damages that may be awarded in a covered lawsuit.

Typically, these professionals and companies can’t merely rely on their general liability insurance since the plan does not protect against claims arising from professional or business practices. Such claims could include misrepresentation, malpractice, or negligence.

Who Needs Professional Liability Insurance?

Any professional or organization that provides a service or advice to others can be held responsible if their work fails to meet the expected standards. As a result, they may need professional liability insurance. It is important to understand that this is different from general business liability insurance (all businesses need that type of insurance). Only certain industries and businesses will also need professional liability insurance.

Examples of professionals and organizations that typically purchase this type of insurance include:

- Medical Providers

- Contractors

- Accountants

- Architects

- Engineers

- Insurance Agents

- Software developers

- Consultants

- Investment advisors

Depending on the state laws, medical professionals may have to purchase a separate medical malpractice insurance policy. Likewise, state licensing bodies may ask lawyers and other professionals for malpractice insurance. Some laws may also require professionals to disclose this information to their clients or patients.

How Does Professional Liability Insurance Work?

Professional liability insurance can help protect a business’s or individual’s assets if they are sued for damages arising from their professional activities.

For example, let’s say an accountant is accused of negligence and found liable for errors that led to a client incurring significant financial losses. If the accountant has professional liability insurance, the policy can help cover their legal expenses and any damages that may be awarded to the client.

Most professional liability insurance policies have three main components:

Coverage for legal defense costs

It can help pay for an attorney to defend you in court if you’re sued for damages arising from your professional activities.

Coverage for damages

If you’re found liable for damages, the policy can help pay for any awards that a court may order.

Coverage for settlements

The policy can also help pay for settlements that may be reached out of court.

What Does Professional Liability Insurance Cover?

If you’re planning to get a professional liability policy for your practice, you should first understand what it covers. For example, if a dissatisfied client or customer sues you for a mistake you made, your professional liability insurance plan can cover costs for the following.

Work Mistakes and Oversight

A work mistake or oversight is a significant reason people get professional liability insurance. If you make a mistake on a job, such as an error in your work, your policy can help cover the cost of any ensuing legal action.

Sometimes an oversight can be even more costly than a work mistake. For example, if you forget to file an important document or miss a deadline, it could have significant consequences for your client.

Example: You’re an accountant who made a mistake on a client’s taxes. If the client sues you for damages, your professional liability insurance will help cover the cost of your legal defense and any awarded damages.

Undelivered Services

If you promised to provide a service but didn’t deliver, your client could sue you for breach of contract. Once again, professional liability insurance would help with the cost of your legal defense and damages awarded to the plaintiff.

Example: You’re a web designer who agreed to design a website for a client. The client could sue you if you don’t deliver the promised work. If they win, your professional liability insurance will help cover the damages awarded to them.

Missed Deadlines

In most industries, clients are on a strict timeline. If you miss a deadline, it could have costly consequences for your client. They may lose money or even their business.

Example: You’re a tax preparer and are filing tax returns for your client. But you miss the deadline, and the IRS fines your client. Since the client now has to pay additional money, they may sue you. Your professional liability insurance will cover the cost of a lawyer and the amount you have to pay as compensation.

Negligence

You may have to deal with a professional liability lawsuit if a client accuses your business of negligence, like not meeting industry standards. Negligence is serious, especially in healthcare, where a single mistake could have devastating consequences.

Example: You’re an architect designing a building for a company. However, your blueprint doesn’t meet the client’s requirements. As a result, the client accuses you of negligence and files a lawsuit. Your professional liability insurance will cover any compensatory costs.

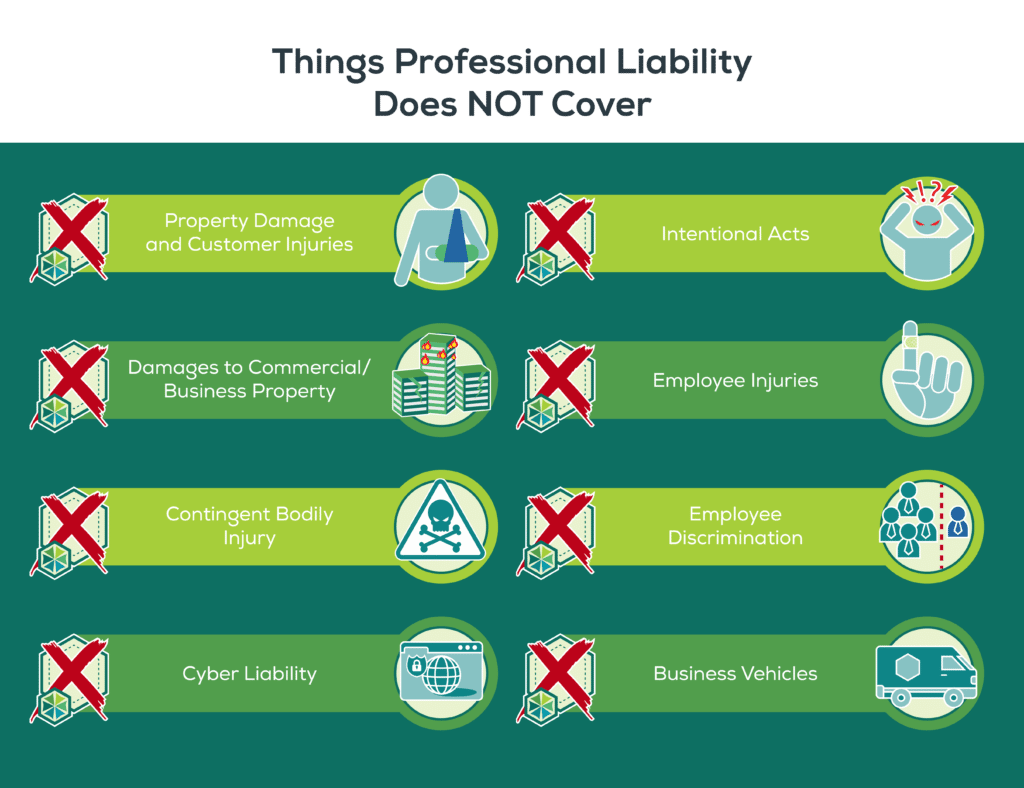

What Does Professional Liability Insurance Not Cover?

Although professional liability insurance will cover you for many risks, it doesn’t include all business-related expenses incurred. The most common risks not covered by professional liability insurance are:

Property Damage and Customer Injuries

If a customer gets injured on your property or if you damage their property, your professional liability insurance will not cover the cost of any resulting claims. To be protected against these types of risks, you’ll need to purchase a separate policy, like general liability insurance.

Example: Let’s say a customer trips and falls down the stairs at your office. They break their arm. If you have general liability insurance, it will cover the customer’s medical expenses, such as medication and physical therapy. However, your professional liability insurance won’t help if the customer chooses to sue you.

Intentional Acts

Since professional liability insurance protects you from negligent mistakes, it won’t cover any damage caused intentionally.

Example: You’re a web designer. A client asks you to design a website for their new business. After you finish the project, they tell you that the site isn’t what they wanted and refuses to pay. In frustration, you erase the entire website. The client sues you for damaging their business.

Damages to Commercial/Business Property

Many natural and man-made disasters can destroy or damage your business property, such as a fire, severe weather, theft, etc. But since professional liability insurance only protects you from third-party claims, it won’t cover any damages to your property. You will need to consider commercial property insurance to protect your business.

Example: Your office suffers water damage after a pipe burst. Since professional liability insurance does not cover property damage, you’ll need property insurance, which is a part of your business owner’s policy.

Employee Injuries

If an employee is injured while working, they can file a workers’ compensation claim. Worker’s compensation insurance will cover their medical expenses and lost wages.

Note that workers’ compensation is not included in professional liability insurance.

Example: One of your employees cuts their hand while unpacking boxes in your office. They decide to file a workers’ compensation claim, and your worker’s compensation policy covers their medical expenses and lost wages. However, if the employee sues you for negligence, your professional liability insurance will not cover the cost of legal defense or settlement.

Contingent Bodily Injury

A contingent bodily injury is an injury that occurs as a result of your product or service. For example, if a consultant creates a list of safety practices and procedures for a company, yet an employee gets injured during safety training, the company can sue the consultant.

Contingent bodily injuries are not covered by professional liability insurance. If you want to be protected against this type of risk, you’ll need product liability insurance.

Example: You own a bakery. One of your customers buys a cupcake and gets food poisoning. They decide to sue you. Since professional liability insurance does not cover contingent bodily injuries, you’ll have to pay the legal costs out of pocket.

Employee Discrimination

Employee discrimination means treating an employee or job applicant unfairly because of their race, color, religion, sex, national origin, disability, or age. If an employee sues you for discrimination, your professional liability insurance will not cover the cost of any resulting claims.

Instead, you’ll need employment practices liability insurance to cover the expenses related to harassment, wrongful termination, or discrimination lawsuits.

Example: You own a small business with ten employees. One of your employees over the age of 40 accuses you of discrimination or age bias. They say you only promote younger employees, and they were passed over for a promotion because of their age. If the employee sues you, your professional liability insurance will not be of any use.

Cyber Liability

Cyber liability refers to an organization’s legal responsibility for its employees or its actions in cyberspace. It also includes the financial losses that may result from a cyber-attack or data breach.

Organizations today increasingly rely on technology and the internet to conduct their business operations. However, this reliance also exposes their businesses to the risks of a breach. Keep in mind that professional liability insurance will not cover cyber liability.

Example: You run a small business that provides bookkeeping services to clients. One of your employees accidentally downloads a virus that corrupts all the files on your network, including your clients’ records. As a result, several clients sue your business for negligence and professional malpractice.

Business Vehicles

Many businesses and professionals use vehicles to transport equipment, products, or people. Unfortunately, if you or one of your employees causes an accident while driving a business vehicle, your professional liability insurance will not cover any damages.

You’ll need commercial auto insurance instead. However, you should opt for hired and non-owned auto insurance if your business uses leased or personal vehicles.

Example: An employee at your company is driving a business vehicle and hits another car. The other driver decides to sue your company. Your professional liability policy will not cover the legal costs.

General Liability vs. Professional Liability Insurance

When searching for professional liability policies, you’ll come across two types of coverage: general liability insurance and professional liability insurance. Both types of insurance are designed to protect businesses, but they cover different risks.

Similarities Between Professional and General Liability

The main similarity between both types of insurance is that they deal with unavoidable liabilities. When you’re running a business, there’s always going to be a chance that someone sues you or that you’re liable for damages.

In that case, general and professional liability policies can come to your financial rescue. Another similarity between the two is that client contracts might require them.

For instance, if you’re a construction contractor, you shouldn’t be surprised to see professional and general liability insurance as a requirement by the project developer. The same applies to other industries, too. Many clients require professionals to have liability policies to cover any potential lawsuits.

Another similarity is the amount of coverage that each policy offers. The limits are usually the same between the two policies. Sometimes general liability insurance limits are higher.

Differences Between Professional and General Liability

Although they both protect businesses from oversights and unintentional harm, professional and general liability policies differ in a few regards.

For one, they cover varying risk exposures. General liability insurance protects businesses against primary liabilities, such as a customer or employee getting injured. For example, general liability will cover medical expenses if a customer is injured on your property.

On the other hand, professional liability insurance covers risks arising out of the services that you provide. For instance, if you’re an accountant and make a mistake in your client’s taxes which leads to an audit, professional liability will kick in.

It’s mainly due to the high legal costs. Plus, you may also be required by the court to pay compensation to the plaintiff.

Additionally, professional liability insurance covers a business’s financial damages, while general liability provides coverage for physical damages.

In some cases, general liability policies may have product liability insurance, too. It is ideal for retailers, manufacturers, and construction professionals since it covers damages incurred due to any physical damage.

Meanwhile, professional liability insurance is ideal for any business that provides advice or services. However, if you want coverage for both general and professional liabilities, you might have to purchase a separate policy or a business owner’s policy (BOP). Most BOP’s include property and general liability, but usually do not include professional liability.

Lastly, the claims process is different for each type of policy. With general liability, the insurer will likely pay for the damages when a business is found at fault and that negligence is the cause of the injury or the damage.

However, with professional liability, the insurer also pays when the business is negligent but most likely that negligence has caused a financial loss, not a physical one.

How Much Does Professional Liability Insurance Cost?

The cost of professional liability coverage depends on several factors.

Frequency of Lawsuits

Some industries are more likely to be sued than others. For example, a doctor may be more likely to be sued for malpractice than an accountant for errors and omissions. The insurance company takes this into account when calculating premiums.

Size of Business

Larger businesses are usually charged higher premiums because they have more exposure to lawsuits. A larger business also means more employees, which increases the probability of potential claims.

Location

Some areas are known for having more lawsuits than others. Therefore, you can expect to pay higher premiums if your business is located in one of these areas.

Claims History

If you have been sued in the past or have had claims filed against your policy, you will likely pay higher premiums. The insurance company will calculate the risk of insuring you based on your claims history.

Duration in Business

How long you have been in business also affects professional liability insurance rates. Start-ups are often seen as higher risk and will pay higher premiums.

Meanwhile, more established businesses with good track records are considered lower risk. Thus, insurance companies charge them lower premiums.

Final Words

Professional liability insurance is a must-have for tech-based services, construction professionals, healthcare providers, and other industries where one mistake could result in a costly lawsuit. If you’re starting a business or expanding your operations into new areas, make sure you have the right professional liability coverage to protect your assets.

For professional liability insurance, there’s no such thing as one size fits all. Instead, the right policy for your business will depend on various factors, including the type of work you do, the size of your company, and the jurisdictions in which you operate.

Choosing the right professional liability insurance policy can be complex, but our experts can help you find the coverage you need at a price that fits your budget.

At Torian, we ensure our clients have peace of mind knowing we’re always here to help. We also offer bundle discounts on your insurance needs to help you save money.Get in touch with us today to find a professional liability policy for your needs.