Homeownership is a significant milestone—a place where memories are created, families grow, and futures are built. Protecting your home, one of your most valuable assets, is essential. Navigating the world of home insurance quotes can seem overwhelming, but with the right guidance, you can secure the best rates at the most competitive prices.

This ultimate guide will empower homeowners and prospective buyers in Southern Indiana, Illinois, and Kentucky to confidently compare home insurance quotes and make informed decisions.

Understanding Home Insurance Quotes

Before diving into comparisons, it’s crucial to understand what a home insurance quote entails. A home insurance quote is an estimate provided by an insurance company detailing how much your policy will cost based on specific information about your home and desired coverage. It outlines the things such as:

- The premium

- Deductibles

- Coverage limits

- Terms of the policy

Home insurance plays a vital role in safeguarding your property and assets. It provides financial protection against unexpected events like natural disasters, theft, or accidents that can cause significant damage or loss. By having the right insurance in place, you ensure that you’re not left shouldering the financial burden alone when the unexpected occurs.

According to Bankrate, comparing multiple home insurance quotes allows you to evaluate coverage options and find one that suits your financial needs. Understanding these quotes allows you to select policies that offer comprehensive protection without breaking the bank.

Comparing home insurance quotes is essential because not all policies are created equal. Prices, coverage options, and customer service can vary significantly between providers. By comparing quotes, you can find a policy that offers the best value—comprehensive coverage at a price that fits your budget.

Key Factors to Consider When Comparing Quotes

When evaluating home insurance quotes, several key factors can influence both the cost and the quality of coverage. Understanding these factors will help you make a well-informed decision.

Coverage Options and Limits

The coverage options and limits you choose directly impact your premium and the protection you receive. Standard home insurance policies typically include:

- Dwelling Coverage: Protects the physical structure of your home against covered perils like fire, wind, and hail.

- Personal Property Coverage: Covers your personal belongings inside the home if they are damaged or stolen. Coverage limits may apply to high-value items, so additional endorsements might be necessary.

- Liability Coverage: Provides financial protection if someone is injured on your property and you are found legally responsible. It covers legal fees and any resulting settlements or judgments, up to your policy limits.

- Additional Living Expenses (ALE): Covers the cost of temporary housing if your home becomes uninhabitable due to a covered loss.

Ensure the coverage limits are sufficient to rebuild your home and replace your belongings. Underinsuring can leave you financially vulnerable, while overinsuring may result in unnecessarily high premiums.

Deductibles and How They Affect Premiums

A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in after a claim. Choosing a higher deductible usually lowers your premium because you’re assuming more of the initial cost in the event of a loss. Conversely, a lower deductible increases your premium but reduces your financial burden when filing a claim.

Consider your financial situation and ability to pay a higher deductible if you experience a loss. Balancing your deductible and premium is key to managing both your monthly expenses and potential future costs.

Impact of Location on Insurance Costs

Your home’s location significantly influences your insurance rates due to factors such as:

- Risk of Natural Disasters: Homes in areas prone to hurricanes, earthquakes, floods, or wildfires typically have higher premiums due to increased risk.

- Crime Rates: Urban areas with higher crime rates may result in elevated insurance costs.

- Proximity to Emergency Services: Homes closer to fire stations and emergency responders often benefit from lower premiums.

Understanding how your location affects insurance costs can help you make informed choices when purchasing a home and comparing insurance quotes.

Personal Factors That Influence Insurance Rates

Several personal factors can impact your home insurance rates:

- Home Size and Construction Type: Larger homes or those made with high-end materials may cost more to insure due to higher replacement costs.

- Age of the Home: Older homes may have outdated systems or materials that increase risk.

- Security Systems: Homes equipped with security alarms, smoke detectors, and sprinkler systems often qualify for discounts. According to Policygenius, installing a security system might qualify homeowners for discounts ranging between 2% to 15% on their insurance premiums.

- Credit History: In some states, insurers consider your credit score as it can indicate the likelihood of filing a claim

By understanding these factors, you can take steps to potentially lower your insurance costs, such as upgrading old systems or installing security features.

Discount Opportunities and Eligibility

Insurance companies offer various discounts that can reduce your premium:

- Multi-Policy Discount: Bundling your home and auto insurance with the same company.

- Protective Devices Discount: Installing smoke detectors, burglar alarms, or fire sprinklers.

- Claims-Free Discount: Maintaining a history without filing claims.

- Loyalty Discount: Staying with the same insurer over time.

Ask each insurer about available discounts to ensure you’re not missing out on potential savings.

Common Terms and Coverage Details

Navigating insurance jargon can be challenging. Familiarizing yourself with common terms and coverage details will help you understand your policy options fully.

Explanation of Essential Home Insurance Terms

- Premium: The amount you pay for your insurance policy, typically annually or monthly.

- Deductible: The amount you pay out-of-pocket on a claim before your insurance covers the rest.

- Liability: Protection against legal responsibility for injury or property damage you may cause to others.

- Exclusions: Specific conditions or circumstances for which the policy does not provide coverage.

- Endorsement (or Rider): An addition to your policy that alters or adds coverage.

Understanding these terms ensures you’re clear about what you’re purchasing and how it protects you.

Understanding Endorsements and Optional Coverages

Standard policies might not cover all risks. Endorsements allow you to customize your policy:

- Flood Insurance: Protects against flood damage, which is typically excluded from standard policies.

- Earthquake Insurance: Provides coverage for damages caused by earthquakes.

- Sewer Backup Coverage: Covers damage from sewage or drain backups.

- Identity Theft Restoration: Helps cover expenses associated with restoring your identity.

Evaluate your specific needs to determine which endorsements are essential for your peace of mind.

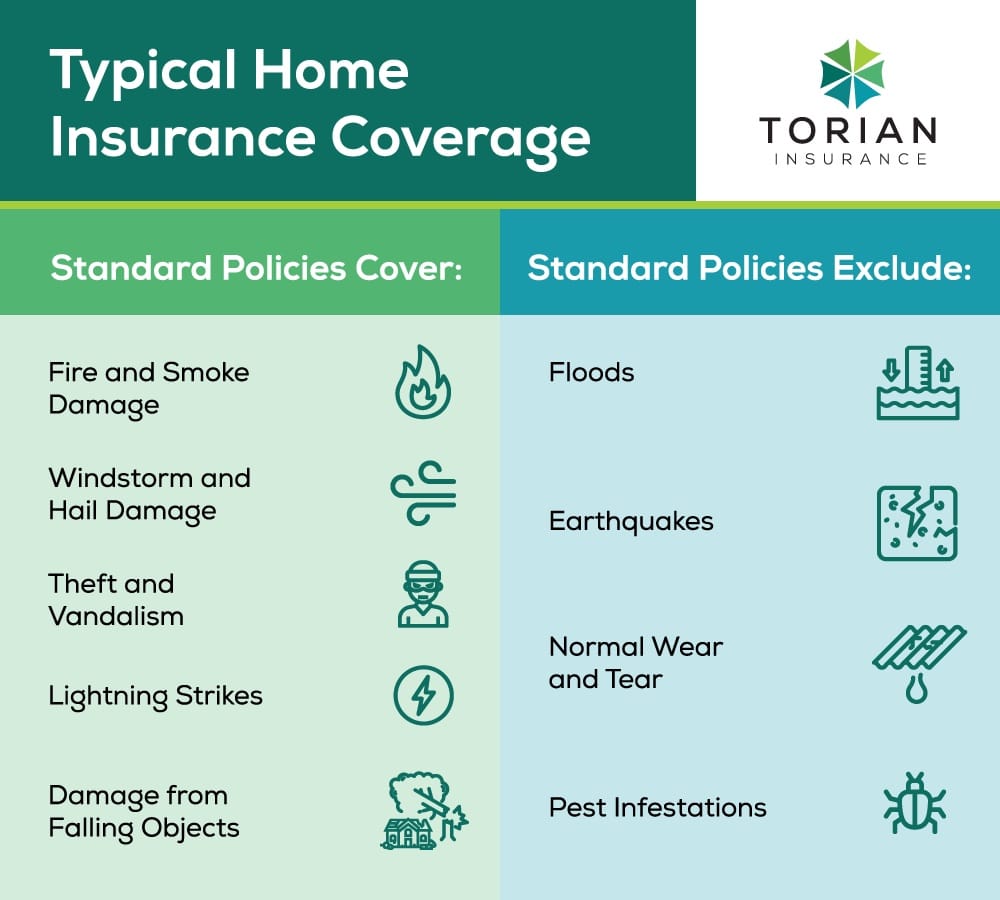

Examples of What Is Typically Covered Under Basic Home Insurance Policies

Most standard policies cover:

- Fire and Smoke Damage

- Windstorm and Hail Damage

- Theft and Vandalism

- Lightning Strikes

- Damage from Falling Objects

However, they usually exclude:

- Floods

- Earthquakes

- Normal Wear and Tear

- Pest Infestations

Review each policy’s exclusions carefully to avoid unexpected gaps in coverage.

Tips for Selecting the Best Home Insurance Policy

Choosing the right policy involves careful consideration of your needs and thorough research.

Assessing Personal Needs and Potential Risks

Start by evaluating:

- Value of Your Home and Belongings: Determine the cost to rebuild your home and replace your possessions.

- Local Risks: Consider natural disasters or crime rates in your area.

- Personal Lifestyle: If you have pets or run a business from home, you might need additional coverage.

This assessment helps you select coverage levels that adequately protect you without unnecessary extras.

Evaluating Insurance Providers Based on Customer Service and Claims Handling

An insurer’s reputation matters. Research:

- Customer Reviews: Look for feedback on customer service and satisfaction.

- Claims Process: Understand how straightforward their claims process is.

- Financial Stability: Check ratings from agencies like A.M. Best to ensure they can pay out claims.

A reliable insurer provides not just coverage but confidence in their support when you need it most.

Importance of Balancing Cost with Coverage Quality

While cost is a significant factor, the cheapest policy isn’t always the best. Low premiums might come with high deductibles or insufficient coverage limits. Conversely, the most expensive policy might include coverage you don’t need.

Aim for a policy that offers the best value—a balance of affordable premiums and comprehensive coverage that fits your needs.

Steps to Take After Receiving a Quote to Ensure an Informed Decision

- Review the Quote Details: Ensure all information is accurate and coverage meets your needs.

- Ask Questions: Don’t hesitate to seek clarification on any aspect you’re unsure about.

- Compare Multiple Quotes: Collect at least three quotes to benchmark coverage options and prices.

- Consult an Independent Insurance Agent: They can offer unbiased advice tailored to your situation.

Taking these steps will help you feel confident in your final decision.

Using Online Tools and Apps for Comparison

Leverage technology to simplify your search:

- Online Comparison Websites: Allow you to compare multiple home insurance quotes quickly.

- Insurance Company Websites: Provide detailed information about policies and coverage options.

- Mobile Apps: Some insurers offer apps for easy policy management and claims filing.

These tools can save you time and help you stay organized throughout the process.

Advantages of Comparing Quotes with Independent Insurance Agents

Working with an independent insurance agent can offer significant benefits over going it alone or dealing with a single insurer.

Explanation of How Independent Agents Offer Personalized Service and Custom Solutions

Independent agents represent multiple insurance companies, not just one. They:

- Understand Your Unique Needs: They take time to learn about your specific situation.

- Provide Tailored Recommendations: Suggest policies and coverage options that match your requirements.

- Offer Ongoing Support: Assist with policy changes, renewals, and claims throughout your ownership.

Their personalized approach ensures you get the most suitable coverage without unnecessary add-ons.

Advantages of Having Access to Multiple Insurance Providers Versus a Single Carrier

By having access to various insurers, independent agents can offer diverse options and policy fits even for unique needs, which direct providers might not offer. This increased variety often results in cost savings and better coverage fits.

Benefits of Receiving Unbiased Advice Tailored to Client Needs

Independent agents can provide objective recommendations because they aren’t tied to one company’s products. This allows them to prioritize your best interests, adjusting solutions as your needs change and advocating on your behalf during policy negotiations.

Steps to Get Started with Comparing Home Insurance Quotes

Ready to find the best home insurance quotes? Here’s how to get started.

Practical Steps for Gathering and Organizing Multiple Quotes

- Prepare Information About Your Home:

- Age, size, and construction details.

- Security features and recent upgrades.

- List Your Personal Property:

- Create an inventory of valuable items.

- Assess Your Coverage Needs:

- Determine necessary coverage limits and endorsements.

Having this information readily available streamlines the quoting process.

Tools and Resources Available for Comparison

- Consult with Torian Insurance: Leverage their expertise to access multiple quotes.

- Use Online Calculators: Estimate coverage needs and potential premiums.

- Attend Educational Workshops: Gain insights into insurance options.

These resources can simplify your search and enhance your understanding.

Contact Torian Insurance

Taking the next step is easy. Reach out to Torian Insurance for:

- Customized Quotes

- Expert Advice Tailored to Your Needs

Their friendly and knowledgeable agents are ready to help you unlock competitive home insurance quotes and protect what matters most to you.

Safeguard Your Property Today

Protecting your home is an essential part of safeguarding your future. By understanding how to compare home insurance quotes effectively, you equip yourself with the knowledge to make confident decisions. Key considerations include evaluating coverage options, understanding policy terms, and balancing cost with quality.

Working with a locally-owned independent agency like Torian Insurance enhances this process. Their personalized approach, extensive provider network, and commitment to community ensure you receive unparalleled service and tailored insurance solutions.

Secure your peace of mind today. Contact Torian Insurance to unlock the best home insurance quotes and protect what matters most to you.