Your vacation home is your sanctuary—a place where cherished memories are made with family and friends. Protecting this dream retreat is paramount. Ensuring it’s properly secured and covered with the right vacation home insurance gives you the peace of mind to enjoy your getaway without worries.

In this guide, we’ll explore essential tips to safeguard your vacation home effectively. From choosing comprehensive insurance coverage to implementing advanced security measures, we’ll help you protect your investment and keep your haven safe.

Why Vacation Home Insurance Matters

Vacation home insurance is crucial because it addresses risks unique to properties that aren’t your primary residence. These homes are often unoccupied for extended periods, increasing the potential for damage, theft, or unnoticed maintenance issues.

Without proper coverage, you could face significant out-of-pocket expenses in the event of unforeseen incidents. Standard homeowner’s insurance policies typically don’t extend full protection to secondary properties, making specialized vacation home insurance essential.

Choosing the Right Vacation Home Insurance Coverage

Selecting the appropriate vacation home insurance ensures you’re protected against specific risks associated with your property.

Types of Coverage to Consider

Consider the following coverage options:

- Property Damage: Protects against damage from fire, storms, vandalism, or other unexpected events.

- Flood Insurance: According to 90% of all natural disasters involve some form of flooding, making this coverage essential. Floods aren’t usually covered in standard home policies.

- Liability Coverage: Covers legal expenses if someone is injured on your property.

- Loss of Use: Pays for additional living expenses if your home is uninhabitable due to a covered loss.

- Personal Property: Covers belongings like furniture, electronics, and personal items within the home.

- Rental Property Coverage: Necessary if you rent out your vacation home, covering tenant-related damages or liabilities.

Implementing Effective Security Measures

Enhancing your vacation home’s security is crucial for several reasons, given the inherent risks associated with properties that are often unoccupied.These homes are frequently targeted by intruders and burglars because they are empty for extended periods, presenting an invitation for unauthorized access. The absence of regular foot traffic or immediate neighborhood watch can embolden criminals looking to exploit the opportunity for theft or vandalism.

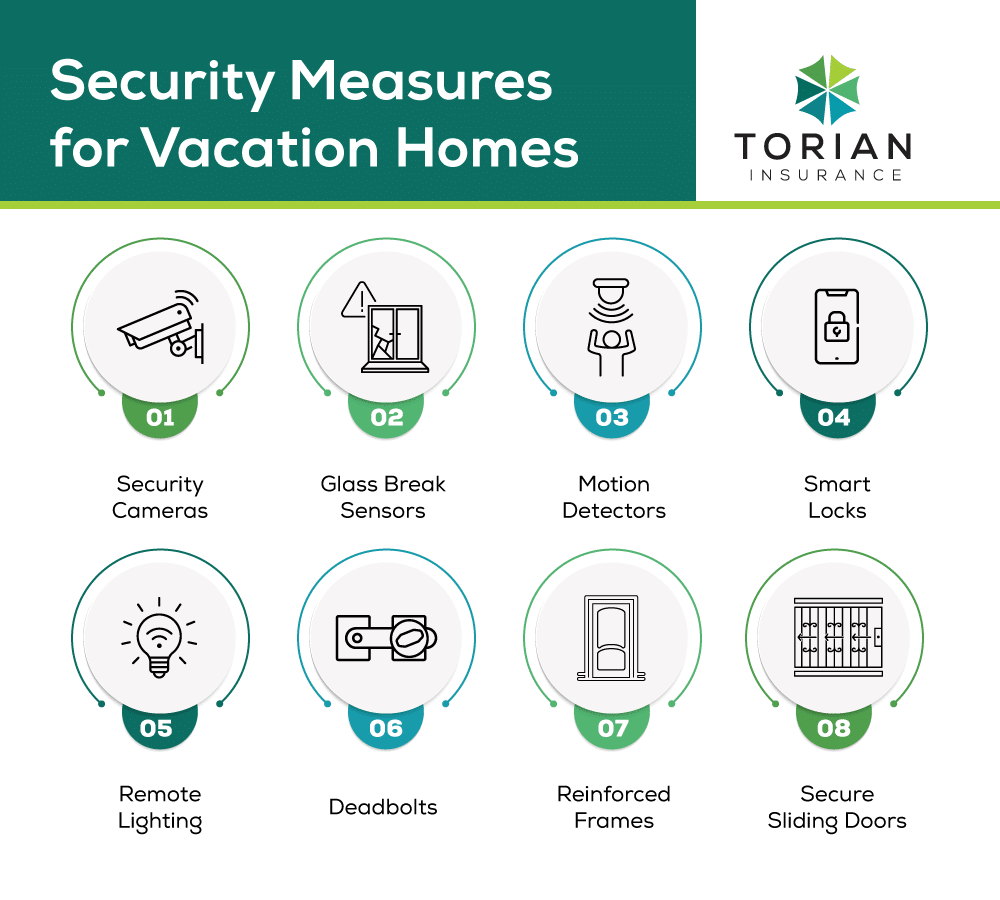

Installing Security Systems

Increased security measures not only deter potential intruders by making the home less attractive to target but also prevent significant financial and emotional damage. A break-in can lead to the loss of valuable items, ranging from personal mementos to expensive electronics or artwork. It can also result in significant property damage, which can be costly and time-consuming to repair. Beyond material losses, there is the psychological impact and sense of violation that can arise from knowing someone invaded your personal space. Modern security systems and smart technology can include:

- Security Cameras: Offer real-time surveillance and recorded evidence.

- Glass Break Sensors: Detect broken windows and trigger alarms for immediate response.

- Motion Detectors: Trigger alarms when movement is detected, alerting homeowners or authorities.

- Smart Locks: Manage access remotely, providing or revoking entry as needed.

- Remote Lighting: Schedule lights to mimic occupancy, deterring potential intruders.

- Deadbolts: Strengthen door security against forced entry.

- Reinforced Frames: Support doors and windows to prevent break-ins.

- Secure Sliding Doors: Use bars or pins to enhance security and prevent unauthorized access.

Investing in advanced security not only protects your property but can also lower your insurance premiums, offering financial benefits alongside peace of mind.

Regular Maintenance and Property Management

Regular maintenance is your property’s first line of defense against turning small issues into costly repairs. By keeping up with routine care, you’re not only protecting your investment but also ensuring a safe, comfortable environment for everyone. Here’s a guide to seasonal maintenance tips that can help you stay ahead of potential problems:

Spring

- Inspect Roof and Gutters: Check for any damage caused by winter weather. Clean out gutters to prevent water damage.

- Check Exterior: Examine the siding, foundation, and windows for cracks or signs of damage.

- HVAC System: Service your air conditioning unit to ensure it is ready for warmer months.

- Landscaping: Trim trees and shrubs, clean up any debris from the winter, and plant new flowers or shrubs.

- Plumbing Check: Look for any leaks or drips, and ensure outdoor faucets and hoses are in working order.

- Pest Control: Schedule an inspection to prevent infestations as animals and insects become more active.

Summer

- Outdoor Areas: Clean and seal decks and patios.

- Windows and Doors: Check seals and weatherstripping to ensure energy efficiency.

- Paint Touch-ups: Look for any areas that might need fresh paint, especially on the exterior.

- Inspect Sprinkler System: Ensure it’s functioning properly and water usage is efficient.

- Clean Outdoor Grill: Make sure your grill is clean and operational for summer cookouts.

- Inspect Water Features: If you have a pool or pond, maintain its cleanliness and balance chemicals if necessary.

Fall

- Furnace Maintenance: Service the heating system to prepare for the colder months.

- Clean Gutters: Remove fallen leaves and debris to prevent clogs and water damage.

- Inspect Roof and Chimney: Check for any signs of wear and prepare for potential snow accumulation.

- Seal Cracks: Inspect foundation and exteriors for any cracks and seal them to prevent drafts.

- Store Outdoor Furniture: Clean and store patio furniture to protect it from cold and damp weather.

- Check Home Safety Devices: Replace batteries in smoke and carbon monoxide detectors.

Winter

- Monitor for Ice Dams: Keep an eye on ice buildup that can cause roof damage.

- Interior Check: Look for drafts and seal them. Add insulation if necessary.

- Monitor Systems: Keep heating systems and plumbing in check, especially in areas prone to freezing.

- Inspect Attic and Basement: Check for signs of moisture and pests.

- Security Check: Ensure all entry points are secure and consider investing in a home security system for the off-season.

- Prepare for Storms: Stock up on supplies and check backup generators if applicable.

Regular maintenance not only helps prevent larger, more costly repairs but also ensures that your vacation home is ready for your use or for rental guests throughout the year. Always adapt these suggestions based on the specific climate and conditions at your vacation property

Hiring Local Assistance

Building a relationship with someone local ensures your vacation home is well cared for even in your absence. Additionally, local professionals can coordinate necessary repairs and maintenance tasks, ensuring that small issues don’t turn into costly problems. A local property manager or trusted neighbor can:

- Conduct regular inspections to catch issues early.

- Respond to emergencies promptly, minimizing potential damage.

- Update you on your property’s condition, providing peace of mind when you’re away.

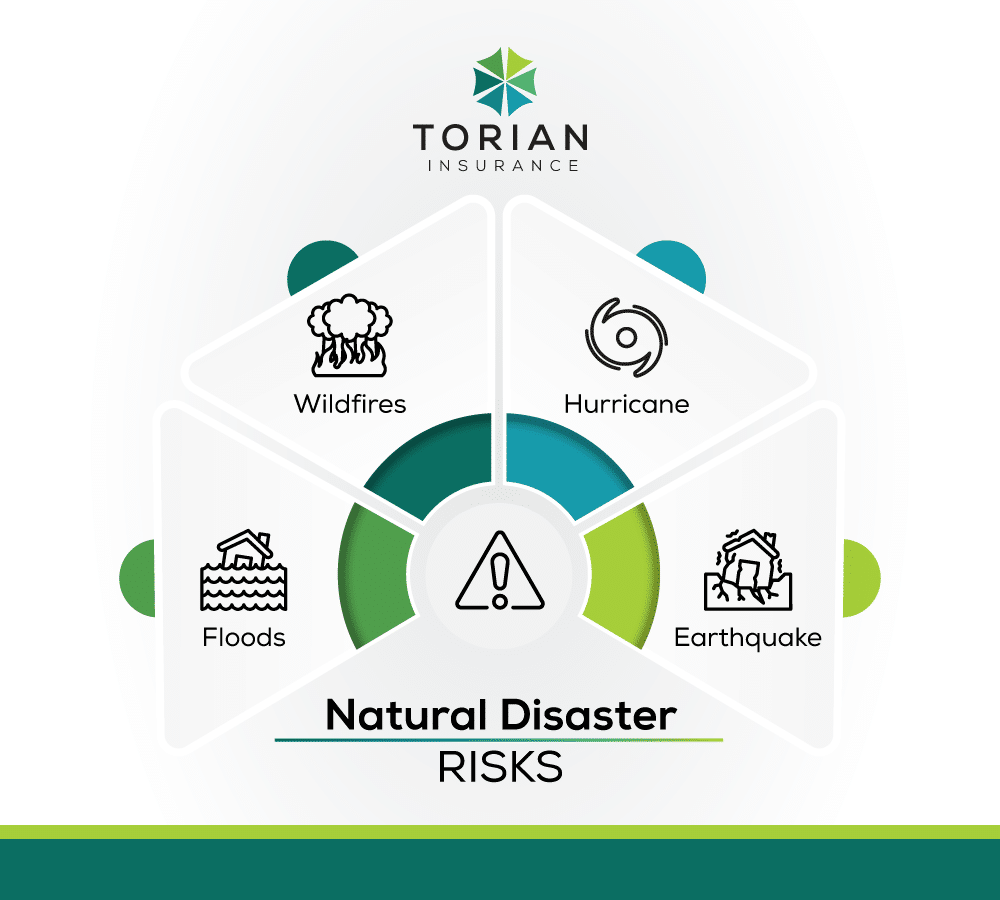

Preparing for Natural Disasters and Emergencies

Vacation homes are often located in picturesque but vulnerable areas, such as coastal zones, mountain ranges, and forested regions, making them more susceptible to environmental hazards like hurricanes, floods, wildfires, and landslides. The impact of climate change exacerbates these risks, as rising sea levels and increasingly severe weather patterns heighten the likelihood and intensity of natural disasters in these areas.

Assessing Local Risks

Determining potential hazards involves assessing the specific environmental and geographical threats that could impact a vacation home’s location. This process includes understanding the area’s history of natural disasters, such as past occurrences of hurricanes, earthquakes, floods, or wildfires, and evaluating the likelihood of future events. It also involves analyzing the geographical features and climate-related issues that might pose a risk, like proximity to water bodies that could flood, fault lines that could cause earthquakes, or forests that are susceptible to fires.

- Flood Zones: Identify if your property is in a flood-prone area. It’s important to note that even areas not previously known for flooding have recently experienced devastating floods due to changing climate patterns, including increased rainfall intensity and frequency. This unpredictability underscores the need for comprehensive flood risk assessments, even in regions traditionally considered low-risk.

- Wildfire Areas: Take precautions if located in dry, fire-susceptible regions. Wildfires have become increasingly damaging through the world.

- Hurricane Zones: Reinforce structures against high winds and flying debris. Hurricanes also bring significant flooding. If you live in a hurricane zone, have an evacuation plan and supplies needed to prep your home prior to a hurricane.

- Earthquake Regions: Secure heavy furniture and consider structural reinforcements.

Ensuring Comprehensive Insurance Coverage

Standard policies may not cover certain disasters:

- Flood Insurance: Often requires separate coverage, essential for flood-prone areas.

- Earthquake Insurance: Necessary in seismic zones to cover quake-related damages.

- Review Exclusions: Understand what your policy doesn’t cover and fill the gaps.

In times of natural disasters, having the right insurance can make all the difference in recovery and financial stability.

Safeguarding Valuables and Personal Items

Protecting valuables at a secondary vacation home requires a combination of secure storage solutions and strategic planning. Here are some effective options to safeguard your possessions:

Secure Storage Solutions

- Install Safes:Install a high-quality safe that is both fire-resistant and burglar-proof. Opt for models that can be securely bolted to the floor or wall to prevent easy removal. Digital keypad or biometric locks offer enhanced security over traditional key locks.

- Hidden Compartments: Use furniture with built-in hidden compartments for unobtrusive storage of items like jewelry, important documents, or cash. These conceal valuables from plain sight and offer an added layer of security.

- Lockable Storage Cabinets: Consider using lockable storage cabinets or drawers to keep valuable items secure. These can be an effective deterrent, especially when located in less obvious areas of the home.

- Off-Site Storage: If you’re rarely at the vacation home, storing particularly valuable items in a local bank’s safety deposit box might be a safer option. This removes them entirely from any potential risk while the home is unoccupied.

Valuables Insurance

When it comes to insuring valuables and jewelry at a secondary or vacation home, it’s important to ensure these high-value items are adequately protected against potential risks such as theft, loss, or damage. Here are some key steps and considerations for safeguarding these possessions:

- Appraisals and Documentation: Start by obtaining professional appraisals to determine the current market value of your valuables and jewelry. Maintain detailed documentation, including receipts, photographs, and certificates of authenticity, as these will be essential in substantiating any insurance claims.

- Secondary Home Insurance Limitations: Standard homeowners insurance policies for secondary or vacation homes often have specific limits on coverage for high-value items like jewelry. These limits may not fully reflect the worth of your valuables. Review your policy carefully to understand any coverage limitations.

- Scheduled Personal Property Coverage: To ensure adequate protection, consider adding a scheduled personal property endorsement, or “floater,” to your insurance policy for the secondary home. This endorsement provides additional coverage over the standard policy limits and typically includes a broader range of perils, such as accidental loss.

- Standalone Jewelry Insurance: Alternatively, purchasing a standalone insurance policy specifically for jewelry and other valuable items can offer comprehensive coverage. This type of policy often includes protection against risks like mysterious disappearance, which may not be covered by standard homeowners insurance.

- Regular Updates and Reviews: Keep your insurance coverage up-to-date with any changes in the value of your items. As market conditions fluctuate, it may be necessary to update appraisals and adjust coverage terms. Regularly reviewing your policy with your insurer ensures you maintain adequate protection.

Managing Utilities and Property When Not in Use

Proper management of utilities and the property itself during unoccupied periods is crucial to prevent accidental damages.

- Adjust Thermostats: Set appropriate temperatures to prevent pipe freezing or excessive humidity.

- Turn Off Water Supply: Prevent potential leaks or floods by shutting off the main water valve.

- Ensure Ventilation: Prevent mold and mildew by allowing air circulation.

- Automate Systems: Use smart home devices to monitor and control utilities remotely.

Regularly inspecting the property, even when not occupied, helps catch any issues early before they escalate.

Benefits of Custom Insurance Solutions

Every vacation home is unique. Custom insurance solutions allow you to tailor coverage to your specific needs, ensuring comprehensive protection without unnecessary costs. Working with an independent insurance agent can help you navigate the various options and select policies that best fit your situation.

Your vacation home is a cherished investment. Protecting it with comprehensive vacation home insurance and proactive security measures ensures you can enjoy your getaway with peace of mind. Taking the time to implement these essential tips not only safeguards your property but also enhances its value and longevity. Torian Insurance offers personalized policies, giving you confidence that your dream retreat is safeguarded according to your exact requirements.

Don’t wait until it’s too late—contact Torian Insurance now to secure your dream retreat with the perfect insurance plan tailored just for you. Call us at (812) 424-5503 or contact us today to get a personalized quote. Our friendly agents are here to assist you every step of the way, ensuring you have the right coverage for your unique needs.