Insurance is designed to protect you from significant financial burdens, and it’s very important to ensure you have the right coverage. On the other hand, you don’t want to pay too much for minimal coverage, or even find yourself paying for coverage you don’t need.

One way to protect yourself from falling victim to the complexities of the insurance industry is to work with an independent insurance agent. Learn more about how an independent agent can help you get the best coverage at the best price below.

What Is an Independent Insurance Agent?

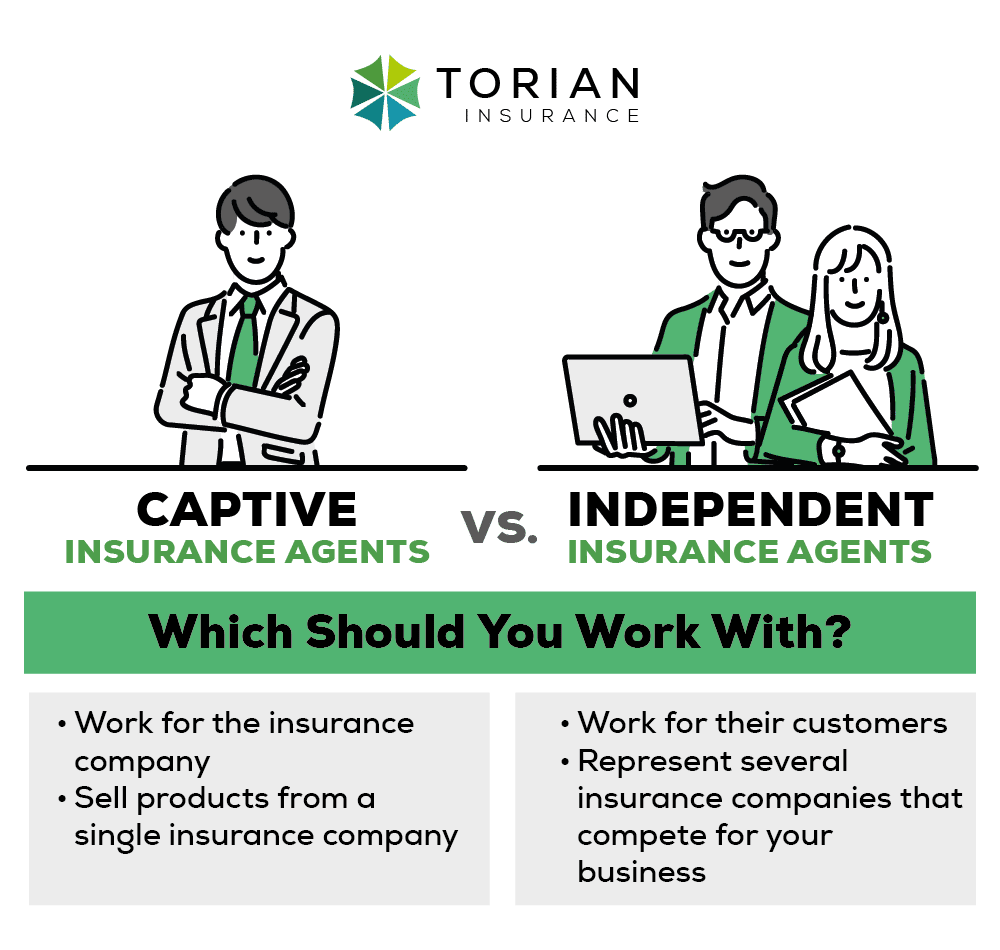

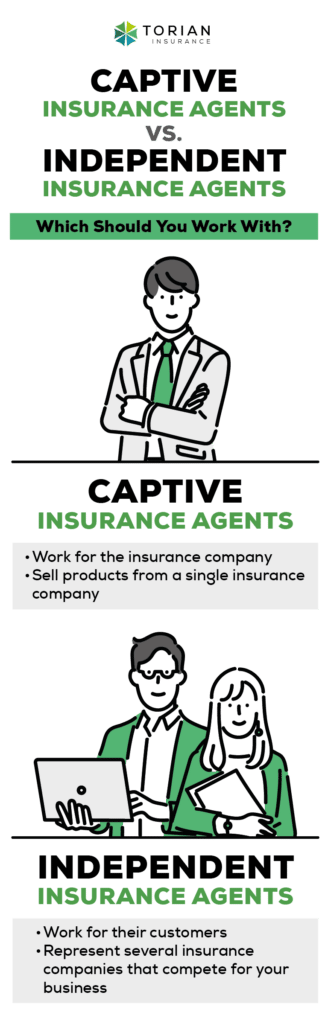

There are two different types of insurance agents: captive agents and independent agents. Both types of agents sell insurance products to consumers. The difference is in what insurance products they sell.

Captive insurance agents work for a single insurance company and only sell that company’s products and services. That means you end up with fewer options when you work with a captive agent.

Independent insurance agents have no exclusivity agreements with any insurance company. Instead, they work with multiple different insurance companies to find you the best possible coverage at the lowest possible price, regardless of which insurance company provides that coverage. Their ability to pay their bills is based on their ability to serve their customers (not serving the insurance company).

Should I Work With a Captive Insurance Agent or Independent Insurance Agent?

Although captive agents have their place in the insurance industry, if you want the best deal, most personalized plan, and most personalized insurance purchasing experience, it’s best to go with an independent agent.

What’s the Difference Between an Independent Agent and a Broker?

In most cases, insurance agents work as captive agents for a specific insurance company. The term broker is simply another way to say independent agent. Brokers and independent agents don’t work for any specific insurance company. Instead, they work for their customers by making insurance companies compete for their business.

5 Reasons You Should Work With an Independent Insurance Agent

There are several benefits to choosing an independent agent to help with your insurance needs. Find the details of the most exciting benefits below.

1. Better Coverage at Lower Prices

Independent insurance agents aren’t beholden to a single insurance company. Instead, they work with multiple companies. This creates a more competitive environment for you, the person purchasing the insurance.

Independent agents force insurance companies to compete for your business. These insurance companies know you’re working with an agent who’s likely to go over the policy options they provide with a fine-toothed comb and compare every aspect of coverage and the cost of each type of coverage against other options.

That means if the insurance company wants to win your business, they have to give their best offer. As a result, you end up with lower premiums for insurance that covers more.

2. Local Agents Understand Local Needs

When you work with an independent insurance agent, there’s a strong chance that you’ll be working with a local agent. There’s a significant benefit to that. Your local agent understands the risk environment in your local area better than an agent that lives anywhere else.

For example, a local agent understands local weather patterns, traffic risks, and other risks that may play into homeowners insurance, car insurance, and other insurance products.

3. Your Agent Works for You, Not the Insurance Company

This may be the biggest reason to work with an independent insurance agent. When you work with a captive insurance agent, that agent works for the insurance company and needs to keep the insurance company’s best interest in mind when they sell insurance products. That doesn’t mean you won’t get great insurance, but it does mean you’re not going to have as many options and that the representative’s central interest isn’t in you.

When you work with an independent insurance agent, your agent works for you rather than the insurance company. Think of the independent agent as your insurance advocate. These agents have your best interests at the forefront of everything they do, even if those interests don’t match with the products offered by some of their insurance partners.

4. They Understand the Complexities of Risk & Insurance

Independent agents tend to have a better understanding of the complexities of risk and insurance because they work with several insurance providers and products on a daily basis and. As a result, they tend to be better equipped to help you find the right coverage considering the unique risks you face.

5. Get the Coverage You Need & Don’t Pay for What You Don’t

Since captive agents work for a single insurance company, their goal is to sell that insurance company’s products. In some cases, this means you could end up with insurance coverage that you may not need but have to pay for.

Independent insurance agents take the time to learn exactly what you need and make you the center of attention. As a result, you end up with the insurance coverage you need and typically avoid paying for coverage you don’t.

The Bottom Line

The bottom line is that the best deals and most coverage is typically offered by independent insurance agents. If you’re in the market for personal or business insurance, consider reaching out to Torian Insurance.

Torian Insurance is an independent insurance agency that has minted relationships with some of the largest insurers in the United States. As a result, they pit insurance companies against each other and make them compete for your business. In the end, you have an insurance agent with your best interests at the center of everything they do, resulting in the best possible coverage for your unique needs at the lowest possible price. Torian Insurance matches customers in Indiana, Illinois, and Kentucky with independent insurance agents that will listen to their needs and find them the right policy. If you live in Evansville, Newburgh, or the tri-state area, contact Torian Insurance to talk about your insurance needs.