Workers’ compensation insurance, also known as workers’ comp or workman’s compensation, is a type of insurance that employers buy to cover employees who get injured or become ill on the job. In exchange, the employer becomes largely immune from legal liability for sick or injured employees. Most employers are required by law to offer workers’ comp, but state laws govern how it works and every state has different laws.

One of the primary goals of workers’ compensation is to create incentives for both employers and employees to keep workplaces safe and avoid injuries. Other goals include keeping businesses operating and taking care of employees while minimizing cost and disruption for everyone.

Who Needs Workers’ Compensation?

As a business owner, you probably need workers’ compensation and so do your employees. Talk to your insurance company and see what the laws are in the state or states in which you operate. Workers’ compensation is required by state law for most employers.

Your employees need workers’ comp as part of their benefits package. That way they know they will be cared for if something happens at work.

Who Doesn’t Need Workers’ Compensation?

Those who don’t need to buy workers’ compensation make up a shorter list than those who do. They include:

-

- Very large employers that can self-insure

-

- Federal and some state government employees

-

- Businesses in Texas

-

- Businesses of certain types that operate under federal rules

-

- Other exempt groups by state law

Federally exempt groups are the Federal Employees’ Compensation Program, the Longshore and Harbor Workers’ Compensation Program, the Federal Black Lung Program, and the Energy Employees Occupational Illness Compensation Program.

You may also have a situation where worker’s comp covers some of your employees, but not all of them. It may not cover certain categories of employees, including:

-

- Independent contractors

-

- Volunteers

-

- Charities

-

- Domestic workers in private homes

-

- Seasonal workers

-

- Some agricultural employees

-

- Some construction businesses

Even if it’s not required by your state, or on the list above for situations where it might not be necessary, most businesses would still benefit from purchasing it. Speak with an agent at Torian Insurance to make sure you and your employees have all the coverage you need and want. Workers’ compensation can get complicated. It’s helpful to have an expert on your side.

What Is Self-Insurance?

Once a large company reaches a certain size and meets several qualifications, it can choose whether it wants to pay claims directly to its employees. In essence, a business may become its own insurance company if it has assets large enough to cover potential risks. Human resources, or another internal office, collects, processes, and handles claims. The employer assumes all financial risk. However, this is not available in all states.

What’s Going On With Texas?

As of 2018, employers in Texas are not required to carry workers’ compensation in their insurance offerings. However, if an employee becomes ill or injured at work, they can sue their employer for the full costs of their injury. Frequently, these full costs are higher than the benefits that insurance pays. Most employers in Texas still buy workers’ comp because of this.

In America’s earlier days, there was no such thing as workers’ comp. If a worker got injured on the job, either the employer could volunteer payment or the employee could sue. Over time, the courts established many claims employers could make to win lawsuits. It was nearly impossible for an employee to win a case. That’s when workers’ compensation came into being. By 1949, every state required employers to carry workers’ comp policies.

Texas law works like the old system, but it does not allow the employer to use the old defenses. This means that the worker has a much better chance of winning any lawsuit. Still, 30% of Texas businesses do not buy workers’ comp.

What if I Don’t Buy Workers’ Comp?

If you don’t buy workers’ comp coverage for your employees, you will be subject to a set of punishments that vary by state. These punishments include large fines, smaller daily fines, and jail time. If an accident happens, your business will probably be liable for the entire cost of your employee’s accident, plus fines. You might also be ordered to stop all work until you buy insurance. In severe or repeat cases, the state commission that oversees workers’ comp may limit your ability to carry on with business, potentially forcing you to shut down.

How Much Does Workers’ Compensation Cost?

Pricing for workers’ comp varies so much that it is hard to figure out an average or even a range. The best thing to do is to sit down with your insurance agent and discuss the details of your business and your employees. At Torian, we know workers’ compensation insurance well and can steer you through the maze of laws and other factors to get prices to you quickly.

In 2016, Illinois had the highest average costs, at $2.23 per $100 of payroll. But this is only an average and actual costs still vary greatly. Indiana had the lowest average costs at $1.05 per $100 of payroll. Again, this number includes a large variance. Coverage for construction workers can be four to 10 times higher.

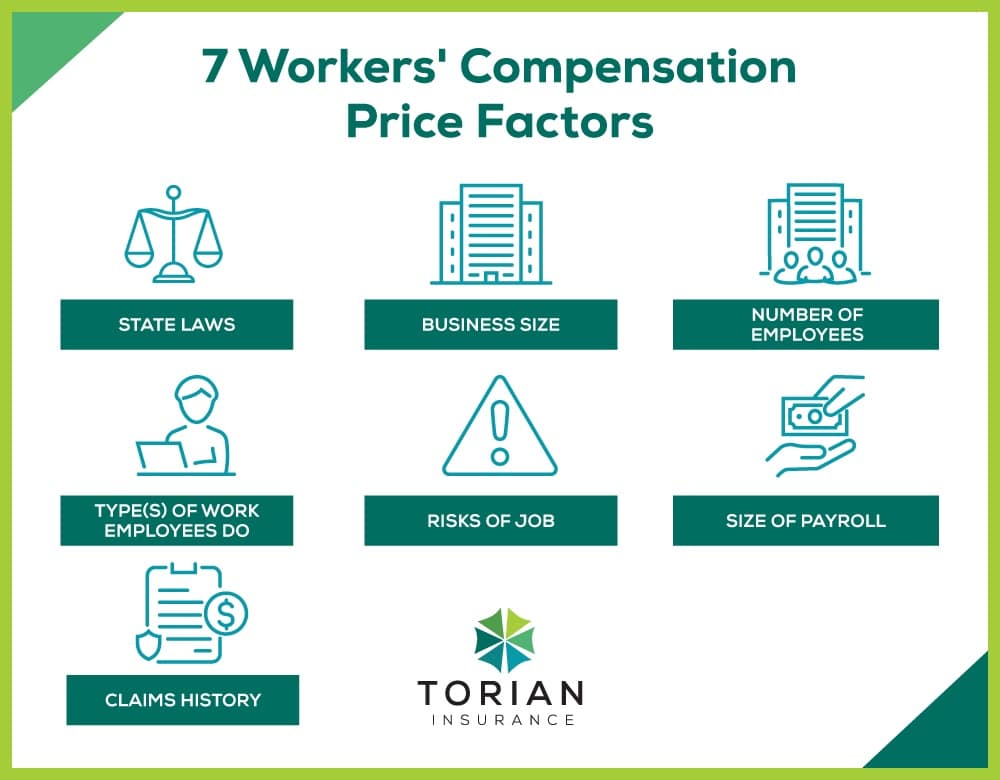

Price Factors

Determining an actual price for workers’ compensation involves weighing many factors. Some of these factors include:

- State laws

- Business size

- Number of employees

- Type(s) of work employees do

- Risks of the job

- Size of the payroll

- Claims history

What Does Workers’ Compensation Cover?

Workers’ compensation covers an employee for a large part of the normal costs of being injured or becoming ill at work. Generally, it pays fully for doctor’s bills and only partially for missed wages. This is because the law is a compromise between the employer’s and employee’s interests.

For a worker to be covered, you must have an active workers’ comp policy. The injured must be an employee of your business who is eligible for worker’s comp, and they must get injured at work or become ill because of conditions at work. Additionally, claims must be filed ahead of all state deadlines.

Workers’ Compensation Benefits

Workers’ compensation insurance covers a wide range of benefits for an injured or ill employee. The insurance company will examine the report you and the employee file to determine which benefits best fit the situation.

-

- Medical coverage includes both emergency and long-term medical costs of treatment.

-

- Wage benefits partially cover income lost when an employee cannot work because of illness or injury. Most insurance covers a percentage of the average weekly wage.

-

- Vocational rehabilitation includes physical and other therapies the injured person needs to get better, as well as general workplace training to avoid more injuries in the future.

-

- Death benefits are paid to an employee’s family if a worker dies on the job. These benefits may include funeral costs and other amounts as required by state law.

-

- Permanent partial impairment (or permanent loss of ability not resulting in death) is when an employee becomes disabled in the workplace and either cannot work or has their ability to work severely limited. Typically, a totally disabled employee will get around two-thirds of their weekly wage.

-

- Temporary disability happens when recovery from an injury or illness takes some time to resolve.

What Does Workers’ Comp NOT Cover

Workers’ compensation doesn’t cover injuries that happen away from the workspace. There are some exceptions, but they vary under state law. It may cover a person who has to travel as part of their job if a road accident happens. It would not cover someone driving to work.

Injuries are not covered when the employee was clearly at fault. This includes injuries resulting from:

-

- A fight that the employee started

-

- Intentional self-harm

-

- Intoxication while at the workplace

-

- Violating company policies

-

- Committing a crime

What About Mental Health?

Requirements for mental health coverage vary by state. Some don’t cover mental health claims that arise from work. Emotional injuries, pain, and suffering are not normally included.

However, as claims (especially for anxiety and depression) become more measurable, more states are including them. In these states, the claims have to be proven to arise from work incidents. But some, like a claim for PTSD after being in a gruesome accident, are more likely to be covered as part of making the employee whole.

How Does Workers’ Compensation Work?

As the employer, you pay a premium every agreed period (such as once a month). An employee raises a claim to you, and you file it with the insurance company. If the company approves the claim, it will pay the bills after you pay any deductible that is part of your policy. In other words, it works like most other insurance policies.

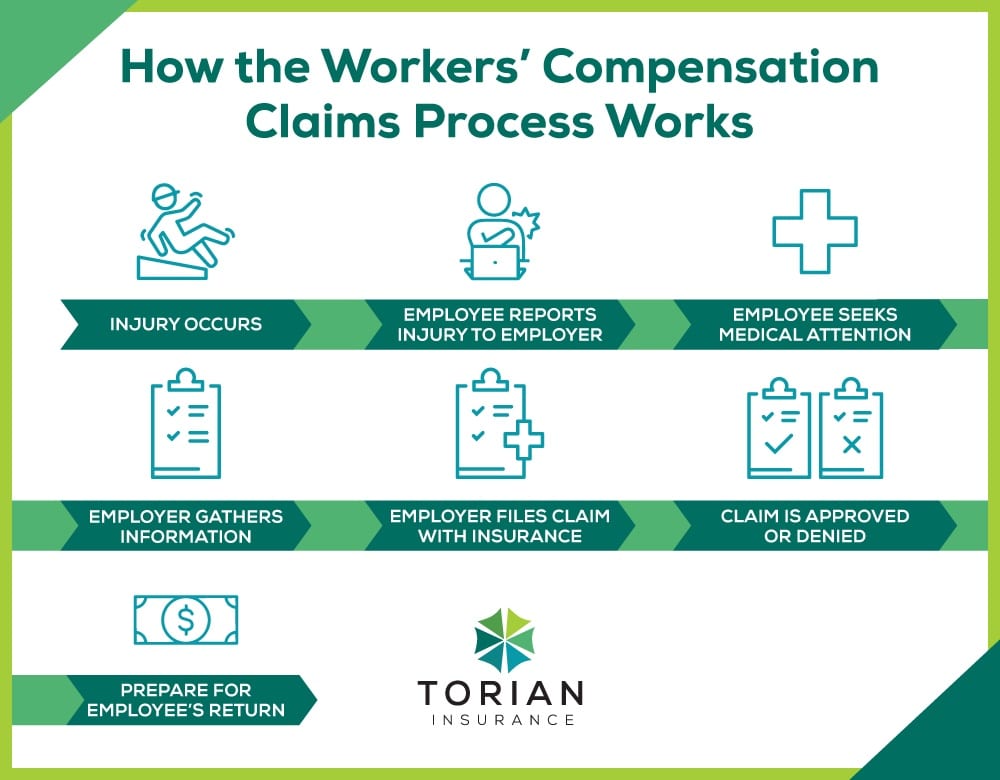

How Does the Workers’ Compensation Claims Process Work?

The claims process works in a similar manner to most other insurance claims. The employer, the employee, and the insurance company all have roles to play. Remember, just as workers’ comp laws vary by state, so do claims processes. But here is a general, step-by-step overview.

Step 1: Train Employees To Report Injuries Immediately

Your employees need to alert you to a work-related injury or illness in a timely manner. That way, you can contact your insurance company as quickly as possible. This is important so you can make sure your employee’s bills are covered and so that the incident is investigated thoroughly.

The faster a workers’ comp claim is filed, the quicker all the processes involved with it begin. The employee knows that all doctors’ bills are covered from the start. This makes them able to seek necessary treatment and not let the injury get worse by trying to live and work with it for a few days.

The employer and insurance company can investigate the occurrence and collect evidence while it is still available. You can interview co-workers while the incident is still fresh in their minds and have the work site examined before someone comes through to clean it up.

It’s important to report illnesses and injuries promptly, even if medical attention is not needed.

Step 2: Instruct the Injured or Ill Employee To Seek Medical Attention Immediately

The employee should leave immediately to seek medical attention. Again, this keeps an injury from getting worse and costing more. The early signs of carpal tunnel syndrome, for instance, are faster, easier, and cheaper to treat than an advanced case.

You can steer your employee toward preferred medical centers and pharmacies that are given preferential payment under your insurance. This helps reduce costs for everyone involved.

If your employee’s illness or injury requires recovery time under a doctor’s orders, approve their time off work immediately.

Step 3: Gather Information and Evidence

You will need to file a claim as soon as possible, but you will need to be prepared to provide all of the details surrounding the incident first. This includes the date it occurred or was reported, the type of injury, the body part(s) affected, the cause of injury, and the estimated time away from work the employee needs to recover. You will need to get this information from the employee or witnesses while their memory is fresh.

Find physical evidence and take plenty of pictures at the site of the occurrence.

Step 4: File a Workers’ Comp Insurance Claim

As the employer, you should file a workers’ comp claim with your insurance agency as quickly as possible. This allows for a fast and thorough investigation and a quick determination of claims.

Keep in touch with the injured worker. Make sure they are receiving proper care until they return to work. You will need to guide them through all the required paperwork.

Step 5: Wait for the Insurance Claim Review Process

Your insurer will use the evidence you have gathered to approve or deny the claim. It will let you (as the employer) and your employee know the status of the claim. If it’s approved, the employee can accept the offer the insurance company makes, or the employee can (with legal representation) negotiate for different benefits.

If the claim is denied, the employee can either request a reconsideration from the insurer, or they can file a formal appeal with the state workers’ compensation board.

Step 6: Prepare for the Employee to Return to Work

When a hurt or ill employee has recovered and is ready to return to work, they must give written notice to both the employer and the insurance company. Some employers have a formal return-to-work program, which may include safety training or modified duties. Talk to your insurance company about implementing a formal return-to-work program and whether it’s right for your workplace.

How Do Claims Affect the Employer?

Claims do matter. Just like auto or home insurance, workers’ comp claims will raise the business’ insurance premiums. The best thing you can do to keep a workplace safe is to train your employees on safety procedures.

Talk with your insurance agency or insurance company about other ways to lower your premiums.

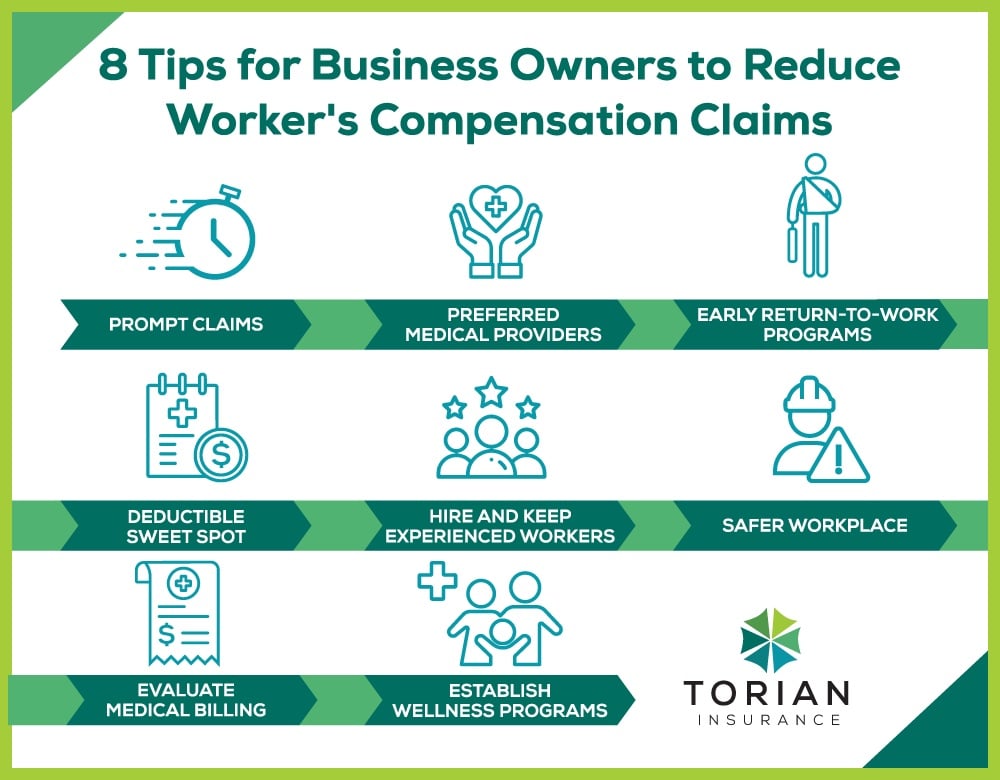

8 Tips for Reducing the Costs of Worker’s Compensation Claims

Consider discussing cost-saving measures when you set up your workers’ comp policy with your insurance provider. You may be able to glean helpful insights on saving money from the representative. Here are a few additional tips that can help reduce your worker’s compensation costs.

1. Report Claims Promptly

Set up a system where employees report all accidents immediately, even if they do not require medical care. Train all employees on how this works. That way, you can be certain that workers’ comp will cover all insurable injuries and illnesses. You will know where the problem spots in the workplace are.

2. Direct Injured Employee To Specific Medical Care Rather Than Letting Them Choose Where To Go

Most insurance plans have preferred medical providers, from doctors to prescriptions. They have negotiated for the lowest prices, which benefits everyone. These are also providers who know how to file claims with your insurer.

3. Implement Early Return-to-Work Programs

Returning to work as soon as possible, even to a lessened or restricted job, helps everyone out. Most employees will be happy to return to full wages. This also keeps you in touch with your employees and able to track changes in their conditions or care. This may mean bringing back workers part time or in different job roles.

4. Agree to a Deductible

Setting a higher deductible is one of the best ways to lower your insurance premiums. However, you don’t want the deductible to be higher than you or your employees can pay. If you set the deductible too low, your premiums will be too high. Talk to your insurer about finding the sweet spot for your business’ deductible.

5. Hire and Keep Experienced Workers

Employees with more experience working safely in the field will lower your costs. These workers are less risky than newer ones.

6. Solve Health and Safety Problems

Strive to make your workplace safer. A safety audit is a great thing to do. Include asking your workers what aspects of the job they consider to be most dangerous. Increasing training, whether as a group or one-on-one, is another great way to boost safety and so is making sure that your signage is clear and up-to-date.

7. Evaluate Your Medical Billing

Going over the bills your employees send in is the best way to catch potential fraud. You can also spot trends in workplace injuries and develop procedures to deal with them.

8. Establish Wellness Programs

Offering wellness programs at the workplace will help lower your claims rate. You can provide workshops, for example, on major diseases like depression or diabetes. You can also offer exercise or cooking classes before or after work. Stressing the importance of continuing with treatment and making sure your workers get the time off of work they need to go to appointments is important, too.

How To Get Worker’s Compensation Insurance

To get workers’ comp, start by calling your state’s workers’ compensation board or your insurance company to determine which laws apply to you. If your business operates in multiple states, you will need to find the laws of each one so you can buy coverage for the employees at these locations.

Torian can help guide you through the maze of workers’ compensation laws in different states. It offers a wide range of workers’ comp insurance policies to fit your business’s needs. The first step is to give us a call at (812) 424-5503 or visit our website.

Worker’s Compensation FAQs

Can I Buy Workers’ Comp Insurance From the State?

Maybe. Businesses in North Dakota, Ohio, Washington, and Wyoming have to buy workers’ comp from the state.

In other states, employers can choose to buy it from either a state or private insurer. These states are Arizona, California, Colorado, Idaho, Kentucky, Louisiana, Maine, Maryland, Minnesota, Missouri, Montana, New Mexico, New York, Oklahoma, Oregon, Pennsylvania, Rhode Island, Texas, and Utah. In some places, only businesses that cannot get insurance through a private insurer use the state option.

In most states, private insurers are the only option. Check out your state laws for coverage choices.

How Long Does Workers’ Compensation Last?

It varies. Workers’ comp generally covers more serious injuries for longer times. An employee who foresees the need for health care over a longer period, for example, should talk to a lawyer about their situation. One who receives a small cut at work may find the doctor’s visit paid for along with a tube of antibiotic ointment. An employee with a leg injury may have a couple of months’ worth of physical therapy before they can return.

Do Some Workers Cost More Than Others?

Yes. Costs are the highest for those workers in the most dangerous jobs. These jobs include lumberjacks, electrical contractors, telecommunications repair workers, construction equipment operators, police, firefighters, and fishers.

Why Can’t You Give Me Any Numbers on Costs?

There is no central clearinghouse of workers’ compensation information. The states keep all information, and different states release different types and amounts of information. Some organizations are working to standardize data collection, but as yet, there is no good way to compare states.

What About Gig Workers (Freelancers or Independent Contractors)?

A gig worker is a freelancer or independent contractor who typically do short-term work for several clients. They often work on a project-based basis or as an hourly or part-time worker. They can work temporarily or ongoing. States continue to refine who is a worker and who is an independent contractor. Some states are considering rules that make it more likely to consider a gig worker an employee. Others are doing the opposite. This is an issue to keep a close eye on.

I’m Ready To Find Out More About Workers’ Compensation Insurance, What Do I Do Next?

Workers’ comp is an important part of providing quality protection for your employees, in case of injury or illness sustained while on the job. It is essential that you are well-informed and have all the information you need to make sure your business is properly protected with a workers’ compensation plan.

There are many cost effective options available these days and more employers are taking advantage of them by shopping around for the best coverage for their businesses insurance needs.

Torian Insurance is here to help you decide which type of worker’s compensation policy is right for your business. Give us a call today if you have any questions or need assistance setting up a policy.