Navigating the constantly shifting landscape of the construction industry can be a daunting task, especially when it comes to risk management. One key aspect that simply cannot be overlooked is comprehensive insurance coverage.

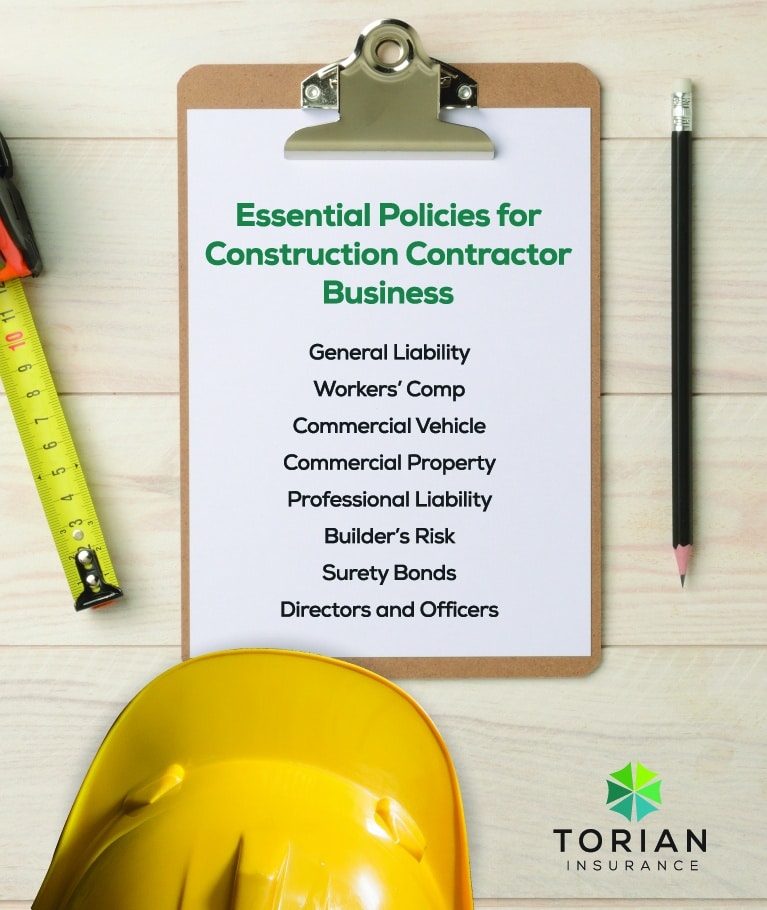

As such, this blog post will delve into the heart of the matter, highlighting eight essential insurance policies that every construction business needs, whether established or emerging, should seriously consider.

From general liability insurance to surety bonds, we will dissect each policy, explaining its purpose, benefits, and critical role in your construction contractor business.

So whether you’re a seasoned contractor or just starting out in the industry, stay tuned as we unravel the complexities of business insurance and bonds in the construction sector, providing you with the knowledge to safeguard your business effectively.

The Importance of Insurance in the Construction Business

Insurance holds an indispensable role in the construction business.

Its primary purpose is to mitigate risks associated with hazardous job sites, potential accidents, and unforeseen costs, all of which are common in the construction industry.

By providing a safety net, insurance offers financial protection to companies, ensuring they are not financially crippled by unexpected incidents.

Moreover, having the right insurance coverage brings peace of mind to business owners, knowing that their assets, employees, and operations are protected against potential mishaps.

In essence, insurance serves as a critical tool for risk management in the construction sector.

Different Types of Insurance Policies to Consider for Construction Contractor Business

The domain of insurance policies is extensive, with a variety of options tailored to the needs of different businesses. These policies serve as a safety net, shielding contractor businesses from potential financial losses due to unforeseen circumstances.

For businesses in the construction arena, some insurance policies hold greater importance than others due to the inherent risks associated with this industry.

For instance, general liability insurance and workers’ compensation insurance are almost universally necessary due to the potential for accidents and injuries on construction sites.

Similarly, commercial vehicle insurance is critical for companies with fleet operations.

Other policy considerations, depending on the businesses specific circumstances, might include commercial property insurance, professional liability insurance, and builders risk insurance, all of which protect against specific risks associated with this line of work.

1. General Liability Insurance

General liability insurance is a fundamental policy that every construction contractor business should have. It offers broad coverage for various liabilities, including bodily injuries and property damage caused by your business operations.

For instance, if a passerby is injured by falling debris from your construction site, or if your activities inadvertently damage a neighboring property, general liability insurance can cover the ensuing costs.

In the construction industry, the likelihood of such incidents occurring is high due to the nature of the work. Hence, general liability insurance is essential as it provides a safety net against these potential risks.

This policy not only safeguards your business financially but also enhances its credibility among clients and partners. It demonstrates that your business is responsible and adequately prepared to handle unforeseen circumstances, thus fostering trust and confidence.

2. Workers' Compensation Insurance

Workers’ compensation insurance is an integral component of any business who has employees. This particular type of insurance is designed to cover medical costs and lost wages for employees who get injured or become ill as a result of their job.

In the construction sector, where the risk of accidents is considerably higher than in many other industries.

The benefits of workers’ compensation insurance are two-fold.

- For employees, it provides necessary financial support in case of work-related injury or illness.

- For employers, having this insurance in place can protect the business from potentially crippling financial liabilities if an employee were to file a lawsuit after an accident. It’s also critical to comply with state workers’ compensation regulations.

In the context of construction, the policy can cover injuries resulting from a wide range of situations, such as falls from scaffolding, accidents involving power tools or heavy machinery, or health issues caused by exposure to harmful materials.

Therefore, it’s clear why workers’ compensation insurance is indispensable in the construction industry. It ensures the welfare of employees while protecting the financial stability of the business.

3. Commercial Vehicle Insurance

Commercial Vehicle Insurance is designed to protect the company’s vehicle, or fleet of vehicles and their operator(s).

This policy covers accidents, theft, vandalism, and damage caused by natural disasters. It can also safeguard against liability claims if one of your company vehicles is involved in an accident causing injury or property damage.

In the construction industry, vehicles such as trucks, vans, and trailers are crucial for transporting tools, equipment, and personnel to and from work sites.

These vehicles are exposed to a variety of risks while on the road or parked at job sites. Without commercial auto insurance, your business could face significant financial burdens following an accident or theft.

This policy ensures that your business can swiftly recover, keeping your operations running smoothly despite unexpected incidents.

4. Commercial Property Insurance

Property insurance for your commercial building is an essential policy for construction businesses. It provides coverage for physical assets owned by the company, including buildings, equipment, and tools.

This insurance policy safeguards against a variety of risks such as theft, vandalism, fire, and other unforeseen damage that could significantly impact the business operations.

For construction contractor businesses, property insurance is particularly crucial due to the high value of the machinery and equipment often involved in their operations.

The loss or damage of these assets can stall projects, negatively affecting the business’s reputation and bottom line. Therefore, having a comprehensive property insurance policy serves as a vital component, helping the company to quickly recover and resume operations after an unfortunate incident.

5. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a crucial policy for a construction business. This policy provides coverage against claims of negligence or mistakes made during the provision of professional services. It kicks in when a construction company is accused of errors, omissions, or negligence that have resulted in financial loss or damage to a client.

In the construction industry, where projects often involve intricate designs and complex processes, there’s a significant risk of errors or omissions occurring.

A single mistake, whether it’s in the planning, design, or building phase, can lead to substantial financial losses and legal disputes. This is where professional liability insurance comes in.

By covering the cost of legal defense and any potential settlements or judgments, it can protect the financial health of a construction contractor business.

Given the potential financial and reputational risks of negligence, professional liability insurance is an absolute must for any construction related business. Hence, having this type of insurance can also open up more business opportunities. It’s a critical policy that provides both financial protection and a competitive edge.

6. Builders Risk Insurance

Builders risk insurance is another essential type of insurance for construction related businesses. It specifically covers a construction project while it’s in progress.

This policy provides coverage for the structure being built and the materials on site that will eventually be part of the structure.

Covered risks typically include events like fire, vandalism, or severe weather. For instance, if a storm damages the construction site and the materials, builders’ risk insurance can cover the costs of the damage, allowing the project to continue without significant financial loss.

Builders risk does not cover the equipment used during construction or renovation. Equipment is either covered by commercial property, or more likely, inland marine insurance.

Not having this coverage could lead to devastating financial consequences if a disaster were to strike mid-construction.

This insurance is crucial for construction businesses as it provides protection specifically tailored to the risks associated with construction projects. It effectively closes a gap that other types of insurance may not cover.

Without builder’s risk insurance, a contractor company could find itself liable for significant costs in the event of a covered incident occurring on an active construction site.

7. Surety Bonds

Surety bonds are a vital aspect of insurance in the construction industry. These bonds act as a financial guarantee that a construction project will be completed as per the terms of the contract.

In the construction industry, surety bonds are a commonplace requirement in bids and contracts.

They can offer protection to both the construction project owners who need assurance that the contractor won’t abandon their work halfway through as well as contractors needing coverage for damages or errors.

The construction industry often involves large-scale projects with significant financial investments. The use of surety bonds offers reassurance to project owners that they will not be left high and dry if a contractor fails to deliver. Moreover, certain legal requirements mandate the use of surety bonds in public construction projects, making them an unavoidable aspect of business for many construction companies.

Securing a surety bond can also enhance a construction business’s reputation, as it sends a strong message about the company’s financial stability and commitment to fulfill its contractual obligations.

Understanding the types of bonds in insurance, such as bid bonds, performance bonds, and payment bonds, is key to determining the right bond for your construction project.

Remember, a surety bond is not a one-size-fits-all solution.

Each construction project has unique risks and requirements. Thus, working with an expert like Torian Insurance, who understands the ins and outs of bonds and insurance in construction, can ensure you get the right bond to match your specific business needs.

8. Management Liability Insurance

Management liability insurance is a key policy that construction contractor businesses should not overlook. This type of insurance aims to protect the company’s top-level management, such as directors and officers, from personal losses if they are sued as a result of serving the company.

It can cover legal fees, settlements, and other costs arising from lawsuits and liability claims made against these key employees for alleged wrongful acts in their management roles.

In the construction industry, where projects often involve significant risks and large sums of money, management, directors and officers can be held personally responsible for the outcomes of their decisions.

For instance, if a project fails or a business decision leads to financial loss, they could face legal action. Management liability helps safeguard the personal assets of these individuals and the financial stability of the business as a whole. It also protects management from claims made by employees such as wrongful termination, sexual harassment, etc.

Additionally, having this insurance in place can help a construction business attract and retain top-level personnel for its leadership roles. Knowing they are protected encourages competent individuals to take up these roles without fear of personal financial loss.

Customizing Your Construction Business Insurance Portfolio

Every construction business is unique, with its own set of risks and requirements. This diversity necessitates a tailored approach to your insurance portfolio.

One-size-fits-all insurance policies might not fully cover the specific risks that your construction business faces. For instance, a small contracting company may require less extensive coverage compared to a large construction corporation that has several ongoing projects.

Consulting with an insurance expert is a crucial step in understanding and managing these risks effectively. You need an insurance company who understands these distinct needs and offers the flexibility to create customized insurance portfolios.

This customization ensures that your business is adequately protected against potential risks while also considering your budget constraints. By evaluating your business structure, operations, and projects, they devise an insurance strategy that aligns with your particular needs and objectives.

With this approach, you and the insurance company you choose to work with can create an insurance package that’s tailored to your business.

Consult with an Insurance Expert to Identify Potential Risks

Ensuring your business has comprehensive coverage provides the financial protection and peace of mind you need to focus on your projects.

Torian Insurance is your ideal partner in this endeavor.

Every construction contractor business is unique, with its specific set of risks based on factors like the type of projects they undertake, the size of their operations, and their location, to name a few. Thus, the insurance needs of every contractor business are unique too.

We offer personalized advice and tailor-made contractor insurance portfolios to fit your unique needs. Our expertise makes us a trusted advisor for construction businesses.

Remember, the right insurance coverage is not a luxury—it’s essential. So don’t leave your business exposed to unnecessary risks.

Reach out to us at Torian Insurance today to discuss your business insurance needs, and let’s create a comprehensive, customized insurance solution that will protect your construction contractor business now and in the future.