When it comes to protecting your home, understanding the nuances of your policy is essential. After all, your home insurance is not just a significant financial investment—it’s where memories are made and cherished. One crucial aspect of home insurance coverage that often confuses homeowners is the distinction between named perils and open perils coverage. Grasping the differences between these two can help you make informed decisions, ensuring your home is adequately protected against the unexpected.

In this comprehensive guide, we’ll delve into what perils are in the context of home insurance, explore the specifics of named and open perils policies, and provide insights to help you determine the best coverage for your unique needs.

Introduction to Home Insurance Perils

Perils are specific risks or events that can cause damage or loss to your home and personal property. Common examples include fire, theft, vandalism, and natural disasters like hail or windstorms. In the realm of home insurance, understanding what perils are covered—and under what circumstances—is fundamental to ensuring you have the right protection.

For many homeowners in Southern Indiana, Illinois, and Kentucky, knowing which home insurance perils are most likely to affect their region is crucial. Factors like regional weather patterns, crime rates, and proximity to risk-prone areas influence which perils you should be most concerned about. This awareness not only helps in selecting the appropriate coverage but also in taking specific safety steps to safeguard your home.

But here’s where it can get a bit complex: Not all home insurance policies cover the same perils, and the way they cover them can vary significantly. This brings us to the key distinction between named perils and open perils coverage.

What Are Named Perils?

A named perils home insurance policy provides coverage only for the perils explicitly listed in the policy document. If a peril isn’t named, it isn’t covered. This type of policy outlines specific events that the insurance company agrees to pay for if they result in damage or loss.

Common Named Perils

Typical named perils in a home insurance policy might include:

- Fire or Lightning: Damage caused by fire or lightning strikes.

- Windstorm or Hail: Damage from windstorms, hurricanes, or hail.

- Explosion: Damage due to explosions.

- Riot or Civil Commotion: Losses caused during riots or civil disturbances.

- Aircraft: Damage caused by aircraft.

- Vehicles: Damage caused by vehicles not owned by the resident.

- Smoke: Damage from smoke, especially sudden and accidental incidents.

- Vandalism or Malicious Mischief: Intentional damage to the property.

- Theft: Losses due to burglary or theft.

- Falling Objects: Damage from objects that fall from above.

- Weight of Ice, Snow, or Sleet: Damage from the weight of ice, snow, or sleet.

- Accidental Discharge or Overflow of Water or Steam: Typically from plumbing, heating, air conditioning, or household appliances.

- Sudden and Accidental Tearing Apart, Cracking, Burning, or Bulging: Usually related to hot water systems, air conditioning systems, or automatic fire protection systems.

- Freezing: Damage caused by the freezing of plumbing, heating, air conditioning systems, or household appliances.

- Sudden and Accidental Damage from Artificially Generated Electrical Current: Such as power surges.

These perils are standard in many basic home insurance policies, often referred to as HO-2 policies. However, it’s important to read your policy carefully because coverage can vary between insurers.

Coverage Limits and Specifics

With named perils coverage, the burden of proof in the event of a claim lies with you, the homeowner. You must demonstrate that the damage was caused by one of the perils listed in your policy. This can sometimes make the claims process more challenging, especially in situations where the cause of damage isn’t immediately clear.

For example, suppose your home’s foundation becomes damaged. Under a named perils home insurance policy, unless you can prove that the damage was directly caused by a covered peril—like accidental discharge of water from a plumbing system—it may not be covered.

Advantages of Named Perils Coverage

- Cost-Effective: Named perils policies are generally more affordable than their open perils counterparts because they cover fewer risks. This can be appealing for homeowners on a tight budget.

- Clarity: You’ll have a clear understanding of what is covered, which can simplify risk management and allow for targeted safety steps. Knowing the specific perils can help you focus on maintaining and safeguarding against those risks.

Potential Limitations

- Limited Protection: Any peril not specifically listed is excluded, potentially leaving gaps in your coverage. This could expose you to significant out-of-pocket expenses if an unlisted event causes damage.

- Claims Process: Proving that a covered peril caused the damage can sometimes be difficult, potentially delaying claim settlements. This can add stress during an already challenging time.

Understanding Open Perils Coverage in Home Insurance

An open perils policy, sometimes referred to as an “all risks” policy, offers broader protection. Instead of listing the perils that are covered, it lists the perils that are excluded. Essentially, if something happens to your home insurance that isn’t explicitly excluded, the damage is covered.

The Inclusivity of Open Perils

Open perils coverage is more comprehensive. It considers any direct damage to your home as a covered loss unless the policy specifically excludes it. This can include unusual or unforeseen events that wouldn’t be covered under a named perils policy.

For instance, if a squirrel chews through wiring in your attic causing a fire, an open perils home insurance policy would likely cover the damage unless animal damage is specifically excluded.

Examples of Generally Covered Risks

Under an open perils policy, you might be covered for:

- Accidental losses not specifically excluded

- Mysterious disappearance of personal property

- Damage due to unexpected events like a tree falling on your home during a storm

- Sudden structural collapses

- Water damage from accidental leaks

Advantages of Open Perils Coverage

- Comprehensive Protection: Offers a wider safety net against potential losses, providing peace of mind that you’re covered for most eventualities.

- Easier Claims Process: The insurance company must prove that the cause of damage is excluded under the policy, which can simplify and speed up claims. This shifts the burden of proof from you to the insurer.

Potential Exclusions

Despite its broad coverage, open perils policies do have exclusions. Common exclusions might include:

- Flood damage

- Earthquake damage

- War or nuclear hazards

- Intentional damage

- Wear and tear or maintenance issues

- Infestations (e.g., termites, rodents)

- Mold, fungus, or rot

- Governmental action

It’s important to review the exclusions in your home insurance policy carefully. In some cases, additional endorsements or separate policies can be purchased to cover excluded perils like floods or earthquakes. For instance, in areas prone to flooding, such as low-lying regions near the Ohio River, purchasing a separate flood insurance policy might be prudent.

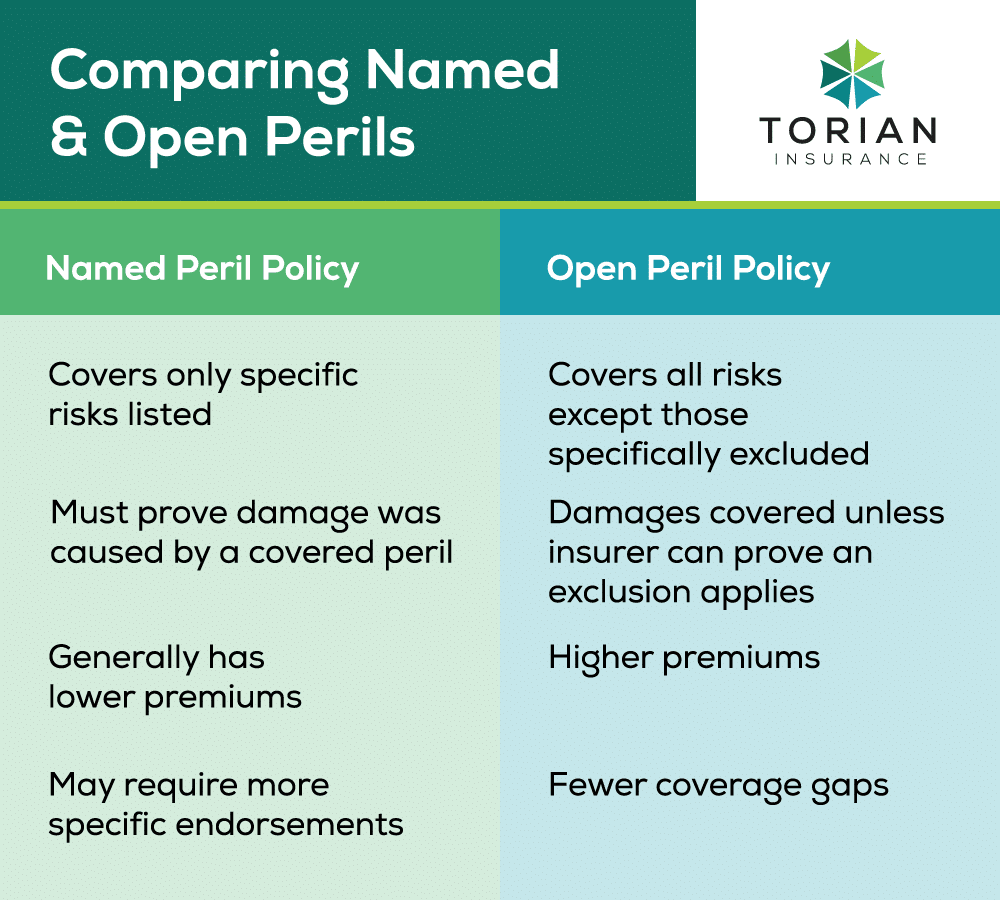

Comparing Named and Open Perils

Understanding the key differences between named and open perils is essential in choosing the right home insurance coverage.

Coverage Scope

- Named Perils: Covers only the specific risks listed in the policy. If it’s not named, it’s not covered.

- Open Perils: Covers all risks except those specifically excluded. This broad coverage accounts for a wide range of potential losses.

Claims Process

- Named Perils: You must prove that a covered peril caused the damage. This can require detailed documentation and sometimes expert assessments.

- Open Perils: The insurer must prove that an exclusion applies. This often streamlines the claims process for the homeowner.

Cost Implications

- Named Perils: Generally lower premiums due to limited coverage. This makes it an attractive option for budget-conscious homeowners.

- Open Perils: Higher premiums reflecting the broader protection offered. The increased cost can be outweighed by the enhanced peace of mind and potential savings in the event of a loss.

Flexibility and Security

- Named Perils: May require additional endorsements to cover specific risks, which can add to the cost and complexity of the policy.

- Open Perils: Provides greater peace of mind with fewer coverage gaps. The comprehensive nature of the coverage can be particularly beneficial for homeowners with valuable properties or those in areas with varied risks.

Real-World Scenarios

Scenario 1: Damage from Unknown Causes

Imagine you return home and find significant water damage in your living room, but the source isn’t immediately apparent. Under a named perils home insurance policy, you would need to prove that the damage was caused by a covered peril—say, accidental discharge of water from a plumbing system. If the cause can’t be identified or isn’t covered, you may have to bear the costs yourself.

With an open perils home insurance policy, unless the damage is due to an excluded cause (like poor maintenance), the insurer is more likely to cover it, easing your financial burden.

Scenario 2: Uncommon Events

Suppose a rare event, like a meteorite fragment damaging your roof, occurs. A named perils policy probably wouldn’t cover this since “meteorite impact” isn’t a listed peril. An open perils policy, however, would typically cover such an unusual event unless specifically excluded.

Factors Influencing Coverage Choice

Selecting between named and open perils depends on various personal and external factors.

Assessing Personal and Geographic Risks

- Regional Weather Patterns: Southern Indiana, Illinois, and Kentucky can experience severe storms, tornadoes, and heavy snowfall. Open perils home insurance coverage might better protect against these unpredictable weather events.

- Crime Rates: If your area has higher rates of theft or vandalism, ensuring these perils are covered is essential.

- Proximity to Risk-Prone Areas: Homes near rivers prone to flooding or regions with seismic activity should consider coverage for those specific risks, which may require endorsements or separate policies.

Value and Vulnerability of Property

- Home Value: Higher-value homes may require more comprehensive coverage to fully protect your investment. The cost to rebuild or repair might be substantial, making open perils coverage more appropriate.

- Personal Belongings: Valuable items like jewelry, antiques, or high-end electronics might not be fully covered under standard policies. An open perils policy, possibly with scheduled personal property endorsements, can offer better protection.

Lifestyle Considerations

- Home-Based Businesses: Operating a business from home introduces additional risks. Standard policies often exclude business-related equipment and liabilities. Specialized coverage can ensure your livelihood is protected.

- Extended Vacancies: If you travel frequently or own a second home that’s vacant for long periods, certain perils become more likely, and some policies may have restrictions or exclusions you need to address.

Reviewing and Updating Coverage

Life changes—like renovations, the addition of safety features, or acquiring high-value items—are all reasons to reassess your insurance needs. Regularly reviewing your home insurance policy ensures it continues to meet your protection requirements.

According to industry studies, 88% of homeowners in the United States have an active home insurance policy, yet many are underinsured due to outdated coverage that doesn’t reflect current circumstances.

How to Evaluate and Select the Right Policy

Choosing the right home insurance policy involves careful evaluation and expert guidance.

Consult with Insurance Professionals

Engaging with experienced insurance agents provides valuable insights tailored to your situation. They can help you understand policy details, exclusions, and endorsements that might be beneficial.

An independent agent can access multiple insurance carriers, offering a range of options. They can help you compare policies like HO-3 (a hybrid policy with named perils on personal property and open perils on the dwelling) and HO-5 (an open perils policy on both dwelling and personal property), ensuring you find the best fit.

Evaluate Your Specific Needs

- Create an Inventory: Document your belongings to understand the level of personal property coverage needed. This can also expedite claims if needed.

- Assess Home Features: Consider the materials, age, and unique features of your home that might affect risk. For example, older homes may have higher risks of certain types of damage.

Balance Cost and Coverage

- Premium Considerations: Weigh the cost difference between named and open perils policies against the potential benefits. Sometimes, the added peace of mind is worth the extra expense.

- Deductibles and Limits: Understand how deductibles affect premiums and claim payouts. A higher deductible can lower premiums but means higher out-of-pocket costs when making a claim.

Leverage Independent Insurance Agents

Independent agents can offer unbiased advice, saving you time and potentially money. They have the flexibility to find policies from various providers.

Choosing The Best Policy For You

Understanding the differences between named and open perils is a critical step in securing the right home insurance coverage. While named perils policies offer cost-effective protection for specified risks, open perils policies provide comprehensive coverage with fewer exclusions. Your choice should align with your personal needs, risk factors, and peace of mind.

Remember, your home is more than just walls and a roof—it’s the center of your life and memories. Ensuring it’s adequately protected against unforeseen events is essential.

Secure Your Home Today—Contact Torian Insurance for a Personalized Consultation and Peace of Mind.