Figuring out how much home insurance you need can be tricky. There’s no single answer that works for everybody — it all depends on factors specific to your home and personal circumstances. It feels overwhelming at first, but it doesn’t have to be. Considering these six factors will help you work out an appropriate coverage level.

1. How Much Your Home Is Worth

The first thing to think about is the value of your home and its contents. Factors that go into determining your home’s worth and your potential income from it include:

- Age of the home. A newly built home often costs at least 30% more than a comparable older home since older homes often need more work.

- Size of the home. A larger home may require more coverage than a smaller home simply because of its higher market value.

- Additional structures. Do you have a garage or shed on the property? These can increase your home’s value and might call for Coverage B, also known as other structures coverage.

- Type of home. Factors like materials, layout, and features affect your home’s value and insurance requirements. You might need more coverage if you have high-end options like a brick exterior.

- Where you live. The climate and environmental risks in your area affect your home’s value and your insurance needs. If you live in a high-risk area, such as a flood zone or an area prone to bushfires, you may need to take out additional coverage to protect yourself.

Plan to review how much home insurance you have regularly. If you make improvements to your property or buy new items for your home, make sure you’re still adequately covered.

2. Cost of Rebuilding Your Home

Figuring out the value of your home is step one, but professionals rarely use it to determine how much home insurance you need. The goal of coverage is to match what it would cost to rebuild the home using similar construction materials and methods.

Why Rebuilding Costs Vary

For the vast majority of properties, an insurance company will determine the actual amount to insuree for. At Torian Insurance, they use a software to estimate reconstruction costs to help determine the ideal coverage level.

Several factors play into this including:

- Local construction costs. The local labor market and differences in material pricing can cause construction expenses to vary. The cost to build can reach $859 per square foot in a New York condominium, but just $314 for one in Denver.

- Square footage. The larger your home’s total area, the more time and materials will be involved in rebuilding.

- Style of the home. Simpler styles cost less to rebuild than homes with complex layouts. Structural elements like a second story or basement also add to the cost.

- Special features. The more luxury amenities you have in your home, the more you’ll pay to rebuild. Tell your agent about all your “extras,” like fireplaces and central air conditioning, so they can accurately calculate replacement costs.

- Materials needed for replacement. The cost to rebuild your home depends on what the original builders used. There’s a high- and low-end version of everything. Also, building material costs are rising, so your rebuild might cost more than the original build.

- Type of exterior wall framing. Your home’s exterior frame is one of the biggest contributors to the cost of rebuilding. Steel costs more than wood, but not all wood-framed houses are the same. Timber framing uses heavier wood to make framing possible without nails or glue, but it’s more expensive.

- Cost of additional structures. Those additional structures will cost money to rebuild.

- Renovations and improvements. If you’ve made any improvements, renovations, or additions to the home, it will affect your rebuilding cost. Always update your agent on these improvements to see how they affect your coverage needs.

Replacement cost coverage is a must-have. Your dwelling coverage should equal the replacement value of your home, which is equal to the square footage multiplied by local construction costs.

Consider the factors above and include any new building costs, including remodeled kitchens or additional rooms and structures. Don’t forget about features that are difficult to replace — they can cost more than you expected.

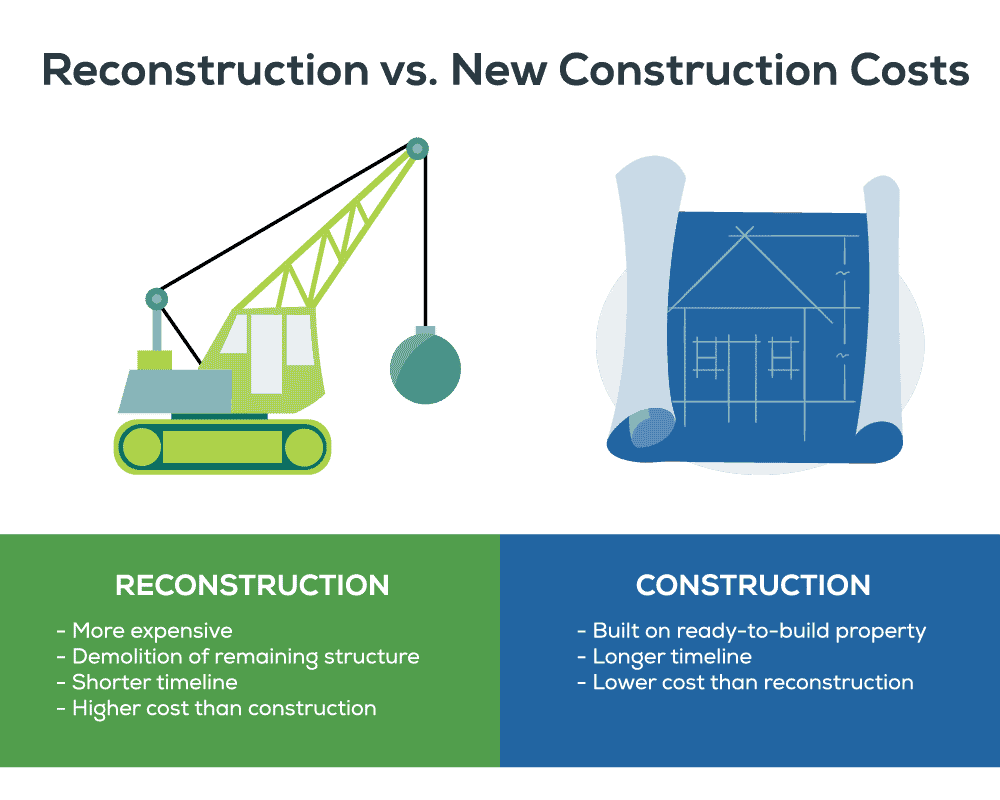

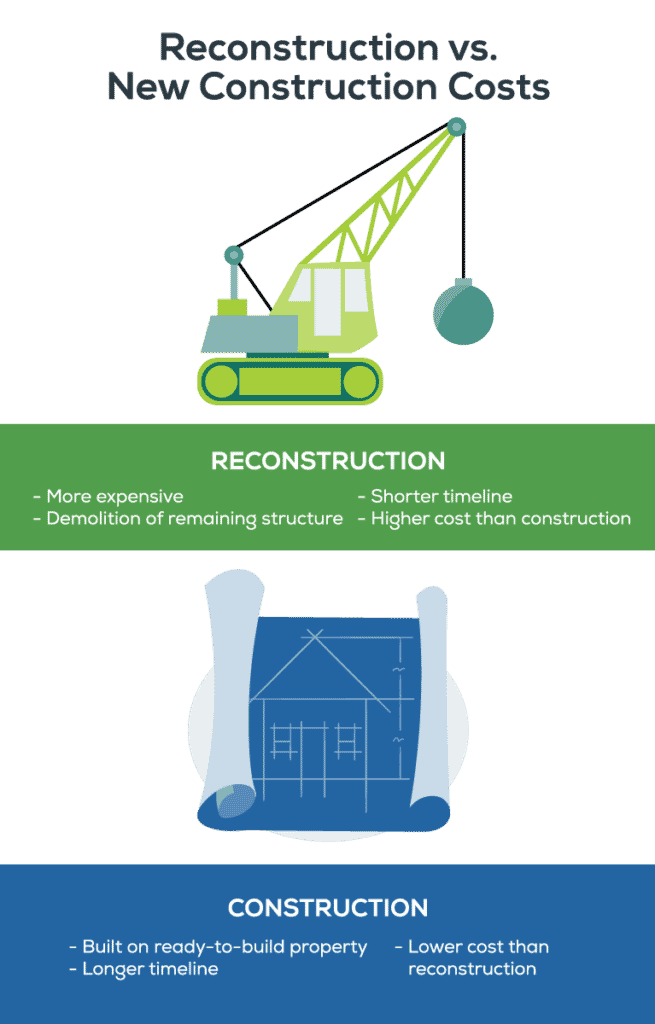

Reconstruction vs. New Construction Costs

Reconstruction is often different and more expensive than new construction.

New homes may be part of a larger development project, meaning a builder is putting up multiple houses at once. These developments benefit from economies of scale. The builders may have access to advantages like bulk labor and materials which aren’t available for a single-home reconstruction.

Also, new construction starts on a ready-to-build piece of property. When a home gets damaged by an event like a fire or windstorm, there’s almost always demolition of the remaining structure and site prep to do before reconstruction. You have to consider those costs as well.

Finally, the timelines are very different. A new home is often constructed on the builder’s timeline, which means the schedule takes into account the builder’s other work. A reconstruction of a damaged or destroyed home operates on a much shorter timeline.

The insurance company wants to get the owner back into the home as quickly as possible. The owner wants the same thing. This often means additional labor to speed up the process, and additional labor means additional cost.

3. Cost of Replacing Your Belongings

Homeowners insurance covers your belongings if they suffer theft or damage due to a covered event. Be aware that while natural disasters like hurricanes are usually covered, floods and earthquakes often aren’t. Get specific information from your insurer about how much home insurance you need for your personal property.

Standard Coverage and the Value of Your Property

Most insurers cover your belongings up to 50% to 75% of your property insurance limit. If you’re covered up to $200,000 for damage to your home, your belongings would be covered for $100,000 to $150,000, depending on your policy. It’s up to you to determine whether you need any more coverage given the value of your belongings.

To accurately assess that value, you need to do a home inventory. Having an inventory simplifies claim processing and can help you understand how much coverage you need.

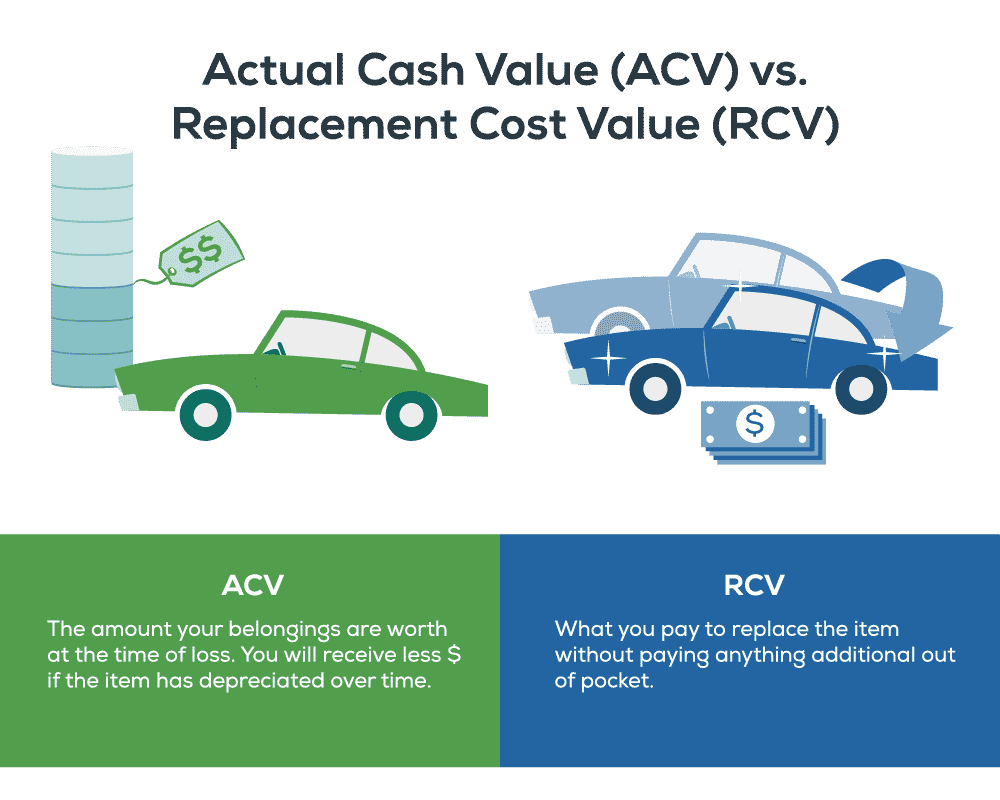

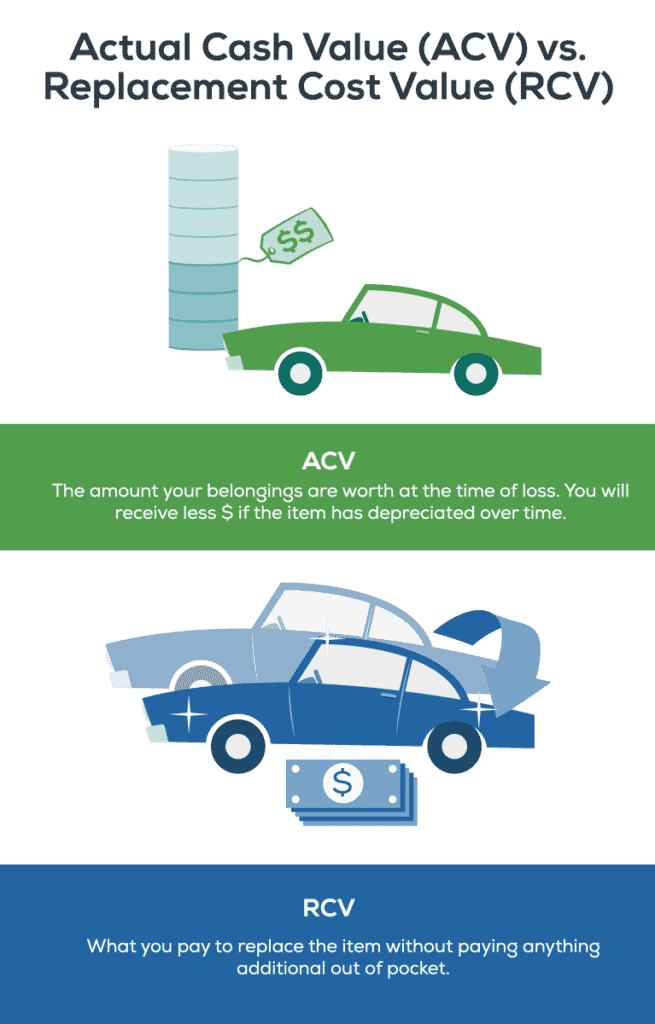

Replacement Cost vs. Actual Cash Value

As you create your list, think about whether you want insurance to cover replacement costs rather than the items’ actual cash value. Cash value is the amount your belongings are worth at the time of loss. Replacement cost is what you’d pay to replace those items without any deductions for loss of value. Replacement cost is typically about 10% higher but is a worthwhile investment if you have valuable items to protect.

For example, if you have a laptop that cost $1,500 to purchase three years ago, you’d receive significantly less in actual cash value because electronics depreciate over time. But with a replacement cost policy, you’d be able to use your insurance payout to replace the item without paying the difference out of pocket.

Certain items of value may also have specific coverage limitations. Standard homeowners policies limit protection for valuables like jewelry, fine art, precious metals, and fur. Jewelry theft is one common exclusion example. Check with your insurance provider to learn how much home insurance your valuables need or if these types of items would be on a separate policy, specifically listed or scheduled (which has it’s advantages).

4. Your Personal Circumstances

Beyond your physical property, several personal factors play a role in how much home insurance you need.

Liability: Covering You Against Damage to Others

Homeowner’s insurance includes liability coverage, which protects you in case someone suffers an accident on your property.

Your risk of a liability claim may be higher if you have certain hazards on your property, such as:

- Animals

- Pools

- Diving boards

- Lakefronts

- Trampolines

- Golf carts

- All-terrain vehicles

The more likely someone could get hurt on something you own, the higher your liability risk. Having sufficient liability limits for your unique situation is a must.

At Torian Insurance, people often ask us, “How much liability coverage do I need?”

It’s a tough question, even for the savviest insurance professional. You never know what might happen. That’s why our typical answer at Torian is, “As much as you can afford.”

How to Cover Your Business

If you run a company out of your home, your standard policy may not be enough. The typical homeowners’ policy will only cover your business equipment up to $2,500, which isn’t enough for most business owners.

You’ll also need to cover your business for liability and protect yourself against lost income.

- Business liability insurance: Protection against potential lawsuits or claims

- A homeowners’ policy endorsement: An addition to your standard coverage for business equipment

- An in-home business policy: Broader protection for your business assets, sometimes including income coverage and coverage for employees

To find out if your business affects how much home insurance you need, talk to an insurance professional.

5. Your Credit Score and Credit History

In most states, with a few exceptions, insurers can use something called an ” insurance score” to help them evaluate your application. Your score can affect your rates, which impacts how much home insurance you can afford.

Like the credit score that determines your mortgage rate, an insurance score uses your borrowing and repayment history to assess your responsibility as a consumer. But credit scores and credit-based insurance scores have different goals.

Your standard credit score predicts whether you’re likely to be at least 90 days late on a payment within two years. An insurance score predicts your likelihood of filing a damage claim. FICO® and Lexis-Nexis® Risk Solutions both have insurance scoring models that companies can use.

These models use many of the same data points as standard credit scores, including:

- Your history of on-time payments

- Missed or late payments

- Accounts in collections

- Balance amounts relative to credit limits

- How often you apply for new credit

Insurance scores also incorporate your auto and homeowners claims history over the past seven years. Unlike credit scores, insurance scores aren’t available to consumers. However, you can access your claims report once a year through the Lexis-Nexis consumer portal.

You can also keep track of your credit history. Maintaining good “credit hygiene” is the best way to help your insurance score. That means:

- Pay all your bills on time

- Create a strategy to pay down your debt

- Keep balances well below your limits

- Don’t apply for multiple loans or credit cards at once

Keep an eye on your credit by checking your reports once a year on AnnualCreditReport.com. If you spot an error, check the credit bureau to have them fix it before it affects your rates.

6. Cost of Liability Claims Filed Against You

The liability portion of a standard homeowners insurance policy covers you against lawsuits for property damage or bodily injury. This includes damage that you, a family member, or a pet may cause others on your property. The coverage includes court costs and damages awarded to the person who files.

Without enough coverage, you could pay out of pocket or find your assets seized to cover lawsuit costs. A minimum of $300,000 in liability insurance is fairly standard, mainly because the cost for coverage above $100,000 is just a few dollars.

If you have items on your property like a pool or trampoline that increase your risk of a liability claim, your agent might recommend a higher minimum. Inflation is hitting medical costs and jury awards along with everything else right now. Agents are promoting high limits of $500,000 or more to keep policyholders protected.

If your standard policy doesn’t cover you enough to protect your assets, consider excess liability coverage or umbrella insurance. An umbrella policy activates when you reach your standard policy limit and offers coverage for additional claim types, including libel and slander.

The Importance of Knowing How Much Home Insurance You Need

Ultimately, the best way to work out how much home insurance you need is to speak with a professional — someone who can assess your individual circumstances and offer expert advice.

A good insurance broker can help you find a policy that provides the right coverage level for your needs. Get in touch today and make sure you’re protecting the things you love.