In today’s business world, protecting yourself and your assets is crucial. If you’re a business owner, understanding the differences between general liability and professional liability insurance is essential to ensure you have the right coverage.

In this article, we will explore the key distinctions between general liability and professional liability insurance. Furthermore, we will showcase Torian Insurance’s expertise in providing customized insurance solutions that cater to your unique requirements.

So, let’s dive in and unravel the complexities of liability insurance, making it a breeze for you to secure your future.

Understanding General Liability Insurance for Business

General liability insurance, often referred to as business liability insurance, is designed to protect businesses and organizations from a wide range of potential risks. Its primary purpose is to cover claims arising from bodily injury, property damage, and personal or advertising injury caused by a business’s operations, products, or premises.

This type of insurance can safeguard businesses from financial loss in case of accidents, injuries, or other incidents that may occur during daily operations.

Coverage provided by general liability insurance typically includes medical expenses, legal defense costs, and settlements or judgments that arise from a covered claim.

Examples of situations where general liability insurance is necessary include a customer slipping and falling on a wet floor in a store, damage to a client’s property caused by an employee, and advertising errors that result in a copyright infringement lawsuit.

Having general (or business liability) coverage can help protect businesses from significant financial consequences related to these events.

Understanding Professional Liability Insurance for Business

Professional liability insurance, also known as errors and omissions (E&O) insurance or business indemnity insurance, is specifically designed to protect businesses and professionals against claims arising from negligence, mistakes, or failure to provide the expected level of service.

This type of insurance is particularly important for service-based industries where clients rely on the expertise and advice provided by professionals.

Coverage provided by professional liability insurance typically includes legal defense costs and potential financial settlements or judgments arising from claims. It is important to note that professional liability insurance does not cover intentional wrongdoing, criminal acts, or claims related to bodily injury or property damage.

Examples of situations where professional liability insurance is necessary include a financial advisor providing incorrect investment advice, an architect designing a structurally unsound building, or a software developer delivering a faulty system that leads to financial losses for the client.

Professionals in fields like healthcare, legal services, and consulting typically require professional liability insurance to safeguard against potential claims and lawsuits resulting from their services.

Key Differences Between General Liability and Professional Liability Insurance

General liability and professional liability insurance serve to protect businesses from different types of risks.

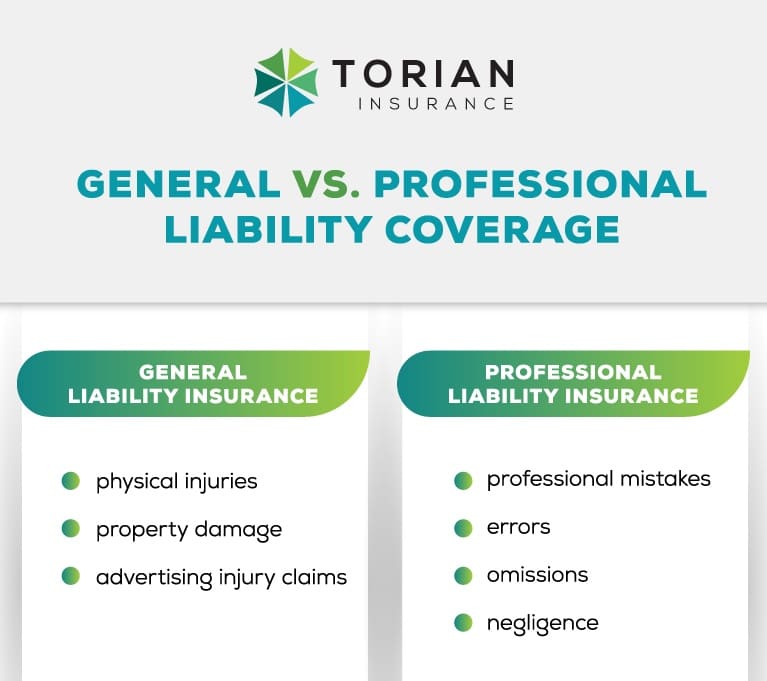

Coverage

General liability insurance covers physical injuries, property damage, and advertising injury claims resulting from business operations. On the other hand, professional liability insurance specifically covers claims arising from professional mistakes, errors, omissions, or negligence in the services provided by your business.

Cost

Cost differences between general liability and professional liability insurance depend on various factors, including the nature of your business, its size, and the level of risk involved. In general, professional liability insurance tends to be more expensive due to the higher potential financial impact of claims related to professional mistakes or negligence.

It is essential to compare quotes and coverage options for both types of insurance to make an informed decision and ensure adequate protection for your business.

Determining Which Type of Liability Insurance is Right for Your Needs

To determine which type of liability insurance is right for your needs, it’s essential to assess your specific risks and potential liabilities. Take into consideration the nature of your work, the services you provide, and the likelihood of encountering legal claims.

For instance, businesses with frequent customer interactions may benefit from general liability insurance, while professionals providing specialized services, such as consultants or architects, may need professional liability insurance.

Evaluating the financial impact of potential lawsuits or claims is another crucial factor in deciding on the appropriate coverage. Consider the costs associated with legal defense, potential settlements and any negative impact on your reputation. Remember that, in some cases, both general and professional liability insurance may be necessary to fully protect your business or personal interests.

Legal Requirements for Obtaining Liability Insurance

In some instances, obtaining general or professional liability insurance may be legally required, depending on your specific industry or location.

For example, general liability insurance is frequently mandated for construction companies, while professional liability insurance is often compulsory for professionals such as doctors, lawyers, and architects. State regulations and licensing boards typically establish these requirements to ensure adequate protection for clients, customers, and the general public.

Failing to meet these legal requirements can result in serious consequences, including fines, loss of licensure, or even the closure of your business. Furthermore, not having the necessary liability insurance in place can leave you financially vulnerable in the event of a lawsuit or claim.

It is crucial to understand the specific requirements for your profession or industry and to ensure compliance with all relevant regulations.

Consulting with an insurance professional can help you navigate these requirements and select the appropriate coverage for your situation.

Torian Insurance's Has Customized Insurance Solutions

Understanding the differences between general liability and professional liability insurance is crucial to ensuring that you have the right coverage for your specific needs. By assessing your risks, evaluating the financial impact of potential lawsuits, and consulting with an insurance professional, you can make an informed decision on the type of liability insurance that best suits your situation.

At Torian Insurance, we understand that each individual, family, and business has unique insurance needs. That’s why we’re committed to providing personalized insurance consultation and assessment services.

As a trusted independent insurance agency, Torian Insurance is committed to helping you protect your legacy with personalized insurance solutions. We pride ourselves on our expertise in providing insurance solutions in Indiana, Illinois, and Kentucky. Our deep understanding of the local market and insurance requirements in the tri-state area enables us to offer comprehensive and customized insurance policies, ensuring you have adequate protection against potential liabilities.

Our team of experienced professionals takes the time to thoroughly understand your specific circumstances and tailor coverage options to best protect what matters most to you.

Reach out to Torian Insurance today and let us help safeguard your hard-earned assets with the appropriate liability insurance coverage for your business.