When your income, possessions and assets grow—so does your level of risk. As a result, high net worth individuals often have very different insurance needs than those with more moderate assets. By working with an experienced insurer, you can be sure you have the coverage you need to protect your valuable assets.

If you are not sure if high net worth insurance is a fit for you, this blog post will explain everything you need to know— including who benefits from it, what it covers, and how much it costs.

What is High Net Worth Insurance?

There are plans and programs for insurance coverage that goes beyond what a standard regular homeowners, renters insurance policy, and auto insurance policy provides. It is designed to protect individuals and families with high levels of assets and income with higher limits and extended coverage options. It can also provide liability coverage in the event that you are sued or held responsible for damages caused by your actions.

These plans can be customized to meet your specific needs and can be tailored to provide the level of protection that you require. Some insurers refer to this as “high net worth insurance policies” where other insurers simply create these plans from different coverage options without calling it a “high net worth insurance plan.” A reputable insurance agency will have a pool of coverage options to choose from and they can customize the right plan needed for specific circumstances.

3 Types of Individuals Who Benefit From High Net Worth Insurance

- Those with Valuables – People with a high net worth have a lot to lose if something goes wrong. They may have expensive homes, luxury vehicles, valuable possessions (like jewelry and art), and a lot of money saved up. If something were to happen to all of that, it would be a huge financial loss.

- Those Who Are More Susceptible to A Lawsuit – Also, people with a high net worth are often targets for lawsuits. If someone were to sue them and win, they could lose everything. That’s why it’s important to have liability insurance to protect against that possibility.

- Those with a High Net Worth – People who have a high net worth often have complex financial situations. They may have multiple homes, businesses, investments, and so on. This can make it difficult to get the right coverage with a traditional insurance policy. High net worth insurance policies are designed to be more flexible and to provide the coverage needed.

How Much Does High Net Worth Insurance Cost?

The cost of high net worth insurance depends on the individual’s circumstances. Generally speaking, people with a high net worth are more likely to face higher premiums because they have more to lose. However, there are a number of factors that can affect the cost of high net worth insurance, including the individual’s age, health, and lifestyle.

People who are considered to be high net worth individuals typically have a net worth of $1 to $5 million or more (depending on the insurer). For these individuals, the cost of high net worth insurance can typically range from $2,500 to $25,000 per year. However, the exact cost will vary depending on the insurer and the coverage that is purchased.

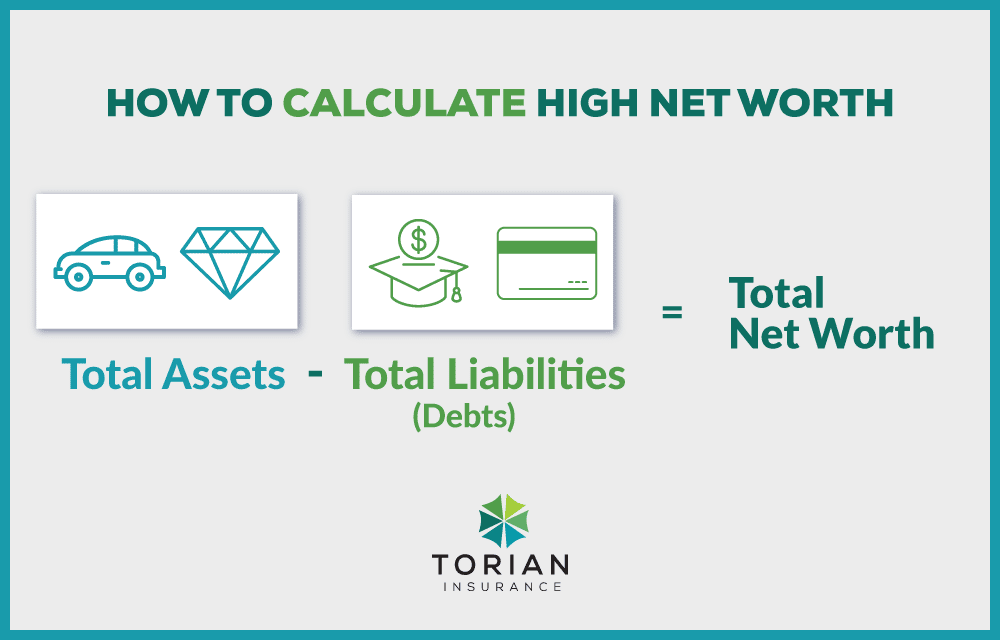

How is Net Worth Calculated?

Many people might assume that high net worth is simply defined as having a high income. However, insurers take a much more comprehensive approach when determining who qualifies for customized insurance policies and programs for high net worth. In addition to income, they also consider factors such as the value of your home, investments, and other assets. They also look at your liability coverage needs and the potential risks associated with your lifestyle.

Insurers use this information to determine how much it would cost to replace your assets in the event of a loss. To do this they will subtract your total liabilities (also known as debts) from your total assets.

Liabilities

Your liabilities will include any outstanding debts such as credit cards, student loans, remaining balance on your home or car, back taxes, etc.

Assets

Assets will include things like the equity in your home, vehicle(s), amounts in your checking and savings accounts, investments, and other assets that have a market value like vehicles, jewelry and expensive art.

Types of High Networth Policies

- High Value Home Insurance

- For many people, their home is their most valuable asset. It’s where they raise their families and make memories that will last a lifetime. That’s why it’s so important to have the right insurance in place in case of any unforeseen events. High value home insurance can give you the peace of mind knowing that your home and belongings are well protected. Most policies will cover the replacement cost of your home and belongings, so you can rest assured that you’re covered in the event of any disaster.

- Umbrella Insurance

- Umbrella insurance provides an additional layer of protection in the event that you are sued for damages. For example, if you are in an accident and the other driver sues you for $100,000, your auto insurance policy may only cover $50,000. If you have umbrella insurance, it would cover the remaining $50,000.

- Jewelry & Valuables Insurance

- Valuables and jewelry insurance protects your investments from theft, loss, or damage. Whether it’s a family heirloom, an engagement ring, or a bracelet you just bought on vacation, your valuables are important to you. And if something happens to them, you want to be sure you’re covered. That’s where insurance comes in. A typical jewelry insurance policy will cover you for loss, theft, and damage. And if you have an item that is especially valuable, you can purchase a rider to extend your coverage.

- Luxury Car Insurance

- Luxury cars are typically defined as those that cost more than $50,000 to replace. Because luxury cars are more expensive to repair or replace, they often require higher levels of coverage than standard auto insurance policies. Luxury car insurance can provide protection for repairs, replacement costs, and even medical expenses. In addition, most luxury car insurance policies include some form of roadside assistance, which can be extremely helpful if you experience a flat tire or run out of gas.

- Watercraft Insurance

- Watercraft insurance is designed to cover boats, personal watercrafts, and other marine vehicles in the event of an accident or other covered loss. Whether you’re a weekend boater or a seasoned sailor, watercraft insurance can give you peace of mind on the water. In most cases, watercraft insurance will cover the cost of repairing or replacing your boat if it’s damaged in an accident. It can also provide coverage for medical expenses if you or a passenger is injured in an accident.

- Personal Cyber Insurance

- In the modern world, we rely on technology for everything from communicating with loved ones to managing our finances. As a result, our personal data is more vulnerable than ever to cyber attacks. Thankfully, personal cyber insurance can help to protect us from the financial fallout of a data breach. This type of insurance covers expenses such as credit monitoring, legal fees, and identity theft protection. It can also help to cover the cost of restoring damaged computer equipment.

- Kidnap & Ransom Insurance

- This coverage typically includes expense reimbursement for things like ransom payments, negotiation fees, and travel expenses. It may also provide coverage for things like psychological counseling and security upgrades. Kidnap and ransom insurance is typically offered as an add-on to a homeowner’s or business insurance policy. It is important to note that kidnap and ransom insurance does not cover the loss of property or income if you are kidnapped.

Are There Alternative Options to High Net Worth Insurance?

Though there isn’t a direct alternative to high net worth insurance, there are measures you can take to protect your valuables through your estate planning, deposits and securities, trusts and legal options, etc.

You can also protect your wealth by self-insuring your belongings. This means setting aside money each month to cover the cost of replacing your possessions in the event that they’re damaged, lost, or stolen.

Self-insuring can be a good option if you have a high deductible on your insurance policy, or if you don’t mind taking on the risk of paying for repairs or replacements yourself. However, it is worth discussing your needs and budget with an insurance agent to get a quote and see what it would cost to properly insure and protect your valuable assets.

Consult with an Expert to Get the Proper Coverage

If you live in an expensive home, drive luxury cars, or take luxurious vacations, you’re likely to be considered for this type of coverage.. High net worth insurance can give you the peace of mind that comes with knowing that your home, automobile, investments and other valuable positions are safe. However, there is no one-size-fits-all option for this type of coverage.

Want to learn more about customizable policies for your needs? The best place to start is by consulting with an insurance agency—They can do the heavy lifting for you by finding the best insurance policies for your needs through the right insurance companies.

Torian Insurance is here to guide you in the process to help you understand the coverage and limits of your policy. Make sure you have the protection you need in the event that something happens to your belongings—Contact Torian today to get started.