Most people are familiar with how comprehensive insurance can cover the cost of a vehicle when it’s totaled in an accident. However, for those who carry a lease or loan their vehicle, the remaining balance on the loan can sometimes exceed the total cash value of the car. In these instances, drivers may be responsible for paying out of pocket to make up the difference.

To protect drivers from these situations, it may be advisable to add gap insurance coverage to an auto policy until the remaining loan amount is less than the vehicle’s estimated value.

Read on to learn all the fundamentals about gap insurance, including when it’s needed and how it can help you save money if your vehicle gets totaled.

What is Gap Insurance?

In short, gap insurance provides additional coverage to drivers who carry a loan or lease on their vehicles. If your vehicle is ever totaled or stolen, comprehensive insurance will cover the actual cash value (ACV) of the model. However, if the money you owe on the vehicle exceeds its estimated value, you could be on the hook to pay back the remaining balance out of pocket. This is where gap insurance comes into play.

With gap insurance, your insurer will make up the remaining balance on your loan or lease minus the ACV payout from a claim. Remember, gap insurance does not help with instances when you have a gap in coverage between providers or are driving without an auto policy.

What is Vehicle Depreciation?

To fully understand how gap insurance works, it’s first important to examine the basics of vehicle depreciation.

When a new car is purchased from a dealership, the vehicle begins to lose value. After about five years, an average new vehicle’s actual cash value could drop by 37% or more. This is known as depreciation.

It’s important to note that some vehicles lose value faster than others, so it’s always advisable to carefully consider a car’s projected depreciation before committing to a loan or lease.

Scenarios When Gap Insurance is Most Beneficial

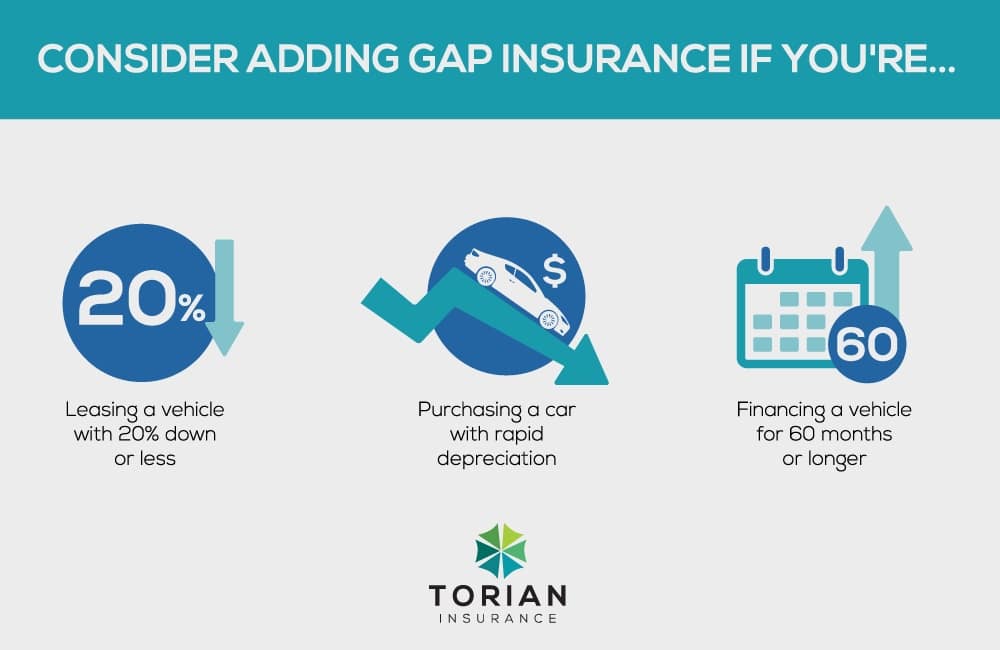

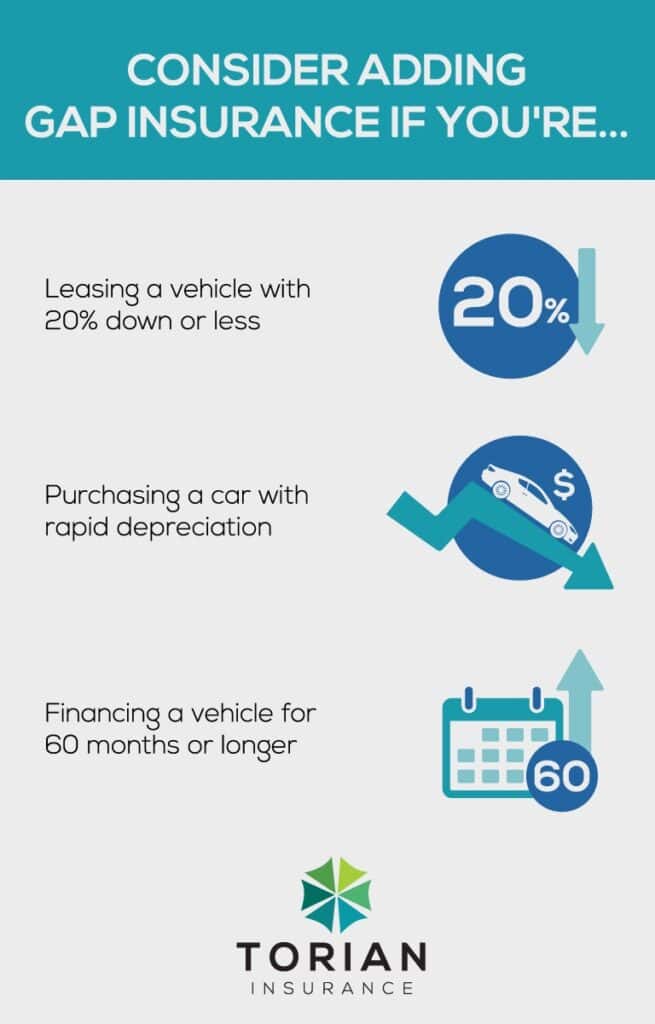

In most cases, dealerships or lenders require gap insurance on leases for new vehicles. However, there are several different situations where it’s recommended to purchase gap insurance even if it’s not mandatory.

Here are a few common scenarios when you should consider adding gap insurance to your existing auto policy.

Leasing a Vehicle with Little Money Down

If you sign a lease on a new vehicle with 20% down or less, you’ll likely want to think about buying gap insurance. Remember, vehicles begin to depreciate the moment they leave the dealership.

If you’re leasing, this could mean that the amount you owe in the first few years can potentially exceed the actual cash value of the vehicle. Having gap insurance during this time can protect you from having to cover this difference when your car is totaled or stolen.

Some leases now include gap insurance as part of the lease payment, so it’s advisable to check with the dealer on this so you don’t end up paying your insurance for provider for double coverage.

Purchasing a Car with Rapid Depreciation

While all vehicles depreciate somewhat over the years, some models lose value at an accelerated rate in contrast to others on the market. For example, the Mitsubishi Mirage loses nearly 58% of its value in the first five years alone. For vehicles like these, you may find yourself “upside down” on the vehicle with negative equity shortly after making the purchase. In this instance, having gap insurance will protect you from being financially liable for a loan balance exceeding the car’s value.

Financing a Vehicle for 60 Months or Longer

If you decide to finance a car for 60 or 72 months, there will likely be a period when the amount left to pay is higher than the vehicle’s cash value. This negative equity can put drivers in a difficult situation if the car becomes totaled or stolen. Without gap insurance, you may have to pay out of pocket for a vehicle you can no longer drive.

What Does Gap Insurance Cover?

To explain how gap insurance works, it may help to provide an illustrative example.

Suppose you purchase a car for $20,000 by taking out an auto loan. A few weeks later, you get into a collision on the road and total the vehicle. Unfortunately, vehicle depreciation since the purchase has lowered the actual cash value of the vehicle to only $18,000. After filing a claim, your auto insurance provider pays the dealership $18,000, leaving you responsible for paying the remaining $2,000 on the loan. If you have gap insurance, this additional amount won’t have to come out of your pocket. Instead, the gap insurance provider will cover the remaining loan balance.

How Do Insurance Companies Calculate Gap Insurance?

Quotes for the cost of gap insurance vary from insurer to insurer. While dealerships often provide their own gap insurance to drivers, these policies are typically more costly than adding a gap insurance policy to your current auto coverage.

In general, more expensive, newer cars will come with higher monthly gap insurance premiums. With that said, auto insurance providers may provide gap insurance for as low as $20 a year if attached to your current auto insurance policy. If you decide to purchase a standalone policy or buy gap insurance through a dealership, costs can rise to $200 or more.

Should I Buy Gap Insurance?

Gap insurance is a valuable addition to your car insurance policy that can provide peace of mind in the event of an accident.

Buying gap insurance is an easy and affordable way to protect yourself financially from vehicle depreciation while a loan or lease is repaid.

If you believe you need gap insurance for your new car, our team at Torian Insurance is here to help. Our friendly staff is happy to provide answers to all of your car insurance questions.

We’ll work closely with you to provide a customized car insurance policy that works for your unique situation and budget. When you’re ready to learn more about what gap insurance can do for you, contact us to get started.

Answers to Your Gap Insurance FAQs

So long as you still owe money on your automotive loan or lease, you are usually eligible to buy gap insurance. However, most insurers won’t offer gap coverage if 3 years have elapsed since you purchased the vehicle.

In addition, gap insurance is typically reserved for new vehicles with higher price tags, so if your vehicle is used, you probably won’t be able to get gap insurance.

Unfortunately, no. Gap insurance only applies to the vehicle listed on the policy. Even if you decide to trade in your vehicle for something new, you will have to buy a new gap insurance policy specific to your make and model.

Yes. While standard auto policies are required by law for all drivers, gap insurance is optional and may be canceled at any point in the policy period.

Many drivers who purchase gap insurance do so for only a short period until there is no longer any negative equity on the vehicle.