One of the main steps of building a business is insuring it. Yet, business insurance can be daunting, especially when you hear stories of “My business insurance doesn’t cover that.”

You don’t want to spend your time as a business owner worrying that an uninsured disaster will occur on your premises with no financial backing. So, how do you ensure that your business insurance is perfect?

The trick is to find the insurance type and plan that suits you best, which can be somewhat challenging. However, if you’re searching for financial protection for your property and equipment, commercial property insurance is what you need.

If you’re a new business owner worried about how to insure your commercial property, keep reading. Here’s all you need to know about commercial property insurance, what it covers, and which policy (or policies) might be best for your business.

What Is Commercial Property Insurance?

Commercial property, also known as business property insurance, is an insurance type that protects commercial property in the event of a disaster. Such includes theft, fire, natural disasters, and more.

This insurance plan benefits service-oriented businesses, retailers, manufacturers, and not-for-profit organizations. In addition, business owners may also combine it with other forms of insurance, such as commercial general liability insurance.

A few items covered by a commercial property insurance policy include your business building, tools, equipment, supplies, inventory, furniture, machinery, appliances, business records, and other valuable papers.

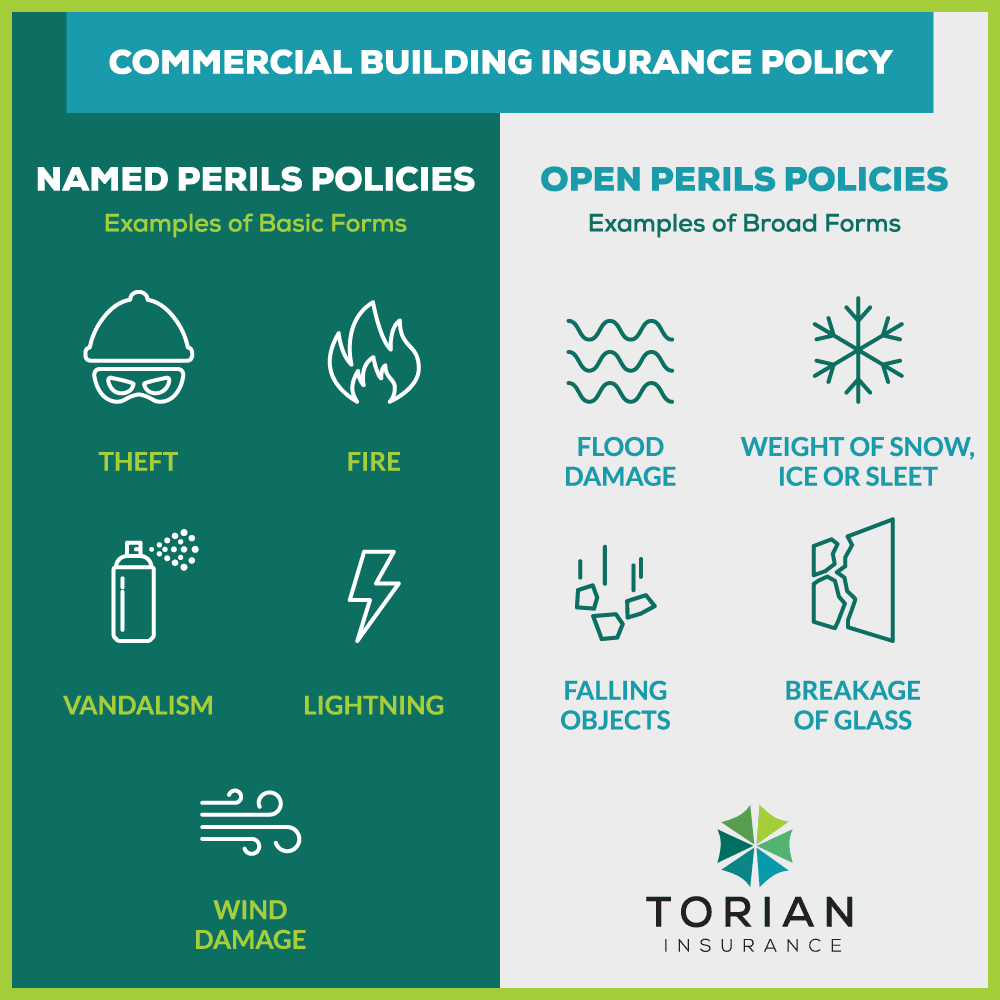

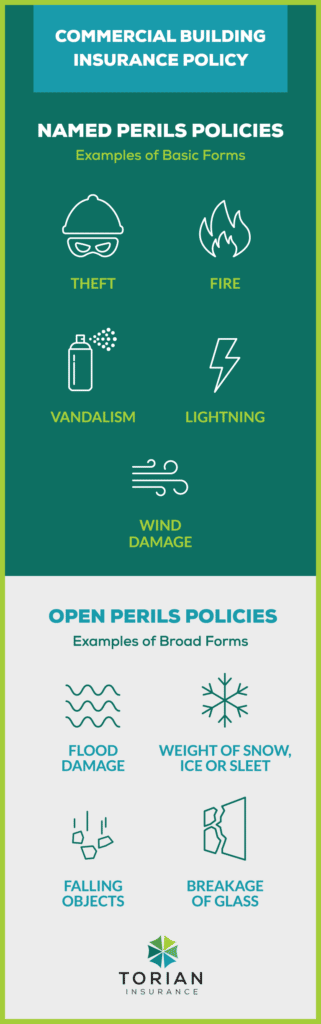

The coverage of a commercial building insurance policy can be divided into two categories: Named Perils policies and Open Perils policies. Named Perils policies only cover those items and mishaps detailed in the policy, such as theft, fire, wind damage, and vandalism. Meanwhile, Open Perils policies offer broader coverage, protecting from any problem except any exclusions mentioned beforehand. Often, flood damage is detailed as an exclusion in Open Perils policies.

Is Commercial Property Insurance a Legal Requirement?

In some cases, insurance on commercial property is not a legal requirement although it could be required by contract or the mortgage company/lienholder. However, most business experts recommend it. Anyone who owns, rents, or leases a commercial building should purchase insurance for the property.

Otherwise, they’ll be left responsible for paying out of pocket for any damage on the property, no matter how big or small. This can be a significant financial burden that most business owners aren’t ready to carry. What’s more, it puts your company’s value at risk.

Thus, it’s best to insure your business property with commercial property insurance to prevent financial mishaps in the future.

What Is Evidence of Commercial Property Insurance?

In commercial property insurance, the “evidence” is the certificate of insurance (COI), also known as the proof of insurance. This helps you, as a business owner, prove that your building is legally covered by commercial property insurance and meets building codes easily.

Most insurers offer this certificate as a default, but business owners can also request them if not received. This is a highly important document to own, so make sure you request your COI from your insurer.

How Much Does Commercial Property Insurance Cost?

Commercial property insurance costs depend entirely on how much equipment and property needs to be covered. However, the insurance company, location, and occupancy are minor influential factors for the prices.

Of course, major corporations with a very expensive abundance of equipment would have to pay a lot more for business property insurance. For example, railroads and manufacturers have equipment worth millions or even billions of dollars.

You may be wondering: what’s the difference between property and commercial property insurance? The main difference is that commercial property insurance is more focused on businesses.

The value of your business’ assets is the main factor the insurance company will consider while deciding the cost of your insurance plan. The agent will meet with your representative to discuss the pricing plans and coverage.

Before this meeting, you must assess the value of your business’ assets. This way, you’ll know the price ranges to expect beforehand.

In addition, the weather conditions and the number of natural disasters in the area also influence the price of the insurance plan. Areas with a greater risk of weather-related disasters generally have higher business property insurance rates.

Tips to Keep the Cost of Commercial Property Insurance Down

Commercial property insurance can be shockingly expensive, especially for small business owners who don’t have much experience in this aspect. Keep these tips in mind while purchasing commercial property insurance policies to keep costs low.

Compare Several Insurers

The first tip to remember while purchasing business property insurance is to be open to multiple insurers. Shopping around is important even if the first insurer you contacted seemed like the perfect option. If you decide to work with an insurance agency, the agent can do the hard work for you and provide you with different options from different companies based on what’s best for your needs.

You never know what add-ons another insurance company could offer or how much lower their prices could be. So, it’s best to keep your options open. The process of comparison shopping isn’t as hectic as you think; you just need good research skills and an internet connection.

Since getting a quote is always free, call every insurer to get a quote and compare prices.

Add or Increase a Deductible

Most property and auto policies include deductibles — a form of self-insurance. In commercial property insurance, the deductible varies based on the insurer and the state. Most start at a minimum of around $1,000 and can go as high as is necessary for proper coverage.

Keep in mind that opting for a higher deductible reduces the cost of the commercial property insurance policy. The details about the deductible cost are included in the commercial property insurance plan.

One of the easiest ways to reduce the cost of your commercial property insurance policy is by adding or increasing a deductible.

Identify Overlapping or Unnecessary Coverages

It’s the bitter truth: some insurers will try to rip you off by including overlapping or unnecessary coverages in the commercial property insurance policy. It’s your job to identify these coverages and request their elimination. If you choose to work with an experienced insurance agency, they can help you keep an eye out for these instances.

For example, hired and non-owned auto can be in either policy but it’s always on the auto policy if there is a commercial auto policy in place. General liability is typically only utilized for this coverage if there is no commercial auto policy in place. In addition, your insurer may include coverages in the policy that no longer exist, making them unnecessary.

As another example, your insurer might still cover a property you sold months ago in your commercial property policy. Save money on your insurance plans by requesting the elimination of these coverages from your policy.

Prioritize Workplace Safety

Insurance begins in the workspace, where you must prioritize workplace safety and security. The lesser damages and losses your building and its people are prone to, the lesser you’ll have to pay for your commercial property insurance policy.

If you’re unsure how to make your workplace safer, contact your insurer for professional advice. You’ll even find that most insurers offer discounts to clients that use deadbolt locks, cameras, monitored alarm systems, and other devices to secure their property.

Smartphones with safety apps, wearables, and internet-connected sensors may help you complete your security plan. Not only will this lower the cost of your insurance policy, but it’ll also create a safe working environment that your employees will appreciate.

Pay Premiums in Advance

Commercial property insurance policies can be expensive, so most commercial property owners prefer to pay in monthly or quarterly installments. However, there’s no denying that insurers prefer to collect their premiums all at once.

So, if you can afford the investments, pay off your insurance costs in one go. The insurer might offer a small discount or other incentive for paying the whole premium upfront which could potentially save you a little money on installment fees. However, you should consult your insurer about such a discount before paying as these discounts don’t always exist.

Purchase Package Policies

Lastly, you can lower the cost of your business property insurance policy by purchasing package policies. This option is much cheaper than buying multiple individual policies. For example, a business owner’s policy includes commercial property insurance and general liability. So, check with your insurer to see if they offer such an option.

Factors That Influence the Cost of Commercial Property Insurance

Certain factors influence the cost of commercial property insurance policies, such as the building’s construction, location, and occupancy. Here’s how they increase or decrease the price of your insurance plan.

Building Construction

Building construction is one of the main factors influencing the cost of commercial property insurance policies. For example, the policy cost will be higher if the building’s construction includes potentially explosive materials.

On the other hand, if the building materials are fire-resistant, the business owner may earn a discount on their commercial property insurance policy. If you plan on remodeling your building, it’s best to consult your insurer about additional costs for the increment in the existing structure. Such may influence the fire rating of the building.

In addition, if the internal structural elements — such as partitions, floors, and stairways — are made of wood, you may lose your discount. Thus, if you want to maintain your fire rating, opt for fire-resistant doors, walls, and floors.

Building Location

Of course, the city or town your building is located in also influences the cost of your commercial property insurance plan. The building may cost more to insure if the city or town is prone to natural disasters. On the other hand, if the town or city has ideal fire protection, the building may cost less to insure. This is determined by a combination of factors, such as, the distance to the fire department, the presence of fire hydrants, and equipment owned by the responding fire department.

Fire and Theft Protection

Fire and theft protection influence policy cost significantly. Ask these about your city or town before picking an insurer or commercial property insurance plan:

- How close is the nearest fire hydrant? What about the nearest fire station?

- Does my commercial property have a fire alarm and sprinkler system?

- Does my commercial property have the correct security system in case of a robbery?

Building Occupancy

The fire rating of a building is an influential factor; the lower the fire rating, the better chance you have at a discount. The building’s use influences its fire rating significantly. For example, restaurants or auto repair shops won’t rate as good as office buildings in this case.

What Does Commercial Property Insurance Cover?

Commercial property insurance protects your commercial building and any equipment used for daily business operations. This policy protects your building and equipment against fire, lightning, theft, and more. One exception is mobile equipment which is usually better covered with an inland marine policy. Construction equipment, for example, that moves from jobsite to jobsite is typically not covered by commercial property insurance.

Since commercial property insurance includes business interruption coverage, it may also help you protect your income. For example, if your business is closed due to property damage covered in the policy, the insurer may compensate you for the lost income.

Other than that, some insurers also include coverage for valuable papers and records in their commercial property insurance policies. Here’s a list of some example coverages that might be included in these policies:

- Commercial building

- Completed additions

- Fixtures

- Machinery and equipment (while on the premises)

- Stock

- All other personal property used in your business

- Tenant’s improvements for a better space

- Leased personal property you’re contractually responsible for insuring

- Furniture

What Are the Exclusions to Commercial Property Insurance?

If you’ve opted for an Open Perils policy, you’ll find that it offers broader coverage except for some exclusions detailed in the plan. Here are some exclusions to commercial property insurance:

- Money, security, or accounts

- Vehicles (with certain exceptions)

- Land, piers, or docks

- Animals other than stock

- Crops, hay, or grain

- Building foundations

- Electronic data

- Cost of excavation, grading, or backfilling

- Cost of restoring information on valuable records (in some cases)

- Walkways, roads, and other paved surfaces

In addition, if your employee intentionally damages the property, the commercial property insurance policy won’t cover that. It also won’t cover minor accidents, such as an employee tripping and damaging their laptop. However, you can get additional coverages for your insurance policy that may include such specific claims, but that’ll cost extra.

What If I Work From Home?

If you’re working from home or running your business at home, your company is still legitimate. Unfortunately, this means you still need commercial property insurance to protect your property and equipment.

You may think your average homeowner’s insurance or renter’s insurance will provide adequate coverage for your home business, but that’s not the case. If your home business has office furniture, equipment, or machinery, your property is vulnerable to damage. An insurance agency can help you determine if your home based business can be included in a homeowners policy. If not, a commercial policy would be necessary.

Can I Customize My Commercial Property Insurance Plan?

As we mentioned, the commercial property insurance plan covers the commercial building, completed additions, fixtures, machinery and equipment, stock, and all other personal property used in your business. It also includes the tenant’s improvements for a better space, leased personal property you’re contractually responsible for insuring, and furniture.

Typically, these policies exclude money, security, accounts, vehicles, land, piers, docks, animals other than stock, building foundations, electronic data, cost of excavation, grading or backfilling, cost of restoring information on valuable records, walkways, roads, and other paved surfaces.

So, if there are elements of your property that require coverage but aren’t, it can be disheartening.

In this case, you can customize your commercial property insurance plan to fit your needs. As a result, it will protect nearly every physical asset your business owns. What’s more, you may find additional coverages in the policy for assets such as special machinery, perishable food items, physical office space, extra furnishing, and more.

You can also attach extra policies such as the business owner’s policy (BOP) or business ordinance coverage for a broader range of protection.

What Aspects Of My Property Are Covered Under Commercial Property Insurance?

The commercial property insurance policy protects the building but that doesn’t necessarily mean every aspect. So, what exactly is considered property in this type of insurance plan? Here are some examples of property that might be covered under commercial property insurance:

- Permanently installed machinery

- Office furniture

- Raw materials

- Goods-in-process

- Finished goods

- The building that houses your business

- Fence and landscaping

- Inventory kept in stock

- Signs and satellite dishes

- Accounting records and essential company documents

- Office equipment (e.g. computers, phone systems, furniture, etc.)

- Manufacturing equipment

However, business owners can purchase endorsement policies in case they require coverage for instances or items not detailed under their commercial property insurance policy.

What is a Business Owner’s Policy?

A business owner’s policy is an insurance plan that offers combined protection for major liability and property risks. This policy offers a broad range of coverage that a business owner might need, whether for their building or business.

Since this is a package policy, it’s cheaper than an insurer would charge if you purchased each coverage individually. Typically, mid-sized and small business owners benefit from the convenience and affordability of the business owners’ policies. However, they need to meet all eligibility requirements to qualify for the policy.

This type of insurance policy covers property, business interruption, and liability insurance. Standard BOPs are Named Perils policies, which means they only cover those items and mishaps detailed in the policy.

On the other hand, special BOPs offer Open Perils coverage with broader all-risk protection. Owned or rented buildings, additions or additions in progress, and outdoor fixtures are considered property under the business owner’s policies.

Items that are kept under the care of the business but belong to a third party can also be covered in this policy. However, it should be kept within 100 feet of the premises or as specified in the policy.

Since BOPs include business interruption insurance, it means the insurer will make up for the loss of income during the interruption of business operations due to a mishap or disaster specified in the policy. The insurer will also cover the expenses if your business begins operating at a temporary location.

Most BOPs also include liability insurance, which means the insurer is legally responsible for the property’s inflicted damage on others. In special cases, these policies may also cover vehicles, crime, mechanical breakdown, forgery, fidelity bonds, and flood insurance.

However, the business owner would have to negotiate with the insurer about the additional costs for these coverages. Professional liability, worker’s compensation, health, or disability insurance are a few exclusions under business owners’ policies.

What is Business Ordinance Coverage?

Business Ordinance Coverage, also known as Building Ordinance Coverage or Ordinance and Law coverage, is an insurance policy covering the increased costs when a business building is under repair. Building codes often change since the construction of the building, causing the repair costs to increase.

For example, older structures that previously didn’t require certain inclusions may require them now. These inclusions may be upgraded heating, ventilating, electrical wiring, air-conditioning (HVAC), fencing, roofing materials, and plumbing units.

Business owners that can’t afford to pay for these increased costs out of pocket can rely on business ordinance coverage policies to insure them. Most insurance policies don’t offer business ordinance coverage, but business owners can purchase them as an endorsement.

This coverage allows policyholders to keep their property up to date with the latest building codes as local governments make new safety requirements mandatory and new materials common.

After the unexpected damage to an older structure, the repair must meet the new building codes and costs a lot more than expected. As a result, basic insurance policies cannot cover these costs for the business owner.

Not only does this coverage protect against high demolition costs, but it also makes up for the loss of value and increased construction costs due to new building codes. Moreover, the location of the building significantly affects the coverage’s cost as some locations have stricter building codes than others.

Do I Also Need Commercial Umbrella Insurance?

You’ll often find an insurance policy that has almost everything your business may need but still misses the mark. In the end, there may be one or two areas that still need coverage. In that case, you need commercial umbrella insurance.

Commercial umbrella insurance is a completely separate policy from commercial property insurance. It’s a policy that offers an additional layer of protection over your primary insurance policies to ensure no aspect is left uncovered. In addition, it covers the cost that is not included in your other liability coverage policies. By opting for commercial umbrella insurance, business owners are able to ensure that there’s zero risk involved in operating their business.

Commercial umbrella insurance can’t be purchased as a separate policy; it’s meant to complement other policies you may have in place to protect your business and its property. For example, if your main insurance policy only covers $1.5 million in liability coverage but you owe $2 million, commercial umbrella insurance will cover the remaining half million.

Of course, the level of coverage influences the cost of commercial umbrella insurance policies. For example, commercial umbrella insurance policies that cover $1 million in liability may cost a few hundred dollars a year.

When it comes to coverage, commercial umbrella insurance policies cover anything business liability insurance covers. That includes medical expenses and attorney fees. While other types of endorsements are available with the same criteria, commercial umbrella insurance only covers business-related issues.

So, if you find that your current policies are missing a certain level of coverage, you need commercial umbrella insurance.

What Insurance Policies Do I Need As a Business Owner?

Although you may not require all these policies as a business owner, it’s best to research how they protect your business and its property from various claims. Some of the main commercial insurance policies are commercial auto insurance, errors and omission insurance, commercial umbrella insurance, and workers’ compensation insurance.

Protect Your Commercial Property With Torian!

Commercial property insurance is crucial for all types of businesses, whether they’re operating in an office or at home. It protects you and your employees from liabilities and damages to maintain your business’ financial stability.

Torian Insurance offers some comprehensive commercial property insurance plans, which cover every necessary aspect of your building. Even if your business has been damaged by fire, theft, or another covered event, Torian will cover the costs for the repair.

Contact Torian Insurance today to get a quote to protect your commercial property from damages or liabilities now.