Navigating the roof claim process doesn’t have to be overwhelming. Whether you’re filing a roof claim for the first time or evaluating insurance for roof damage, understanding each step can simplify the experience and protect your home.

When severe weather affects Southern Indiana, Illinois, or Kentucky, partnering with a reputable local insurance agency that offers tailored insurance solutions may help streamline your claim process and provide added support, although the actual efficiency and peace of mind achieved can vary based on the agency’s specific offerings and your unique situation.

Immediate Actions to Take After Roof Damage

Taking prompt action is vital to prevent further harm and support your roof damage insurance claim.

Inspect and Document the Damage

Quickly assess your roof for missing shingles, cracks, or signs of water intrusion. Safety is paramount; if you are uncomfortable with heights, notice significant damage, or your roof is steep or difficult to access, do not attempt to climb onto the roof yourself. Instead, perform a safe inspection from the ground using binoculars to look for visible issues like sagging areas or discoloration.

Use your phone or camera to take clear, time-stamped photos and videos from multiple angles. Capture wide shots of the entire roof and zoom in on specific problem areas, such as missing shingles, holes, or debris. Don’t forget to document any interior damage, like water stains or sagging ceilings, that may have resulted from the roof issue.

If you are unable or uncomfortable performing the inspection yourself, consider hiring a professional roofing contractor to conduct a thorough assessment and provide you with detailed documentation, including photos and a report. Their expertise can help identify hidden issues that might be missed at first glance and provide valuable evidence for your claim. This documentation helps substantiate the extent of the damage when you file with your insurer.

Make Temporary Repairs

Taking immediate action to prevent further damage is crucial after discovering roof issues. These temporary fixes, sometimes called “loss mitigation,” demonstrate to your insurance company that you are actively protecting your property, which is often a requirement of your policy.

Implement short-term fixes to prevent additional damage from wind, rain, or other elements while you await professional repairs. For example, cover exposed areas where shingles are missing or the roof is punctured with protective materials like tarps securely fastened down. Ensure you use appropriate safety measures if you are working at heights, or consider hiring a professional to perform these temporary repairs if you are uncomfortable or the damage is extensive.

It’s wise to take photos or videos of the damage before you make any temporary repairs, as well as document the temporary repairs themselves. Retain all receipts for any supplies purchased (like tarps, plywood, or fasteners) or for services rendered by a contractor for these emergency measures. These expenses are often reimbursable under your insurance policy, so keeping meticulous records is essential for your roof damage insurance claim.

While your policy likely encourages or requires temporary repairs to prevent further loss, it can be helpful to notify your insurance provider about the damage and your planned temporary fixes as soon as possible. This ensures they are aware of the situation and can confirm what temporary repair costs may be covered.

Notify Your Insurance Provider

Contacting your insurance provider immediately after discovering roof damage is a critical first step in the claims process. Many homeowners’ insurance policies require notification “promptly” or “as soon as practicable” after a loss occurs. Delayed reporting could potentially complicate or even jeopardize your claim, so don’t wait.

Most insurers offer several convenient ways to file a claim: by phone through their claims hotline, via their website portal, or through a mobile app. Choose the method you prefer.

When you contact them, be prepared to provide key information to help initiate your roof damage insurance claim quickly. This typically includes:

- Your policy number.

- Your contact information.

- The date and approximate time the damage occurred.

- A brief description of how the damage happened (e.g., severe thunderstorm, hail, wind).

- Details about the visible damage you’ve observed.

- Information about any temporary repairs you have already made to prevent further damage.

After you report the incident, you will typically receive a claim number. This number is your unique identifier for your claim and should be referenced in all future communications with the insurance company. They will also inform you of the next steps in the process, which usually involves assigning an insurance adjuster to evaluate the damage.

Keeping a record of when and how you reported the claim—including the date, time, the method used (phone, online), the name of the representative you spoke with (if by phone), and the claim number provided—is highly recommended for your documentation. Prompt notification not only helps you meet policy requirements but also gets the official claims process underway, allowing for a timely inspection and resolution.

Understanding Your Home Insurance Policy

Having a solid grasp of your home insurance coverage is crucial. Different types of coverage and terms can significantly affect your claim settlement, so take time to review key policy details carefully.

Replacement Cost Value (RCV) vs. Actual Cash Value (ACV)

- Replacement Cost Value (RCV): Covers the cost to repair or replace your roof at current market prices, minus your deductible. Depreciation is not factored into the payout.

- Actual Cash Value (ACV): Pays out based on the roof’s current depreciated value. While premiums might be lower, the settlement may be less if your roof is older.

Understanding which valuation method your policy uses is essential when filing a roof claim, as it affects the payout for repairs. A roof nearing the end of its life might yield a smaller payout under ACV, while RCV can offer more comprehensive coverage for newer installations.

What Types of Roof Damage Does Insurance Typically Cover?

Standard homeowners insurance policies are designed to cover sudden and accidental damage caused by specific events, often referred to as “perils.” When it comes to your roof, dwelling coverage typically protects against damage from forces outside your control.

Common covered perils that can cause roof damage include:

- Windstorms: Damage caused by high winds, including those from severe thunderstorms, tornadoes, or hurricanes, which can lift or tear off shingles, or cause structural damage.

- Hail: Damage from hailstones, which can cause dents, cracks, and weaken shingles, potentially leading to leaks over time. Hail damage is usually covered in standard policies, though some areas prone to severe hail might have special deductibles or coverage limitations.

- Falling Objects: Damage caused by trees, branches, or other objects falling onto the roof.

- Weight of Ice, Snow, or Sleet: Damage resulting from the excessive weight of accumulated ice, snow, or sleet, which can cause roofs to sag or collapse, or lead to ice dams causing water backup.

- Fire and Lightning: Damage caused directly by fire or a lightning strike.

- Vandalism: Damage intentionally caused by others.

It is equally important to understand what is generally not covered. Standard policies typically exclude damage resulting from:

- Wear and Tear: Gradual deterioration due to the roof’s age and exposure to the elements.

- Neglect or Lack of Maintenance: Damage that occurs because the homeowner failed to perform necessary upkeep, such as cleaning gutters or addressing minor issues promptly.

- Mold, Fungus, or Rot: Often excluded, especially if resulting from long-term leakage due to poor maintenance.

- Earthquakes and Flooding: These are typically excluded perils requiring separate insurance policies (like flood insurance).

- Pest Infestations: Damage caused by insects, rodents, or other animals.

- Faulty Workmanship or Materials: Issues arising from improper installation or defective roofing products, which might be covered by warranties instead.

- Cosmetic Damage: Some policies, particularly in hail-prone areas, may not cover damage that only affects the appearance of the roof but not its function or structural integrity.

Your specific policy documents detail the covered perils and exclusions. Always review your policy carefully or consult your insurance agent to understand the exact scope of your roof coverage.

Deductibles, Exclusions, and Filing Deadlines

- Deductibles: The amount you must pay out of pocket before insurance coverage kicks in. Compare the estimated repair costs with your deductible to determine whether filing a claim makes sense.

- Exclusions: As mentioned above, most policies exclude damage caused by general wear and tear or neglect. Confirm that the damage qualifies under your coverage.

- Filing Deadlines: Check both your policy and relevant state laws for time limits to file. Missing these deadlines can result in a denied claim. Keeping a personal filing calendar and tracking notifications from your insurer are useful practices.

Taking the time to understand these components clarifies your financial responsibilities and strengthens your position when negotiating settlement amounts with your insurance adjuster.

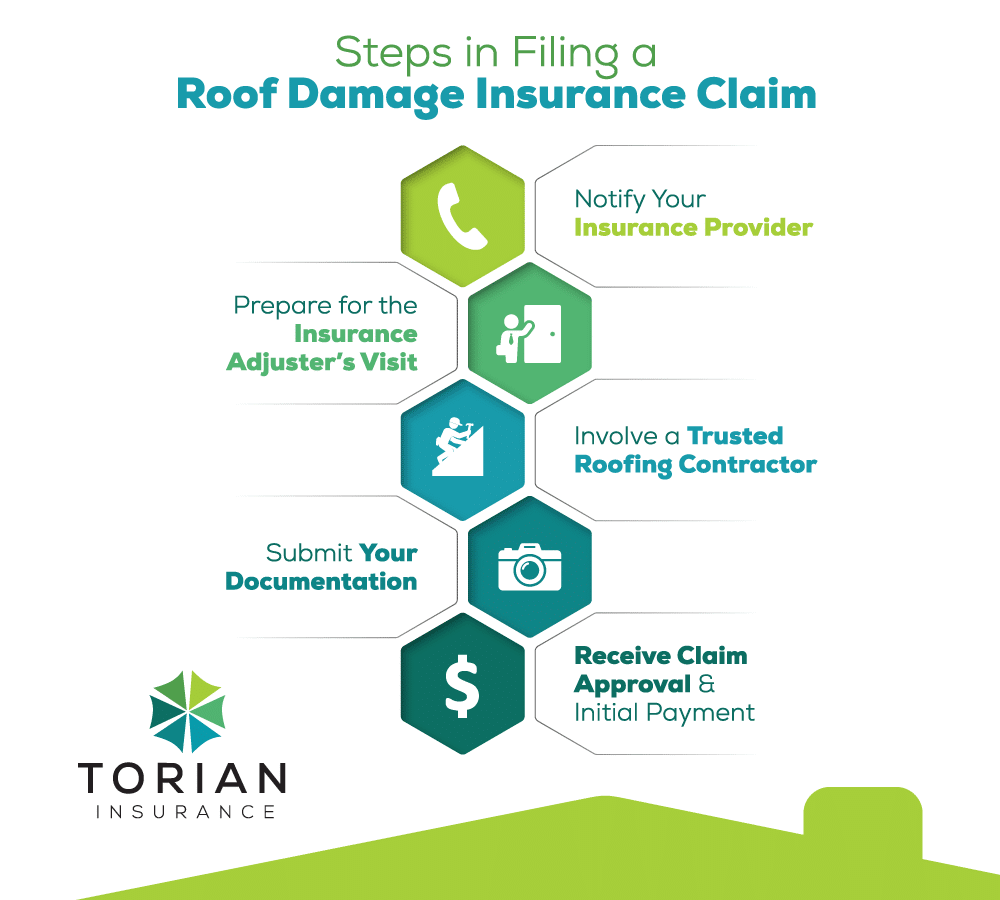

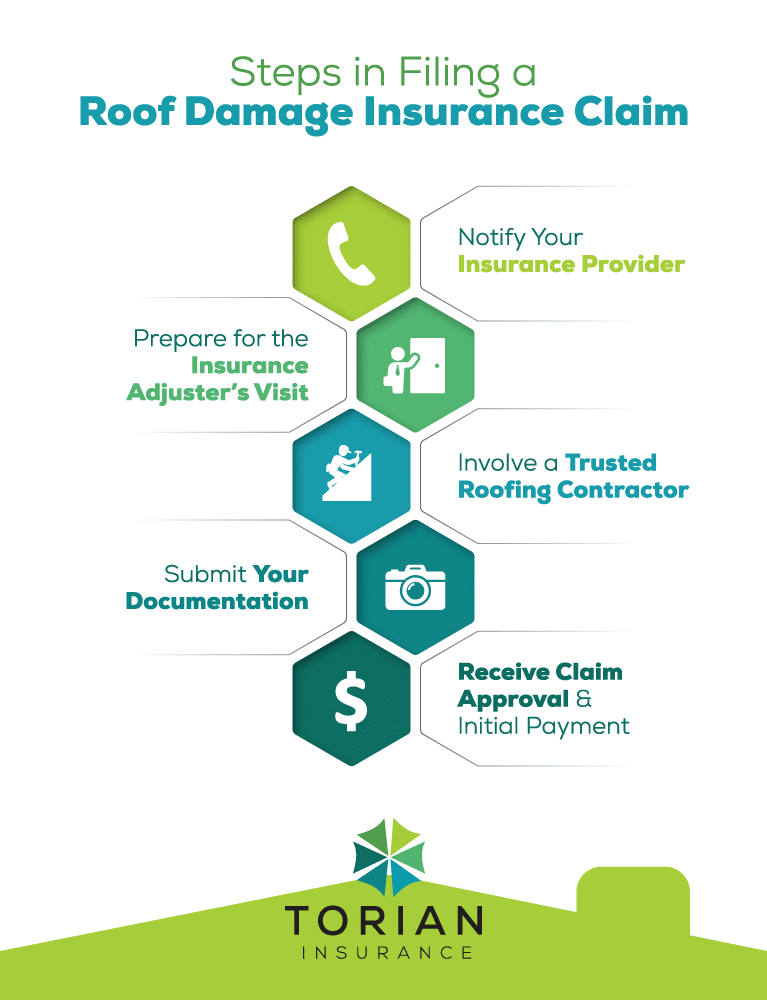

Steps in Filing a Roof Damage Insurance Claim

A structured approach can reduce stress and keep your roof claim process moving smoothly. Here’s a breakdown of the procedural steps and the rationale behind each stage.

1. Notify Your Insurance Provider

As mentioned before, this is one of the very first steps that needs to occur after you notice potential roof damage.

2. Prepare for the Insurance Adjuster’s Visit

Your insurer will assign an adjuster to assess the damage. Organize your photos, videos, and receipts. Being present during the adjuster’s inspection can help contextualize the damage and ensure nothing is overlooked.

3. Involve a Trusted Roofing Contractor

Hire a reputable roofing contractor experienced with insurance claims. Their independent estimate provides a second opinion, helping ensure repairs align with your coverage allowances. Look for a company that adheres to professional guidelines and has a solid reputation among customers to avoid potential discrepancies in repair estimates.

4. Submit Your Documentation

Compile and submit all evidence, contractor assessments, and receipts to your insurance provider. A clear, organized submission supports your claim and can help accelerate the review process. Utilizing digital organization tools can assist in managing your documentation efficiently.

5. Receive Claim Approval and Initial Payment

Once approved, you will typically receive an initial payout (minus your deductible). Schedule repairs promptly. If unexpected damage is later discovered during repairs, you might need to file a supplemental claim to cover additional costs. Although thorough early inspections can minimize surprises, staying prepared is advisable.

Handling Common Claim-Related Challenges

- Denied Claims or Low Settlement Offers: This is a frustrating situation, but it doesn’t have to be the final word. If your claim is denied or the initial settlement offer seems too low based on your contractor’s estimate, take action:

- Understand the Reason: First, ask your insurer for a clear, written explanation for the denial or the basis of their low offer.

- Request a Re-inspection: If you believe the adjuster missed damage or made an error in their assessment, formally request a re-inspection. Be prepared to point out the specific areas of concern and provide your contractor’s detailed estimate and report as supporting evidence.

- Provide Additional Documentation: Submit any further evidence you have, such as more detailed photos or videos, engineering reports (if applicable), or a second opinion from another reputable contractor.

- Cite Your Policy: If you understand your policy coverage (referencing the sections on covered perils and dwelling coverage), you can point to specific language that supports your claim.

- Escalate: If you cannot reach an agreement with the initial adjuster, ask to speak with their supervisor or file a formal appeal through the insurance company’s internal dispute resolution process.

- Consider Professional Help: For significant disputes, you may consider consulting with a public adjuster (who works for you, not the insurer, on a contingency fee basis) or an attorney specializing in insurance claims.

- Unforeseen Damage Discovered During Repairs: Sometimes, the full extent of roof damage, particularly to underlying structures, isn’t apparent until repairs begin. If your contractor discovers new, related damage:

- Stop Work (if necessary): Assess if continuing work could cause further issues or safety hazards.

- Document Immediately: Have your contractor take detailed photos and videos of the newly discovered damage before it is repaired.

- Notify Your Insurer: Contact your insurance adjuster or claims department immediately to report the unforeseen damage.

- File a Supplemental Claim: You will likely need to file a supplemental claim for the additional costs associated with repairing the newly discovered damage. Your contractor’s documentation and revised estimate will be crucial supporting evidence for this supplemental claim. Do not assume these additional costs will be automatically covered; you must inform the insurer and get approval.

- Understanding Depreciation Holdback (for RCV Policies): If you have a Replacement Cost Value (RCV) policy, your initial claim payout might be the Actual Cash Value (ACV), which is the replacement cost minus depreciation. The remaining amount (the depreciation holdback) is typically paid out after repairs are completed and the insurance company receives proof of the final repair costs. Ensure you understand this process and provide the necessary documentation (paid invoices) to recover the full RCV amount you are entitled to.

- Concerns Over Premium Increases: It’s natural to worry about your premium increasing after filing a claim. While one significant claim for a weather-related event typically doesn’t cause a drastic spike, multiple claims over a short period or claims for less severe issues could potentially impact your rates at renewal time.

- Understand Your Policy and State Rules: Premium increases are influenced by various factors, including your claims history, the cost of the damage, the type of claim, your location, and state insurance regulations.

- Weigh the Cost: For very minor damage that’s only slightly above your deductible, consider paying for repairs out-of-pocket rather than filing a claim, especially if you’ve had recent claims.

- Discuss with Your Agent: Talk to your insurance agent about how filing a claim might affect your specific policy and premium going forward.

- Delays in the Claim Process: Insurance claims can sometimes take time. If you experience significant delays, maintain consistent and documented communication. Follow up periodically, keep records of all interactions, and politely inquire about the status and expected timeline. If delays are unreasonable, refer back to any state regulations regarding claim handling periods and consider escalating through the insurer’s management or contacting your state’s department of insurance.

Maintenance Tips to Prevent Roof Damage

Regular maintenance can help prevent major repairs and support a stronger roof damage insurance claim in the future. Proactive measures not only save money but also serve as evidence of due diligence if a claim is necessary later.

- Gutter Cleaning: Keep gutters and downspouts clear to ensure proper drainage and prevent water buildup near shingles.

- Timely Repairs: Address minor issues such as cracked flashing or loose shingles promptly to prevent them from escalating.

- Trim Overhanging Branches: Remove or trim nearby branches that could potentially fall on your roof during a storm.

Conducting an annual or semiannual roof inspection—particularly after significant storms—can help catch potential issues before they worsen.

Long-Term Considerations for Your Insurance Profile

Repeated claims over time may influence your premiums and your insurer’s risk assessment. While it’s important to file claims for legitimate damage, consider balancing the cost of minor repairs with the possibility of future premium increases. Maintaining thorough documentation of roof inspections, repairs, and upgrades can demonstrate responsible homeownership and support your claims if needed.

If you’re considering a broader update to your overall insurance strategy, consult your agent about whether bundling different types of coverage—such as auto or life insurance—might yield better rates.

Your Next Steps After Roof Damage

Filing a roof damage insurance claim need not be an ordeal. By thoroughly documenting damage, understanding your policy details, and relying on reputable professionals, you can protect your home with confidence. A proactive approach—through regular maintenance and careful policy reviews—ensures you’re prepared for whatever severe weather may bring.

Need guidance with your claim or want to explore tailored insurance solutions? Contact your local insurance agency today for personalized support.