In the world of construction, where the stakes are as high as the structures built, Errors & Omissions (E&O) insurance emerges as a crucial safety net for contractors.

It’s not just about having the coverage; it’s about understanding how to navigate the complexities of E&O insurance claims when risks become realities.

This step-by-step guide aims to equip construction professionals with the knowledge and strategies needed to handle these claims efficiently and effectively.

Recognizing the Importance of E&O Insurance for Contractors

Errors and Omissions (E&O) insurance, also known as professional liability insurance, is an essential safeguard for contractors operating within the highly intricate and risk-prone construction industry. This specialized form of liability insurance is designed to protect professionals against claims of negligence, mistakes, or oversights that could potentially occur during the course of their work.

E&O insurance is typically recommended for contractors working on projects that require specialized skills and knowledge, where errors or omissions could result in significant financial losses to the contracting party.

The types of risks covered by E&O insurance are vast and varied, including design flaws, construction defects, and misinterpretation of project specifications, among others.

Contractors might find themselves facing claims that allege the provided work failed to meet contractual promises or industry standards. By having E&O insurance, contractors can mitigate these risks, as the policy typically covers legal fees, settlements, and judgments, thus preserving the contractor’s financial stability and reputation in the industry.

The Claims Process: A Step-by-Step Guide

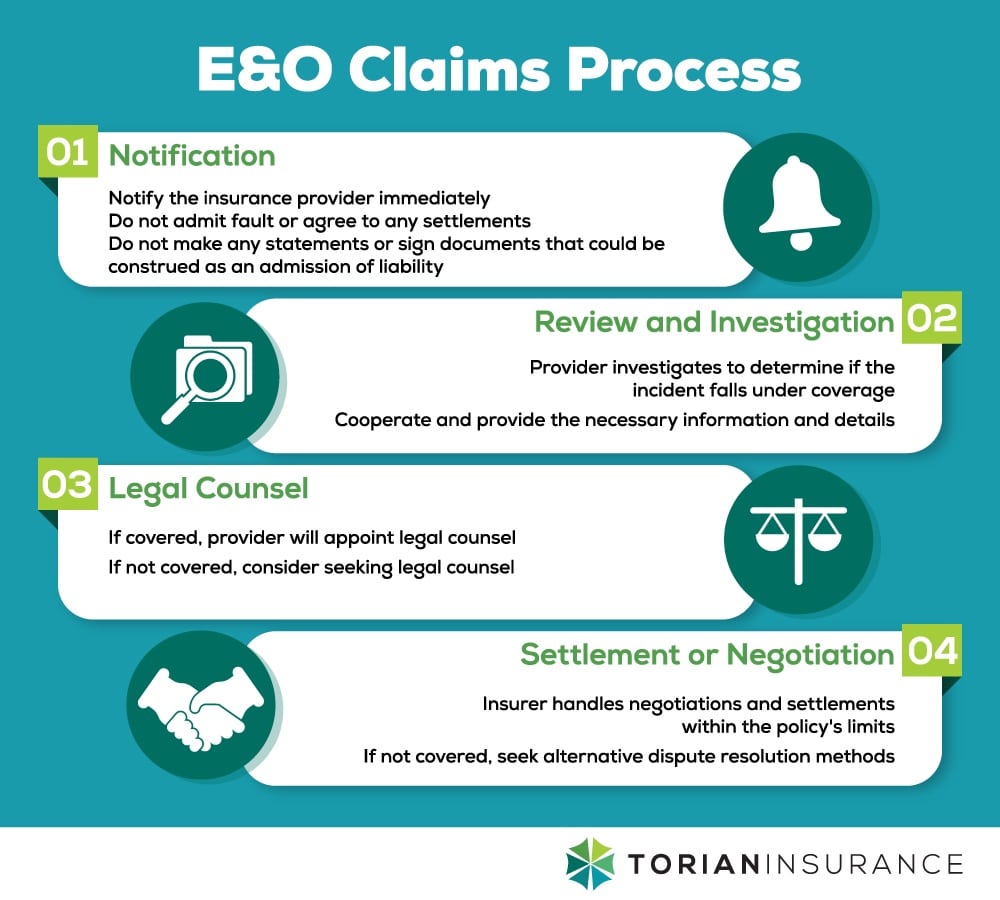

Once a contractor notifies their insurance provider of an E&O claim or potential claim, the claims process begins. This section will provide a step-by-step guide on what contractors can expect throughout the claims process, from the initial notification to the resolution of the claim.

It will also provide insights into how contractors can work with their insurer to achieve the best possible outcome.

Step 1: Notification

Immediate Actions to Take When Facing an E&O Claim

When a contractor is confronted with an Errors and Omissions (E&O) insurance claim, time is of the essence. The first critical action is to notify the insurance provider immediately upon learning of a claim or a potential claim. This swift response enables the insurer to start their investigation as soon as possible and arrange for the necessary defense if the claim is legitimate.

Careful Considerations with E&O Claims

Contractors must also be careful not to admit fault or agree to any form of settlement without the consent of their insurance provider. Doing so can violate the terms of the E&O policy and potentially jeopardize coverage. The consequences of such premature actions could be severe, resulting in denied claims or out-of-pocket expenses for settlements and legal fees.

Similarly, contractors must avoid making any statements or signing documents that could be construed as an admission of liability. All these actions could potentially harm the contractor’s chances of a favorable outcome in defending against the claim.

Step 2: Review and Investigation

What to Expect from Your Insurer

Upon notifying your insurer about a potential E&O claim, they will undertake a thorough review of the incident in question. The insurer’s initial task is to ascertain if the event or error falls under the coverage provided by your policy.

This determination is critical as it dictates whether the insurance company will proceed with defending the claim on your behalf.

Cooperation Between Contractors and Insurers During the Claims Process

Open communication channels are crucial for a smooth claims process. Contractors should be prepared to answer questions, provide additional details as needed, and clarify any ambiguities that arise.

By actively participating and collaborating with their insurer, contractors can help ensure a fair assessment and expedite the resolution of the claim. Additionally, cooperation is essential if the contractor wishes to file a claim for policy reimbursement. The insurer may partially reimburse contractors for expenses incurred from defending non-covered claims or lawsuits arising out of project work that goes beyond their coverage limits.

Step 3: Legal Counsel

If the Claim is Covered

If the claim is covered, the insurance company typically appoints legal counsel specializing in construction industry claims to defend you. This legal representation is a significant asset, as they possess the expertise to navigate the complexities of E&O litigation.

The insurer handles negotiations and settlements within the policy’s limits, aiming to resolve the claim efficiently and effectively while minimizing the financial impact on your business. As a contractor, it’s imperative to understand that cooperation with your insurer during this process is essential for a successful defense.

If the Claim is Not Covered

If the claim is not covered by the E&O insurance policy, contractors may find themselves in a challenging position. In such cases, it is crucial to carefully review the denial from the insurer and seek legal advice to fully understand the reasons behind the denial.

Contractors should consider consulting with legal counsel specializing in insurance claims to explore potential avenues for appealing the decision or resolving the claim through alternative means.

Step 4: Settlement or Negotiation

Settlement of a Covered Claim

Upon successful defense of the claim, if the insurer determines that a settlement is warranted, they will engage in negotiations with the claimant on behalf of the contractor. The goal is to reach a settlement within the policy’s limits, ensuring that the financial impact on the contractor’s business is minimized.

The insurer will work to achieve a fair and reasonable resolution that addresses the claimant’s concerns while protecting the contractor’s financial stability and reputation. Throughout this process, it is vital for the contractor to maintain open communication with their insurer and provide any necessary assistance to facilitate the negotiation and settlement process.

Additionally, contractors should be aware that settlement may involve various considerations, such as non-disclosure agreements, future obligations, and the impact on their professional standing. It is essential to carefully review and consider the terms of the settlement before reaching a final agreement. Consulting with legal counsel experienced in E&O claims can provide valuable insight and guidance during the settlement process.

Alternative Solutions for Claims Not Covered

It’s important for contractors to be proactive in addressing claims that are not covered by their insurance. This may involve engaging in negotiations with the affected party, seeking alternative dispute resolution methods, or pursuing other forms of risk management to mitigate the potential financial impact on their business.

Ultimately, understanding the reasons for a claim denial and exploring available options for resolution is essential for contractors facing E&O claims that fall outside the coverage provided by their insurance policy.

Strategies for Claim Prevention in the Construction Industry

Constructing a solid foundation for claim prevention requires contractors to adopt meticulous contract documentation practices. By ensuring that all agreements and project details are clearly outlined and agreed upon, contractors can significantly reduce the likelihood of disputes that may lead to E&O claims. This includes specifying the scope of work, project timelines, payment terms, and any other critical terms that could affect project outcomes.

Regular communication with clients is another pivotal strategy for avoiding misunderstandings that could result in claims. Keeping clients informed about project progress and any changes can help manage their expectations and provide an opportunity to address concerns early on.

Additionally, establishing robust quality control procedures is crucial for minimizing the risk of errors and omissions. Contractors should implement systematic checks throughout the project’s duration to ensure work meets the required standards and specifications. Doing so may prevent mistakes from compounding into costly claims and help maintain the quality expectations of clients.

The Role of Torian Insurance in Supporting Contractors Through E&O Claims

Torian Insurance stands as a pivotal ally for contractors navigating the complexities of Errors & Omissions claims. With a deep understanding of the construction industry and the intricacies of E&O insurance, Torian Insurance provides the necessary guidance and support throughout the claims process. They assist clients in understanding the nuances of their policies, ensuring that contractors are aware of their coverage scope and limitations.

The value of having Torian Insurance as a partner extends beyond policy clarification. They act as intermediaries between the contractor and the insurance company, facilitating communication and advocating on the client’s behalf. Their expertise is instrumental in helping contractors prepare the required documentation and coordinate with the legal counsel appointed by the insurer.

Moreover, Torian Insurance offers resources and services tailored to the construction industry, which can significantly streamline the claims experience, making it less stressful and more efficient for their clients.

Seeking a Trusted Insurance Partner for Your Business? Click Here

Torian Insurance has a commitment to personalized service and tailored coverage. Learn more about our insurance offerings for contractors.

Tailoring E&O Coverage to Your Construction or Contractor Business

Understanding the specifics of E&O coverage is essential for construction businesses to ensure they are adequately protected. Each construction project carries its own set of risks, and as such, E&O insurance policies should be customized to match the unique challenges and exposures of the business.

Contractors need to be aware of policy details such as coverage limits, deductibles, and exclusions to avoid any surprises when a claim arises.

Torian Insurance specializes in assisting construction businesses in the tri-state area to tailor their E&O coverage to their specific needs. The company’s expertise in the construction industry allows them to provide valuable insights into the types of risks that contractors should be prepared for.

With the help of Torian Insurance’s knowledgeable team, construction professionals can confidently select E&O insurance that not only meets their current requirements but also adapts to the evolving nature of their projects and operations.

Encouraging Contractors to Review and Update Their E&O Coverage

Regular policy reviews are critical in ensuring contractors have adequate E&O coverage for their ever-evolving business needs. As construction businesses grow and take on new projects, the risks they face may change, necessitating updates to their insurance policies to maintain comprehensive protection.

Contractors should make it a practice to evaluate their E&O coverage at least annually or after significant business changes, such as entering new markets, offering new services, or experiencing a change in project size or scope.

Torian Insurance is committed to assisting contractors with policy evaluations and updates. Their expertise is invaluable in identifying potential gaps in coverage and recommending adjustments to keep pace with the dynamic nature of the construction industry.

Contractors can reach out to Torian Insurance for personalized advice and to ensure their E&O insurance is tailored to the specific risks and requirements of their business operations.

Don't Leave Your Legacy to Chance—Reach Out to Torian Today

As we’ve navigated the intricacies of E&O insurance claims and underscored the importance of timely, informed actions, it’s clear that being prepared and having a knowledgeable ally is invaluable for any contractor.

Embrace proactive claim prevention strategies to fortify your construction business against the unforeseen.

Reach out to our team to discuss your professional liability insurance needs, and together, we’ll ensure your construction business is built on a foundation of resilience and expert support.