Protecting your home with the right insurance is essential, yet many homeowners never unlock the full value of their policies. They often miss out on significant cost savings and tailored coverage simply because the options feel overwhelming. This guide is designed to change that. We will provide a clear path to optimizing your insurance, starting with the fundamentals of your policy and moving through powerful strategies for regular reviews, strategic savings, and enhanced long-term protection. By the end, you’ll have the confidence to ensure your biggest asset is protected effectively and affordably.

Decoding Your Policy: Coverage, Deductibles, and Exclusions

Your homeowners insurance policy is a detailed contract designed to protect your home, belongings, and finances from unexpected events. To truly maximize its value, you must first understand its core components.

The Core Areas of Protection

A standard policy is built around four main areas of protection:

- Dwelling: This covers the physical structure of your home, including its walls, roof, and any attached fixtures like a deck or garage. It’s crucial to ensure your policy reflects the current cost to completely rebuild your house, not just its market value.

- Personal Property: This protects the items inside your home, such as furniture, electronics, and clothing. For high-value items like jewelry, fine art, or collectibles, their value may exceed standard limits. In these cases, consider adding special endorsements or riders to your policy for adequate coverage.

- Liability: This protects you financially if someone is injured on your property or if you or a family member cause damage to someone else’s property. It covers legal expenses and any awarded damages, up to your policy limit.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to a fire, severe storm, or another covered event, ALE covers the temporary costs of living elsewhere, such as hotel bills and restaurant meals.

Understanding Policy Exclusions

While knowing what is covered is the first step, it is equally important to know what your policy does not cover. Standard policies typically exclude damage caused by floods, earthquakes, mold, or pest infestations. If you live in an area prone to these risks, you will need to purchase separate, specialized coverage to be fully protected. Always ask your agent to explain any technical terms or limits so that you fully understand the scope of your coverage. For more details on homeowners insurance regulations, consult your state’s guidelines, such as the Indiana Department of Insurance, the Illinois Department of Insurance, or the Kentucky Department of Insurance.

How Deductibles Impact Your Costs

A critical part of how your policy functions is the deductible—the amount you must pay out of pocket for a covered loss before your insurance coverage begins to pay. Your deductible directly impacts both your premium costs and your financial responsibility in a claim. Here’s the trade-off:

- Higher Deductibles: Choosing a higher deductible often results in lower annual premiums. By agreeing to take on a larger portion of the initial cost of a claim, you reduce the insurer’s risk, and they pass those savings on to you.

- Lower Deductibles: A lower deductible means you will pay less out of pocket when you file a claim, but this convenience generally comes with higher premium payments.

When selecting a deductible, carefully consider your personal savings and your tolerance for financial risk. A good rule of thumb is to choose the highest deductible you can comfortably afford to pay on short notice. Always ask your agent to explain any technical terms or limits so that you fully understand the scope of your coverage and can adjust it to meet your needs.

The Keystone Habit: Keeping Your Policy Current with Regular Reviews

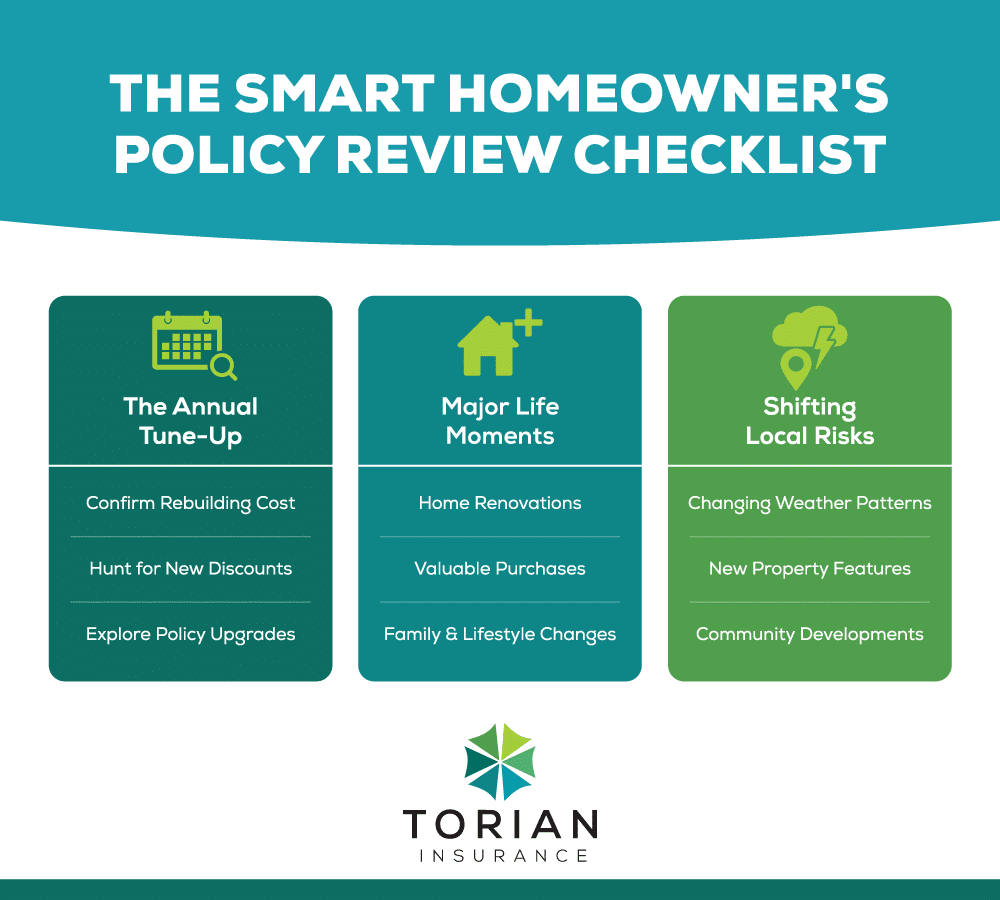

Your insurance needs are not static; they change as your life evolves. A policy that was perfect five years ago might leave you dangerously underinsured today. Treat your policy like a living document by conducting regular reviews. When to schedule a policy review:

Annually

Set a yearly reminder to connect with your agent. During this review, discuss:

- Your home’s current rebuilding cost to ensure your dwelling coverage is adequate.

- New discounts your insurer may be offering.

- Any new policy features or endorsements that could add protection.

After Major Life or Property Changes

Don’t wait for your annual review if a significant event occurs. Contact your agent immediately if you:

- Complete a renovation or addition: Increasing your home’s value requires an increase in coverage.

- Acquire high-value items: New jewelry, art, or electronics may need a special endorsement.

- Start a home-based business: Standard policies often have limited coverage for business-related liability or property.

- Experience a family change: A new baby, a child leaving for college, or a change in marital status can affect your needs.

When Local Risks Change

Proactively assess your home’s specific risks:

- Local Weather & Environment: Are wildfires, hurricanes, or flooding becoming more common in your area? Discuss specialized coverage like flood insurance.

- Property Features: Did you add a swimming pool, trampoline, or extensive landscaping? These can increase liability risks and may require adjustments to your policy.

Strategic Savings: How to Lower Your Insurance Premiums

Excellent homeowners insurance doesn’t have to break the bank. While comprehensive coverage is essential, savvy homeowners can leverage several strategies to significantly lower their premiums without compromising on protection. By being proactive and discussing your options with an agent, you can uncover substantial savings. Here are two of the most effective ways to manage your costs.

Strategy 1: Unlock Multi-Policy Discounts by Bundling

One of the simplest ways to save is by bundling, or combining different insurance policies under a single provider. If you already hold an auto, life, or other insurance policy, housing it with the same company that provides your homeowners insurance can lead to significant multi-policy discounts. The benefits go beyond just cost savings:

- Reduced Overall Premiums: Insurers reward loyalty, and the most common reward is a notable discount on each policy you bundle.

- Simplified Policy Management: You’ll have one point of contact, one bill, and one renewal date to track, making your administrative tasks much easier.

- Easier Claims Processing: In a major event that affects both your home and car (like a severe storm), having one provider can streamline the claims process considerably.

While bundling is often a great financial move, there are times when standalone policies from different carriers may better suit your unique needs. Discuss your full insurance portfolio with a trusted independent agent to determine the best cost-saving strategy without sacrificing the quality of your coverage.

Strategy 2: Maximize Every Available Discount

In addition to bundling, insurers offer a wide array of discounts for proactive homeowners who reduce risk. Make sure you’re taking advantage of every opportunity you qualify for. Consider these common discount categories:

- Home Safety and Security: Installing monitored security systems, smoke detectors, deadbolt locks, and water leak sensors demonstrates that you are actively protecting your property, which can lower your premium.

- Home Maintenance and Fortification: Making your home more resilient can also lead to savings. Upgrading your roof with impact-resistant materials or installing storm-proof windows can sometimes qualify you for additional discounts.

- Your Personal Profile: Insurers often reward responsible clients. Maintaining a claims-free record can make you eligible for loyalty or safe-homeowner discounts. Furthermore, some insurers offer discounts for new homeowners, retirees, or those in specific professions.

The key is to have regular conversations with your agent about any new discounts you might be eligible for. Always document any safety or structural improvements you make to your home, as these small changes can lead to significant savings over time.

Essential Preparation: Protecting Your Assets

Maintaining a clear, organized inventory of your belongings is vital in case you need to file a claim. Follow these simple steps to keep your records up to date:

- Walk through your home room by room and list key items along with their approximate value.

- Use photographs or videos to document the condition of your belongings.

- Keep receipts, appraisals, or other proof of purchase for high-value items.

By keeping your records current, you can simplify the claims process and ensure you receive fair compensation when needed.

Beyond the Basics: Enhancing Your Long-Term Protection

Once your foundational coverage is in place, you can enhance your financial security with these advanced strategies. These forward-thinking steps offer greater peace of mind by strengthening your defenses against major risks and leveraging modern tools to your advantage.

Add a Crucial Safety Net with an Umbrella Policy

A major lawsuit can easily exhaust the liability limits on your standard homeowners policy, putting your personal assets at risk. For an extra layer of defense, a personal umbrella policy is an invaluable enhancement.

- What it does: It provides at least $1 million in additional liability coverage that kicks in after the limits on your homeowners or auto policies have been reached.

- Why it’s smart: For a relatively low annual premium, an umbrella policy acts as a crucial safety net, protecting your home, savings, and future earnings from being jeopardized by a large claim.

Leverage Technology and Future Planning

Stay ahead of risks by using modern tools and planning for what’s next.

- Embrace Digital Tools: Use your insurer’s mobile app to review policy details, manage your home inventory, and file claims instantly. Additionally, smart home devices that provide real-time alerts for hazards like water leaks or intruders can help you mitigate risks before they become major problems.

- Plan for the Unexpected: Set aside an emergency fund specifically for your insurance deductible so you aren’t caught off-guard financially. It’s also wise to monitor market trends, like rising local construction costs, which may signal that you need to increase your dwelling coverage to avoid being underinsured.

This proactive approach ensures your protection strategy evolves along with your life and the world around you.

Finding the Right Partner: Why an Independent Agent Matters

Independent insurance agencies work with multiple carriers to find the best policy for your unique needs. The advantages include:

- Local Expertise: Agents understand regional risks and can customize your coverage accordingly.

- Personalized Service: Relationships with independent agents mean you receive dedicated attention and flexible advice.

- Wider Choices: With access to several insurers, independent agents help you compare options and find the best rates.

For example, Torian Insurance has been serving homeowners in Evansville, Southern Indiana, Illinois, and Kentucky for over a century. Their local insight and personalized approach ensure that your insurance is both comprehensive and cost-effective.

Making the Most of Your Homeowners Insurance

Optimizing your homeowners insurance is one of the most important steps you can take to safeguard your investment. By being proactive and informed, you can ensure your policy perfectly aligns with your life and budget.

While these tips provide a powerful roadmap, the easiest path to confidence is working with an expert who can navigate the details for you. The independent agents at Torian Insurance are dedicated to providing that personalized, local expertise.

If you’re a homeowner in Southern Indiana, Illinois, or Kentucky, let’s build the right plan together. Contact our dedicated Torian Insurance team today for a friendly, no-obligation consultation and put our experience to work for you.