Landscaping companies in the Evansville, Newburgh, and the broader tri-state area face unique challenges, from unpredictable weather to the inherent risks of physical labor and equipment use. Protecting your business with the right landscaping insurance coverage is not just prudent—it’s essential. In this post, we’ll delve into the specific risks associated with the landscaping industry and the importance of having insurance that safeguards your business against potential financial setbacks.

Understanding the nuances of insurance for landscaping companies can be daunting, but it’s a critical component of your business strategy. From property damage to liability claims, having comprehensive coverage can mean the difference between a minor setback and a major financial crisis. With Torian Insurance‘s expertise, we’ll guide you through the types of insurance coverage that can fortify your business and help you thrive despite the uncertainties.

What is Landscaping Insurance?

Landscaping insurance is a specialized form of business insurance designed to address the specific risks associated with operating a landscaping company. This type of insurance provides comprehensive coverage that combines various policies tailored to protect the financial health of landscaping businesses against unexpected losses, liabilities, and lawsuits.

Landscaping insurance is crucial for protecting landscaping businesses from potential liabilities, such as property damage and injury claims, ensuring compliance with legal standards, and safeguarding against financial losses from business interruptions or equipment damage. This specialized insurance not only promotes business continuity and financial stability but also enhances the company’s credibility and compliance with legal requirements.

Who Needs Landscaping Insurance?

Landscaping insurance is essential for a wide range of professionals within the landscaping and lawn care industry, each of whom plays a distinct role in the operation and success of such businesses. Some of the specific roles and job titles that should consider securing landscaping insurance are:

- Landscape Contractors

- Lawn Care Providers

- Arborists and Tree Surgeons

- Landscape Designers and Architects

- Hardscape Contractors

- Irrigation Specialists

- Gardeners

- Pesticide & Herbicide Contractors

- Tree Trimmers

Understanding the Unique Insurance Needs of Landscaping Companies

Landscaping companies operate in an environment filled with a myriad of unique risks, making it crucial for them to carry robust insurance coverage tailored to their specific needs. The very essence of their work — altering and maintaining landscapes — exposes them to unique challenges and hazards that differ significantly from many other types of businesses.

Property Damage Risks During Projects

Landscaping projects can vary widely, from simple lawn maintenance to extensive redesigns involving construction. During such activities, there’s a high possibility of unintended property damage. For example, while installing a new garden feature, workers might accidentally damage underground pipes or wiring, leading to significant service disruptions and expenses. When mowing grass debris may fly and break a window. Or, heavy equipment used on site might ruin a client’s driveway or other parts of their property.

Equipment Theft or Damage

Landscaping requires the use of various tools and machinery, from common lawn mowers to large excavators and tree trimming equipment. These items are not only expensive but also prone to theft and damage. The machinery may be left on job sites overnight or stored in remote locations, increasing the risk of theft. Similarly, accidental damage can occur due to mishandling or harsh working conditions.

Bodily Injury Liabilities

This type of insurance provides financial protection for the business against claims by third parties such as customers, vendors, or visitors who may suffer injuries on the premises. In the landscaping industry, where physical labor and machinery are commonly used, the risk of accidents leading to bodily harm is higher. Having Bodily Injury liability insurance in place ensures that the company is financially prepared to handle any legal claims or medical expenses that may arise from such incidents. It is a foundational coverage that all landscaping companies should consider to safeguard their assets and reputation.

Environmental and Pollution Risks

Landscapers often work with fertilizers, pesticides, and other chemicals that can be harmful to the environment if not managed correctly. Accidental spillage or runoff can lead to pollution issues, potentially harming local wildlife or leading to hefty fines from environmental regulatory bodies.

Business Interruption

Landscaping companies can face disruptions due to equipment breakdowns, weather conditions, or even loss of essential personnel. For example, a landscaping contractor in Florida may primarily service a region that experienced widespread damage from a hurricane. Many customers may not need regular landscaping services during this time.

Vehicle-Related Risks and Accidents

Landscaping companies frequently travel to various client sites, making them heavily reliant on their vehicles. This constant travel increases the exposure to vehicle-related risks and accidents. Landscaping vehicles, which often carry heavy equipment and tools, are susceptible to accidents ranging from minor fender-benders to major collisions. Furthermore, the vehicles could be damaged by the load they carry or even by vandalism when parked on-site. For example, a landscaping truck transporting soil and stone may be involved in an accident due to the shifting weight of its cargo, potentially leading to injuries and significant vehicle damage.

Moreover, landscapers might sometimes need to park their vehicles in less secure, remote locations while working at job sites, increasing the risk of theft or vandalism.

Types of Insurance Coverage for Landscaping Companies

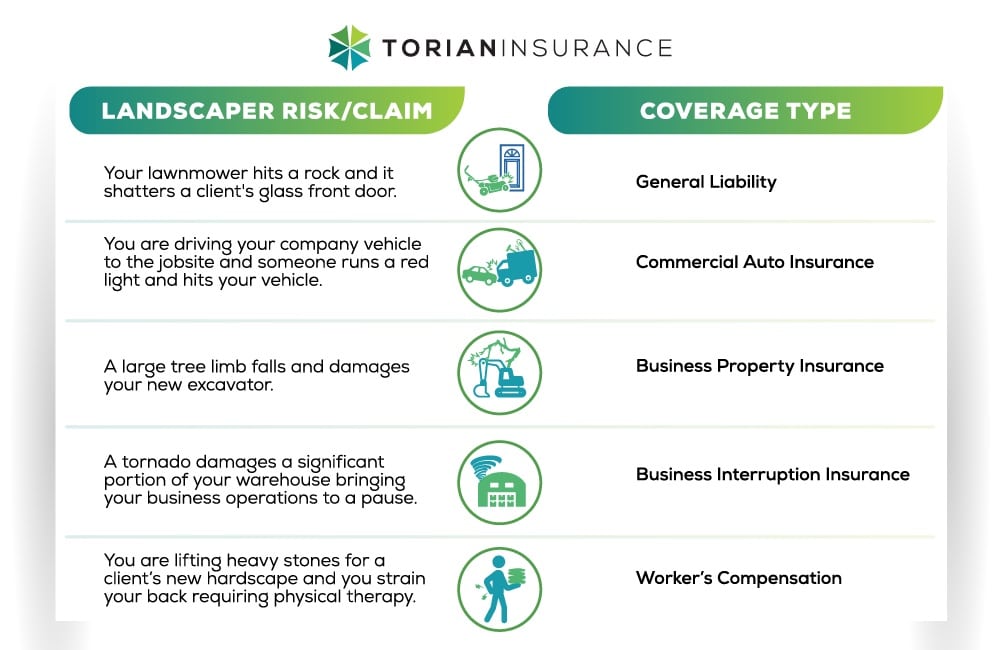

Landscaping businesses face a multitude of risks that can be mitigated through various types of insurance coverages. Each type of insurance serves a unique purpose, addressing specific risks associated with the nature of landscaping work.

General Liability Insurance

General liability insurance is crucial for any business, including landscaping. It protects the company from financial losses resulting from bodily injury, property damage, and legal defense and judgment costs that could occur under normal business operations. For instance, if a landscaper damages a client’s property by accidentally cutting through an underground cable or if a passerby trips over landscaping equipment and gets injured, general liability insurance can cover the compensation costs.

Commercial Auto Insurance

Given that landscaping companies frequently use vehicles to transport tools, equipment, and personnel to various job sites, commercial auto insurance is essential. This coverage protects against damages from collisions or vehicle-related incidents. It covers vehicle repair costs, medical bills for any bodily injuries, and liability claims from third parties, ensuring that both company vehicles and any associated liability are adequately insured.

Commercial Property Insurance

Commercial property insurance covers the physical assets of a landscaping business from damages caused by fire, vandalism, smoke, certain natural disasters, and other covered perils. It’s vital for protecting your business’s infrastructure, tools, and equipment stored at a fixed location. Specialized landscaping equipment, which can be very expensive, is also covered under this policy against loss or damage.

Business Owner’s Policy (BOP)

A Business Owner’s Policy combines general liability insurance and commercial property insurance and sometimes includes business interruption insurance. This bundled insurance is often cost-effective and covers a range of risks, making it a preferred option for small to medium-sized landscaping businesses. The commercial property section of a BOP protects business premises and contents, such as office equipment and smaller tools, against fire, theft, and natural disasters.

Business Interruption Insurance

Often included in a BOP, business interruption insurance covers loss of income that a landscaping business might suffer after a disaster. For instance, if a landscaper has to cease operations due to storm damage at their business premises, this insurance can help cover lost income and ongoing expenses until the business is operational again.

Workers’ Compensation Insurance

Landscaping work can be physically demanding and potentially dangerous. Workers’ compensation insurance is therefore essential as it covers medical costs and a portion of lost wages for employees who become injured or ill on the job. In fact, between 2001-2017 there were over 18,000 workers compensation claims from the landscaping industry. For example, if an employee suffers a back injury while lifting heavy equipment, this insurance can help cover their medical expenses and recovery costs.

Umbrella Insurance

Umbrella insurance provides extra liability coverage beyond what your other policies offer. It kicks in when the policy limits of your existing liability coverage are reached. For landscaping companies facing a large liability claim, umbrella insurance can provide an additional safety net that helps protect against potentially ruinous financial judgements.

Inland Marine Insurance

Despite its name, inland marine insurance has nothing to do with water-related risks. Instead, it covers tools and equipment while they are in transit between job sites or stored at a location other than the primary business premises. This is particularly beneficial for landscapers who constantly move expensive equipment like lawnmowers, trimmers, and other machinery between multiple locations.

Additional Insurance Policies for Landscaping Businesses

Beyond the core insurance coverage options, there are several other types of policies that landscaping businesses might consider to ensure comprehensive protection against a wide array of risks:

- Cyber Insurance: As landscaping businesses increasingly utilize digital tools for scheduling, client communication, and financial transactions, the risk of cyber threats grows. Cyber insurance protects businesses from losses related to data breaches, cyber-attacks, and other electronic security threats, covering expenses like notification costs, legal fees, and more.

- Errors and Omissions Insurance (E&O): E&O insurance, also known as professional liability insurance, is essential for landscaping companies offering design and consulting services. This insurance covers legal fees and damages if your business is sued for negligent services or failing to perform professional duties, providing protection if, for example, a design flaw leads to property damage or additional costs for the client.

- Employment Practices Liability Insurance (EPLI): EPLI protects businesses against claims made by employees alleging discrimination, wrongful termination, harassment, and other employment-related issues. Considering the varied workforce employed by landscaping businesses, EPLI provides an essential safeguard against possible litigation from employees.

- Environmental Liability Insurance: Given the nature of landscaping work, there is an inherent risk of environmental damage, whether from inadvertent pollution during pesticide and herbicide application or other activities that might affect the local ecosystem. Environmental liability insurance covers claims arising from environmental damage, including cleanup costs and civil penalties.

- Flood Insurance: For landscaping businesses located in flood-prone areas, flood insurance is critical. Standard commercial property policies typically do not cover flood damage, making dedicated flood insurance a necessary component of a well-rounded insurance strategy.

What is Not Covered by Landscaping Insurance?

Under a landscaper’s insurance policy, there are typically several exclusions that define what is not covered by the policy. These exclusions are critical for landscapers to understand so they can adequately assess their risk exposure and consider additional coverage if necessary. They may include:

- Intentional damages

- Normal wear & tear

- Faulty workmanship

- Professional advice

- Personal vehicles

- Earthquakes & flooding typically require their own policies

- Armed conflicts or war

- Unlawful dismissal

How Much Does Landscaping Insurance Cost?

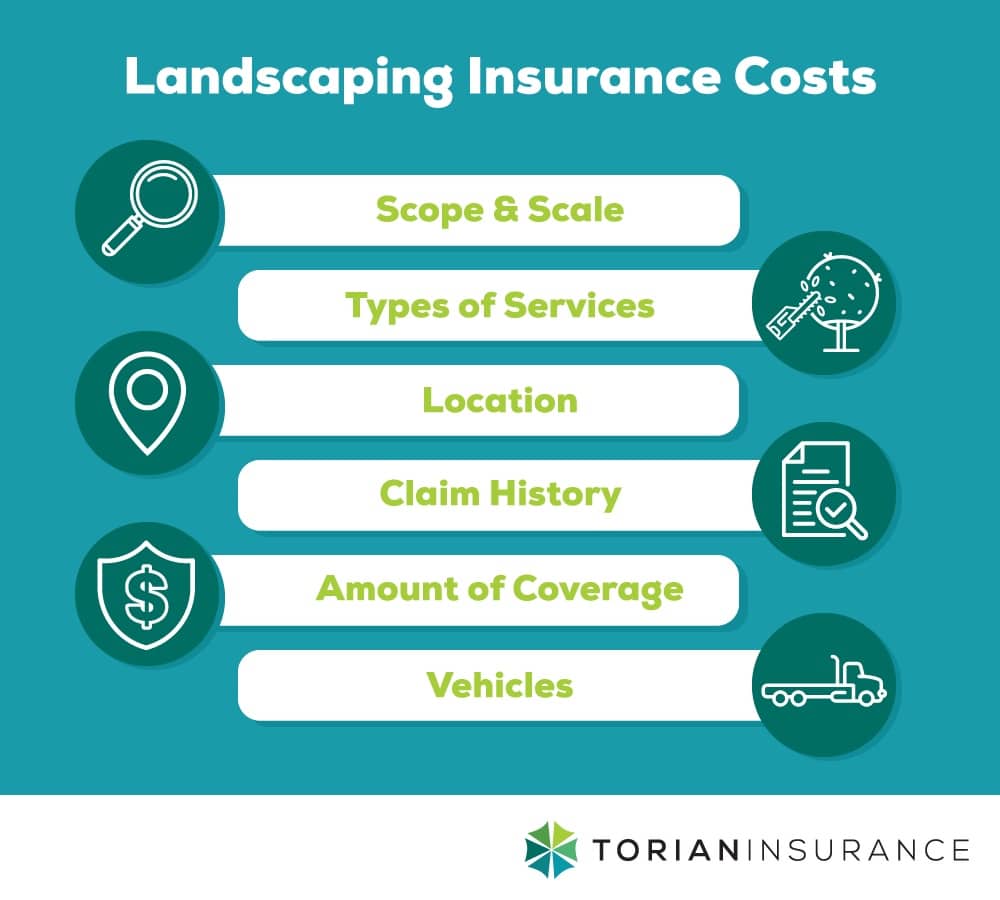

The cost of landscaping insurance can vary significantly based on several factors. Understanding these factors will help landscaping business owners to anticipate their insurance expenses and choose the right coverage options that align with their specific needs and budget constraints. Here are key variables that influence the cost of landscaping insurance:

Scope and Scale of Business Operations

The size of your landscaping business and the volume of work you handle significantly influence your insurance costs. A larger company with many employees, for example, will likely pay more for workers’ compensation and general liability insurance than a smaller outfit or solo operator due to the increased liability risks. Likewise, companies that engage in higher-risk landscaping activities like tree removal or large-scale landscape construction may face higher premiums than those performing basic lawn care services.

Types of Services Offered

The specific types of landscaping services provided can also affect insurance costs. For instance, companies that use pesticides or heavy machinery may incur higher premiums due to the increased risk of environmental damage or injury. In contrast, a company focused solely on design services might have lower risk and therefore lower insurance costs.

Business Location

The geographic location of your business plays a crucial role in determining insurance costs. Insurers often base premiums on the local risk factors, such as the likelihood of natural disasters (e.g., floods, hurricanes) and the general cost of doing business in that area. Additionally, different states have different regulatory environments and requirements for insurance coverage which can affect the cost.

Claim History

A landscaping company’s history of insurance claims can also impact how much they pay for coverage. A history of frequent or costly claims may lead to higher premiums as insurers view the business as high-risk. Conversely, a clean claim history can qualify a business for lower premiums through discounts and other incentives offered by some insurers.

Coverage Limits and Deductibles

The level of coverage you choose will directly affect your premiums. Higher coverage limits increase the insurer’s risk, leading to higher costs. Conversely, choosing a higher deductible, which means your business will cover a greater portion of any claim before insurance kicks in, can lower your premium costs. Balancing this trade-off is crucial for maintaining adequate coverage while controlling costs.

Number and Type of Vehicles

For landscaping companies that utilize a fleet of vehicles or specialized equipment, commercial auto insurance costs depend on the number and types of vehicles insured, as well as their use cases. Additional coverages for equipment transported in these vehicles can also affect costs.

Typical Cost

The cost of insurance for landscaping businesses can vary significantly based on several factors, but to give a general idea, the median yearly cost for landscaper insurance is approximately $45 per month, or about $530 a year, for a policy with coverage of $1 million in general liability, according to data from Insureon. However, these figures are median values and actual costs can depend heavily on your specific situation and needs.

It is essential for landscaping business owners to work with a reputable insurance broker or agent who understands the unique aspects of their business. These professionals can help in assessing risk, recommending appropriate coverage levels, and finding the best rates available. This partnership can ensure that the business is protected without overpaying for unnecessary coverage.

Assessing Your Landscaping Company's Insurance Needs

An expert insurance agent plays a pivotal role in helping landscaping business owners identify potential coverage gaps. These professionals have the knowledge and experience to guide entrepreneurs through the complexities of various insurance products. They can assist in determining the right types and amounts of coverage based on a company’s specific needs, which is essential for safeguarding against financial losses. Factors such as regional weather patterns, local regulations, and the landscape of the client base are also taken into account, ensuring that the insurance solutions provided are not just generic policies, but are tailored to address the unique challenges faced by each landscaping company.

Minimizing Risks Through Safety Practices and Training

Implementing robust safety protocols is crucial for landscaping companies aiming to minimize workplace accidents. These measures not only protect employees but also help in reducing the likelihood of insurance claims. Landscaping businesses should establish clear guidelines that dictate the use of protective gear, adherence to safety procedures, and proper handling of hazardous materials.

Regular maintenance of equipment is another key practice in mitigating risks. By ensuring that all tools and machinery are in good working order, landscaping companies can prevent malfunctions that may lead to injuries or property damage.

Additionally, employee safety training is invaluable, as educated workers are less likely to engage in unsafe practices that could result in accidents or injuries. Investing in ongoing training reinforces a culture of safety and can substantially diminish the frequency and severity of insurance claims.

Why Choose Torian Insurance for Your Landscaping Company

Torian Insurance stands out in the tri-state area due to its deep understanding of the unique challenges and risks landscaping companies face. The expertise of Torian Insurance in crafting personalized insurance solutions ensures that each landscaping business receives coverage that aligns precisely with its individual needs. This bespoke approach to insurance means that business owners can operate with confidence, knowing they are protected against the specific perils of their industry.

Landscaping business owners who partner with Torian Insurance benefit from more than just customized insurance packages; they receive ongoing support and advice that is invaluable in navigating the complexities of risk management. Should a claim arise, Torian Insurance will provide expert support to guide businesses through the process efficiently and effectively. Maintaining clear communication channels between clients and insurance carriers enables claims processing that is timely and seamless, freeing up business owners’ time so they can stay focused on driving their companies forward.

Getting Started with Torian Insurance for Your Landscaping Business

Recognizing the unique risks that landscaping companies face is crucial, and equipping your business with the right insurance coverage is essential to safeguard against the unexpected. To begin exploring insurance options with Torian Insurance, company owners can easily initiate the process by scheduling a personalized consultation. This initial step typically involves contacting Torian Insurance via their website, or phone. During this preliminary interaction, business owners will provide basic information about their company, aiding in preparing for a comprehensive insurance assessment.

Landscaping company owners should gather detailed information about their business operations, including the nature and scope of services offered, the number and type of employees, an inventory of equipment and vehicles, and any current insurance policies in place. Providing this information ensures a thorough evaluation of the company’s specific needs, allowing Torian Insurance to tailor coverage options that provide optimal protection. This collaboration is a strategic step towards securing the right insurance coverage, with guidance and support offered throughout the entire process.

With Torian Insurance, you’re not just finding a policy; you’re building a relationship with a team that understands the intricacies of your industry and the specific challenges of the tri-state area. Let us customize an insurance solution that fits your business perfectly.