Business-related mishaps happen all the time, even when you’re prepared for them. That’s why you need to be protected from potential lawsuits against your business that could trigger unexpected expenses.

Injury and damage claims can be disastrous for small and independent businesses, but with business liability insurance, you’re financially protected in the case of claims made against you or your company.

Business liability insurance helps pay for legal fees, medical bills, and other claims that your company may be faced with. Without business liability insurance, you could be held financially responsible for all injuries and damage that occur within the business’s operation. These types of claims can cost as much as $50,000, if not more.

These litigation costs can be detrimental to any small company, but a monthly insurance payment can help your business avoid tens of thousands of dollars in legal fees down the road. Purchasing business liability insurance is one of the best ways to ensure the protection of your company.

Why Is Business Liability Insurance Important?

Businesses are faced with lawsuits every day. It’s impossible to secure your property and business against all the mishaps that can take place. A customer could slip and fall on your property, or you may be sued by one of your employees. Even a well-managed company can be faced with litigation due to unforeseen incidents.

Owning a business isn’t just your way of earning income. It’s a passion and a livelihood. Liability claims can destroy everything that hard-working business owners like you have worked toward. Protecting your business from instances such as injuries and damage is essential to having peace of mind and confidence in running your operation.

Technology and judicial case law are always changing. Evolving business practices and laws make having business liability insurance especially important. No matter what changes occur in the business sector, you can remain confident that your insurance company has your back by protecting your financial investments.

Business liability insurance is a crucial safety net for your everyday livelihood.

What Types of Business Liability Insurance Are There?

General liability insurance varies depending on which insurance company you choose. Each insurer has different terms, conditions, and requirements. It’s crucial that your insurance company not only fits the needs of your current business, but that it can also evolve as policies, laws, and your business grow and change over time.

Alongside business liability insurance, there are other liability insurance types that you may find useful for risk management. Here are some examples:

- General Liability Insurance protects you from any personal injuries that may occur as well as coverage for things such as medical payments, advertising injuries, and more.

- Professional liability insurance protects you from claims made by customers who are unhappy with your services.

- Management liability insurance protects your business from claims relating to wrongdoings within your management team.

- Cyber liability insurance protects your business from financial losses resulting from cybercrimes.

The numerous types of general liability insurance can make the decision process overwhelming. Talking to an insurance agent is the best way to evaluate different policies and find the best business liability insurance for your unique business.

Who Needs Business Liability Insurance?

In today’s uncertain and litigious world, businesses face liability claims every day. Business liability insurance is vital because it can help you manage these risks and cover the financial losses in the event of litigation or a settlement to avoid litigation. It allows business owners like you to protect your assets and livelihood.

If your business is ever responsible for damage or injury, you may be subjected to catastrophic legal fees. This financial burden could potentially ruin your business if you’re forced to pay for all the damages yourself. That’s why business liability insurance is so essential — it protects you from incidents that could happen on any given day.

What Are the Benefits of General Liability Insurance?

A bonus to having general liability insurance is that it legitimizes your business. It lets your associates and partners know that your business is well-established and maintained. These are just a few of the benefits that your business will have other than a safety net for injury and damage:

Your business is well-established. To customers and competitors, general liability insurance signals that you’re planning for your business to be around for a long time. Long-term businesses don’t want to threaten their future. They’re careful to avoid potential claims. Being properly insured signals that your business is trustworthy, takes its operations seriously, and is committed to its goals.

Your business is responsible. Having general liability insurance shows customers that you’re willing to take responsibility in the case of accidents, injuries, or damage that happens during business operations. It shows that you want to protect both your business and the customers from any incidents that may occur. It offers assurance — just like ensuring your property is up to code and has a secure infrastructure so customers have a smaller chance of injury.

It increases client contracts. To clients, having general liability insurance is a requirement for working with them. Customers don’t want to be held responsible for your mess-ups. Having this safety net sends a message to your clients that you don’t want to deal with claims. You have a higher business standard in place to avoid them. It shows that your business is trustworthy.

General liability insurance signals to clients and competitors that your business is safe, well-established, trustworthy, and responsible. Every legitimate business should have a great reputation. General liability insurance helps you achieve it.

Is Business Liability Insurance Required by Law?

In some states, you may be required to purchase professional liability insurance. Business liability insurance, on the other hand, is not legally required in most states. Worker’s compensation is handled at the state level and it’s requirements will vary depending on the location.

However, every business needs general liability insurance to be successful. It not only protects you from potential legal claims, but it also signals to your clients that you hold your business to a high standard, run a trustworthy business, and take the safety of your employees and customers seriously. It increases your business’s reputation in the community, as well as within the specific industry you operate in.

For example, if you own a coffee shop that’s known for its high-quality ingredients and newly renovated cafe space, this will bring more customers into your cafe. Customers know your cafe will keep them physically safe and healthy, making them more likely to order more, stay a while, and recommend your shop to their friends. It will also let nearby competitors know that you take your business seriously.

General liability insurance works in a similar way by legitimizing businesses and keeping them protected against financial damages. This can make running your business smoother and more successful in the long run.

A local insurance agency can help you navigate the insurance requirements for your state. An insurance agent can also find you the best rates and insurance deals by acting as a middleman between your business and large insurance companies.

Having general liability insurance should be a priority for your business. Additionally, having a local insurance agency with personalized expertise in the field will allow you to find the best deals for your unique company.

What Does Business Liability Insurance Cover?

Business liability insurance protects your business from claims that would normally fall on you to manage financially. This type of insurance covers many different kinds of damage and injury.

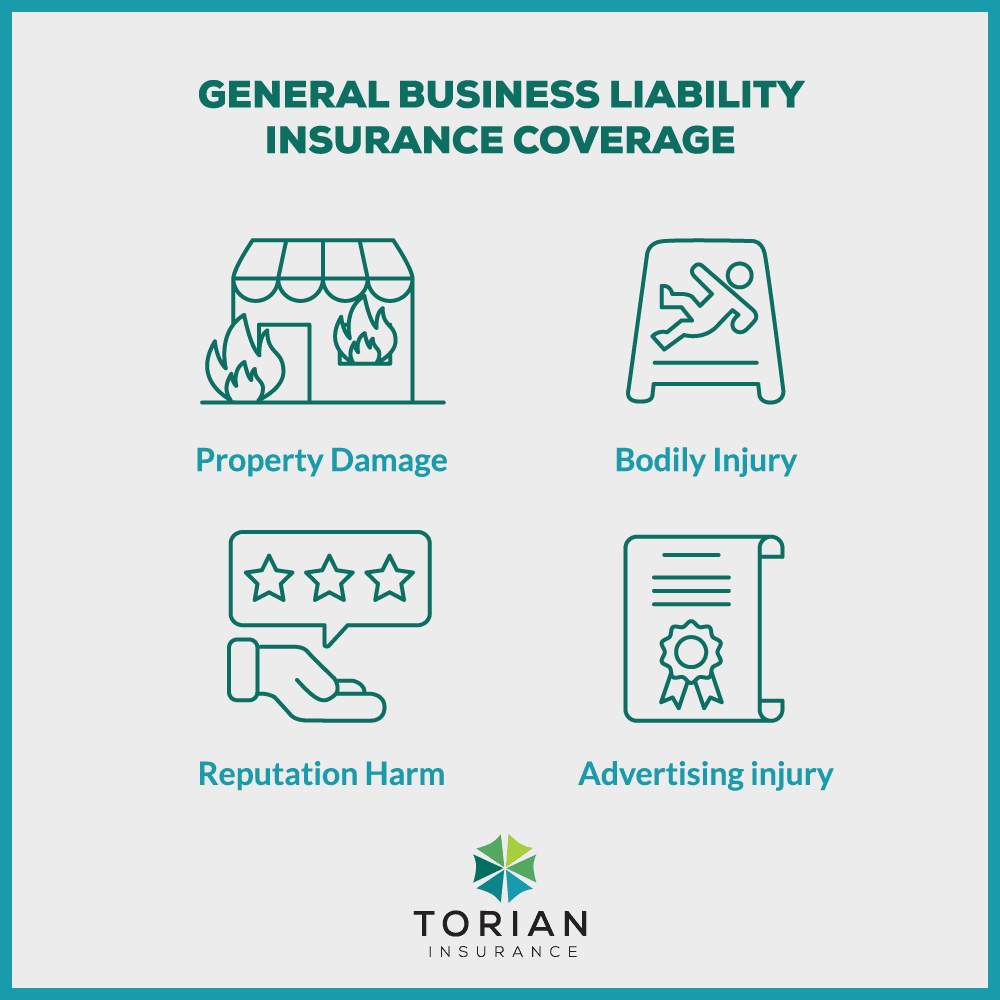

Here are some examples of what is typically covered:

Property damage. This can happen if your business is responsible for damage to someone else’s personal property or if your business damages the property of others. An example would be if someone’s belongings are stolen while visiting your business, or if the house your construction company is building becomes damaged during the project.

Bodily injury. If an injury occurs while someone is visiting your business, general liability insurance can cover their medical costs. A common example is slips and falls that happen to customers within the business’s property that result in injury. The medical treatment necessary for these injuries may be the subject of a lawsuit against your company.

Reputational harm. This claim can occur if you say something about another company that damages its reputation in the public eye. An example would be if you’re quoted by a local newspaper telling falsehoods about a competitor’s service or practices in an attempt to damage their business financially.

Advertising injury. This sort of claim typically deals with defamation. It can happen if your business defames another organization or business owner. Copyright infringement, libel, slander, and stolen ideas are all types of advertising injury.

These claims aren’t cheap. A slip-and-fall claim can cost a business as much as $20,000. Reputational harm lawsuits can skyrocket to as much as $50,000 in costs. Business liability insurance protects your business from these costly claims.

What’s Not Covered by Business Liability Insurance?

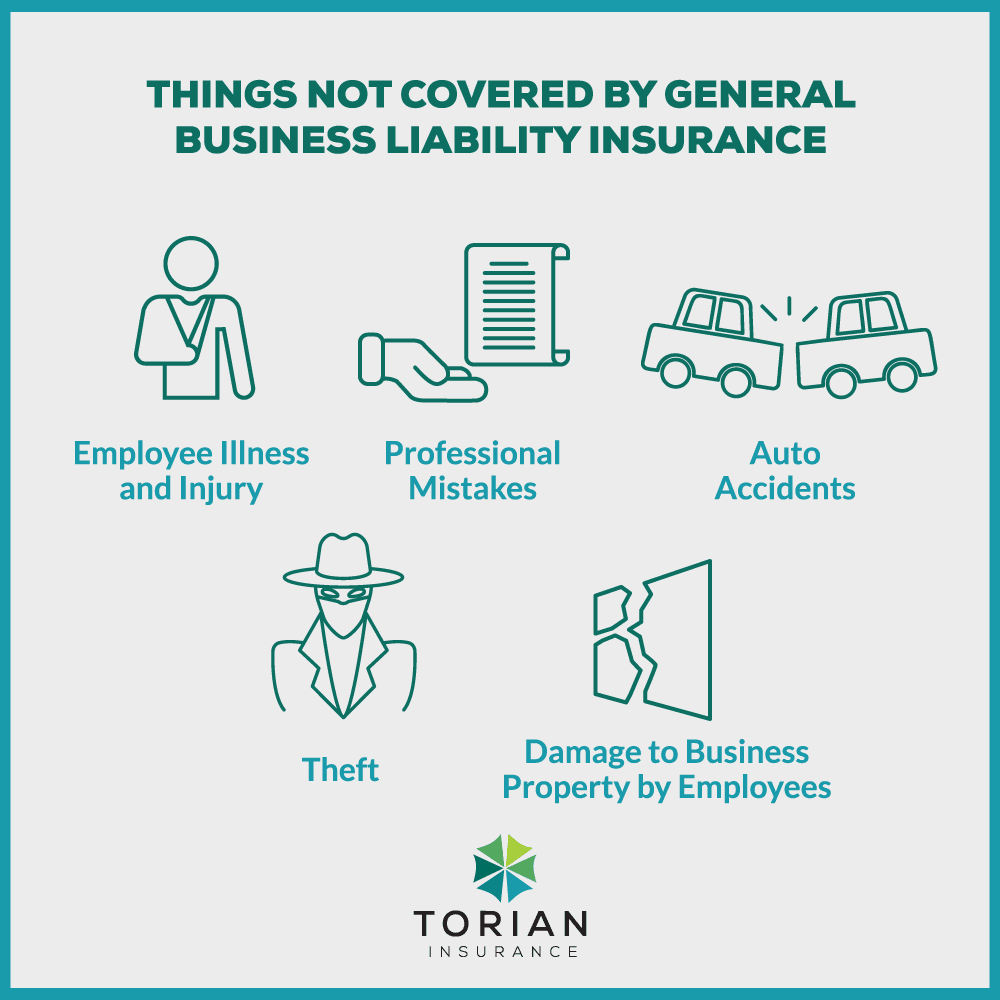

General liability insurance covers many claims, but it doesn’t cover everything. It’s important to know what your business liability insurance covers and what it doesn’t in order to be prepared.

Here are some examples of what is typically not covered by this insurance type:

- Employee illness and injury

- Professional mistakes

- Auto accidents

- Theft

- Intentional acts

- Criminal acts

- Wrongful employment practices

- Damage to your business property by you or your employees

There are alternate insurance types that cover what general liability insurance doesn’t cover. Here are some examples:

- Workers’ compensation insurance

- Commercial auto insurance

- Commercial property insurance

- Professional liability insurance

- Errors and omissions insurance

Insurance of any kind — general liability and other types — won’t cover illegal or intentional acts by you or your employees. However, commercial crime insurance protects you from financial losses that result from theft, forgery, money laundering, embezzlement, and fraud. Crime insurance, in addition to business liability insurance, can aid you in managing the risks that come with owning a business.

How Much Does Business Liability Insurance Cost?

The cost can vary depending on what type of business you own, the location, the market, and even your business’s financial history. On average, business liability costs are typically a minimum of $350 to $500 annually.

General liability insurance is almost exclusively rated based on the class of business and either gross annual sales or payroll. The following factors can make minor differences once the class and exposure are determined:

- Business type

- Business age, size, and location

- Policy details

- Deductibles

- Insurance claims history

- Policy limits

- Number of employees

A business owner’s policy is a combined form of insurance that includes general liability insurance, business interruption claims, and commercial property insurance. This is more expensive than business liability insurance on its own, but it bundles multiple insurance types so you get the most protection for a combined cost. The average cost of this policy is $53 per month for small businesses.

The cost of business general liability insurance, whether it’s general liability insurance or a bundled business owner’s policy, is worth it. For a small payment each month, your business is protected from potentially thousands of dollars of legal claims. These lawsuits can devastate a business, so a financial safety net is a great investment.

Is General Liability Insurance Tax-Deductible?

General liability insurance for business is tax-deductible. Since it’s considered part of the cost of owning a business, it can normally be written off during tax season.

According to the Internal Revenue Service, as long as the insurance type is a necessary business expense, it can be fully deducted. At times, personal and business expenses can blur. This can happen when your business operates from within your home or when your vehicle is used for both personal and professional use.

Make sure that these personal expenses are left out of your tax write-offs. You can do this by separating the mileage used for business versus personal use. If you’re unsure, consulting a tax professional will ensure the numbers are accurate on your tax forms.

How Is the General Liability Premium Calculated?

The general liability insurance premium is calculated by taking numerous different factors of your business into account. By compiling factors such as the size, location, number of employees, and financial history, insurance companies rate your business based on risk. The bigger the company, the bigger the risk of a claim arising.

This is also why bigger companies pay more for their liability insurance — they’re more likely to face litigation than smaller companies that pay for the same type of insurance. Different insurance companies may calculate risk differently, so it’s important to get quotes from multiple insurers before making your final decision.

What’s the Difference Between General Liability and Professional Liability Insurance?

Professional liability insurance protects you from negligence claims regarding your company’s professional services or advice.

With professional liability insurance claims, for example, your company might act as a consultant that gives new startups financial and business advice on how to grow their company. If your client’s business suffers financially due to your suggestions, it may sue for negligence. This is where professional liability insurance would step in and protect you from these types of claims.

General liability insurance doesn’t protect you from consulting and advising negligence claims. It instead protects you from claims involving bodily injury, reputational harm, copyright infringement, advertising injury, and damage to others’ property.

While professional liability insurance protects you against negligence claims due to spoken or written services, general liability insurance protects you against physical claims of damage to property, medical claims, defamation claims, and more.

What Are the Risks of Not Purchasing Business Liability Insurance?

Not paying for commercial general liability insurance for your company is a huge risk that can have devastating consequences. Court costs, final judgments, and lawyer fees can be extremely expensive. And legal guidance isn’t the only price you’d need to worry about. Even if a lawsuit is eventually dropped, the price of going to court could put you thousands of dollars in debt. These extreme costs can even lead to bankruptcy.

Purchasing business liability insurance helps to ensure the safety of your company. Having documented proof of your general liability insurance is also crucial, so make sure your certification of insurance is documented along with the insurance’s policies, requirements, and limits.

Liability insurance for business protects your employees as well as yourself from financial losses. If you’re faced with a claim and don’t have business liability insurance, your employees may be subjected to wage drops or termination as a result of your company’s losses during a court case. The risks of not having general liability insurance are potentially devastating, not only to you but also to employees who are as invested in your company as you are.

Help Your Business Stay Financially Secure With Business Liability Insurance

Business liability insurance is the crucial backbone of every business. When you’re faced with potential lawsuits, ensuring your company’s financial stability is one of the most important ways you can protect the future of your business.

Business liability insurance allows you to fulfill your dream of starting your own major company, opening your own local bakery, and everything in between. By covering the financial costs associated with lawsuits and claims that could happen at any time, you can continue everyday business without being subjected to that kind of substantial financial burden.

If you’re looking for business liability insurance and are unsure where to start, Torian Insurance can offer expert guidance and protection for your business. Torian is an independent agency that serves businesses in Indiana, Illinois, and Kentucky. In addition to our expansive insurance coverage and employee benefits, we look out for your company as a whole. Torian knows how precious business ownership is. No lawsuits should get between you and your business dreams. Whether you own a small business or a large company, Torian Insurance wants to protect what you’ve worked so hard to create, maintain, and grow. We’ll be a present and hands-on contributor to your business’s well-being, no matter the scale. Demand only the best protection for your business.