Insurance is more than just a policy; it’s a financial safety net that protects your home, vehicle, health, and business from unexpected setbacks. By covering losses from accidents, natural disasters, or other emergencies, the right coverage ensures financial stability, legal compliance, and peace of mind.

This article will explain the clear benefits and inherent challenges of insurance, offering simple, jargon-free explanations to help you choose coverage that fits your unique needs, whether you are an individual, a family, or a business owner.

Common Types of Insurance and When They Are Needed

Different circumstances call for various types of insurance. Knowing your options helps you select coverage that best suits your needs.

Personal Insurance

- Car Insurance: Legally required coverage that protects you in case of accidents.

- Home Insurance: Secures your property and valuables against damage or theft.

- Health Insurance: Helps cover medical expenses, ensuring timely care.

- Life Insurance and other specialty policies (e.g., pet or personal cyber insurance) serve more specific needs.

Commercial Insurance

- Business Liability Insurance: Protects companies against claims for injury or property damage.

- Professional Liability Insurance: Guards professionals against claims of negligence or errors in service.

- Additional coverages like commercial auto, property, and workers’ compensation may be necessary depending on the nature of your business.

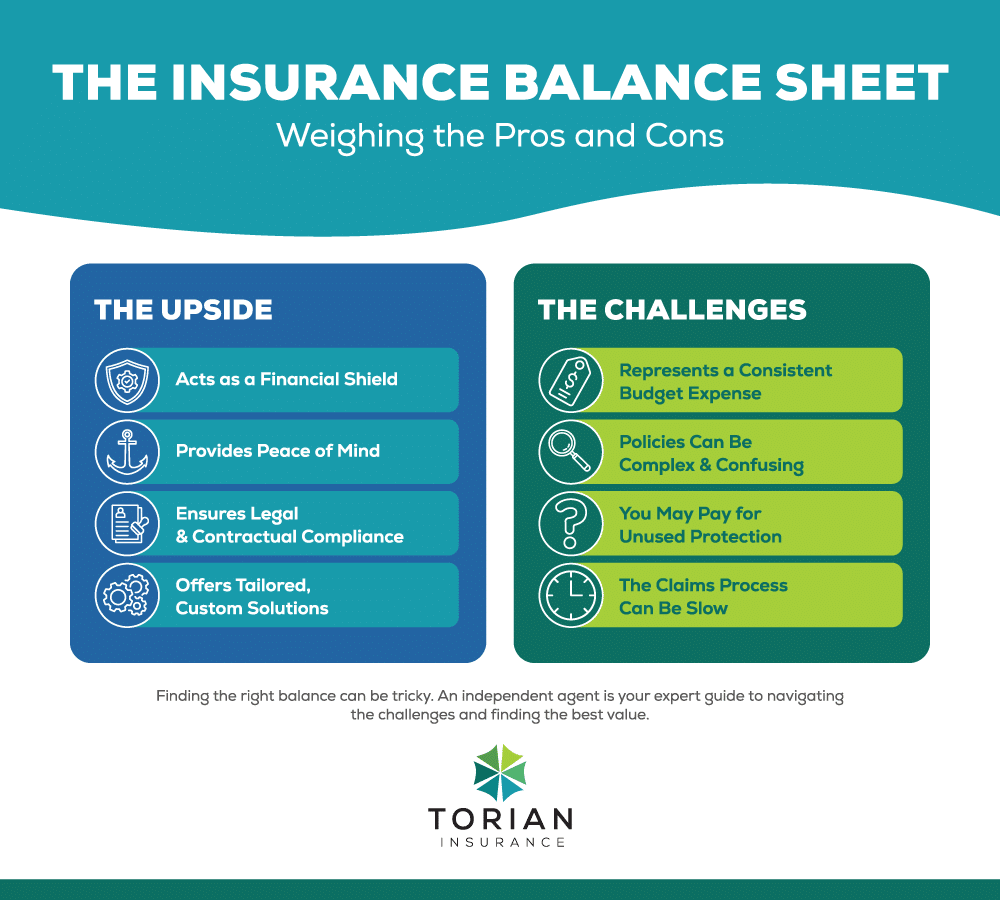

The Core Benefits of Purchasing Insurance

Insurance offers significant advantages by reducing your financial uncertainty and helping you maintain control during emergencies. Here are some key benefits:

Protection from Unexpected Financial Strain

Insurance minimizes the impact of sudden, costly events. By paying regular premiums, you ensure that a substantial financial safety net is always available to protect your long-term goals.

Adhering to Legal Requirements

Many insurance types are mandated by law. For example, drivers must have a valid auto policy, and employers are required to obtain workers’ compensation. Meeting these legal requirements not only avoids fines but also builds a sense of responsibility and security for everyone involved.

Providing Peace of Mind

Beyond financial protection, insurance offers the comfort of knowing that you and your loved ones are prepared for life’s uncertainties. Life insurance and disability insurance ensure that your family is cared for even in difficult times. This safeguard allows you to concentrate on personal and professional growth without constant worry.

Tailored, Customizable Solutions

Insurance policies can be designed to meet your exact needs. Independent agents work with multiple carriers to create plans that fit your situation, whether as an individual or a business owner. This means you get coverage that reflects your personal or commercial risks without being forced into a one-size-fits-all solution.

Navigating the Drawbacks and Challenges of Insurance

While insurance offers many benefits, there are also challenges to consider:

High Premium Costs

Comprehensive coverage often involves significant premiums, which can strain your budget. Although bundling policies or adjusting coverage amounts can help lower expenses, the overall financial commitment may still be high.

Complex Policy Language and Hidden Limitations

Insurance documents can contain technical language. Terms like “coverage gaps” may signal scenarios where certain events or items are excluded. Simplifying policy information or getting guidance from an agent helps ensure you understand exactly what is and isn’t covered.

Paying for Unused Coverage

It can sometimes feel like you are paying for benefits you rarely use. However, the genuine value of insurance lies in its ability to provide essential protection when major incidents occur, even if they happen infrequently.

Lengthy Claims Processes

Filing a claim can be time-intensive and may require detailed documentation. A reputable agency can guide you through the necessary steps, helping you navigate lengthy claims processes more efficiently.

A Practical Guide to Choosing the Right Policy

Selecting the right insurance is a crucial financial decision. To ensure your premiums are a sound investment, follow a thoughtful process to find coverage that perfectly balances your risks and your budget. Here are the essential steps to make a well-informed choice:

1. Assess Your Personal and Business Risks

The first step is to identify your unique vulnerabilities. For an individual, this might be the risk of a health emergency or a car accident. For a business, it could be the risk of a liability lawsuit or property damage. Knowing what you need to protect helps you prioritize the types of coverage that matter most.

2. Set Appropriate Coverage Limits and Deductibles

Your policy limits must align with the actual costs you might face. For example, home insurance coverage should reflect the current cost to completely rebuild your house, not just its market value. At the same time, consider your deductible—the amount you pay out-of-pocket before coverage kicks in. A higher deductible can lower your premium, but you must be comfortable paying that amount in an emergency.

3. Compare Different Policies and Providers

Insurance is not a one-size-fits-all product. Coverage options, policy terms, and pricing vary significantly between providers. It is crucial to compare multiple policies to find the best overall value. An independent agent can be an invaluable asset here, as they can gather and compare quotes from several different carriers on your behalf.

4. Clarify All Policy Details and Exclusions

Before committing, make sure you understand exactly what your policy covers—and more importantly, what it doesn’t. Pay close attention to exclusions (specific events not covered) and any coverage gaps. Don’t hesitate to ask your agent to simplify policy terms and explain any confusing language. A clear understanding now prevents costly misunderstandings later.

5. Schedule Periodic Reviews of Your Policies

Your insurance needs are not static; they evolve as your life changes. Events like getting married, buying a new home, or starting a business can significantly alter your risk profile. Schedule a regular check-in with your agent (at least annually) to confirm that your coverage is still adequate, up to date, and competitively priced.

The Value of Local and Independent Insurance Agents

Local independent agents bring unique advantages such as:

- A strong understanding of community risks.

- Personalized recommendations tailored to your situation.

- Advocacy throughout the claims process, ensuring a smooth experience.

For residents of Southern Indiana, Illinois, and Kentucky, Torian Insurance truly understands the specific risks faced by individuals, families, and businesses in the region. Because the agency is locally owned and operated, the team has firsthand knowledge of common weather challenges, local regulations, and community practices that can affect coverage. This deep local connection sets Torian Insurance apart from large, national agencies, allowing it to create personalized plans that address actual needs on the ground. Moreover, working with a team that lives and works in the same region helps foster genuine rapport, ensuring policy owners feel supported every step of the way.

Emerging Trends in the Insurance Landscape

Advances in technology are reshaping insurance solutions:

- Tools like artificial intelligence can personalize policies and streamline underwriting.

- Improved data analysis helps insurers better gauge individual risk factors.

- Digital platforms simplify the process of comparing quotes and accessing policy details.

Staying informed about these trends can help you secure the most efficient and cost-effective coverage possible. From personal lines to complex commercial policies, innovations may open new opportunities for quicker approvals and more competitive rates.

Balancing Security and Complexity: Making Informed Insurance Choices

Insurance is essential for safeguarding your financial well-being and ensuring preparedness against life’s uncertainties. It offers vital protections—from cutting costs during emergencies to satisfying legal obligations—yet also comes with potential drawbacks like higher premiums and complex language. With a thorough understanding of both benefits and challenges, you can find the right balance for your needs.

If you need help exploring your options, reach out to Torian Insurance for customized advice and coverage. With local roots and a deep commitment to personalized service, Torian Insurance stands ready to guide you toward a secure financial future.