If you have a car and drive it on public roads, you must have car insurance; it’s the law. The reason is simple. Insurance protects the general public in the event you cause damage to someone else or their property with your car. Since there are over 6 million car accidents in the U.S. each year, it’s not an unreasonable requirement.

But car insurance itself is a pretty complex topic with several working parts. Various factors determine your rate, whose insurance policy covers what damage, and what damages are covered in the first place. With auto insurance being so complicated, a few questions here and there aren’t unusual. Here are the answers to some of the most common:

1. Does Full Coverage Cover At-Fault Accidents?

Full coverage (in consumer terms) typically refers to carrying both liability and physical damage coverage on the same vehicle. Collision coverage and comprehensive coverage are the two main components of physical damage coverage. In most cases, full coverage insurance will cover your damages even if you’re at fault for the accident. There are some exclusions to the rule. For example, if your policy doesn’t include collision coverage, you will be responsible for your own vehicle damage. There are a few events that can also exclude you from the coverage you would typically have:

- Negligence. If you were significantly negligent, and that’s why the accident happened, this is usually covered, as one of the key components of liability coverage is the presence of negligence that caused the accident.

- Banned Driver. If you’re a banned driver on the insurance policy of someone else’s car, their insurance policy will not cover you.

- Business Use. If the accident happened while you were using your vehicle for business, damages might not be covered.

- Modifications. Insurance typically doesn’t cover the cost of vehicle modifications. So, if a modified part was damaged in an accident, the repairs are on you.

2. Does Insurance Follow the Car or the Driver?

The answer to this question depends on your policy, but insurance usually follows the car, not the driver. What’s that mean?

If you get in an accident driving someone else’s car, their car insurance generally provides coverage for the accident. On the other hand, if you let someone borrow your car and they get in an accident, your insurance is typically the one you file the claim with.

Keep in mind that claims increase insurance rates, so be careful about who you let borrow your car.

3. How Long Do I Have To Get Insurance On a New Car?

Regardless of your state, you must have at least liability coverage and, in most cases, personal injury protection before you can drive on public roads. If you have a current policy, most will provide a limited amount of time that a newly acquired vehicle is automatically covered. So if you have a policy in place, an additional vehicle or a replacement vehicle being added to that policy–it would have some automatic coverage. This allows you to buy a vehicle after hours or on weekends when your insurance agent isn’t in the office.

If you don’t have an existing policy, you must purchase one before taking ownership of a vehicle. That means you have to get insurance before driving your new car off the lot or out of the driveway. Although this is a legal requirement, it’s also a moral one. After all, you don’t want to drive around uninsured and potentially cause damage to someone’s property that you can’t afford to fix.

4. Does Car Insurance Cover Rental Cars?

That depends on the policy you have. In most cases, if you carry at least liability and comprehensive insurance, the coverage will carry over to rental cars you drive. Still, there’s no guarantee that’s the case for everyone.

If you plan on renting a car, call your insurance company and let them know about your plans. Ask the representative if your insurance plan covers you if you’re in an accident in a rental vehicle. The worst thing they can say is, “No.”

It’s important to be informed. If your insurance policy does cover rental vehicles, it could save you a lot of money when you consider the exorbitant price tags rental companies place on insuring their own vehicles.

5. How Long After an Accident Do You Have To File a Claim?

It’s best to file an insurance claim within 24 hours of a car accident. The faster you file, the faster your coverage will kick in, but some circumstances could lead to a delay in filing your claim. For example, if the damage to your vehicle costs less to repair than your deductible, you may decide to forego filing a claim immediately.

Unfortunately, not all injuries are apparent right away. Months down the road, you may end up with a backache you’ve never had before and go to the doctor, only to find out that the car accident caused damage to your back you may deal with for the rest of your life.

The good news is that you typically have at least a couple of years to file your claim. The exact time frame depends on the state you live in and its statute of limitations on insurance claims. For example, if you live in Florida, you have up to four years to file a claim.

A helpful insurance agency can provide guidance through the insurance claim process and they can help you understand the best timing for filing a claim based on your specific circumstances.

6. What Should You Consider When Choosing Automobile Insurance?

There are several factors you should think about as you shop around for a new car insurance plan. The most important include:

- Coverage. Insurance isn’t typically about having the minimum to meet legal requirements; it’s about having enough coverage to ensure you don’t face any significant financial hardships resulting from a car accident. Make sure you know and are comfortable with your coverage limits.

- Price. Your car insurance shouldn’t break the bank, but you don’t necessarily want the cheapest option. Pay close attention to price and value for that price as you shop around.

- Provider. Your insurance company can make the steps after an accident very easy or pretty difficult to get through. Consider the insurance provider and their history of providing quality services before you sign up.

7. What Factors Do Insurers Consider When Determining My Price?

Insurance companies take a wide range of factors into account when determining how much you’ll pay for coverage. Some of the most important include:

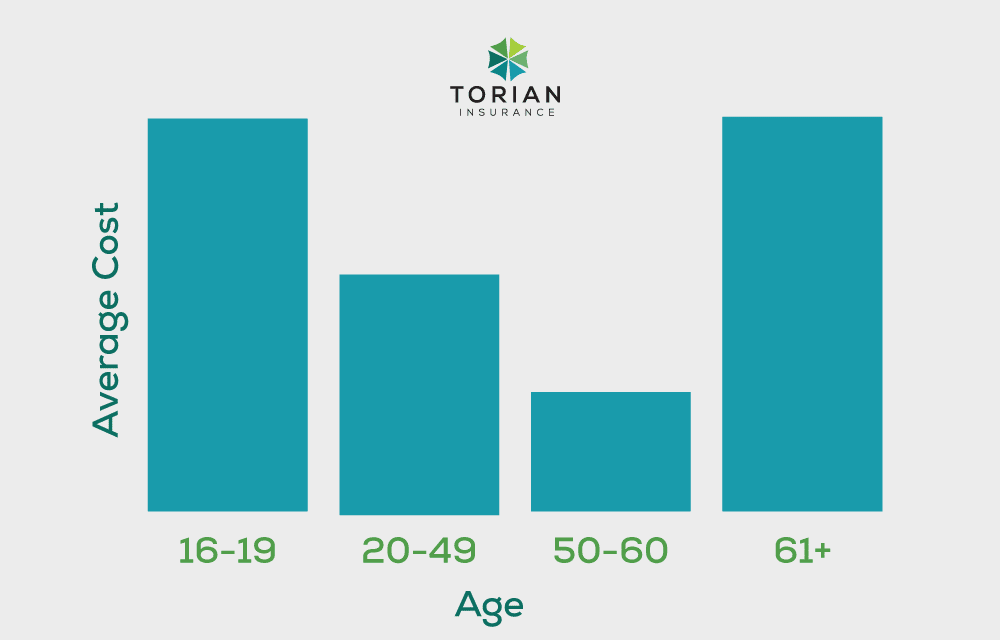

- Your Age. Insurance is typically cheaper as you age. Younger drivers tend to pay the highest premiums.

- Your Car. The type of car you drive will also play a role in your insurance coverage, and it makes sense. You’re more likely to get in an accident in a sports car than in a minivan.

- Your Driving Record. If you have a clean driving record, you’ll pay a far lower premium than a driver with a history of several accidents and speeding tickets.

- Your Car’s Value. If your car is totaled, your insurance company may pay your car’s value, so more expensive cars are more expensive to insure.

- Your Location. Some locations are known for more instances of car accidents than others. You pay lower premiums when you live in rural areas than in cities where accidents are more common.

- Your Credit Score. Your credit is also a determining factor. If you have a good credit score, you’ll likely pay a lower premium than someone with a bad credit score.

8. What Makes a Car More Expensive To Insure?

Different cars come with different insurance premiums. Here are a few things that could make your car more expensive to insure:

- Sports Cars. If your car is labeled as a sports car, it will probably be more costly to insure than other vehicles.

- Body Style. Big box cars are typically more expensive to insure than cars with smaller body styles.

- Safety Features. Safety features like lane assist can make your car cheaper to insure, but a lack of them will make it more expensive.

- Anti-Theft Features. If you don’t have an anti-theft device installed on your vehicle, you’ll probably pay more than someone who does.

A common assumption is that red cars are more likely to get into an accident than any other color or that some colors are more likely to be involved in an accident. At Torian Insurance, we have found no basis to this. We don’t ask for the vehicle’s color when providing insurance and we are not aware of it being a factor with any of our insurance carriers that we offer.

9. Which Gender Pays More for Car Insurance?

Men typically pay more for car insurance because men are more likely to get in car accidents. In fact, men are about 1.5 times more likely to cause a car accident than women.

10. What Age Pays the Most for Auto Insurance?

Drivers ages 16 to 19 typically pay the most for auto insurance. That’s because these are new drivers with very little real-world driving experience. New drivers are more likely to cause car accidents, posing a larger risk to insurance companies.

Drivers between 50 and 60 typically see their best car insurance rates. However, drivers over 60 may experience rate increases as they age.

11. Does Your Credit Affect Your Car Insurance Rate?

Yes. Your credit shows your car insurance company how likely you are to pay your bill on time every month. If you’re more likely to pay your bills, you’re less of a risk to the insurance company. Why?

Insurance works because there are several members with each insurance company. Insurance premiums from those without claims help cover the sometimes extreme costs associated with customers who do have claims. When customers aren’t likely to pay as agreed, they may throw a wrench in the whole system, leading to a higher premium.

12. How Long Does a Quote Lock In Your Rate?

There’s no law requiring insurance companies to lock in your quoted rate for any amount of time, and insurance rates can change daily. The good news is that most car insurance companies lock in your quote for 30 days to give you time to make your decision.

Remember, most (but not all) insurance companies offer to lock in your quoted rate. Ask your agent if you’re concerned about how long a rate lock may last.

13. What Is the 21-Day Rule for Car Insurance?

The 21-day rule, otherwise known as the “Advanced Quote Discount” is a theoretical rule that suggests you’re likely to get the best deals on new car insurance plans when you shop 21 days before your current insurance policy expires.

Although there’s no guarantee that shopping 21 days before your policy expires will save you money, it’s worth a shot!

14. Can I Cancel My Car Insurance Any Time?

Yes, regardless of which company you work with, you can cancel your policy at any time. However, you may want to look into the terms of your specific policy first. Some car insurance policies require a minimum notice period before you can cancel and may require you to pay fees.

15. Why Would an Auto Insurance Company Drop You?

There are three common reasons an insurance company will drop your coverage:

- Claims History. This is the most common reason people get dropped or canceled. If your history of claims is hefty—you could potentially be dropped by your insurance company.

- Application Misrepresentations. If you misrepresent yourself on your insurance application, chances are your insurer will eventually catch on and drop your coverage.

- Unpaid Premiums. Your insurance company is not required to provide coverage if you haven’t paid your premiums.

- License Issues. If your license is suspended or revoked, you can expect your insurance company to drop your policy immediately.

16. What Happens When an Insurance Claim Is Made Against You?

When an insurance claim is made against you, your insurer will investigate the claim to see if it is valid. If it is, the insurance company typically pays damages minus your deductible.

However, once a claim has been filed against you and validated by your insurer, you can expect your premiums to rise. After all, drivers with insurance claims against them represent more risk than those with none.

Still Have Car Insurance Questions?

You don’t have to read countless articles that leave you scratching your head to understand insurance. The professionals at Torian Insurance are always here to help. Click here to get your free quote, and call us for a consultation if you have any questions.