If you’re looking for the best coverage for your vehicle, you should be familiar with the different sections of a car insurance policy and the various terms. Whether it’s your first car or it’s the first time you’re getting auto insurance, the concepts may be perplexing.

You may be asking yourself questions like: How do I find the best car insurance near me? What kind of coverage do I need? How much does car insurance cost? What is a deductible?

Get answers to these questions, and more, with this guide that reviews some of the most critical things to know about car insurance when crafting a coverage plan that works for you.

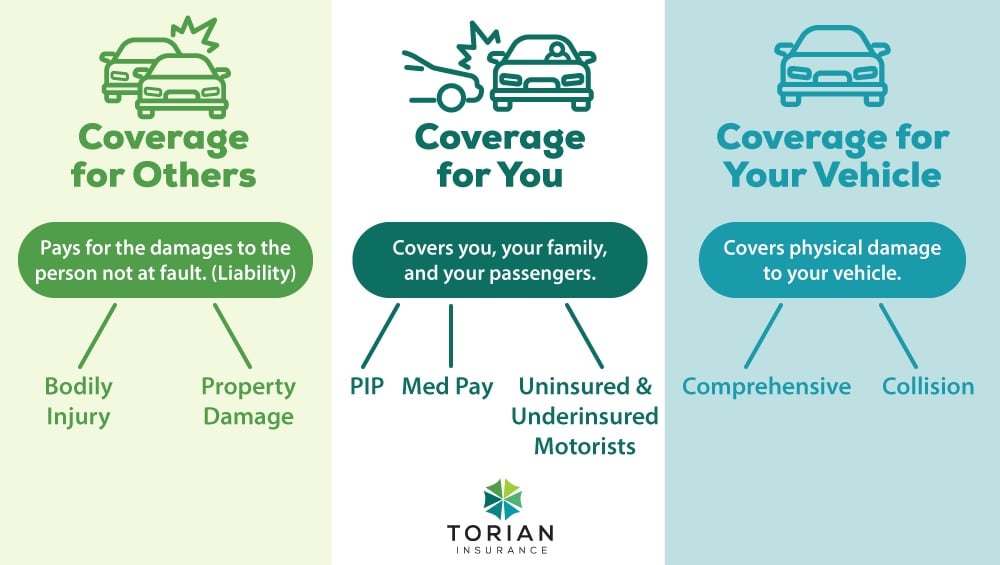

1. Main Sections of a Car Insurance Policy

Possibly the most important thing you need to know about car insurance is the main sections of a car insurance policy and what coverage is a fit for your needs. Typically, there are three high-level sections to consider in the case of an accident; Coverage for others, coverage for yourself, and coverage for your vehicle.

Depending on your state, some of these options may be optional, while others may be mandatory. Before you pick and choose coverages for your insurance plan, you need to know what your state requires.

1. Coverage for Others

This section of an auto policy helps you, as the driver, pay for expenses for an accident you caused that resulted in property damage and/or bodily injury to others. Liability coverage is compulsory in most states across the U.S.

Drivers are required to get at least the minimum amount of auto liability coverage as per the law. There are two major components of liability coverage:

- Bodily Injury: Bodily injury liability pays for the expenses to the injured party on your behalf, in the instance that you caused the accident.

- Property Damage: Property damage liability helps the driver pay for the damage they cause to someone else’s property while they’re driving.

Keep in mind that liability insurance has coverage limits based on what you’ve chosen; the insurer will cover the liability according to these limits.

All states have a minimum coverage limit for property damage and bodily injury liability that is mandatory. You can buy additional coverage based on your needs. Typically, there are three limits on a car insurance policy:

- Bodily Injury Limit (Per Person): The limit establishes a cap on the amount an insurer will pay for the medical expenses of each individual you injured in an accident.

- Bodily Injury Liability Limit (Per Accident): This is the maximum amount your insurance company will pay for the medical expenses of people injured by a single accident you have caused. Since this amount may have to cover multiple people, it’s best to set a larger limit.

- Property Damage Liability Limit: This is the maximum amount your insurance company will pay to repair the damage caused by you to someone’s property. The maximum payout will be below the limit you’ve set

Pro Tip

Torian Insurance recommends limits of at least $100k for per person liability coverage and $300k per accident for bodily injury. Meanwhile, the recommended minimum for property damage is $100k. Although some providers have minimum limits of $25k to $50k, Torian rarely works with them. Most of the companies Torian represents are offering higher minimum limits of $250k or even $500k.

2. Coverage for You

These sections of an auto policy provides coverage for you, your family and your passengers in case of an accident. They also provide Personal Injury Protection (PIP), otherwise known as no-fault insurance.

- PIP: This coverage is offered by insurance in no-fault states. These states have higher thresholds, limiting your ability to sue the other driver for your injuries. The coverage protects everyone in the vehicle, irrespective of the fault.

- Med Pay: Medical Payment or Med Pay is offered regardless of fault and protects you and the other people in a vehicle. It offers coverage for medical costs immediately without wasting time on identifying the fault. Medical payments coverage helps pay for costs like surgery, X-rays, hospital visits, and more. Additionally, Med Pay is mandatory in some states and optional in others. Most insurers offer $5k to $10k limits for Med Pay. But you can also buy Med Pay for some companies that offer limits as high as $100k.

- Uninsured & Underinsured Motorist: Uninsured & Underinsured motorist liability insurance protects you in the event of an accident with an at-fault driver who doesn’t have liability insurance or whose liability insurance limit is too low to cover the medical expenses of the injured parties. Uninsured motorist property damage insurance covers replacement or repair of your vehicle in case you’re in an accident with an at-fault motorist who doesn’t have insurance. The limit you choose for this coverage could be dependent on your vehicles value but it’s a good rule of thumb to set the amount at an average limit that works for most vehicles.

Pro Tip

At Torian Insurance, our clients mainly choose $50k for uninsured motorist property damage as it’s sufficient to replace most vehicles. You can also increase the limit at a meager cost if you drive a higher-value vehicle.

3. Coverage for the Vehicle

You need physical damage coverage in certain circumstances. When you see the term ”full coverage”, keep in mind that it means physical damage PLUS liability coverage.

Agents often use the term “full coverage” when describing both physical damage and liability coverage for a vehicle, but you shouldn’t take the term for its face value since it doesn’t exactly offer ”full coverage”.

To clarify, each company’s policy has certain exclusions, which means no policy guarantees 100% coverage of an accident.

Physical damage coverage includes the following:

- Comprehensive Coverage: It covers damage to your vehicle from things like hail, fire, theft, and vandalism. Comprehensive coverage has a deductible, which refers to the amount you must pay out of your pocket before your insurer reimburses you for the covered claim. In most policies, there’s no limit on comprehensive coverage. The insurer will merely pay the cost for repairs. If the vehicle is damaged beyond repair, the insurer will research its current value and make payments accordingly.

- Collision Coverage: It covers the repair or replacement of your car when you’re involved in a collision with a vehicle, or even stationary objects like a fence, guard rail or a tree. Just like comprehensive, most policies don’t list a limit. The limit is determined by the value of the vehicle at the time of the loss. They will simply pay you the cost of replacement or repair according to the vehicle’s current value.

Pro Tip

You need both of these coverage options if there’s a lease or active loan on your car. If there’s no loan or lease, these options become optional, although at Torian Insurance, we highly recommend these. These are highly recommended for most policies.

Need Coverage for Your Unique Circumstances?

Although there are several circumstantial coverage options, here are a couple of common options that are available for unique situations.

Rideshare Insurance coverage

If you’re a driver for a ridesharing company, like Lyft or Uber, you must know that your personal car insurance does not cover your vehicle’s ”business use”.

Simply put, if you’re in an accident during work hours, you may have to pay the medical and repair expenses on your own.

State laws typically require ridesharing companies to have insurance for their drives. But if you use your car for business and personal purposes, you should consider getting additional coverage.

Classic Car Insurance

This covers the costs of repair for a classic car, such as modified vehicles, modern classics from the 80s or 90s, custom builds, antiques, muscle cars, race cars, sports cars, old military vehicles, and classic trucks or SUVs.

It’s important to speak with an insurance agent thoroughly when getting this type of coverage. Some classic car insurance policies have mileage limitations because the longer a car is on the road, the more chance it has to get in an expensive accident.

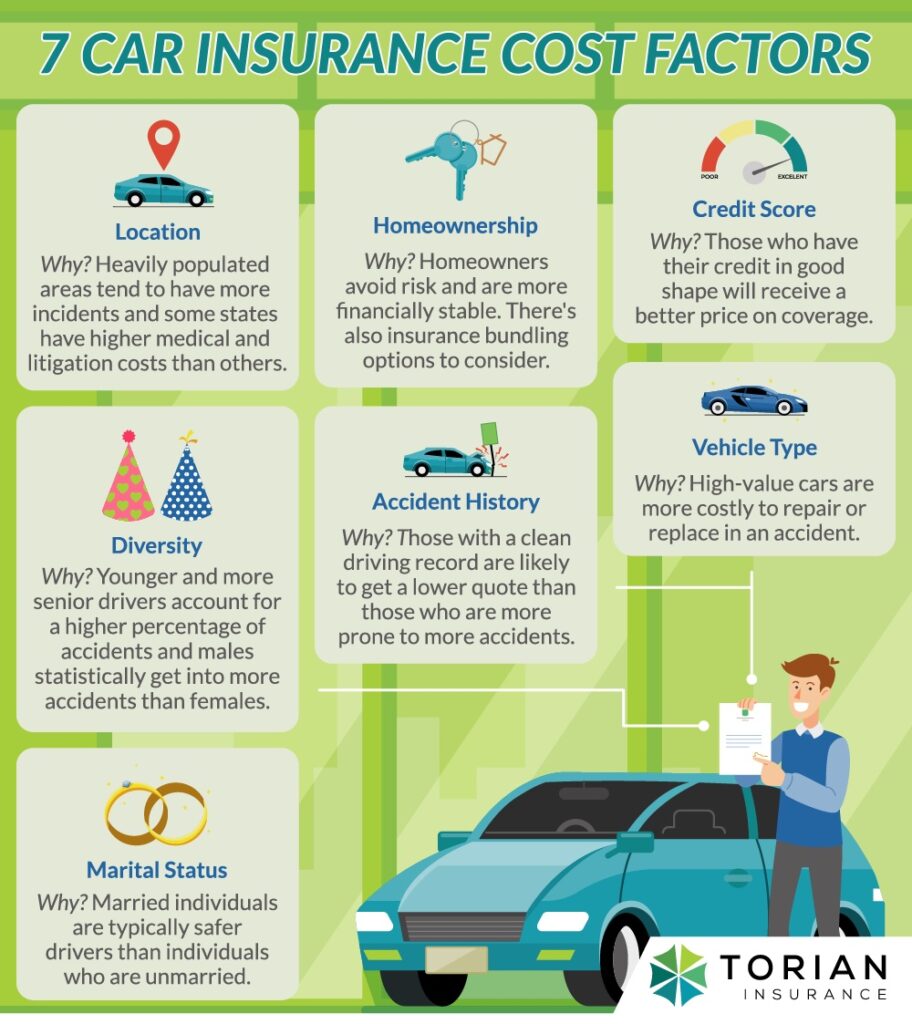

2. How Car Insurance Rates Are Calculated

Car insurance quotes are the estimated price you have to pay for an auto insurance coverage plan.

The insurance companies calculate these quotes based on multiple factors, such as gender, location, vehicle, general driving behavior, the value of your car, annual mileage driven, etc.

The national average car insurance premium is $2,646. However, this figure can be different, depending on the state you live in and other factors.

Aside from the types of coverage you choose, the mandated state requirements, and your deductible amount, there are several other factors that affect car insurance rates.

Below are some of those factors and why they are taken into consideration for a quote:

Location

Where you live matters a lot in terms of determining your auto insurance quotes. Insurance in some states, such as Ohio and North Carolina, is cheaper than insurance in Louisiana and Michigan.

As a rule of thumb, states with a higher annual number of accidents tend to have more expensive auto insurance.

Additionally, medical bills and litigation costs can also be higher in certain states compared to others.

Diversity

Car insurance companies use your personal information, such as age and gender, to calculate your coverage costs, too.

For instance, young male drivers statistically get into more accidents, whereas female drivers are less likely to perform reckless driving activities than men. Thus, the premiums for female drivers are usually lower than they are for male drivers.

Marital Status

Insurance companies see married individuals as safer drivers. Moreover, these individuals tend to be more financially stable. Therefore, they often get lower insurance quotes than unmarried individuals.

Homeownership

Owning a home may help lower your insurance costs as companies see homeowners as more risk-averse and financially stable. Homeowners can also bundle coverage plans and buy home and auto insurance together for a lower policy premium.

Accident History

Insurance companies also use your accident history to determine how prone you are to getting into another accident. If your driving record is clean, you’re likely to get a lower quote.

Meanwhile, someone with one or several at-fault accidents will have to pay a higher premium.

Credit Score

Some insurers also use credit scores to determine a customer’s risk level. Car insurance is often cheaper for individuals with good credit scores.

However, it can be more expensive for people who have poor credit scores. If you keep your credit in shape, it will result in you getting a better price on your coverage.

Vehicle Type

The type of car you drive also determines the cost of your insurance premium. High-end or high-value cars are more costly to repair or replace in an accident.

Therefore, these cars tend to have higher insurance quotes than cheaper cars. But if your car has remarkable anti-theft and safety features, you’ll likely get a reduction in your insurance costs.

Similarly, driving a classic car or a custom build will qualify for classic car insurance coverage, which has higher premiums and may come with mileage limitations since more miles equals more chances to get into an accident.

3. Auto Insurance Deductibles

The word ”deductible” comes up a lot when there’s talk of any kind of insurance. A deductible is an out-of-pocket expense you have to pay before your insurer takes over.

Insurance companies have deductibles in place to mitigate moral hazards. A moral hazard is a risk where a policyholder may feel tempted to drive recklessly and get into an accident due to insurance coverage.

For instance, a policyholder may leave their vehicle unattended in a theft-prone area because they have auto insurance. With no deductible, there’s somewhat low accountability and the need to be responsible.

A deductible mitigates this risk and ensures that policyholders are responsible.

By carrying a car insurance deductible, you lower the insurance company’s expenses when they’re covering a claim. Companies save this money and pass it over to consumers who have higher deductibles.

For instance, if your deductible is $1,000, it means you have to pay the first $1,000 on your car’s repairs yourself. Your insurer will take responsibility for the rest.

Even though deductibles offset the insurance costs to some extent, they are not always favorable to customers. Thus, you should pick an appropriate deductible according to your driving patterns and lifestyle rather than choosing the one that’s the lowest in price.

Pro Tip

At Torian Insurance, we typically see deductibles ranging from $250 to $1000, with $500 being the most common, depending on the insurer you choose. But you can also opt for higher deductibles of up to $5k or $10k for specialty or high-value vehicles.

4. Car Insurance Discounts

When you are speaking with an insurance representative, you should always ask about discounts offered by the insurers.

Here are some ways you can get a discount on your auto insurance:

- Multi-Car Discounts: If you have multiple cars insured with the same company, you are likely to have a lower premium than if you get insurance for each of them separately. Generally, multiple drivers must be related by marriage or blood and live at the same address to qualify for this discount, but it’s not always a requirement.

- Multiple Policy Discounts: If you’re insuring your home and car with one insurer, you’re likely to get a discount on both policies.

- Good-Student Discounts: If you’re in college, you can qualify for a discount by maintaining a set GPA and scoring high academically.

- Claim-Free Discounts: Drivers who have gone two or three years without filing any claims are likely to get discounts on their future policies. However, the number of years varies according to the insurer and policy period.

- Vehicle Safety Discounts: You could be eligible for discounts on auto insurance if your car has safety features like a steering wheel lock, a security system, an alarm, backup cameras, auto braking, lane departure warnings, collision avoidance warnings, etc.. For instance, some insurers will give you a discount on your coverage plan if you have anti-theft devices in your vehicle.

- Telematics – You can get discounts for safe driving practices by allowing the insurance company to monitor your behavior. For instance, you can get a discount for not speeding or staying away from particular areas. You will be required to install a device in your vehicle or download an app on your phone which are used to monitor aspects of your driving behavior, like quick acceleration, hard braking, time spent driving, speed, and mileage driven. It then reports these things to the insurance company. In some cases, you’ll get a discount simply for agreeing to the idea. This is a relatively new way to get discounts but it will likely be offered by the majority of insurance companies down the road.

5. Gap Insurance

The previously mentioned insurance coverages are either mandatory or highly recommended in most states. However, you can also opt for optional car insurance coverages, such as gap insurance coverage.

Gap insurance is only necessary if you have a lease or an active loan on your car. If your vehicle is stolen or totaled, gap insurance covers your auto loan and if you owe more money than the car’s depreciated value. It’s also called lease gap coverage since it covers the gap between the amount required to pay off the lease/loan and the car’s value.

Here’s an example of how it works:

Suppose you buy a car for $30,000. You still have to pay $20,000 in auto loans when your car gets completely damaged in a collision. Your collision coverage will pay off the car’s depreciated value to the lender.

Let’s say it’s $17,000 in this case. How do you pay the remaining $3,000? Without gap insurance, you’ll have to pay this amount yourself. In this scenario, gap coverage essentially helps you bridge the gap in paying off the loan.

6. Vehicle Replacement Cost Coverage

New car replacement coverage is a relatively new option that you can buy instead of gap insurance. Insurers offer this plan for newer vehicles, preferably within two years of the current model year.

This coverage pays for a vehicle’s replacement with a current model that’s similarly equipped, if the original vehicle is damaged beyond repair.

Since it can be a bit tricky to grasp, let’s explain the difference between actual cash value and replacement cost auto insurance.

In replacement cost insurance, your plan covers the cost of replacing the car with a model similar to the one you had. The insurer does not have deductions for depreciation.

For instance, if your two-year-old car is deemed a total loss, the insurer will pay for a new car with features as similar as possible to the car you lost.

Meanwhile, in an actual cash insurance value policy, the insurer pays for replacing your vehicle with one that’s in a similar condition to the one you lost. In this case, depreciation comes into play.

For instance, if your two-year-old car is deemed a total loss, the insurer will determine its current value in used condition and give you that amount as payment.

Although these plans have lower premiums, replacement cost coverage options are more likely to adequately replace your vehicle.

Torian Insurance is Here to Help

Now that you understand these car insurance basics, you know that the type of insurance coverage you may need, and the cost of your premium is dependent on SEVERAL factors. The make and model of your car, its age, the mileage, how much you drive, your personal information, the deductible amount… all of this goes into the overall cost of your coverage.

Third-party liability insurance is mandatory in most states to cover damages to other people and property when an accident occurs. In addition to the required coverage, there are more coverage options worth examining.

Consider protecting your financial responsibilities in a no-fault accident or if the person you hit is uninsured. Having coverage for any physical damage to your vehicle is also something to contemplate.

If all these options seem overwhelming, you are not alone in that feeling. Getting guidance through the process from a reputable insurance agency is invaluable for determining what you actually need vs. extra costs that aren’t necessary.

Contact Torian Insurance today to discuss your car insurance needs. We have representatives standing by ready to answer all your questions.