People purchase insurance in many cases to offset the possibility of major expenses, such as health bills, car repairs, or home damage. However, something more abstract that many of us fail to adequately protect is our ability to earn an income in the first place.

Few of us are independently wealthy. Our continued lifestyle relies on us reliably bringing in money from the job we’ve chosen or that the breadwinner in our household does so. Even a few weeks out of work with a temporary injury can be a major setback for many families. Such injuries are common, unfortunately.

Disability insurance is a valuable resource to consider — you and your dependents don’t want to be left without a source of income in the event that injury or illness takes you out of the workforce for a time. Even young and healthy workers benefit from understanding all their options when it comes to this kind of coverage.

What Is Disability Insurance?

Put simply, a disability insurance policy stipulates a certain benefit in the form of a monthly payment in the case of certain perils, which are usually an injury or illness. The policies are structured either to pay out a defined benefit, like a certain amount of dollars per month for the length of your benefit period, or a percentage of your income, like 60%.

Your disability coverage may not kick in right away if it has what’s known as an elimination period, or waiting period. This is the first few weeks or months during which you’d rely on savings or other income before the disability benefit began. Afterward, you’ll have a benefit period, which lasts for the amount of time that you cannot return to work. It can also be capped at, for instance, 24 or 36 months.

Many employers provide some form of disability insurance as part of their benefits package, so the first step as someone investigating disability insurance is to determine what your employer already offers. However, many workers realize that they’d take a major cut in income if they were to be disabled and need to use only their employer-provided coverage, which is where personal disability insurance provides additional benefits.

What Is Covered Under Disability Insurance?

Under a disability income insurance policy, what is “covered” is a little different from other insurance policies. For instance, most policies will explain to you the kinds of conditions that make you unable to do your current job. Other than a few policies that have exceptions for certain mental illnesses, most injuries and illnesses that make you self-evaluate that you cannot return to work for a time or long-term would qualify you to receive your disability benefits.

Some surprising benefits might include being able to take short-term disability income benefits while recovering from giving birth, even if the birth was standard and without complications.

Similarly, there are policies available that allow you to claim disability income if you can still work other jobs but are unable to work in your own, chosen occupation. Own-occupation disability insurance provides you your benefit for as long as you cannot work in your originally chosen industry.

For instance, if you’re injured in such a way that you can no longer lead your very physical landscaping crew, but you are able to take on a part-time role in a new field as an administrative assistant during your recovery, own-occupation insurance might continue to pay out your benefit even as you take on this new role, according to the terms of your policy.

Disability insurance comes in both short-term and long-term forms. While each policy varies, the idea is that short-term usually offers a benefit period of a few months, while a long-term policy is more likely to be expressed in terms of years. While more people will have an illness or injury in their lives that a short-term benefit would be useful, having a long-term policy in place before the arrival of a major illness or injury that requires years before returning to work is key to moving through that recovery.

How Much Does Disability Insurance Cost?

The general figures for how much a disability insurance policy will cost tend to be represented in terms of percentage of salary per year, so you could expect to pay anywhere from 1% to 4% of your yearly salary in premiums. Very robust policies could cost more than that, and very basic or low-benefit policies might even cost less.

The factors that will impact your insurance policy premiums have to do with the way your benefit is structured and a variety of risk factors that makes it more likely for you to file a claim on your policy.

Benefit-Related Factors

- Many disability insurance policies pay a portion of your income, for instance between 45% and 60% of your monthly income. If you aim for a higher percentage, you’ll pay more in premiums.

- Most benefits have an elimination period, which may be very short for a short-term disability policy or substantially longer with a long-term disability policy. Generally speaking, if you can manage your finances for a while with a longer elimination period, your premiums will be lower on average.

- If your income is quite high to begin with, your percentage-based benefit will thus be larger. With that higher benefit comes higher premiums.

- Riders can limit your coverage and thus reduce your premiums, such as any-occupation benefits which only apply when you cannot work any kind of job. This is opposed to own-occupation benefits that pay out if you cannot work in your desired industry.

- Riders can also cost you more, such as a guaranteed renewable rider that helps you lock in your policy or your rates. Similarly, a cost of living rider adjusts your benefit as inflation or the cost of living goes up.

Personal Risk Factors

- All things being equal, younger people will be able to qualify for lower insurance premiums for disability insurance than older folks, prompting some people to lock in disability coverage when they are younger.

- Risky jobs with a high incidence of injury can prompt higher insurance premiums.

- Current poor health or a medical history of illness may impact your rates. One way that individuals with chronic health concerns avoid higher premiums can be by excluding that condition as one that could prompt a disability benefit, but that can have other negative results, such as if that condition means you need to eventually stop working.

- Gender impacts your risk factors — providers weigh in statistics regarding how often men versus women tend to experience a disability claim as they age.

- If you participate in activities or sports that have high-risk factors, you may also see an increase in your disability insurance premium quote.

How Can You Get Disability Insurance?

Often, companies that offer health insurance benefits have a full benefits package that may include some form of short-term or long-term disability coverage. It may be fully covered by the company, or it could be somewhat subsidized by the company. In either case, it’s valuable to review it and opt in if you want disability insurance during enrollment for benefits.

HR or a benefits representative can help you understand the ins and outs of the policy or refer you to the insurer for answers. Because insurance can be negotiated by an employer for a large group, the rates are often quite good, even if you are paying most of the premium yourself. Hence, this is often the best place to start. From there, you can let a personal income insurance policy cover over and above what’s offered by your employer.

For those who don’t have employer-sponsored disability insurance, reaching out to a Torian Insurance representative is the best first step for getting disability insurance established.

Your agent will discuss the many factors above and can help you compare a few different options, including:

- longer and shorter elimination and benefit periods,

- higher and lower percentages of your income, and

- policies with and without various riders and protections.

They’ll also help you understand any employer-provided coverage, make sure that you’re making the most of it, and that you’re also getting more robust coverage through a personal disability income insurance policy.

Who Needs Disability Insurance?

Many people are under the impression that disability insurance is most relevant to the kind of people who might be injured by their jobs. In reality, many disabling events or illnesses have nothing to do with workplace injuries. More people than you might think will experience a disabling event at some point in their working lives, even if that disabling event simply requires weeks or months to recover their ability to return to their job as opposed to causing years of recovery or long-term inability to work.

When you consider how recovery from giving birth, mental health episodes, and cancer happen to many people at some point in their lives, you start to see how disability insurance could help smooth out cash flow during a time when earning income is likely neither feasible nor at the top of your mind.

One of the most compelling reasons for any worker to consider disability insurance is that it’s often more affordable the younger one is, making now the best time to lock in a strong rate. Disability insurance is also a particularly good fit for anyone whose income contributes substantially to the livelihood of both themselves and others, such as stay-at-home spouses, part-time spouses, or children.

While no one knows who will actually need their disability insurance, having it on hand as early as possible brings the best possible protection from disabling events that would otherwise jeopardize financial stability.

In Case of Accident or Injury, How Does Disability Insurance Help You?

Rather than paying for specific medical bills, groceries, or rent costs, your disability income protection comes in the form of unrestricted funds. If you have experienced an injury or illness that keeps you from working and you have passed your elimination period, you can contact your insurer and file a claim on your disability insurance.

At that point, you’ll begin to receive income at the specified rate in your policy for the duration of your benefit period or until you return to work. Some policies have an allowance that lets you slowly return to work, during which time you can receive a partial payment of your disability benefit. This helps to ease the transition if you went suddenly from full-time to no work and now want a more gentle return.

This income benefit can ease challenges in a variety of ways. For one thing, having some money coming in from your insurance allows you to avoid falling behind on monthly bills, which could result in debt or financial insecurity. For people receiving treatment for their illness or injury, this income can be a much-needed source of copays, coinsurance, or other upfront costs of medical care.

One of the biggest ways this income can be used, however, is to continue paying for elements of the lives of your dependents without having to feel the pinch of restructuring the daily lifestyle of your home. During a stressful season, it’s a comfort to have temporary or permanent benefits that reduce the amounts of sudden changes in the family.

Some policies even come with specific riders that protect a payment on your student loans or with a payment that protects your continued contributions to retirement accounts. These special provisions may come with a higher premium, but they allow you to prioritize the bills and savings that mattered to you even when you weren’t experiencing an illness or injury.

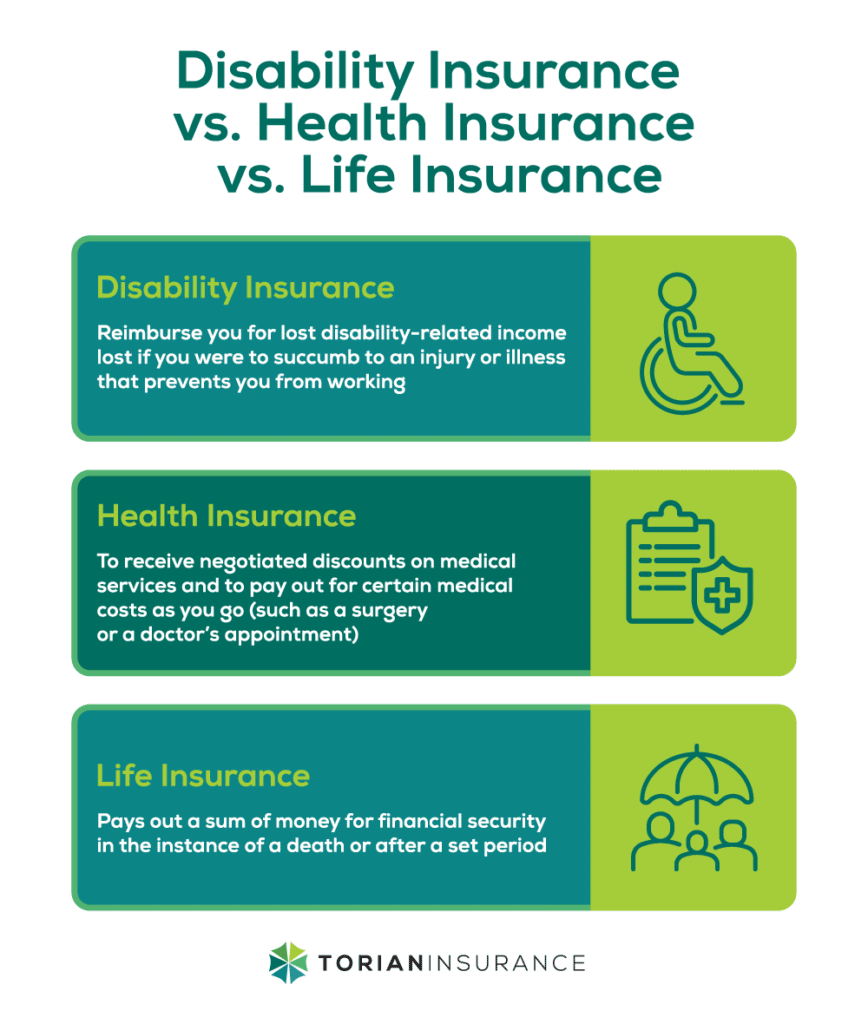

Differences Between Disability Insurance and Other Insurances like Health and Life Insurance

Health insurance works quite differently from disability insurance. The expected role of health insurance is often to both get negotiated discounts on medical services and to pay out for certain medical costs as you go. If you experience a disabling event like an illness or injury, your health insurance will still pay for any medical care or healthcare costs you incur. That’s why disability insurance isn’t insurance for disability care — rather, it’s for disability-related income loss.

Life insurance is structured in a few different ways. Term life insurance, for example, provides a death benefit if that death occurs during the period of time that the policy is in effect, whereas whole life insurance has an investment and cash-out component option in addition to a death benefit. While the benefit from a life insurance policy can be a lump sum, it can also be paid out in installments similar to disability benefits.

Disability insurance isn’t guaranteed to pay out eventually, since the hope is for the insured person to not experience a disabling event. Instead, it’s a protection against the realistic fact that many people do eventually experience an illness or injury that keeps them out of work for weeks or months, and in some cases, puts an end to a career in a particular field or no longer allows that person to work at all.

4 Top Tips When Choosing Disability Insurance

As with many kinds of insurance, a more robust policy that brings with it more benefits or flexibility is likely to have a higher premium cost. The key is to optimize your policy — include the features that would be most helpful to you, like a higher benefit or a longer benefit period, and shy away from any coverage that you don’t need. Think through how you can use the combination of employer-offered coverage, personal disability insurance, and the potential of Social Security in the event of a disability that takes away your income for a time.

Consider Supplemental Coverage To Cover Gaps in Employer-Provided Coverage

If you get a special provision in your policy that says your employer-provided coverage pays out first, you can often save some money while getting additional coverage as part of a personal disability insurance policy. Employers may offer a robust benefit that still isn’t enough to cover your family’s expenses. Be aware that expenses can shift during a time of illness and injury, so don’t assume you’ll spend substantially less just because you’ll be recovering.

If You Have a Nest Egg, Consider Lowering Premiums With a Longer Elimination Period

Since elimination periods are the amount of time you go without a benefit before the benefit kicks, they’re a bit like deductibles in the sense that the deductible is the amount you pay first before an insurance claim. It never hurts to have a little bit saved, when it is possible, to cover the first period when you experience an illness and injury, especially since it may not be immediately apparent how long it will take for you to recover and return to work.

By opting for a longer elimination period, you might end up covering your own expenses out of your savings for a time. However, your overall policy premiums until then will be lower, which can end up being an overall source of savings. If a long elimination period is likely to put a lot of stress on your family’s nest egg and could cause you to go into emergency debt, the higher premiums for a shorter elimination period might be worthwhile.

SSDI Can Take a Long Time to Go Through, So Consider a Substantial Benefit Period

If you assume that you won’t need benefits for very long because any permanent disability will prompt you to apply for Social Security disability, keep a few things in mind. First, the disability benefits provided by SSDI are modest, with the average payment being $1234 per month in 2019. So, if your expenses are higher than that, you may want your disability insurance to pay over and above that amount at least for a time.

Second, applying for SSDI is no easy task — it’s a time-intensive process, and it’s fairly common to have applications rejected, leaving you to go through the process of appeals with additional documentation. These appeals can take anywhere from months to years. If your benefits run out during that time, it could cause financial strain.

Riders Like a Cost of Living Rider Can Help Ensure Your Policy’s Future Value

Some disability income benefits are set, such as $2000 a month. They can also be indexed, which is when you’d start at a $2000 a month payout but adjustments are made each year to account for what $2000 was worth for prior years given inflation and other factors. Indexed or cost of living adjusted benefits require a bit more in your premiums, but when you’re buying a policy that you might only use in 20 or even 25 years, you will want that money to afford the essentials in the future.

Let Torian Help You Find The Personalized Disability Coverage For You

Disability insurance is part of the safety net that you can cast over yourself and the people you love. When this insurance is in place, you can access financial security during a time when pain, medical treatments, and other stress-inducing elements of illness and injury are taking most of your attention.

Your family can continue to live in their home, purchase the items they need, and pay regular bills like student loan payments. It gives workers a chance to truly focus on rest and health rather than on getting back to work as fast as possible, risking re-injury or illness complications.

That being said, it’s important that you have sound guidance as you navigate policies — don’t just search for “Disability insurance near me.” Torian insurance agents have great experience in the world of disability insurance as well as a wide variety of other insurance types. We’ll direct you to high-quality insurance providers and find the perfect blend of value and affordability that gives you the kind of coverage you want.

Don’t sit awake at night pondering what-ifs about your family’s sources of income. Insure the valuable asset of your ability to work for income, and let us walk you through the process today.