An annual insurance policy review is a critical yet often overlooked element of effective financial and risk management. Life moves fast—whether it’s personal milestones like buying a home or starting a family, or business changes such as growth or entering new markets. Without regular check-ins, your insurance policies may no longer align with your evolving needs, leaving you with gaps in protection or paying for unnecessary coverage.

Taking the time to assess your policies ensures they reflect your present lifestyle, goals, and responsibilities. By identifying areas where coverage is insufficient, redundant, or outdated, you gain confidence knowing your personal and business assets are adequately safeguarded. This guide will walk you through actionable steps to review and adjust policies, ensuring that your protection keeps pace with every stage of life.

Why Annual Insurance Policy Reviews Are Essential

Regular insurance policy reviews maintain robust protection as your life or business evolves. While many invest significant time when first purchasing an insurance policy, it’s easy to overlook the importance of revisiting that policy later. Failing to adjust your coverage can lead to underinsurance or overinsurance, straining your financial resources and leaving you vulnerable to risks.

An annual review aligns your coverage with major life events—whether purchasing a new home, welcoming a child, or expanding a business. Adequate coverage becomes increasingly critical as these milestones and responsibilities grow, providing peace of mind and ensuring your assets, family, or business are protected against unexpected challenges.

What an Insurance Policy Review Involves

An insurance policy review evaluates your current insurance coverage to ensure it aligns with your present needs. Changes in personal life or business operations can create coverage gaps or render certain policies obsolete. A thorough review assesses whether your coverage limits, deductibles, endorsements, and policy terms remain adequate or need adjustments to better protect your assets and finances.

Significant changes such as purchasing a new home, expanding operations, or updating inventory signal the need to reassess your policies. Additionally, evolving risks, regulatory updates (for instance, consult the Indiana Department of Insurance if you reside in Indiana), or new insurance products might also necessitate a review. Gathering all relevant documentation, including policy declarations, renewal notices, and records of major changes, ensures a productive evaluation.

Step-by-Step Checklist for Personal Insurance Policy Review

Reviewing your personal insurance policies ensures they align with your current lifestyle, financial goals, and responsibilities. Significant changes—like purchasing a home, welcoming a new family member, or acquiring valuable items—impact the type and level of coverage you need. This checklist guides you through assessing, updating, and optimizing your personal insurance policies.

Evaluate Major Life Changes

Reflect on key milestones or events over the past year:

- Marriage, divorce, or changes in household size

- Purchasing or selling a home, condo, or rental property

- Adding new vehicles, motorcycles, or watercraft

- Undertaking significant home renovations

- Changes in family needs due to dependents or financial responsibilities

Review Key Personal Insurance Policies

The most common personal insurance policies that need an annual review are:

Home Insurance

In assessing your home insurance, it’s critical to ensure that your coverage matches the full replacement cost of your home, especially if you’ve undertaken any significant renovations or expansions. Additionally, it’s advisable to update your policy to reflect any changes in your home’s market value, ensuring your insurance coverage remains adequate. For those who have recently purchased a home, it’s important to verify that your policy complies with local guidelines, protecting your investment effectively.

Car Insurance

It is crucial to verify that your liability limits are adequate for your current financial situation and driving habits. Adjusting these limits ensures you are well-protected against potential liabilities in the event of an accident. Additionally, it is important to reassess and adjust your collision and comprehensive coverage based on your vehicle’s age and condition. By ensuring that these aspects of your car insurance are up-to-date, you can align your coverage with the vehicle’s depreciation, maintaining financial prudence and effective protection.

Life Insurance

When considering life insurance, it’s important to ensure that your beneficiary designations are up-to-date, especially after significant life changes such as marriage, divorce, the birth of a child, or the passing of a loved one. Updating your beneficiaries ensures that your life insurance benefits are directed according to your current wishes and circumstances. Additionally, take the time to evaluate whether your current life insurance coverage is adequate for meeting your financial obligations and responsibilities. This may involve assessing changes in debt levels, income, or the needs of dependents, to determine if adjustments to your coverage are necessary to provide sufficient financial protection for your loved ones.

Renters or Landlord Insurance

Whether you are a tenant or a property owner, having the right insurance coverage is crucial to safeguarding your interests.

For renters, it is essential to ensure that your insurance policy covers your personal belongings and provides protection against liability risks. This means verifying that your possessions are insured against theft, damage, or loss and that you are covered in the event that someone is injured on the property and holds you responsible.

On the other hand, if you are a landlord, it is important to confirm that your insurance policy offers comprehensive protection against property damage, tenant-related risks, and possible loss of rental income. Such coverage should include protection from natural disasters, vandalism, and unforeseen circumstances that could affect your property’s condition or your ability to generate rental income.

Health and Disability Insurance

It’s crucial to periodically reassess your health and disability insurance to ensure they align with your current circumstances and provide the protection you need.

Health insurance should be reviewed particularly after major life changes, such as switching jobs or experiencing new health developments, to confirm that your medical needs and those of your family are sufficiently covered. This may involve comparing different plans, evaluating network providers, or adjusting your coverage to better suit your healthcare preferences and financial situation.

Meanwhile, disability insurance is essential for providing income protection in the event of an illness or injury that prevents you from working. Ensure that your disability insurance policy offers an adequate income replacement to support your living expenses and financial responsibilities during such times.

Specialty Insurance

When it comes to specialty insurance, it’s important to regularly review your coverage to make sure it adequately protects your valuables, such as jewelry, fine art, or collectibles. These prized possessions often require specific coverage beyond standard homeowners or renters insurance because of their high value or unique nature.

In addition to insuring valuables, you should also explore niche insurance options that might cater to your individual lifestyle and needs. For example, personal cyber liability insurance can offer protection against data breaches and online security threats, safeguarding your digital presence. Similarly, if you have pets, look into pet insurance, which can help cover unforeseen veterinary expenses and ensure your furry family members receive the care they need.

Identify Potential Gaps, Overlaps, and Updates

After reviewing your policies, identify any gaps where coverage falls short and overlaps where you might be paying for redundant coverage. Streamlining your policies ensures you’re not overpaying while maintaining comprehensive protection.

Consult an Insurance Expert

Navigating insurance complexities can be overwhelming. Partnering with a knowledgeable local insurance expert can simplify the process. Experts help pinpoint gaps, optimize protections, and align policies with your unique circumstances.

Step-by-Step Guide for Reviewing Your Business Insurance Policies

Keeping your business insurance up to date is essential as your company grows and evolves. Whether you’ve expanded operations, introduced new products, hired additional employees, or changed your business model, ensure your coverage reflects these changes. This checklist guides you through reviewing and optimizing your business insurance policies.

Identify Changes in Your Business

Assess how your business has evolved over the past year:

- Launching new services or products introducing unique risks

- Expanding physical space or acquiring new properties

- Increasing employee count or creating new roles

- Investing in new equipment, vehicles, or technology

- Shifts in financials, such as higher revenue or increased assets

Review Key Types of Business Insurance

The most popular business insurance policies that need to reviewed are:

Commercial Property Insurance

Start with commercial property insurance, ensuring that it accurately reflects the current value of your business property, including any renovations or newly acquired assets, to prevent gaps in coverage. It’s also important to verify that all essential assets are covered.

Business Liability Insurance

Business liability insurance requires careful evaluation of liability limits to ensure they are sufficient to cover potential risks, such as lawsuits stemming from customer injuries or property damage. As your business diversifies its services or enters new markets, update your coverage accordingly.

Workers’ Compensation Insurance

In terms of workers’ compensation insurance, adjust policies to reflect changes in staff size or job roles, as these can affect your premiums. Ensure you remain compliant with state requirements and that you offer adequate coverage for any new hires.

Commercial Auto Insurance

For businesses with company vehicles, commercial auto insurance policies should align with the current number and types of vehicles in operation. Keep in mind any changes in vehicle usage, such as expanded routes or new drivers, to maintain proper coverage.

Cyber Liability Insurance

With the rising importance of cybersecurity, review your cyber liability insurance to ensure it protects against your current data storage, processing, or sharing practices. As remote work and new software tools become more prevalent, assess whether additional protection is necessary.

Commercial Umbrella Insurance

Commercial umbrella insurance provides additional liability coverage that extends beyond the limits of your existing policies. Confirm that it is sufficient, especially after significant business growth or market expansion.

Management and Professional Liability Insurance

Management and professional liability insurance should include Directors and Officers (D&O) coverage to mitigate emerging risks. If your services expose you to claims from clients or stakeholders, consider adding or enhancing professional liability coverage. With expanded leadership roles or organizational changes, it is prudent to review your management liability insurance.

Group Benefits Insurance

Review group benefits insurance like health, vision, and dental plans to ensure competitiveness and alignment with employee expectations. Explore scalable benefits packages for workforce growth.

Tips for Conducting a Successful and Comprehensive Insurance Policy Review

A well-organized insurance policy review ensures your coverage evolves with your life or business needs. Follow these actionable tips to uncover gaps, eliminate redundancies, and optimize your protection.

Gather All Relevant Documents

Compile all insurance-related documents, including current policies, renewal notices, and proof of recent claims or significant purchases. This comprehensive overview facilitates a thorough review.

Create a List of Significant Changes

Outline major life events or business milestones from the past year, such as getting married, renovating your home, or hiring new employees. Focus on areas requiring immediate attention to keep your coverage relevant.

Explore Umbrella Coverage

Consider adding an umbrella insurance policy for enhanced liability protection if you own significant assets. It provides an extra layer of coverage above standard policies, offering peace of mind for unexpected, high-cost claims.

Ask Questions and Consult an Expert

Reach out to a trusted insurance professional to clarify coverage details, identify gaps, and highlight opportunities for improvement. Experts ensure informed decisions based on your unique needs.

Evaluate Opportunities to Bundle Policies

Bundling related policies can lead to discounts and simplified management. For example, combining home, auto, and life coverage may reduce costs without sacrificing quality.

Review Deductibles and Coverage Limits

Adjust deductibles and coverage limits to reflect your current financial situation. Balancing these elements optimizes premiums and ensures adequate protection.

Stay Proactive with Regular Reviews

Schedule annual reviews or more frequent ones after significant changes. Proactive reviews prevent gaps in coverage and unexpected premium increases, keeping your protection up to date.

The Role of Independent Insurance Agents in Policy Review

Navigating the complexities of insurance is daunting, especially when managing multiple personal and business policies. Independent insurance agents excel at providing tailored solutions that fit your unique needs, budget, and circumstances.

Personalized Coverage

Independent agents work with a wide array of insurers, offering unbiased recommendations to find the best coverage options. They analyze various plans to identify policies that balance protection and affordability, ensuring comprehensive coverage tailored to your specific requirements.

Local Expertise

Independent agents understand regional challenges and risks. This local insight allows them to advise you based on community-specific needs, enhancing the relevance and effectiveness of your coverage.

Comprehensive Support

Independent agencies like Torian Insurance provide customer-first values and long-term relationships. They can guide you through policy reviews, research coverage options, and deliver custom insurance solutions that reflect your needs and local community nuances.

Advocacy and Optimization

Independent agents act as dedicated advocates, simplifying policy reviews, identifying coverage gaps, and making proactive recommendations. They also help you take advantage of opportunities like bundling policies or upgrading coverage as your life or business evolves.

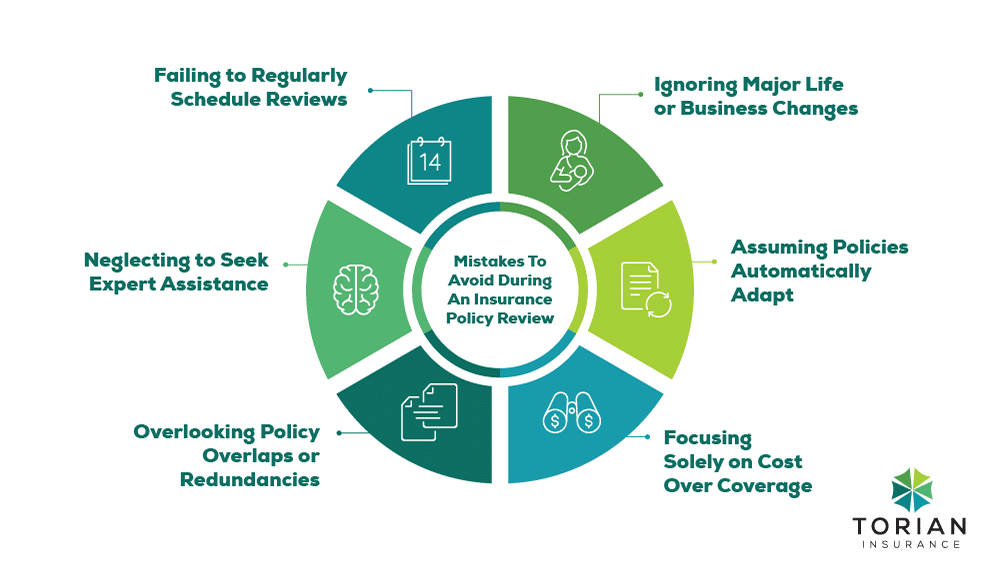

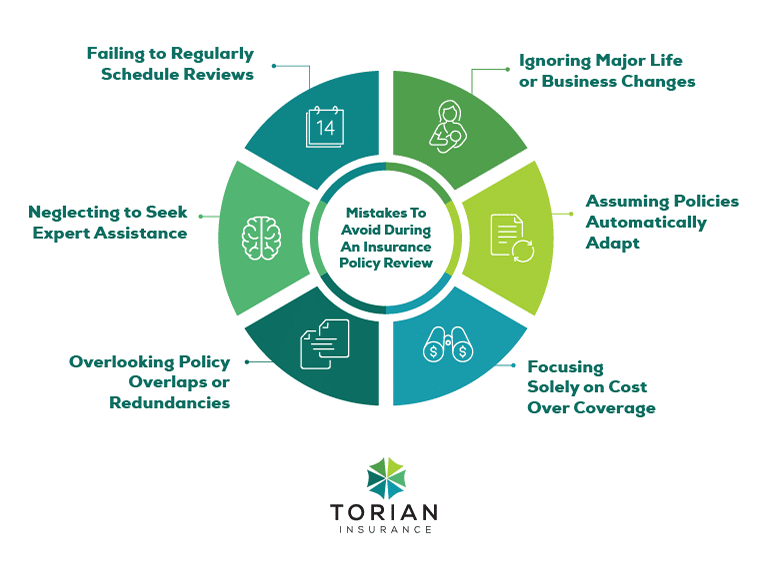

Avoiding Common Mistakes in Insurance Policy Reviews

Even with the best intentions, certain missteps during an insurance policy review can undermine your efforts to maintain optimal coverage. Avoid these common mistakes to ensure your review is effective and thorough:

- Ignoring Major Life or Business Changes: Failing to adjust policies after significant personal or business milestones can leave critical gaps and expose you to unnecessary risks.

- Assuming Policies Automatically Adapt: Insurance policies don’t evolve with your needs automatically. Proactively managing your policies ensures they stay aligned with your current situation.

- Focusing Solely on Cost Over Coverage: Prioritizing cost above coverage can leave you underinsured. Balance affordability with comprehensive coverage tailored to your needs.

- Overlooking Policy Overlaps or Redundancies: Multiple policies may provide overlapping coverage, leading to inflated premiums without added value. Streamline policies to maintain necessary protection efficiently.

- Neglecting to Seek Expert Assistance: Policy reviews can be complex. Consulting an insurance professional provides clarity, identifies gaps, and ensures informed decisions.

- Failing to Regularly Schedule Reviews: An annual habit or conducting reviews after major changes keeps your coverage current and minimizes financial risks.

By avoiding these mistakes, you maximize the benefits of your insurance policy review, strengthening your protection and ensuring you’re prepared for life’s unexpected turns.

When to Schedule Your Annual Insurance Policy Review

Timing your insurance policy review appropriately ensures your coverage stays relevant and effective. While many wait until renewal dates, certain life events or business milestones may call for a more proactive review schedule.

Before Policy Renewal

Contact your insurance agent 30 to 60 days before your policy’s renewal date. This proactive approach allows time to evaluate coverage thoroughly, make adjustments, and explore new options without the pressure of impending deadlines.

Following Major Life Changes

Significant life events—such as purchasing a new home, getting married, or welcoming a child—often warrant changes to your coverage. These milestones impact everything from home and auto insurance to life and health coverage, ensuring your policies reflect new responsibilities and financial goals.

After Significant Business Changes

For business owners, growth or operational changes should trigger an immediate policy review. Hiring new employees, launching new products, or expanding into additional locations introduce exposures that require updated or additional coverage.

During Periods of Economic or Environmental Change

External factors like inflation, rising property values, or regional risks can prompt policy reviews. For example, increased construction costs may necessitate higher limits for property insurance, or heightened cybersecurity threats may require expanded cyber liability.

Begin Your Annual Review

Conducting an annual insurance policy review is essential in safeguarding your personal and business assets. By meticulously evaluating your coverage, you can identify gaps, eliminate redundancies, and adjust protections to reflect life’s changes or business growth. Whether it’s a growing family, a newly purchased home, or an expanding operation, staying proactive ensures preparedness for both expected milestones and unforeseen challenges.

A comprehensive review of both Personal and Commercial Insurance policies protects your financial well-being and provides peace of mind. It maintains coverage that is relevant, cost-effective, and tailored to your evolving needs. Rather than risking outdated or insufficient policies, take the effort now to secure your future.

For expert guidance and a truly customized approach, consider partnering with an independent insurance agent. If you’re ready to take the next step, schedule your free annual policy review with Torian Insurance today. Let our experienced team help you protect what matters most—your family, your business, and your peace of mind.

Watch the informative video below to learn more about the importance of reviewing your insurance policy at least once a year: