If you own a car in the United States, you legally have to have insurance. However, that legal responsibility typically stops with personal injury protection and liability coverage, which protects the car, people, or property you might harm in an accident. Protecting your own property is not mandatory.

Whether or not legally required, however, optional insurance is essential for keeping your vehicle safe from accidents and damages. Most people get either comprehensive or collision insurance as optional, as these two provide the most protection.

We’ve put together a complete guide to understanding the differences between collision vs. comprehensive insurance to help you determine which coverage options you need for your vehicle.

What Is Comprehensive Coverage?

Comprehensive insurance is a specific type of auto insurance coverage that helps you prepare for the things you have no control over. This coverage protects you from a significant financial burden if something you can’t control, like the weather or an animal, damages your vehicle.

The name of the coverage, however, is a bit misleading. In fact, it’s sometimes referred to as “other than collision” (OTC). When you see comprehensive, you may think this type of insurance covers everything. Unfortunately, that’s not the case.

Comprehensive coverage protects you only against specific events and will fall short in other areas. Find the details about what’s covered, what’s not, how much comprehensive insurance costs, and why you should consider signing up for a policy below.

What Does Comprehensive Insurance Cover?

As mentioned, comprehensive insurance coverage takes care of you when events you can’t control happen. These events typically include:

- Acts of God: Flood, fire, strong winds, and hail can all cause significant damage to your vehicle. With a comprehensive insurance policy, you can rest assured that you’re covered if any of these acts damages your car.

- Animals: About 1.5 million people collide with a deer in their vehicles, causing between 175 and 200 deaths and over 10,000 injuries annually. The damage this causes to vehicles is also significant. Comprehensive insurance typically covers risk events caused by animals.

- Vandalism or Theft: If you’re the victim of vandalism or theft, comprehensive coverage will help reduce your losses.

What Does Comprehensive Insurance Not Cover?

From the above, you may think that comprehensive insurance covers all damages that might happen to your vehicle while parked somewhere, but that’s not exactly the case. As with all other types of auto insurance, comprehensive plans only have specific events they will cover.

Some examples of the things not covered by comprehensive insurance include:

- Accidents With Other Vehicles: If you get involved in an accident with another vehicle, you can’t rely on coverage from comprehensive insurance.

- Collisions With Objects: If you collide with a tree, mailbox, or any other object, you can’t use comprehensive coverage.

- Other Collision Events: Comprehensive coverage typically doesn’t cover rollovers, damages from potholes, and other similar collision events.

Comprehensive Coverage Cost

Comprehensive insurance typically costs between $100 and $300 per year, but those numbers can vary significantly based on a few factors. These include:

- Where You Live: Different geographic locations pose different environmental risks. Insurance companies take these risks into account when they price the policies.

- Your Vehicle’s Value: If an event totals your vehicle, the insurance company will have to pay your vehicle’s fair market value. As a result, more expensive cars come with higher insurance premiums.

- Your Credit Score: Your credit score plays a role in the cost of your premiums regardless of the type of insurance you’re purchasing.

Why Get Comprehensive Coverage?

Comprehensive insurance is a must, especially if you own a vehicle you can’t afford or would not want to replace. The simple fact is that there’s no way to predict when lightning will hit a tree in your front yard, causing it to fall on your car or when a deer will jump in front of you at 60 miles per hour.

Comprehensive insurance not only alleviates the financial burden associated with unforeseen risk events, but it does so at relatively minimal premiums.

What Is Collision Coverage?

Collision coverage alleviates the extreme financial burden of colliding with another vehicle or object on the road. Whether you or another driver damages your car, collision insurance will help you cover the expenses, which tend to add up quickly.

The average auto body repair costs between $75 and $2,500 without mechanical repairs needed after a collision. Collision coverage ensures that these expenses don’t come out of your pocket.

What Does Collision Insurance Cover?

As mentioned above, collision insurance covers you in the event of a collision with another vehicle or object when your vehicle is in motion or stopped at a light or stop sign. This type of insurance helps with events like:

- Car Collisions: Whether you crash into another car or one crashes into you, your collision policy has you covered.

- Rollovers: If your vehicle rolls over while you’re driving, your collision policy will kick in to help pay for damages.

- Object Collisions: If you hydroplane and collide with a tree, light pole, building, or another fixed object, your collision insurance will help cover costs.

What Does Collision Insurance Not Cover?

Collision insurance helps you alleviate financial risk in a collision with another vehicle, an object, or a rollover, but it doesn’t cover all costs. In particular, it covers the cost of car repairs but not:

- Medical Expenses: Injury protection covers your medical expenses after a collision. Therefore, collision coverage won’t help here.

- Liability: If you’re at fault in an accident, you may be required to pay for damages to someone else’s property. This is where liability coverage helps, but collision coverage does not.

- Comprehensive Risks: Acts of God, animals, or thieves may cause damage to your vehicle, but the collision insurance policy won’t cover the expenses from that. The comprehensive insurance plan will.

Collision Coverage Cost

Collision coverage typically costs between $300 and $600 per year. That works out to be between $25 and $50 per month. However, the price you pay may vary based on several factors:

- Your Age: Younger drivers are more likely to make mistakes that lead to collisions. As a result, these drivers typically pay higher premiums.

- Your Driving Record: If you have a record of moving violations and accidents in the past three years, you can expect to pay a higher premium for collision coverage.

- Your Location: You’re more likely to be involved in a collision in some demographic regions. Therefore, your location plays a role in the cost of your collision coverage.

- Your Vehicle’s Value: The more expensive your vehicle is, the higher your premiums will be.

What If Someone Else Causes the Accident?

There are typically at least two parties involved in a collision — unless you collide with an object like a tree, building, or mailbox. When two people get involved in an accident, the responding police officer looks at the evidence to decide which driver is at fault for the collision.

If someone else is at fault in your accident, they will be responsible for the damages, but that doesn’t mean they will pay all the expenses. Many drivers are uninsured or underinsured and don’t have the financial wherewithal to cover their damages. There is a separate coverage in most auto policies for uninsured motorists (UM) and underinsured motorists (UIM). This is where your policy can help with an accident caused by someone who has little or no insurance. In some cases, a collision policy will kick in to alleviate significant financial risk—but that is dependent on the policy.

Why Get Collision Coverage?

Collision insurance is a relatively inexpensive way to ensure your vehicle will get repaired after a collision, whether with another vehicle or an object. As mentioned above, this type of coverage even takes care of you if another driver causes an accident and doesn’t have adequate insurance to cover the cost of repairs.

If your car’s value is more than you’re willing or able to pay to replace it at any given time, it’s a wise idea to purchase collision insurance coverage.

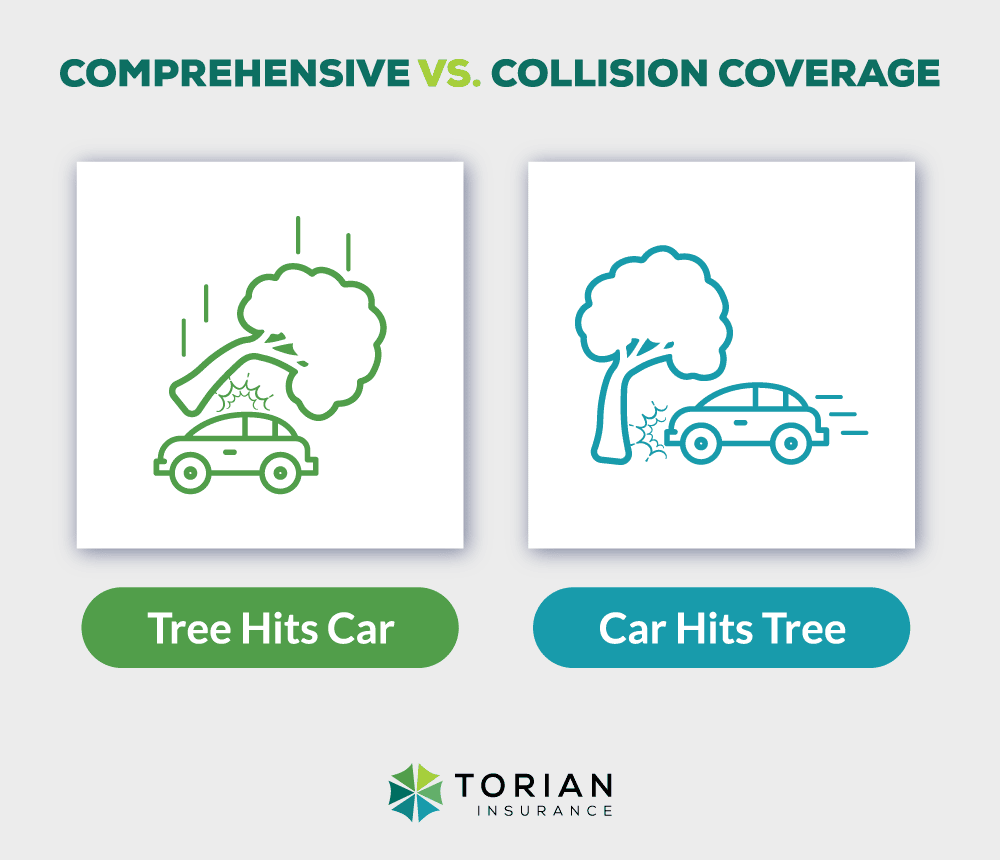

The Difference Between Comprehensive and Collision Insurance

Both comprehensive and collision insurance cover the cost of your vehicle repairs. However, as highlighted above, they cover different types of events. Here’s a quick recap:

- Comprehensive Insurance: This insurance covers damage to your vehicle as the result of an act of God, an animal, vandalism, or theft.

- Collision Coverage: This insurance covers damage to your vehicle from a collision with another vehicle or an object. It also covers the cost of repair or replacement in the event of a rollover.

Another core collision vs. comprehensive insurance difference is in the cost of coverage. Collision insurance is typically more expensive than comprehensive insurance. Nonetheless, if you want complete coverage, it’s best to sign up for a full coverage policy that includes both comprehensive and collision insurance.

Here are some other differences and factors you may want to consider before deciding on collision vs. comprehensive insurance.

Maximum Coverage Amounts

There is typically no difference between the maximum coverage amounts for collision and comprehensive coverage. Both types of insurance tend to cover your damages up to the total cost of your vehicle.

However, it’s important to mention that insurance policies typically cover the total value of your vehicle, not necessarily the total amount you owe. As drivers might end up owing more money than their vehicle’s worth, adding gap insurance to your coverage plan may be a good option.

Deductibles

Most insurance policies, whether auto insurance, health insurance, or homeowners’ insurance, come with deductibles. This is the total amount you’ll need to pay when damages occur. Comprehensive and collision policies are no different.

In most cases, the deductibles on these policies are somewhere between $500 and $1,000, though they can be as low as $0 or far higher. They typically have a direct correlation with insurance premiums. Higher deductibles come with lower premiums, while lower deductibles come with higher premiums.

Which Coverage Is More Important for My Vehicle?

Whether you need one or another insurance for your car (or both) will depend on your preferences and a few other factors, such as the type of garage you have, the geographic area, and similar.

Generally speaking, collision insurance may be more suited for you if you:

- Park your vehicle in a closed garage

- Live in a high-population region with frequent traffic jams

On the other hand, comprehensive coverage may be a better option if you:

- Drive very little but park your vehicle outside

- Live in a region known for significant natural disasters like hurricanes, tornadoes, or wildfires

Do I Need Both?

If you can’t afford nor would want to replace your vehicle in the event of an accident, you should have both types of coverage. Collisions and weather accidents are impossible to predict and sometimes even avoid. If you want some extra piece of mind when driving (or parking), consider getting both comprehensive and collision insurance.

Which Car Insurance Coverage Is Right for You?

As mentioned, both comprehensive and collision insurance have their fair share of advantages and disadvantages. If you want to fully protect the passengers, the vehicle, and yourself on the road, consider getting full coverage car insurance. This type of car insurance will give you some extra piece of mind by providing liability, medical payments, collision, comprehensive, and uninsured or underinsured motorist coverage all in one.

But again, it’s essential to consider your situation and needs to get the best possible insurance. Full coverage car insurance can be pricey, and not everyone needs it. As we suggested above, consider your vehicle’s worth, the environmental risks in your driving area, and potential collision costs before choosing a specific plan. This will help you decide on collision, comprehensive, or full coverage car insurance.

It’s also good to consider that not all insurance policies are created equal. Torian Insurance works to provide you with the best possible coverage at the lowest price, delivering around-the-clock customer service, bundle discounts, customized plans, and much more. Whether you need auto, health, life, homeowners’, or any other insurance type, we got you covered. Don’t waste your time scouring the web only to end up with a sub-par insurance policy. Get your free quote from Torian Insurance today and acquire the coverage you need at the best price.