Navigating the maze of motorcycle insurance can often be a daunting task. Among the various options, one term you may come across is Motorcycle GAP Insurance.

But what exactly is it, and more importantly, do you need it?

This blog post aims to demystify the concept of Motorcycle GAP Insurance, shedding light on its benefits, costs, and relevance to motorcycle owners.

Whether you’re an existing motorcycle owner or planning to buy one, this comprehensive guide will enable you to make informed decisions about your motorcycle insurance needs, aligning with Torian Insurance’s mission to provide personalized insurance solutions.

So rev up, as we embark on this informative journey to help you ride with peace of mind.

Understanding Motorcycle GAP Insurance

Motorcycle GAP Insurance, or Guaranteed Asset Protection Insurance, is a type of coverage that fills the gap between the actual cash value of your motorcycle and the remaining balance on your loan or lease. Bikes, like any other vehicles, depreciate over time.

In case of a total loss, where your motorcycle gets stolen or damaged beyond repair, a typical insurance policy will only pay for the present market value of the motorcycle, which might be less than what you owe on your loan or lease.

This is where Motorcycle GAP Insurance comes into play. It covers the difference, or the ‘gap’, between the current market value of your bike and the amount you still owe. This means that if your motorcycle is totaled, you won’t be left with a hefty bill to pay off your loan or lease. By understanding this, you can avoid financial surprises and ensure you’re adequately protected.

Is Motorcycle GAP Insurance Really Necessary?

Motorcycles can often be easy targets for thieves, and they are also more prone to severe damage in accidents. In such cases, the loss can be devastating, especially when the payout from a standard insurance policy doesn’t cover the remaining balance on your loan or lease. However, GAP insurance isn’t necessary for all motorcycle owners. For example, if you purchased your motorcycle used, gap insurance isn’t an option for you as it’s only for new motorcycles.

To decide if you need Motorcycle GAP Insurance, it’s essential to first evaluate your financial situation and risk tolerance. This involves considering how easily you could manage the outstanding loan balance if your motorcycle were stolen or totaled. A smaller down payment means you owe more on your motorcycle. As a result, the payout from standard insurance policies might not be enough to cover this sizable loan balance. If this would put a significant financial strain on you, GAP insurance might be a wise investment.

Next, consider the age and value of your motorcycle. New motorcycles depreciate quickly, and if you owe more on your motorcycle than its depreciated value, GAP insurance could bridge this gap. For older model motorcycles with lower outstanding loans and slower depreciation, GAP insurance may not be as necessary.

With GAP insurance, you get peace of mind knowing that even in the worst-case scenario, you won’t be left with substantial debt on a motorcycle you no longer have.

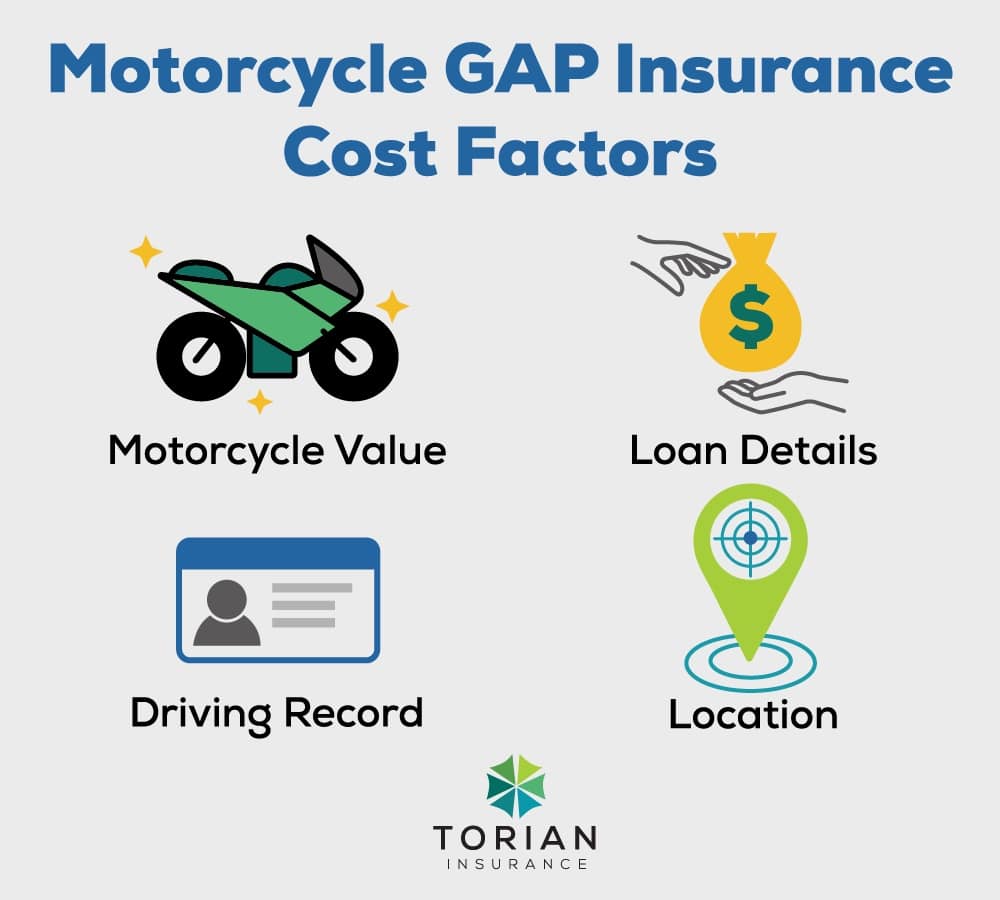

The Cost of Motorcycle GAP Insurance—4 Factors

The cost of Motorcycle GAP Insurance varies widely, influenced by several factors. It’s vital to understand these factors to make an informed decision about purchasing this insurance.

Motorcycle Value

One of the key elements affecting the cost is the value of your motorcycle. As a general rule, the higher the value, the more expensive the GAP insurance will be.

Certain motorcycle types and models tend to be more expensive to insure due to higher theft rates or costlier repairs.

Loan Details

The details of your loan, such as the loan amount and terms, also play a role in determining the insurance cost. A longer loan term might result in higher GAP insurance costs due to the extended period of potential risk.

Driving Record

Your driving record can similarly affect the price, with a clean record usually leading to lower premiums.

Location

Your geographic location can factor into the cost as well, as areas with higher accident or theft rates may lead to higher insurance premiums.

It’s also worth noting that weather conditions in the area you live in can sometimes be unpredictable and harsh, which may increase the risk of accidents or damage to your motorcycle.

How to Purchase Motorcycle GAP Insurance

When it comes to purchasing motorcycle insurance, selecting the right insurance provider is paramount.

The chosen provider should be reputable, reliable, and have excellent customer service. It’s crucial to research and compare multiple providers, looking at their coverage options, premiums, and customer reviews.

Seeking recommendations from friends, family, or other motorcycle owners can also be beneficial. You can also utilize online aids such as “find-an-agent” tools, like this one, to help you find an independent insurance agent in your area.

Once you’ve narrowed down your provider, it’s time to delve into the terms and conditions of the policy.

Motorcycle GAP Insurance policies can vary greatly, so it’s vital to understand what exactly is covered and what isn’t.

Ask questions if anything is unclear and ensure you’re comfortable with the policy before signing on the dotted line. Reading the fine print can help you avoid any unpleasant surprises in the future and ensure that the policy meets your individual needs and circumstances.

Torian Insurance’s Approach to Motorcycle GAP Insurance

When it comes to Motorcycle GAP Insurance, Torian Insurance can be your trusted partner. Our team is knowledgeable and experienced, and we are ready to guide you through the complexities of insurance.

We ensure that you fully understand your policy, including the terms and conditions, so you can be confident in your coverage.

Furthermore, we are committed to providing excellent customer service. We know that insurance can be confusing and sometimes overwhelming, and we are here to support you every step of the way.

Whether you have questions, need assistance with a claim, or simply want to discuss your options, our team is readily available to help.

In addition, we understand the regional factors that can influence the need for GAP insurance, particularly in the tri-state area surrounding Torian Insurance. We use this knowledge to provide insurance solutions that not only meet your needs but are also compliant with local regulations and requirements.

Torian Insurance—Personalized Service and Comprehensive Knowledge

Navigating the world of insurance, especially the niche area of Motorcycle GAP Insurance, can be quite complex. Remember, it’s all about your circumstances, the value of your motorcycle, and your tolerance for financial risk.

Torian Insurance, as an independent insurance agency with an extensive history and commitment to personalized solutions, is well-equipped to help you navigate these decisions.

If you’re contemplating Motorcycle GAP Insurance, or other motorcycle insurance options, give us a call.