There are several different types of insurance, especially when it comes to insurance that protects your property. You’re likely familiar with common options like homeowners and renters insurance, but you may not have heard of dwelling insurance.

So, when the topic of dwelling coverage comes up, there are several questions you’ll probably want to ask, including whether or not you need it and, if you do, how much coverage you need to be fully protected.

Here’s an overview of this type of insurance coverage that should answer all your questions.

What is Dwelling Coverage, and Does Everyone Need It?

Dwelling coverage is part of your overall homeowners’ insurance policy. As its name suggests, this insurance is designed to protect you from significant expenses if something happens to your home or dwelling.

For example, if a hurricane, tornado, or other natural disaster causes damage or completely destroys your home, dwelling coverage kicks in to help cover the cost of damages. However, knowing what’s covered and what’s not is important, so you’re not left out in the cold if something happens.

The question of whether or not you need dwelling insurance depends on whether or not you own the home where you live. If you’re a homeowner, this is essential coverage to have. If you don’t own the home, there are dwelling policies (that also include dwelling coverage). In most cases these are sold to people who own the home but do not live in it. Rental properties are the most common type of home covered on a dwelling policy.

In this article, we are focusing on dwelling coverage that is included in your overall homeowner’s policy.

What Does Dwelling Coverage Cover?

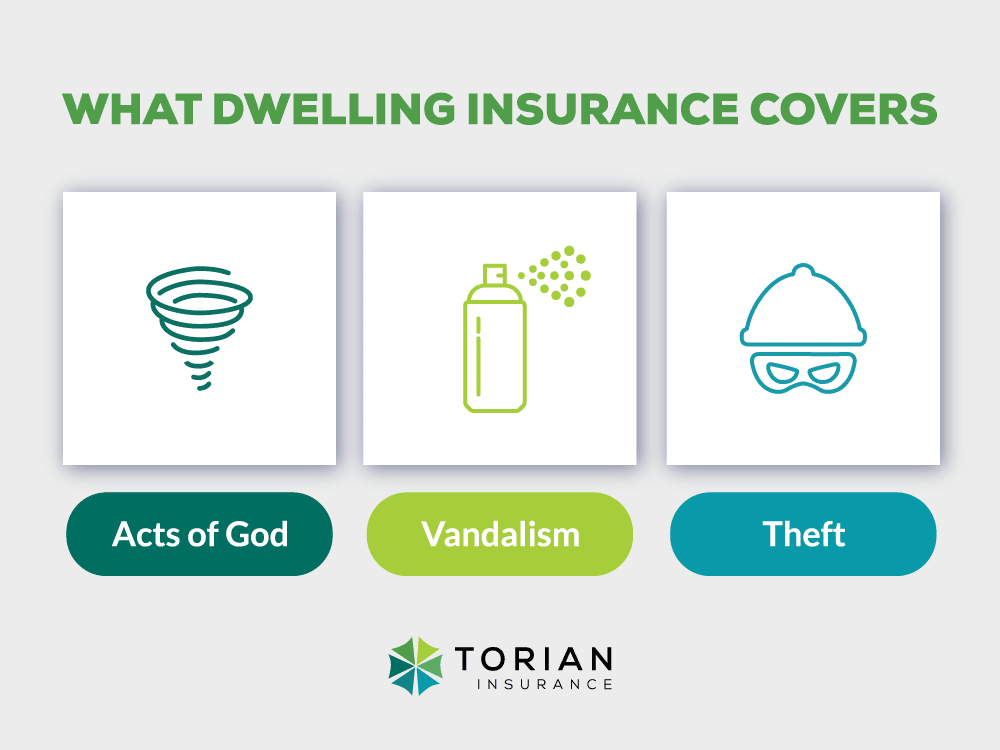

As mentioned above, dwelling insurance is designed to cover the cost of repairs if your dwelling is damaged or destroyed in various events. Those events typically include:

- Acts of God. Hurricanes, fires, tornados, and other acts of God can significantly damage your home. Dwelling coverage takes care of the cost of that damage.

- Vandalism. If someone vandalizes your home, you’re covered. For example, if a kid throws a rock through a costly window or someone spray paints a mural on your wall, your insurance company will pick up the bill.

- Theft. Although nobody can steal a dwelling, thieves can steal essential parts that are permanently attached to your home. For example, air conditioning units, well pumps, and other permanently attached features are likely protected in the case of theft.

Aside from events, dwelling insurance is pretty specific on the items of value it covers. Those include:

- Your Home. Your home’s structure is covered in the event of damage; this includes all pieces of the structure from the foundation to the roof.

- Permanently Attached Fixtures & Appliances. Permanently attached fixtures and appliances like light fixtures, ceiling fans, HVAC systems, and well & septic systems are also covered. Moreover, if you have a fence attached to your home, chances are it’s covered too.

What Does Dwelling Coverage Not Cover?

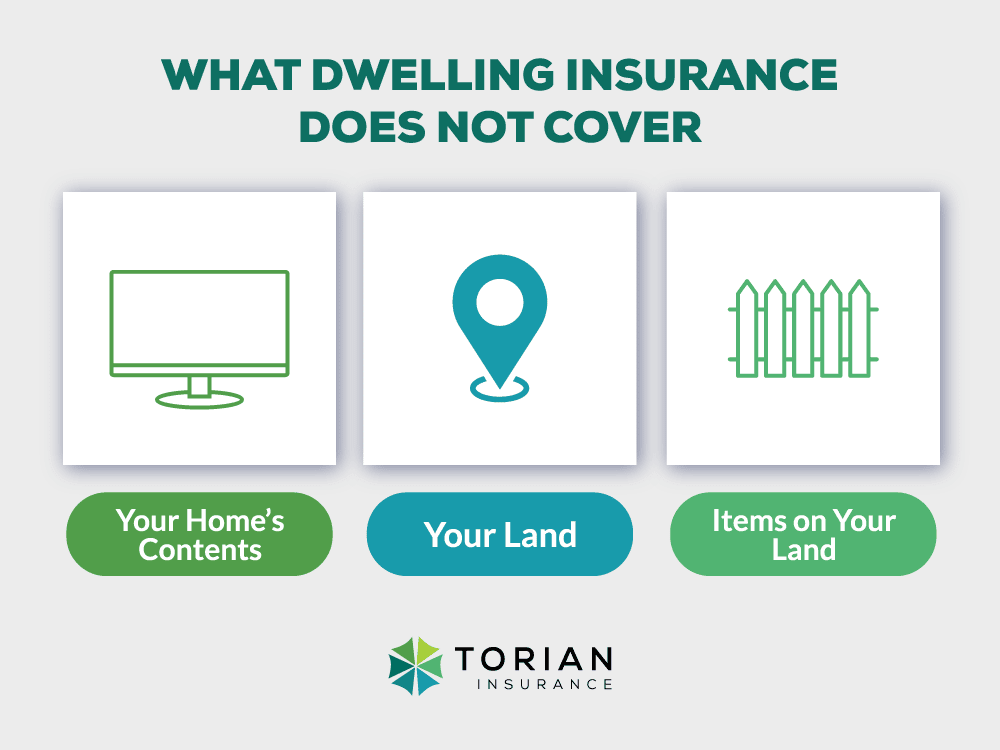

Dwelling insurance often covers the most expensive parts of your home when damage happens, but it doesn’t cover everything. The following items aren’t typically included in dwelling coverage:

- Your Home’s Contents. Although your home is covered under dwelling insurance, its contents aren’t. That means your televisions and other electronics, clothing, collectibles, and any other item confined within the walls of your home that’s not permanently attached isn’t part of this coverage.

- Your Land. Dwelling insurance doesn’t extend to the land your home sits on. So, if a storm takes a tree down on your property, it isn’t going to pay for the cost of debris removal.

- Items on Your Land. Dwelling insurance also doesn’t cover items on your land. For example, your car and boat aren’t covered in the event of damage. Moreover, your fence may not be covered if it wraps around your entire house rather than being permanently attached to your walls for back or front yard privacy.

Although these are limitations of dwelling coverage, it’s important to remember that this coverage is only one part of your overall homeowners’ insurance policy, so most items that aren’t covered by your dwelling coverage are part of other types of coverage in your overall policy.

How Much Does Dwelling Coverage Cost?

The cost of dwelling coverage for your home may vary wildly from the cost of coverage for someone else’s. That’s because each dwelling is unique, and insurance companies take multiple factors into account when they determine the price you pay.

Nonetheless, there are averages we can quote here.

In the United States, the average cost of dwelling insurance for a $300,000 home is about $1,900 per year. However, your cost may be significantly higher or lower depending on the unique aspects of your home and you as an insurance customer.

How Do Insurance Companies Calculate Dwelling Insurance?

Insurance companies calculate the price of any policy based on the risk writing that policy poses to the insurance company. When risk increases, so too does the price. Adversely, when there’s less risk, the price is lower.

There are several factors insurance companies use to determine the risk writing your policy poses to the company, but the most important include:

- Reconstruction Cost. In a worst-case scenario, your insurance company may have to pay the overall price for reconstruction of your home. The more expensive your home would cost to rebuild, the higher your premiums will be.

- Your Location. Some areas are more prone to natural disasters, vandalism, or theft than others. If you live in an area that poses a higher risk of these events, you can expect to pay more for dwelling coverage.

- You. You also play a major role in the pricing of your dwelling coverage. Insurance companies take factors like your age, credit score, and how long you’ve maintained coverage on your home into account when they write new insurance policies.

Do I Need Dwelling Coverage if I Rent?

The simple answer is no, but that’s not the whole story. Dwelling insurance covers the cost of repairing the dwelling you own, but if you don’t have one, there’s no point in paying an average of close to $2,000 per year to cover it.

That doesn’t mean you don’t need insurance.

If you’re a renter, you must get a renters’ insurance policy. Without one, if a natural disaster, an act of vandalism, or an act of theft happens that results in financial damages to you, you’re left with the burden of those damages on your shoulders.

Renters’ insurance policies are relatively inexpensive, averaging around $180 per year or $15 per month. So, you can have insurance coverage for an entire month for a little more than you pay for a value meal at Mcdonald’s.

Although the price is minimal, you might be surprised to learn how much this type of policy covers. Your property is covered if an event occurs, but that’s not the point. Your insurance company will also cover the cost of a temporary relocation if a covered event damages the structure where you live to the point where it becomes unlivable.

The Bottom Line

Dwelling insurance is important, but it’s only one piece of a quality overall homeowners insurance policy. Of course, if this is your first time shopping for homeowner’s insurance, you may find it challenging to navigate the complexities of your options, but you don’t have to go at it alone. Torian Insurance has been serving members of your community since 1923 and is happy to do the same for you. Contact Torian Insurance today to learn more about your home insurance options.