In the complex world of electrical work, every flick of the switch carries a potential risk. Electrical contractors face a unique set of challenges, from job-related injuries and legal liabilities to financial losses stemming from property damage or theft.

This blog post will illuminate the importance of robust insurance coverage for electrical contractors, delving into the various types of policies that can help shield your business from the unexpected.

Prepare to navigate the complexities of insurance with newfound clarity and confidence.

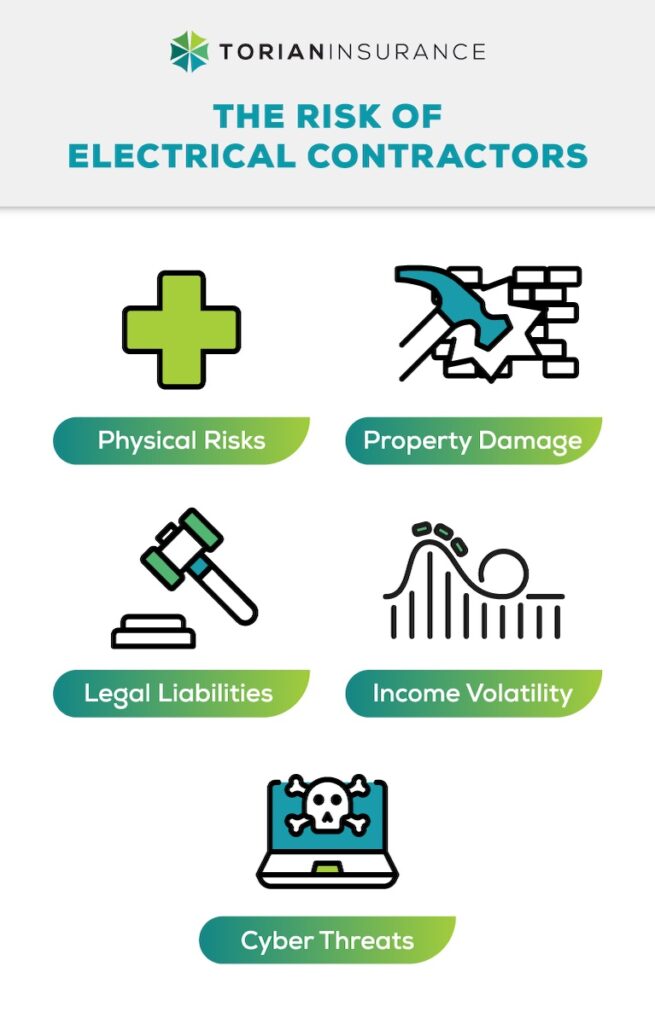

Understanding the Risks Electrical Contractors Face

Electrical contracting is a field mired with intrinsic and significant risks. Let’s take a deeper look at some of the more common risks associated with electrical contractor work.

Physical Risks and Associated Costs

Job-related injuries like electrical shocks, burns, or falls can escalate into a grave threat to the health and safety of electrical contractors. These injuries can adversely affect not only the physical health of the person involved but also the financial health of the business that employs them. For instance, should an accident occur, business owners might encounter hefty medical costs, lost wages, and potential legal liabilities in the form of lawsuits. This emphasizes the undeniable value of being amply insured.

Property Damage and Its Financial Repercussions

The extent of potential risks stretches far beyond personal injuries, venturing into realms like property damage that can transpire both at the work-site and away from it. Incidents such as unintentional damage to a client’s home during a wiring assignment or a fire resulting from flawed installations can give rise to steep financial consequences.

Legal Liabilities and Possible Financial Outcomes

Legal liabilities can originate from accidents due to professional errors or customer injuries. This could entail costly legal defense fees and hefty settlement payouts. Electrical contractors can also face legal action from dissatisfied clients who may sue for damages incurred due to faulty work. In these situations, having the right insurance coverage can save the business from significant financial losses.

Income Volatility Due to External Factors

The fluctuating workflow brought on by unforeseen circumstances such as poor weather conditions or emergencies can put significant pressure on contractors who rely upon steady income to remain afloat. And while insurance can’t prevent these situations from occurring, it can provide financial support, ensuring that payments and overhead costs are met despite a dip in income.

Emerging Challenges in the Digital Age

In an interconnected digital age, newer challenges are emerging too. Cyber threats carry a tangible risk, more so if you handle sensitive customer information electronically. A data breach could lead to considerable fines, loss of customers, and damage to a contractor’s reputation.

Every angle of the electrical contractor’s profession has inherent risks, and it is of utmost importance to assess and understand these risks to put in place a solid plan to mitigate and manage them effectively. An insurance policy that takes these unique challenges into account is a crucial element of any such risk management strategy.

Types of Insurance Coverage Essential for Electrical Contractors

Electrical contractors must navigate a landscape of potential hazards that can have significant financial repercussions without the right insurance coverage. Fortunately, there are several insurance coverages available to mitigate these risks and protect the business and its assets.

General Liability Insurance

General Liability Insurance is a fundamental necessity for electrical contractors, providing protection from third-party claims that may arise during operations. It protects against incidents that could occur on the job, including customer injuries or property damage, ensuring that the business is not financially crippled by lawsuits.

General Liability also covers damage caused by products or services, ensuring that your business is not held liable for any losses incurred by a customer due to faulty work.

Commercial Auto Insurance

Commercial Auto Insurance is crucial for electrical contractors who rely on vehicles to transport tools, equipment, and personnel to various job sites. This coverage takes care of expenses resulting from commercial vehicle accidents, protecting the business from the high costs associated with vehicle repairs, medical bills, and legal issues.

Commercial Property Insurance

Commercial Property Insurance safeguards the business premises and assets, offering security against losses from events like fire, theft, or vandalism. It also covers lost income due to property damage, ensuring that the business can continue to operate even after a disaster.

Worker's Compensation Insurance

Workers’ Compensation is mandatory coverage in most states, providing benefits to employees who suffer work-related injuries or illnesses. This insurance is essential for electrical contractors as it not only covers medical expenses and lost wages for injured workers but also limits the business owner’s liability for workplace accidents.

Business Owners Policy (BOP)

The Business Owners Policy (BOP) is tailored for small business needs, combining property and liability insurance into one convenient package, often at a cost-saving rate. A BOP usually covers property, liability, and business interruption, with options to add additional coverage as needed.

Commercial Umbrella Insurance

Commercial Umbrella Insurance is an additional layer of liability coverage for unexpected events that exceed the limits of standard policies. It provides an essential safety net for businesses that engage in high-risk activities such as electrical work. With umbrella coverage, contractors can rest assured that they are protected from catastrophic events that could otherwise leave their business in financial ruin.

Other Coverage Options

- Surety Bonds are essential for contractors to guarantee the fulfillment of their contractual obligations.

- Inland Marine Insurance protects the tools and machinery that are vital to electrical work, whether they are stored on-site, in transit, or at a job site.

- Business Interruption Insurance covers the loss of income that a business may suffer after a disaster while it’s closed for repairs. Lastly, Errors and Omissions Insurance defends against claims of professional mistakes or negligence in the services provided.

Each of these coverages is designed to address specific risks in the electrical contracting business, ensuring a comprehensive safety net for both the contractor and their clientele.

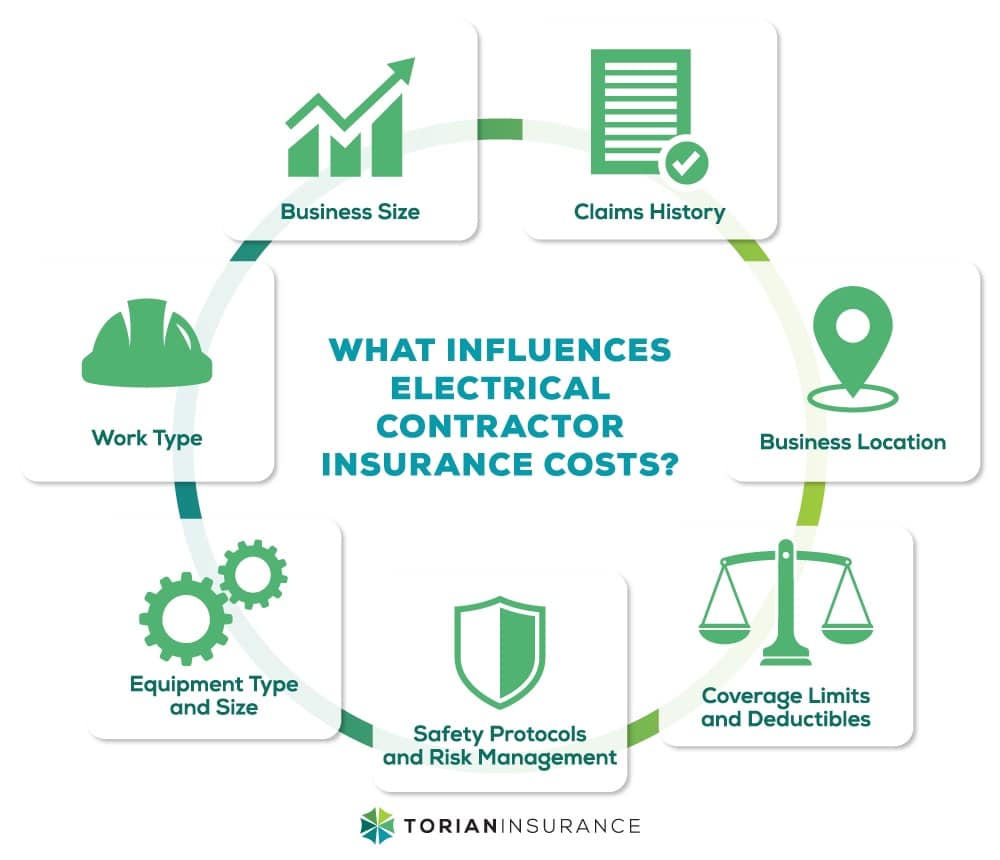

Factors Affecting the Cost of Electrical Contractor Insurance

Various factors influence premiums for electrical contractor insurance, ensuring that each business receives a rate reflective of its unique risk profile.

- Work type is a critical determinant of insurance costs; for example, high-risk electrical jobs such as working on high voltage systems or in hazardous locations may result in higher premiums due to the increased likelihood of accidents or damage.

- The size of the business plays a role in insurance rates, with larger operations potentially facing greater risks and subsequently higher insurance costs.

- The contractor’s claims history also plays a role in determining insurance costs. A history of frequent or severe claims may result in higher premiums as insurance providers perceive the business as a higher risk. On the other hand, a clean claims history may lead to lower premiums.

- The location of the business is also a factor, with some states having higher insurance rates due to factors like weather patterns, frequency of natural disasters, or higher levels of litigation.

- The type and size of equipment and tools used by the business also impact insurance costs, with more expensive or specialized equipment resulting in higher premiums.

- Safety protocols and risk management practices can also impact insurance costs. A business with a strong safety record and a well-implemented risk management plan may be able to secure lower insurance rates.

- Coverage limits and deductibles selected by the contractor also play a role in determining insurance costs. Higher coverage limits and lower deductibles may result in higher premiums, while lower coverage limits and higher deductibles may result in lower premiums.

It’s essential for electrical contractors to work with an experienced insurance agent who can evaluate these factors and ensure they receive the most competitive rates for their business. At Torian Insurance, agents are well-versed in the intricacies of electrical contracting and can help contractors navigate the complexities of insurance coverage to secure the best policy for their needs.

Why Electrical Contractors Shouldn't Skimp on Insurance

Electrical contractors operate in a field where the potential for serious accidents and financial losses is high. Even a minor electrical mishap can lead to significant expenses, including medical bills, repair costs, and legal fees.

Without proper insurance coverage in place, these costs are shouldered by the business and can potentially lead to financial ruin for small contractors. Moreover, unanticipated events due to weather or emergencies can halt operations entirely unless there’s adequate protection offered through Business Interruption Insurance.

The reality of being uninsured or underinsured is that it places the entire business at risk in the case of a lawsuit or substantial property damage. For example, if an electrical contractor is found liable for an incident that exceeds the limits of their insurance policy, they may have to pay out of pocket, which could lead to business insolvency or personal bankruptcy.

These scenarios underscore the critical nature of comprehensive insurance coverage for electrical contractors to protect against such risks and ensure the longevity of their business.

Special Considerations and Exclusions in Electrical Contractor Insurance

Understanding the limits of insurance coverage is as vital as having the policy itself.

Special considerations in electrical contractor insurance often include an evaluation of business-specific risks that may require additional endorsements or riders to ensure comprehensive protection. For example, high-risk tasks like working with high voltage systems or in hazardous locations may require additional coverage options to ensure that all risks are adequately addressed.

Similarly, contractors should be aware of exclusions in their policies, which outline situations where coverage will not apply. This information is crucial as it helps contractors understand potential gaps in their coverage and allows them to take steps to mitigate these risks.

For example, a general liability policy may not cover incidents related to asbestos or mold, which may require additional specialized coverage.

It is crucial to discuss these considerations with an experienced agent to ensure that all potential risks are addressed and covered through appropriate policies.

The Integral Role of Torian Insurance in Securing and Empowering Electrical Contractors

Serving as a strategic partner in risk management, Torian Insurance is pivotal in providing a safety net for the challenging field of electrical contracting. Recognizing the unique challenges and risks associated with the profession, Torian leverages a century’s worth of expertise to offer tailored insurance plans that precisely fit each contractor’s needs.

They look beyond standard insurance offerings to devise thoughtful insurance solutions. These specialized plans include non-standard coverage for niche areas of operation. This method of careful risk consideration is designed to deliver comprehensive coverage at the most cost-effective rates, safeguarding the financial health of your electrical contracting business.

Acquiring an insurance policy from Torian Insurance transcends just receiving coverage—it means establishing a partnership with a trusted advisor who is deeply invested in your protection and empowerment. Aligning yourself with Torian is an affirmation of your commitment to both securing your business assets and ensuring its vibrancy for many years to come.

Become a part of the Torian family and let our team assist you in mapping out an insurance strategy that is as unique and robust as the electrical services you offer.

Enabling Safe Circuits of Success with the Proper Insurance Solution

As electrical contractors, the stakes are high with every wire you run and every service you provide. The right insurance coverage isn’t just a safety net—it’s an essential component of your business strategy, safeguarding your livelihood, your employees, and your reputation. At Torian Insurance, we understand the intricacies of your work and are poised to offer you a customized insurance portfolio that addresses each risk you face.

With our century-long experience and dedication to the electrical trade in the tri-state area, partnering with us means securing more than just insurance; it’s about gaining a trusted ally in risk management. Let’s tailor a policy that reflects the unique aspects of your business, so you can focus on powering the community with confidence.

Take the first step towards comprehensive protection. Reach out to us at Torian Insurance and allow us to craft a personalized insurance solution that keeps your business energized for the long haul.