Classic car insurance is essential for safeguarding your beloved vintage vehicle—a prized possession that holds both sentimental and monetary value. Whether you’ve recently acquired a timeless gem or have been preserving one for years, understanding how to secure the right classic car insurance is crucial.

This ultimate guide will demystify the eligibility criteria and provide essential tips to help you navigate the process effectively, ensuring your classic car remains protected for generations to come.

Understanding Classic Car Insurance

Classic car insurance differs significantly from standard auto insurance policies. It offers specialized coverage tailored to the unique needs of classic car owners, acknowledging the vehicle’s historical significance, limited use, and potential appreciation in value.

How It Differs from Standard Auto Insurance

Standard auto insurance is designed for daily-use vehicles that depreciate over time. In contrast, classic car insurance typically provides:

- Agreed Value Coverage: You and the insurer agree on the car’s value upfront, guaranteeing that amount in case of a total loss.

- Limited Use Consideration: Policies recognize that classic cars are not daily drivers, adjusting premiums accordingly.

- Specialized Repair Options: Access to professional restorers and parts specialists familiar with vintage vehicles.

Understanding these differences helps you select the right classic car insurance coverage that truly protects your investment.

Defining a Classic Car

When considering classic car insurance, it’s essential to understand how insurers define a “classic car,” as definitions can vary among providers.

Common Criteria Used to Classify a Classic Car

While criteria may differ, insurers generally consider a vehicle a classic car if it:

- Age: Is typically at least 20–25 years old.

- Condition: Is well-maintained or restored to its original condition.

- Historical Interest: Has unique design features or significance from its manufacturing era.

Variations in Definitions Among Insurance Providers

Some insurers may have specific classifications:

- Antique Cars: Vehicles over 45 years old.

- Vintage Cars: Vehicles 25 years or older but less than 45 years old.

- Collectible Cars: Limited editions or models with special features, regardless of age.

Understanding your insurer’s specific definition ensures you meet their eligibility requirements and that your vehicle is correctly classified for coverage.

Eligibility Criteria for Classic Car Insurance

To qualify for classic car insurance, you’ll need to meet certain eligibility criteria set by insurers.

Age and Condition of the Vehicle

- Minimum Age: The car is usually at least 20 years old.

- Excellent Condition: The vehicle must be well-maintained, properly restored, and retain its original design.

- Original Design: No modern touches are permitted.

Limited Mileage Requirements

- Annual Mileage Caps: Typically limited to between 1,000 and 7,500 miles. The exact mileage limit depends on the insurance company and the state, but it’s usually not more than 7,500 miles per year.

- Odometer Verification: May be required to prove limited usage.

Storage Requirements

- Secure Storage: Vehicle must be stored in a locked, enclosed garage or facility when not in use.

- Protection from Elements: Storage should shield the car from weather-related damage.

Usage Restrictions

- Non-Daily Use: The car shouldn’t be used for commuting or routine errands.

- Permitted Activities: Usage is limited to car shows, exhibitions, club activities, and occasional pleasure drives.

Proof of Ownership and Documentation Needed

- Title and Registration: Legal proof of ownership is required.

- Photographs: Recent photos showcasing the vehicle’s condition.

- Maintenance Records: Documentation of regular upkeep and any restorations.

Types of Classic Car Insurance Policies

Choosing the right policy is vital for adequate protection. Key types include:

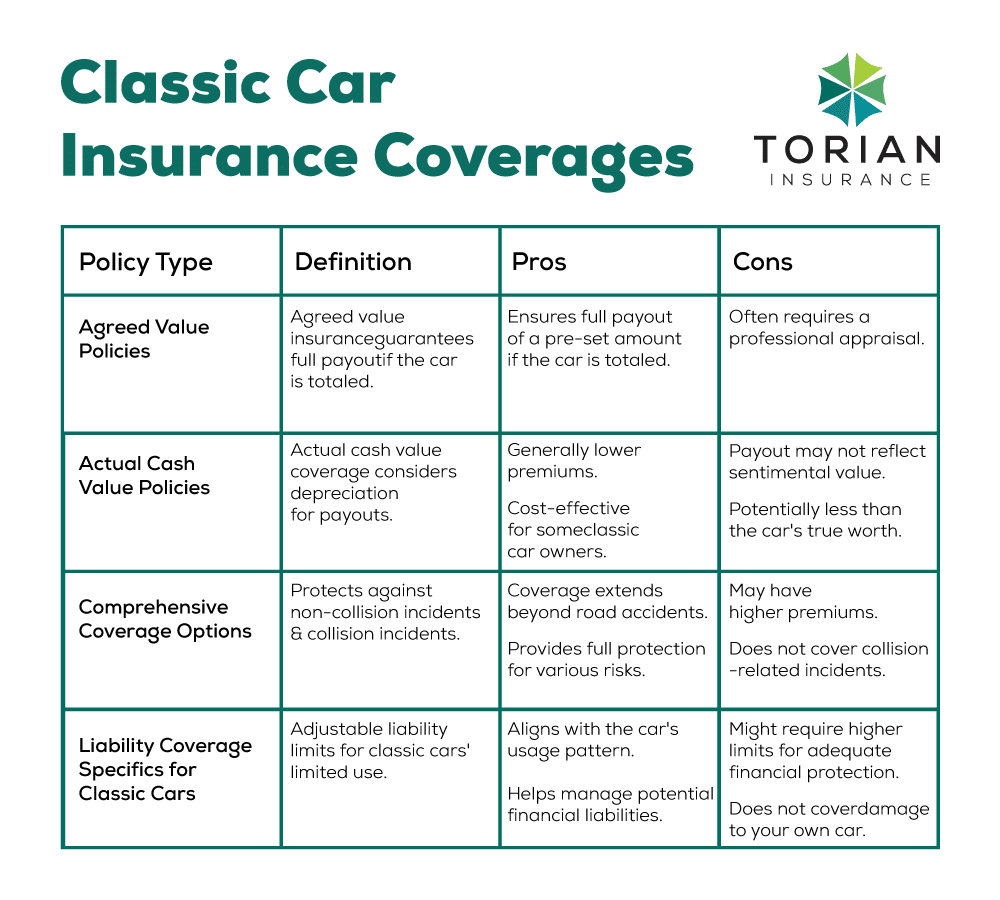

Agreed Value Policies

Agreed value policies are designed to protect your classic car by establishing its value at the start of the insurance coverage. In this setup, you and the insurer mutually agree upon the car’s worth, which guarantees full compensation of the predetermined amount if the car is deemed a total loss. This policy type provides peace of mind as it ensures you will receive the agreed payout regardless of market fluctuations. However, to establish this agreement, insurers may require a professional appraisal or substantial documentation to justify the car’s valuation.

Actual Cash Value Policies

Actual cash value policies differ from agreed value policies in that they calculate the car’s worth based on its current market value while accounting for depreciation. This approach often results in lower premiums, making it a more cost-effective option for some classic car owners. However, the downside lies in potential payout calculations, as they may not fully reflect the car’s true value or its sentimental worth to the owner.

Comprehensive Coverage Options

Comprehensive coverage is an essential component for classic cars, offering protection against non-collision-related incidents such as theft, fire, vandalism, and natural disasters. Given the vulnerability of vintage vehicles to these types of risks, comprehensive coverage ensures that extensive events beyond just road accidents are covered, giving complete protection tailored to the needs of classic car owners.

Liability Coverage Specifics for Classic Cars

Liability coverage specific to classic cars provides customized limits designed to accommodate the limited use and reduced exposure these vehicles typically experience. This form of insurance not only helps manage potential financial liabilities arising from accidents but also ensures compliance with state minimum requirements for vehicular insurance. Tailoring liability limits in this manner helps reflect the classic car’s unique usage pattern.

Additional Coverage Options

- Spare Parts Coverage: Insures extra parts specific to your classic car.

- Roadside Assistance: Specialized services for vintage vehicles.

- Automobilia Coverage: Protects collectible items related to your car.

Benefits of Classic Car Insurance

Opting for classic car insurance over standard auto insurance offers numerous advantages.

Enhanced Protection Tailored to Vintage Vehicles

One key benefit is enhanced protection through specialized policies designed to meet the unique demands of classic car enthusiasts. These policies often provide better coverage terms, including provisions like agreed value and usage considerations, ensuring that the insurance reflects the car’s true worth.

Financial Security in Case of Loss or Damage

In the event of loss or damage, classic car insurance offers financial security with adequate payouts that align with the vehicle’s value, and comprehensive protection that covers a wider range of potential risks.

Preservation of the Car’s Value

Moreover, such insurance helps preserve the car’s value over time by accounting for value appreciation, thus safeguarding the investment made in maintaining these cherished vehicles.

Access to Specialized Services and Support

Having access to specialized services and support is a significant advantage of classic car insurance. One of the key benefits is access to expert repairs, ensuring that your vintage vehicle is in the hands of professionals who are experienced in restoring such automobiles to their former glory. These specialists possess the necessary skill set and knowledge to appropriately handle the unique needs of classic cars, maintaining their authenticity and value. Additionally, certain insurance policies offer restoration coverage, providing financial protection during the restoration process. This coverage can alleviate some of the financial burdens associated with restoring a classic car, making it easier for owners to preserve and enhance their prized vehicles.

Requirements for Securing Classic Car Insurance

Securing classic car insurance typically requires meeting specific criteria, such as verifying the car’s age and condition, demonstrating limited annual mileage, providing secure storage details, and submitting documentation on ownership, appraisals, and maintenance history to ensure accurate coverage tailored to vintage vehicles.

Detailed Vehicle Appraisal and Inspection

- Professional Appraisal: Provides an accurate valuation for agreed value policies.

- Condition Verification: Confirms the car meets the insurer’s standards for coverage.

Maintenance and Condition Records

- Service History: Demonstrates regular maintenance and care.

- Restoration Documentation: Records detailing any restoration work performed.

Security Measures

- Anti-Theft Devices: Installation of alarms, tracking systems, or immobilizers may be required.

- Secure Storage Proof: Evidence of appropriate storage facilities to protect the vehicle.

Annual Mileage Logs or Usage Reports

- Mileage Verification: Records ensuring compliance with mileage limitations.

- Usage Documentation: Logs of events and activities where the car is used.

Preparing Your Classic Car for the Insurance Application Process

Proper preparation can streamline your application and improve approval chances.

Document and Verify the Vehicle’s Condition

Start by taking high-quality photographs from all angles to capture the car’s current condition. Pair these images with detailed descriptions that highlight unique features, modifications, and the overall state of the vehicle. To ensure authenticity and thoroughness, consider getting third-party inspections from reputable mechanics or classic car specialists, as their professional reports can further substantiate your records.

Gather Necessary Paperwork

This includes having ownership documents such as the:

- Title

- Registration

- Any relevant historical documentation readily available

It’s also important to keep up-to-date appraisals from certified appraisers, as these valuations help reflect the true market value of your car. Furthermore, maintain comprehensive maintenance logs detailing regular services and any restorations, as these records support the car’s upkeep and value.

Maintain the Car to Meet Insurer Standards

Regular cleaning helps keep the car in pristine condition, preserving both its appearance and integrity. Proper storage is equally important, ensuring that the environment prevents any deterioration or damage. Additionally, scheduled servicing for routine mechanical checks and preventative maintenance will keep the car in optimal running condition, aligning with insurer expectations.

Schedule Inspections and Appraisals Efficiently

Begin by booking these appointments well in advance to avoid any unnecessary delays. Prepare by organizing all necessary documentation so that the process can proceed smoothly and quickly. After the inspections, follow up promptly to ensure that all reports and findings are submitted to the insurer in a timely manner, thereby maintaining continuous and comprehensive coverage.

Tips for Choosing the Right Classic Car Insurance Provider

Selecting the right insurer is as important as securing the right coverage.

Research and Compare Providers

- Coverage Options: Evaluate what each insurer offers.

- Premium Costs: Consider affordability relative to benefits.

- Policy Flexibility: Look for customizable options to suit your needs.

- Industry Experience: Prefer insurers specializing in classic car insurance.

- Customer Reviews: Read testimonials from other classic car owners.

- Professional Affiliations: Memberships in industry organizations can indicate credibility.

Understand Policy Terms and Coverage Options

- Read Thoroughly: Be aware of exclusions and limitations.

- Ask Questions: Clarify any uncertainties before committing.

- Policy Duration: Note renewal terms and potential rate changes.

Seek Recommendations from Classic Car Communities

- Clubs and Forums: Engage with fellow enthusiasts for insights.

- Personal Experiences: Learn from others’ dealings with insurers.

- Local Events: Network at car shows or meets for advice.

Common Challenges and How to Overcome Them

Being aware of potential obstacles helps you navigate them more effectively.

Navigating Varying Definitions of Classic Cars

Navigating the varying definitions of classic cars can be challenging, but thorough research into different insurers’ classifications is essential. It’s crucial to provide detailed information about your vehicle to ensure it aligns with a specific insurer’s requirements. By understanding what qualifies as a classic car according to each provider, you can present your vehicle effectively, ensuring it meets their criteria for coverage. This approach not only helps secure insurance but also ensures that your vehicle is correctly categorized, thereby maximizing the benefits of a specialized policy tailored to its unique characteristics.

Addressing High Premiums

Addressing high premiums can be effectively managed through several strategies designed to reduce costs. One approach is to bundle multiple insurance policies with a single provider, which often leads to significant discounts. Another strategy is to increase deductibles, which can lower the premium payments by agreeing to pay more out-of-pocket in the event of a claim. Additionally, enhancing the security of your insured items, such as installing approved anti-theft devices, can qualify policyholders for lower rates, as these measures reduce the risk of loss or damage.

Ensuring Continuous Coverage During Restoration

It is important to maintain an ongoing dialogue with your insurer, keeping them informed about the progress and stages of the restoration process. This communication allows for timely adjustments to your coverage, ensuring that your policy accurately reflects the car’s current state throughout its restoration. As the vehicle undergoes various changes, modifying the policy accordingly provides continued protection and helps protect your investment during each phase of the restoration.

Handling Claims for Vintage Vehicle Damages

One crucial aspect is to document the condition of your car regularly by maintaining up-to-date records and photographs, which can be invaluable when substantiating claims. It’s also important to work with specialized repair shops staffed by professionals who have experience with vintage car repairs, ensuring that any restoration or repair work meets the high standards required for classic vehicles. Additionally, staying informed about your policy’s claims process is essential, as understanding the specific steps and requirements involved will help facilitate a smoother and more efficient claims experience.

Safeguard Your Classic Car Today

Protecting your cherished classic car with the right insurance is essential for preserving both its value and legacy. Classic car insurance offers specialized coverage tailored to the unique needs of vintage vehicle owners. By understanding eligibility requirements and preparing adequately, you can navigate the insurance process with confidence.

Don’t leave your classic car’s fate to chance. Secure the right classic car insurance today to ensure your treasure is protected for generations to come. Reach out to a specialized classic car insurance provider now to explore your options and get personalized assistance.

Remember, your classic car is more than just a vehicle—it’s a piece of history worth safeguarding.