Insurance isn’t just another expense—it’s a critical investment that shields your business from unexpected liabilities, property damage, and operational disruptions. When exploring small business insurance, understanding what drives insurance costs is essential for selecting coverage that meets your needs without overstretching your budget. Important pricing factors include your business type, location, claims history, and the coverage levels you choose. With a solid grasp of these elements, you can quickly secure personalized protection that brings lasting peace of mind.

Partnering with independent insurance agents means you gain expert insights into your business’s risks. They assess your unique situation and design a plan that strikes the perfect balance between comprehensive protection and affordability.

Why Customized Solutions Matter

No two businesses are alike. Standard, one-size-fits-all policies can leave critical gaps in your coverage. Tailored insurance solutions ensure that whether you operate a retail store, tech startup, or construction firm, your policy addresses your specific challenges. For example, while a basic liability policy might protect against general risks, you may also need specialized cyber protection or a plan that includes commercial auto and workers’ compensation coverage.

At Torian Insurance—an insurance agency Evansville IN—we serve small businesses in Southern Indiana, Illinois, and Kentucky by delivering custom insurance solutions. Our efficient quote process is designed to match your precise requirements and budget, ensuring you get the protection you deserve.

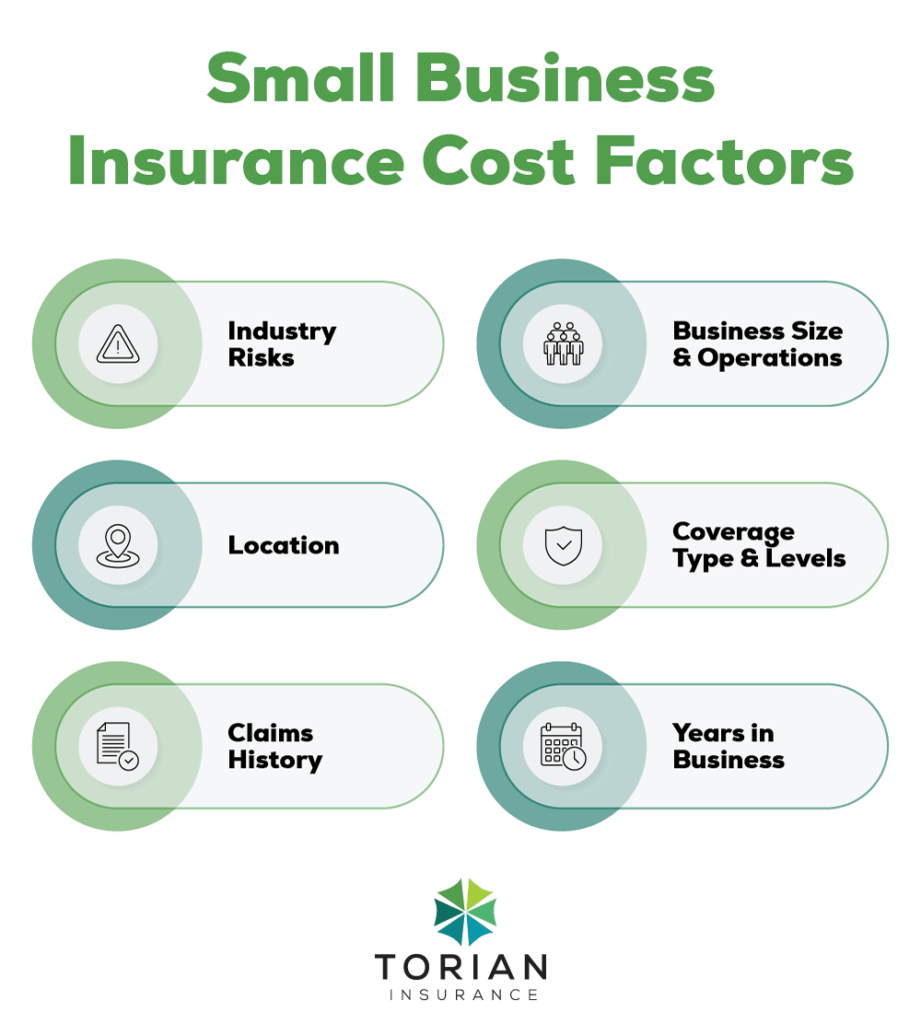

Factors That Impact Small Business Insurance Costs

Several elements significantly contribute to the overall cost of commercial insurance premiums. Understanding how these factors influence rates empowers you to make informed decisions and work towards obtaining the right coverage at a fair price.

- Industry-Specific Risks: The type of business you operate is a primary cost driver. Industries with a higher likelihood of facing specific types of claims will generally have higher premiums for relevant coverages. For instance, construction businesses face inherent risks of employee injury and property damage, leading to higher workers’ compensation and general liability costs. Conversely, a tech company might have lower physical risk but require more expensive cyber liability coverage due to the sensitive data they handle.

- Business Size and Operations: The scale of your business directly impacts your risk exposure. Factors like the number of employees and annual revenue play a critical role in determining your risk profile and significantly affect premiums. More employees generally mean a higher potential for workers’ compensation claims. Higher revenue can indicate increased business activity and potential exposure to liability claims. The complexity of your operations also matters; a business with extensive public interaction, like a retail store, might pay more for general liability than a home-based consultant.

- Location: Where your business is located influences costs due to various regional characteristics. Local weather patterns (like tornado risk in the Midwest), crime rates, and the cost of legal claims in your area can all affect rates. Furthermore, state-specific regulatory requirements, such as mandates for workers’ compensation or commercial auto insurance, directly impact which policies you must carry and their associated costs.

- Coverage Types and Levels: The specific types of insurance you choose and the amount of coverage you select are major determinants of cost. Opting for higher coverage limits (the maximum amount an insurer will pay for a claim) will increase your premium, but provides greater financial protection against large losses. Conversely, choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage begins) can lower your premium, but means you’ll pay more yourself in the event of a claim. Bundling policies, like with a Business Owner’s Policy (BOP), can also impact overall cost, often offering savings compared to purchasing individual policies separately.

- Claims History: A history of multiple past insurance claims signals a higher future risk to insurers, typically resulting in increased premiums upon renewal. Conversely, a clean claims history over several years may lead to more favorable rates.

- Years in Business: Insurers often view established businesses with a longer operating history as less risky, which can sometimes lead to lower premiums compared to brand-new startups.

Understanding these factors is crucial for navigating the world of commercial insurance and securing coverage that is both comprehensive and cost-effective for your small business.

Common Types of Coverage for Small Businesses

Small businesses face a myriad of risks, making it essential to have the right mix of coverages. Below are the main types of insurance typically needed:

- Business Owner’s Policy (BOP): This is a popular and often cost-effective option for many small to medium-sized businesses. A BOP bundles several key coverages, typically including General Liability Insurance, Commercial Property Insurance, and Business Interruption Insurance, into a single policy. This bundling usually results in a lower premium than purchasing each policy separately. BOPs are generally available to businesses in lower-risk industries with fewer than 100 employees and under a certain amount of annual revenue (often $1 million or $2 million). The average cost for a BOP can range from around $57 to $141 per month, though this varies significantly based on the factors mentioned previously.

- General Liability Insurance: Often considered foundational coverage, General Liability (GL) protects your business against claims of bodily injury or property damage sustained by third parties (like customers or visitors). If a customer slips and falls on a wet floor in your retail store, or an employee accidentally damages a client’s property, GL can help cover medical expenses, legal fees, and settlement costs. While generally not required by state law in all cases, many landlords and client contracts do require you to carry GL. The average cost for a basic GL policy for a small, low-risk business is often between $42 and $85 per month, but can be higher depending on risk factors.

- Workers’ Compensation Insurance: In almost all states, businesses with employees are legally required to carry Workers’ Compensation insurance. This coverage provides benefits such as medical care, rehabilitation, and a portion of lost wages if an employee is injured or becomes ill as a direct result of their job duties. It helps protect employees and can help prevent costly lawsuits against your business. The cost of Workers’ Comp varies significantly based on the industry (riskier jobs cost more) and is typically calculated per $100 of your payroll. Average costs can range widely, but is around $45 to $86 per employee per month, emphasizing that this is highly dependent on the specific jobs performed and payroll.

- Commercial Property Insurance: This protects your physical business assets – including owned or rented buildings, equipment, inventory, and furnishings – from losses due to events like fire, theft, vandalism, or certain natural disasters. Commercial property insurance helps ensure you can repair or replace damaged property and continue operations or recover quickly after an unexpected event. This coverage is often included in a BOP. The average cost varies greatly based on the value of the property and its location, but can range from approximately $67 to $250 per month for many small businesses.

- Business Interruption Insurance: Also known as Business Income insurance, this coverage helps replace lost income and cover ongoing operating expenses (like rent or payroll) if your business is forced to temporarily close due to a covered property loss (e.g., a fire or storm damage). It’s designed to help your business survive and recover during the period of disruption. This is typically included as part of a BOP or can be added as an endorsement to a Commercial Property policy.

Specialized Coverages

Some scenarios require additional or specialized policies:

- Cyber Liability: Protects against the financial fallout from data breaches or cyberattacks.

- Commercial Auto Insurance: Covers vehicles used for business operations, such as deliveries or client visits.

- Professional Liability Insurance (Errors & Omissions Insurance): This coverage is vital for businesses that provide professional services or advice (consultants, accountants, marketing agencies, etc.). It protects against claims of negligence, errors, or omissions in the professional services provided that cause a client financial harm.

Each coverage type is tailored to meet specific risks, creating a robust safety net for your business.

Evaluating Coverage Needs for Small Businesses

Every enterprise is unique, and your insurance needs will evolve as your business grows and changes. It’s critical to evaluate your insurance needs regularly to ensure your coverage remains appropriate and cost-effective.

- Assess Your Specific Risks: Think critically about the potential worst-case scenarios for your specific business operations, industry, and location. What types of accidents are most likely? What valuable assets could be damaged or stolen? Do you handle sensitive data? Understanding your unique risk profile is the first step to identifying necessary coverages and appropriate coverage limits.

- Review Coverage Limits: Ensure your policy limits (the maximum the insurer will pay per claim or per policy period) are adequate to cover potential losses, including potential legal defense costs and settlement amounts in a lawsuit. Underinsurance can leave you exposed to significant out-of-pocket expenses.

- Choose Deductibles Strategically: Consider your business’s financial capacity when selecting deductibles. A higher deductible will lower your premium, but you must be able to comfortably afford that amount out-of-pocket in the event of a claim.

- Understand Policy Details (Including Exclusions): Insurance policies contain exclusions – specific situations, perils, or types of damage that are not covered. Reviewing these with your agent is crucial to understand any potential gaps in coverage. Endorsements or riders can often be added to a policy to provide coverage for specific risks that might otherwise be excluded.

- Regularly Review Your Needs: As your business expands, hires more employees, moves to a new location, or offers new products/services, your risk profile changes. Conduct periodic reviews of your insurance coverage (at least annually, or after significant business changes) to ensure it still aligns with your current operations and risks. This also provides an opportunity to discuss potential cost-saving adjustments.

- Tailored Adjustments: Work with your agent to tailor deductibles, coverage limits, and consider relevant endorsements to align your coverage precisely with your business realities and budget, ensuring you’re not paying for unnecessary extras while maintaining essential protection.

By taking these steps, you’ll help keep your policy in tune with your evolving needs and safeguard your business effectively.

Benefits of Independent Insurance Agencies for Small Businesses

Working with an independent agency offers unique advantages:

- Tailored Solutions: With access to multiple carriers, independent agents design policies encompassing a variety of close-fitting options.

- Competitive Pricing: A broad network of providers helps secure the best rates without sacrificing coverage.

- Informed Guidance: Commissions can influence recommendations, but reputable agents strive to present a range of quotes based on real needs.

- Local Expertise: Knowing the region—especially in Southern Indiana, Illinois, and Kentucky—helps agents address specific local risks.

These benefits translate into better overall coverage for small businesses looking for long-term success.

How to Get Fast and Accurate Insurance Quotes

Securing fast insurance quotes is simpler with a bit of preparation. Here’s how:

- Gather Key Information: Collect details about your operations and location, such as employee count, annual revenue, and any specific risks.

- Consult with an Expert: An independent agent from Torian Insurance will guide you through billing, coverage comparisons, and policy customization.

- Review and Confirm: Carefully evaluate the quote to ensure it covers your potential risks completely and fills any coverage gaps.

By following these steps, you minimize delays and secure coverage that accurately aligns with your needs.

Strategies for Managing Insurance Costs Over Time

While insurance is a necessary investment, there are proactive strategies you can implement to help manage your insurance costs over the long term without compromising essential coverage.

- Implement a Formal Safety and Risk Management Program: Actively identifying and mitigating potential hazards can significantly reduce the likelihood of claims, which directly impacts your premiums. This includes implementing formal safety training for employees, establishing clear safety protocols, and regularly inspecting your premises for potential dangers.

- Invest in Approved Safety and Security Measures: Installing certified safety equipment, such as monitored fire alarm systems, security systems, sprinkler systems, and potentially water leak detection systems, can not only protect your business but may also qualify you for premium discounts from insurers.

- Maintain a Favorable Claims History: While claims happen, a track record of fewer or less severe claims demonstrates a lower risk profile to insurers, which can help keep your premiums lower over time. For very minor incidents, you might discuss with your agent whether filing a claim is the most cost-effective approach in the long run, considering the potential impact on future premiums.

- Increase Deductibles Strategically: As mentioned earlier, choosing a higher deductible can lower your premium. If your business has a strong cash reserve to comfortably cover a higher deductible in the event of a claim, this can be a viable cost-saving strategy.

- Bundle Your Policies: Where applicable, opting for a Business Owner’s Policy (BOP) instead of purchasing General Liability, Property, and Business Interruption coverage separately can often result in a lower overall premium.

- Regularly Review Coverage and Shop Around (with your Agent): Don’t let your policy automatically renew without review. Annually, discuss your coverage with your independent agent. Business changes might mean you’re eligible for new discounts, or your needs may have shifted. Your agent can also compare options from multiple carriers they work with to ensure you’re getting competitive rates for the coverage you need.

These strategies not only help manage costs but also foster a strong culture of safety.

Secure Your Tailored Quote

Securing comprehensive, cost-effective protection starts with understanding the factors that shape small business insurance costs. By choosing tailored coverage, you not only shield your venture from unforeseen challenges but also gain confidence in your company’s future. With Torian Insurance, getting the right policy is quick and straightforward.

Contact Torian Insurance now to secure your quote and transform uncertainty into the protection your business deserves.