Insurance and risk management are the two essential pillars of financial security. Insurance serves as your safety net, protecting you from unexpected losses—from accidents to health emergencies—by making catastrophic costs manageable. But true security also requires a proactive strategy.

Risk management is that strategy: the process of identifying, assessing, and mitigating potential threats before they happen. This guide breaks down the insurance basics and risk management strategies that empower individuals, families, and business owners alike, helping you face uncertainties with a confident and well-prepared plan.

The Fundamentals of How Insurance Works

Insurance operates on the principle of shared risk. By paying a regular premium, you contribute to a collective pool that covers the costs when losses are incurred. Understanding the key terms can clarify how this system benefits you:

- Policy: A legal contract that details your coverage, limits, and exclusions.

- Premium: The periodic fee you pay to keep your insurance active.

- Deductible: The amount you pay out-of-pocket before the insurance company covers the rest.

- Coverage: The specific risks and losses that your policy protects against.

Premium amounts depend on several factors, including your risk profile, history of claims, asset values, and sometimes credit scores. Simple actions like bundling policies, maintaining a good record, or opting for a higher deductible can help control premiums while ensuring robust protection.

How Insurance and Risk Management Work Together

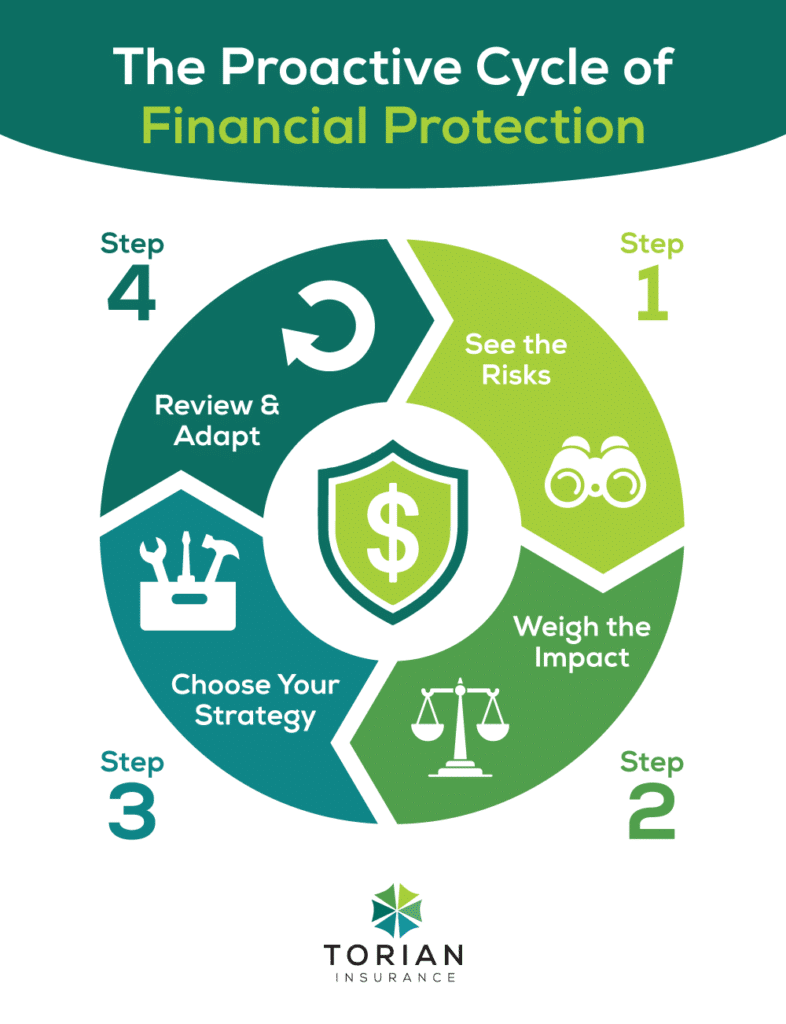

Risk management is the strategic process you use to protect yourself from financial harm, while insurance is one of the most powerful tools to execute that strategy. The process of risk management provides the “why” and “how,” while insurance provides the “what if.” This systematic approach generally follows four key steps:

- Identify Risks: The first step is to recognize all potential threats and vulnerabilities you face, from property damage and legal liability to health emergencies and cyber threats.

- Analyze Risks: Once identified, you determine the likelihood of each event occurring and assess its potential financial impact. A minor inconvenience is treated differently than a potential catastrophe.

- Develop Mitigation Strategies: Based on your analysis, you decide how to handle each risk. This is where you choose to avoid, reduce, accept, or transfer the risk.

- Control and Monitor: Finally, you apply your preventative measures and continuously review your strategies to ensure they remain effective as circumstances change.

Insurance plays its most critical role in Step 3 as the primary method for risk transfer. Instead of accepting the full financial burden of a catastrophic event yourself, you transfer the majority of that risk to an insurance company. In exchange for a predictable premium, the insurer agrees to cover the unpredictable and potentially devastating costs of a covered loss.

By transferring risk, insurance achieves several essential goals within your management plan:

- It protects your valuable assets by providing the funds to repair or replace them after an incident.

- It enhances financial stability by transforming a potentially bankrupting expense into a manageable, budgeted premium.

- It accelerates recovery by providing immediate financial support, reducing downtime for a business or disruption for a family.

Furthermore, your insurance policies become a key part of the “Control and Monitor” step. Regularly reviewing your coverage ensures your risk transfer strategy adapts to new assets, changing liabilities, and an evolving risk landscape.

In short, while proactive risk management helps you prevent and minimize threats, insurance ensures you can recover completely when the unexpected happens.

Key Types of Insurance for Individuals and Families

Choosing the right insurance policies is crucial for safeguarding your home, health, and assets. Below are some essential coverages with unique benefits for personal and family security:

Homeowners and Renters Insurance

- Homeowners insurance protects your property and personal belongings from risks such as fire, theft, and natural disasters. It also often includes personal liability coverage.

- Renters insurance safeguards your personal items and offers liability protection, especially important when your landlord’s policy does not cover your possessions.

Auto Insurance

Auto insurance is not just a legal requirement—it also provides vital protection on the road. Key components include:

- Liability Coverage: Protects against damages and injuries you may cause.

- Collision Coverage: Covers repair costs after an accident.

- Comprehensive Coverage: Protects against non-collision incidents like theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Ensures you’re covered even if the other driver lacks sufficient insurance.

For example, understanding your options is easier when you review the auto insurance coverage details that best meet your driving needs.

Health, Vision, and Dental Insurance

These policies reduce the financial burden of healthcare. Health insurance helps manage unforeseen medical expenses, while vision insurance and dental plans ensure that routine and preventive care remains affordable.

Life and Disability Insurance

- Life insurance secures your family’s future by providing financial support to cover expenses such as funeral costs and debts in the event of your passing.

- Disability insurance offers income protection if you become unable to work due to illness or injury, keeping your finances intact during tough times.

Pet Insurance and Specialty Coverage

- Pet insurance covers veterinary expenses, offering greater peace of mind.

- Specialty coverage includes policies such as personal cyber insurance, valuable items insurance, and even kidnap and ransom insurance, ensuring that unique risks are appropriately managed.

Key Types of Insurance for Businesses

Businesses encounter a variety of risks that can disrupt daily operations and incur significant expenses. The right insurance choices can safeguard your business continuity:

Commercial Property and General Liability Insurance

- Commercial property insurance protects physical assets—buildings, equipment, and inventory—from losses due to fire, theft, or natural disasters.

- General liability insurance covers legal claims for bodily injury or property damage, including advertising and personal injury claims.

Commercial Auto and Umbrella Insurance

- Commercial auto insurance covers vehicles used for business, offering protection against collisions, damages, and liability claims.

- Commercial umbrella insurance provides extra liability coverage that supplements primary policies, defending against large or unexpected claims.

Workers’ Compensation and Contractor Insurance

- Workers’ compensation insurance is often required by law and supports injured employees with medical expenses and lost wages.

- Contractor insurance is designed for trades professionals, covering liabilities, tools, and worksite risks.

Cyber and Professional Liability Insurance

- Cyber liability insurance defends against the financial fallout from data breaches and cyberattacks, including regulatory fines.

- Professional liability insurance protects service providers from claims of negligence and errors in their professional services.

Business Interruption and Management Liability Insurance

- Business interruption insurance compensates for lost income and expenses when unexpected events severely disrupt operations.

- Management liability insurance covers claims against directors and officers related to financial mismanagement or compliance failures.

The Independent Agent Advantage: Getting a Truly Custom Solution

Every individual, family, and business faces a unique set of risks. A generic, one-size-fits-all insurance policy can leave you dangerously exposed with coverage gaps or, conversely, force you to pay for protections you don’t need.

A truly effective financial strategy requires a custom solution—one that offers comprehensive protection, cost efficiency, and the adaptability to evolve with your changing circumstances. This level of tailored coverage provides the ultimate peace of mind, knowing your risks are well-managed.

Achieving this is the specialty of an independent insurance agent. Unlike captive agents who represent a single company and its products, an independent agent works for you. They leverage their industry expertise and access to multiple providers to build a policy that is precisely aligned with your financial goals. The benefits of this approach are significant:

- Access to a Wider Market: Independent agents can compare various rates and coverage options from numerous insurers, ensuring you find the best possible fit for both your budget and your needs.

- Personalized, Unbiased Advice: They invest the time to understand your specific situation, offering tailored recommendations. With deep insights into regional risks and regulations, they can craft a plan that addresses your unique challenges.

- A Partner for the Long Haul: The relationship doesn’t end at the sale. Your agent provides comprehensive support, from the initial policy selection to ongoing reviews and, most importantly, advocacy and assistance during the claims process.

This client-focused guidance ensures you aren’t just buying a product but are building a strategic defense that protects what matters most.

Common Misconceptions about Insurance and Risk Management

Many people mistakenly view insurance as an unnecessary expense rather than a crucial investment in financial security. Common myths include:

- Premiums are always unaffordable, even though the cost of an unexpected loss could be far greater.

- Risk management is only for large companies, when in reality, every individual faces risks—from minor accidents to serious health issues.

Dispelling these misconceptions is essential. A balanced approach that combines preventive measures with the right insurance policies can protect your financial future, regardless of your size or industry.

Emerging Trends in Insurance and Future Outlook

As technology transforms the insurance industry, staying updated can help you make informed decisions. Some key trends include:

- The use of artificial intelligence and data analytics to better assess risk and customize coverage.

- Personalization of auto insurance through telematics, which tailors policies to individual driving habits.

- Advances in digital platforms that simplify claim processing and policy management.

- Increased focus on cyber risk management as digital threats evolve.

By understanding these trends, you can adapt your insurance and risk management strategies to meet future challenges effectively.

Additional Considerations for Holistic Financial Planning

In addition to standard insurance policies and risk management practices, integrating comprehensive financial planning is crucial. A well-rounded approach that includes investment strategies, emergency savings, and retirement planning works together with insurance to secure long-term financial stability. This holistic strategy not only protects against unexpected losses but also optimizes financial growth and provides peace of mind during unpredictable market changes.

Proactive Financial Protection: The Way Forward

Insurance and risk management are fundamental components of a strong financial plan. By understanding how insurance works, recognizing the types of policies available, and actively managing risks, you can protect your financial future from unexpected setbacks.

Partnering with an independent agency like Torian Insurance offers the benefit of personalized, locally informed advice that adapts to your unique needs. Their expertise ensures that you receive the right coverage now and in the future.

Take a proactive step toward secure financial protection. Contact Torian Insurance for a personalized consultation and discover a tailored insurance strategy designed with your future in mind.