Have you ever waited in a long queue to get a rental car, and finally, when it is your turn, the salesperson also requests you to purchase rental car insurance? Some people consider this insurance a necessity, while others ignore it as a redundant expense. However, the option you choose depends on your knowledge of rental car insurance and its coverage policies.

So do you really need rental car insurance? In this article, we’ll dive deeper into rental car insurance and find out the types of auto insurance available to you.

What Is Car Insurance?

At times your existing car insurance already covers a rental car. And if it does, you might be making an unnecessary expense by purchasing separate rental car insurance. So, before you make a purchase, you should explore what your car insurance offers (and doesn’t offer) first.

Suppose you have personal car insurance. In that case, it might be covering various liability and other policies that you selected while buying the insurance.

In some cases, the policy also mentions that this coverage extends to the rental car you drive for your own tasks. For instance, the deductibles and any coverage limit provided in your personal car insurance policy may also apply to your rented vehicle.

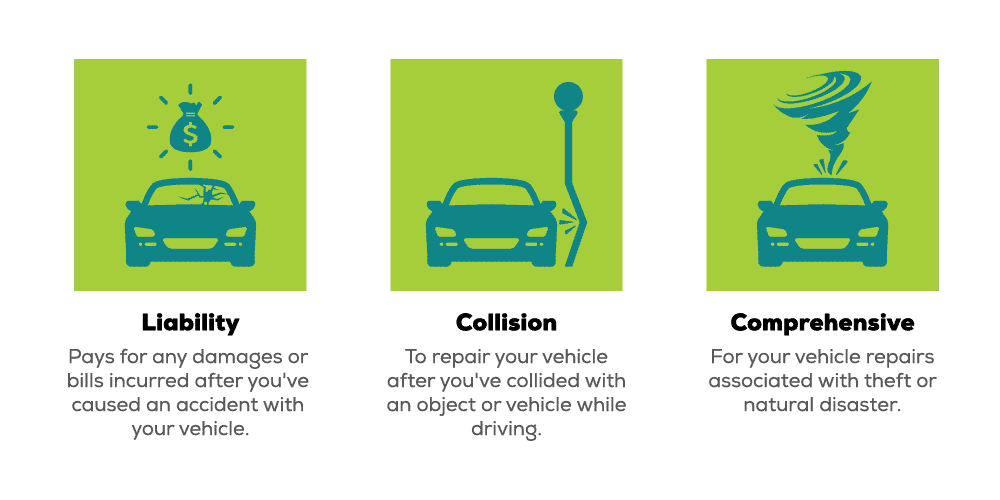

Car insurance primarily comes with three types of coverage: liability, collision, and comprehensive.

- Liability helps you pay for any damages or bills incurred after you caused an accident with your vehicle.

- Comprehensive coverage is designed to pay off any expenses incurred while repairing your own or rental vehicle. The repairs are done due to damage caused by theft or natural disaster.

- Collision coverage helps to repair your car (rented or owned) after you have collided with an object or vehicle while driving it.

Without well-curated car insurance, you are forced to pay these claims out of your pocket, and that’s a cost that not everyone can bear. This often puts the financial assets of various individuals at risk, and that’s probably the last thing you’d want.

So, should you get separate rental car insurance? As long as you are using your rental car for your personal benefit and not for business, auto insurance might be able to work perfectly for you, provided it offers collision, comprehensive, and liability coverage.

However, if it doesn’t, having rental car insurance separately is the wisest decision you can make today. Insurance bought from rental agencies provides additional coverage, which can benefit you in many ways.

Does My Car Insurance Cover Rental Cars?

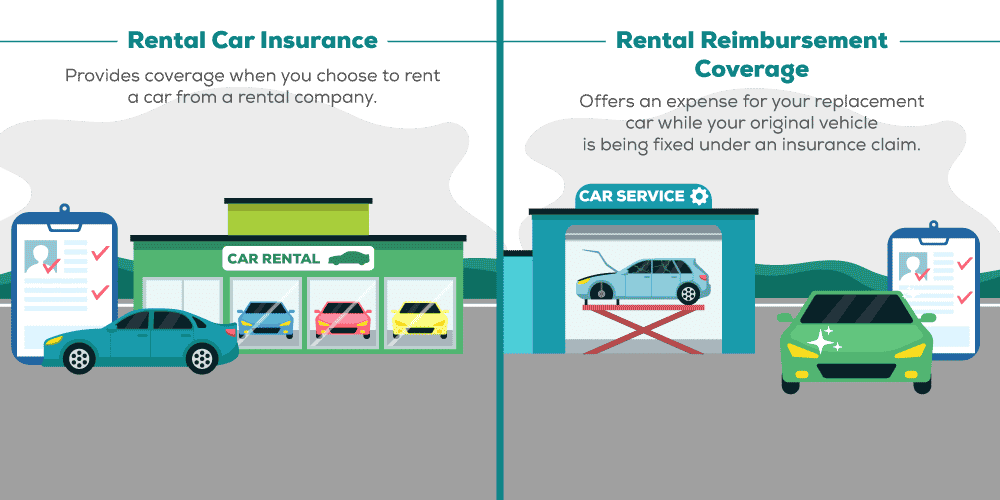

Before we explore this insurance more, it is vital to understand that rental car insurance is different from rental reimbursement coverage. Rental reimbursement coverage works as a car insurance policy extension. It offers an expense for your replacement car while your original vehicle is in a repair shop after an accident.

This coverage allows you to continue with your daily activities when your original car isn’t available. One of the best characteristics of rental reimbursement coverage is that it pays for any expenses incurred on your rental car, even if you were the one who caused the accident.

On the other hand, rental car insurance has a different definition. This insurance provides coverage when you choose to rent a car from a rental company. For instance, if you want a rental car to travel to an airport, you might consult a rental car company for their services, and in exchange, they might ask you whether you need insurance or not.

To give them a proper answer, you should know if your current car insurance policy covers rental car expenses. Therefore, it is always wise to contact your insurance company and ask them what your personal car policy covers regarding a rental car.

Rental Car Insurance Through a Credit Card

We have already discussed how personal auto insurance may provide enough coverage for your rental car as well; in that case, it is unnecessary to buy additional coverage. Similarly, in some cases, if you have purchased your rental car through a credit card, the card issuer may also offer insurance for your vehicle.

So, how does it work? When you buy a rental car using your credit card, you may be urged by the rental service to purchase their coverage. If you already know about the perks your card company offers, you can choose to pay the entire amount of your rental vehicle from the card that comes with adequate limits and coverage.

You can then file a claim with your credit card company if you get into an accident or lose your rented car via theft. Most credit cards that come with the perks of providing rental car insurance offer loss damage waiver (LDW) or collision damage waiver (CDW). A CDW saves you from any responsibility that may hit you after a rental car theft or damage.

It is always best to communicate with the card issuer and allow them to discuss the options you have before you book your rental car. For instance, if the issuer says that the credit card company does cover any collision expenses incurred through your rental car, it is useless to buy separate rental car insurance from an agency that provides similar insurance.

Since the insurance provided by your card company is secondary, it might help pay your expenses and deductibles that exceed the limits that your personal car insurance may have set. Moreover, credit card insurance saves you from paying the always-increasing insurance rates on vehicles.

That said, credit card rental insurance often doesn’t support long rental periods. The coverage provided is limited to a few weeks or a month only. In addition, this insurance excludes luxury cars, cargo vans, and motor vehicles from their coverage.

In a nutshell, if your current car insurance policy or your card issuer offers you adequate coverage for your rental car insurance, you shouldn’t spend extra money to get additional coverage from an agency. However, if that’s not the case, you should consider investing in rental car insurance.

Below we have listed some scenarios in which getting additional insurance for your rental car is necessary.

Your Current Car Insurance Policy Doesn’t Have Collision and Comprehensive Coverage

If that’s the case, you need additional coverage, or otherwise, you may have to pay for all expenses incurred due to an accident. If this is risky for your current financial status and may affect your assets, you should purchase additional rental car insurance.

You Only Have Personal Car Insurance and Not One for Business

Suppose you want to use your rental car for business purposes, but you only have personal car insurance. In that case, having additional rental car insurance will help cover any injuries and damages on trips made for business tasks.

Traveling Abroad

If you want to travel abroad in your rented car, your personal car insurance may or may not provide coverage for rental cars in most locations. Therefore, it is always good to communicate with your agent before going on a vacation. However, according to general standards, most US insurance companies don’t provide coverage on rental cars used abroad (especially in Europe). In that case, having rental car insurance is the best option.

Rented Car Having a High Value

You may consider renting a car with a higher value than your personal vehicle. In that case, your current car policy may not be able to offer you enough coverage, so you will be required to get an additional rental policy.

Renting for a Long Duration

Most credit card-provided insurance have a limited time to offer coverage. Generally, the limit is between a few weeks and a month. So, if you are renting a car for a period longer than that, you may want to consider buying rental car insurance.

One of the best reasons for getting rental car insurance is that in case of an accident, everything comes on the rental company’s records, not yours. Therefore, you will be free from all the claims made. Moreover, if the car has lost its value by a considerable margin, the rental company will be responsible for all the maintenance work.

Before spending your money, make sure that you discuss all these factors with your insurance provider. Then, choose a rental car insurance policy that meets all your needs.

Types of Rental Car Insurance Available for You

If you have finally agreed to buy rental car insurance, know that you will have to do some research to find the right type. Lucky for you, this section of the guide will make things easy for you.

Your rental car insurance agency may offer you four types of rental car insurance policies:

Loss Damage Waiver

This isn’t an insurance policy, but this option helps you waive a responsibility you may have to pay for environmental damage, theft, or accidental damage to your rental car. This waiver is quite like collision and comprehensive insurance, and if you have them already, getting a separate loss damage waiver is useless.

That said, you won’t have to pay any deductible with a loss damage waiver, which is an attractive point to consider. This waiver can save you from expenses incurred in circumstances when your vehicle is in a shop for repair.

Liability Coverage

This coverage can help you cover for the injuries caused to the other driver due to your fault. But, again, if you have personal car insurance, you may not need this policy from your rental car insurance.

Personal Effects Coverage

Personal effects coverage protects your personal belongings stolen from the rented car. This includes things such as your clothing or laptop.

Personal Accident Insurance

This insurance can pay off your and your passengers’ medical bills incurred after an accident in a rental car. However, if you already have personal injury protection or health insurance, this expense might already be covered.

Factors to Consider When Choosing a Rental Car Insurance

To avoid regrets later, you should consider some critical factors when selecting a rental car insurance policy:

Coverage

Make sure that the coverage you get through your insurance meets your needs. For example, if your current car insurance already covers possible major expenditures, don’t buy duplicate policies. An insurance agency can help you determine if your current policy provides coverage or not.

Company Reputation

It is important to buy an insurance policy from a company with a good brand reputation. Don’t just go for any insurance provider that sounds good. Many agencies will come to you, but seal the deal with the best one.

Discounts

Ask your insurance provider for any discounts that you might avail yourself of. It is always good to save some money on premiums.

Customer Support

If you choose a particular insurance provider, make sure that you are satisfied with their customer support. You may require their help during sudden incidents; strong support from the customer service department is critical, saving you from any hassles.

Consult Torian Insurance

If you decide to rent a car, know that your personal car insurance may provide you with enough coverage in most cases. However, there might be some scenarios that it may not. In that case, getting a rental car insurance policy is ideal.

Make sure to evaluate your options and your current policy before renting a car or getting an additional insurance policy. If you decide to get rental car insurance, assess the different types before investing your money.

Lucky for you, Torian Insurance can help you with just that and much more.

Whether you are a business or an individual, Torian provides you with independent agents and creates customized insurance profiles. The agents understand your needs before consulting their network of insurance providers to offer you a solution that can help protect you.

One of the best things about us is our team with a combined experience of 600 years. That’s a lot to provide you with a solution you’ll genuinely need.

So, whether you want to go for home, health, or car insurance, simply contact Torian Insurance for your required services. A representative will connect you with an agent, and from there, you can save yourself from all the insurance-related hassl