Car accidents happen at the most unlikely times and leave a long trail of distressing inconveniences. First, you’ll have to see a physician to ascertain whether you suffered any injuries from the accident. Thank heavens when you get out unscathed. Then, your second worry will kick in — how do you get a rental car quickly so you can continue with your daily routine as your car gets fixed?

If you have rental car reimbursement coverage, this will be the least of your worries. You can call your insurance company right away and have it send you a rental car, or you can rent the vehicle yourself and bill your insurance to get the reimbursement later. Either way, rental reimbursement coverage is a lifesaver when you need alternative transportation while waiting for your car to get repaired.

Understandably, you may have a ton of questions regarding rental car reimbursement. At Torian Insurance, we know you need authentic answers before pulling the plug and getting rental reimbursement insurance coverage. We have compiled this exhaustive guide to help you get started.

Let’s start by describing rental reimbursement coverage.

1. What Is Rental Car Reimbursement and How Does It Work?

Put simply, rental reimbursement coverage pays for the expenses of a rental car or public transportation costs when your car is being repaired after sustaining damage from a covered accident. The coverage typically lasts for a month, as the average amount of time it takes for a car to be fixed is around two weeks.

Covered accidents are outlined under collision and comprehensive insurance and include collisions with objects, vehicles, and animals. This means you must first have collision or comprehensive insurance coverage to qualify for rental reimbursement.

Thus, you cannot claim rental car reimbursement if your car is in the garage for a noncovered claim or a typical mechanical breakdown. In the case of a mechanical breakdown, you can claim transportation expenses under mechanical breakdown insurance (if you have it).

Note that rental reimbursement must be on your policy before the accident in order for you to be covered. If you have only liability coverage for your car, you may not be able to add rental car reimbursement to your policy. Also, if you have full coverage, it doesn’t mean rental reimbursement is automatically included, but you can always add it at a minimum cost.

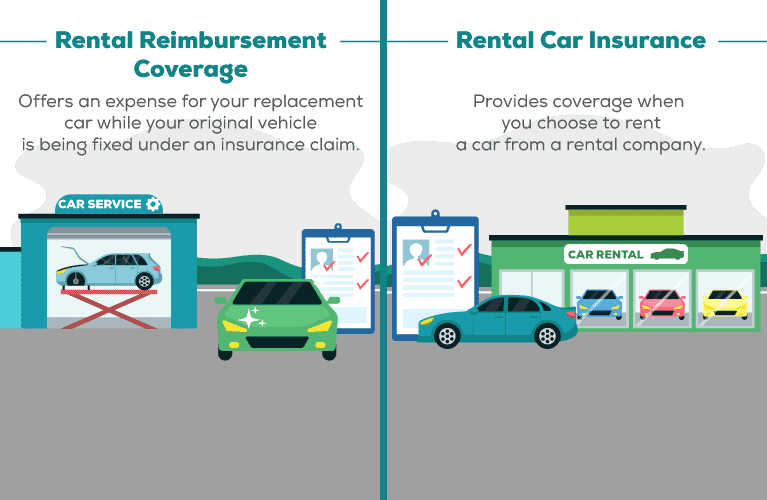

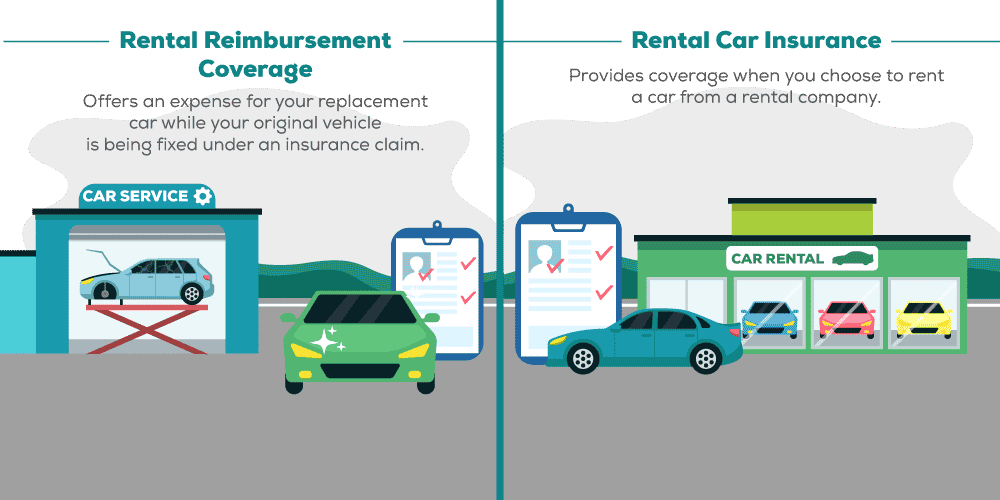

Is It the Same as Rental Car Insurance?

No. Rental car reimbursement and rental car insurance are two different policies. Rental car insurance covers you and your rented car from possible damage or injuries that could happen when you’re driving a rented car. You purchase rental car insurance as an addition to the third-party cover, theft cover, and damage cover, which are the three basic types of coverage that rental cars carry.

Rental car insurance offers extra coverage, such as personal accident insurance, loss damage waiver, and personal effects coverage, to cover excess costs that are not included in the three basic types of rental car insurance coverage.

2. Costs for Rental Car Reimbursement

The costs for rental car reimbursement insurance vary depending on the type of car you drive, the prevailing rental rates in your location, your driving experience, how long you’ll rent the car, and your insurer. At Torian Insurance, we typically see costs for rental reimbursement around $10 per year per vehicle. The cost is determined by the daily amount of coverage that you purchase.

When you purchase, you’ll see a daily limit up to a maximum of 30 days of coverage. For example, if you bought a $30-a-day rental, you’ll see something like “$30/$900” on your policy. This equates to $30 a day up to a maximum of 30 days for a total of $900.

How Do I Know How Much Coverage I Need?

To estimate how much coverage you need, consider how much it costs in your city to rent the type of vehicle you’re currently driving. For instance, it costs about $173 per day to rent a midsize SUV in New York and $161 per day for an economy car. Hence, if you’ll need a midsize SUV for your replacement vehicle in New York, you should purchase enough coverage to rent it for 30 days.

As rental car costs have increased like just about everything else, we’re encouraging clients to increase the amount of coverage they have for rental reimbursement, with a recommendation of at least $50 per day. This is a well-informed figure, given that car rental fees can add up to about $130 a day on average.

You and your insurer may also consider local stats, such as the rate of car accidents in your location, to estimate the chances of your car getting involved in an accident. For instance, Baltimore; Washington, D.C.; and Boston are the cities with the most car accidents. The more accident-prone your city is, the more you’ll need and benefit from rental car reimbursement coverage.

3. What Happens to My Rental Reimbursement When I Am at Fault or Not at Fault for the Accident?

Rental car reimbursement coverage applies when your insurer is paying for your car repairs. This means you’re eligible for rental reimbursement if you had collision or comprehensive coverage before the accident and you’re at fault.

When you’re not at fault for the accident, the other driver’s liability insurance will pay for your rental car expenses until your car is fixed. However, in some cases, the other driver’s insurance may not be required to cover the total cost of the rental.

Also, remember it can take weeks or months to determine who was at fault for the accident, so you may find yourself paying for the rental car costs upfront and then getting the reimbursement later.

Torian Insurance: We Are Here for You and Your Car

Often, the more arduous task is finding an insurer who prioritizes you and your car when you need help the most — when you’re involved in an accident. When you trust Torian Insurance with your rental car reimbursement coverage, you can rest easy, knowing we’ll have your back when you need us the most. We’ll get you a rental car or reimburse you promptly without unnecessary red tape or extra costs. Contact Torian today for all your car insurance needs.