Navigating the often-confusing world of insurance becomes much easier with the help of independent insurance agents. These professionals work with multiple carriers, offering flexible and personalized solutions that cater directly to your unique needs. Whether you need coverage for your home insurance, car insurance, or specialized plans like motorcycle insurance and pet insurance, independent agents ensure you get policies that fit your situation while delivering peace of mind.

In an era when online quotes and flashy advertisements dominate, independent agents provide a refreshing alternative by offering expert guidance, clear explanations, and personalized advocacy. This article explores the vital role of independent insurance agencies, highlights how they differ from captive agencies, and explains the distinct advantages they offer. Using Torian Insurance, a leading insurance agency in Evansville IN, as an example, we illustrate how local, independent agents can provide customized solutions and genuine community-focused service.

Introduction to Independent Insurance Agencies

Independent insurance agencies are a cornerstone in the insurance industry. Unlike agents who work exclusively with one insurance company, independent agents compare policies from a variety of providers. This multi-carrier approach means you have access to a wider range of options and can receive coverage that is specifically tailored for your situation.

The personalized service provided by independent agents goes beyond merely offering a list of policies. They take the time to understand your circumstances and explain each option in simple, clear language, helping you make well-informed decisions about protecting your home, business, or loved ones.

What Does an Independent Insurance Agency Do?

An independent insurance agency acts as both an advisor and facilitator in the insurance-buying process. Here’s how they can serve you:

Comprehensive Evaluation:

They begin by evaluating your specific needs—whether it’s for your home, health, vehicle, or business. If you have specialized requirements such as Medicare supplement insurance or professional liability coverage, they can guide you toward appropriate options based on real-world considerations rather than industry jargon.

Tailored Recommendations:

After reviewing various policies, they present options that best match your profile. By comparing costs and benefits side by side, they ensure you understand nuances such as deductibles or claim procedures without overwhelming you with technical details.

Navigating the Paperwork:

From selecting a policy to handling all the necessary documentation, independent agents continually support you. They also guide you through the claims process, offering assistance to help secure a fair outcome when issues arise.

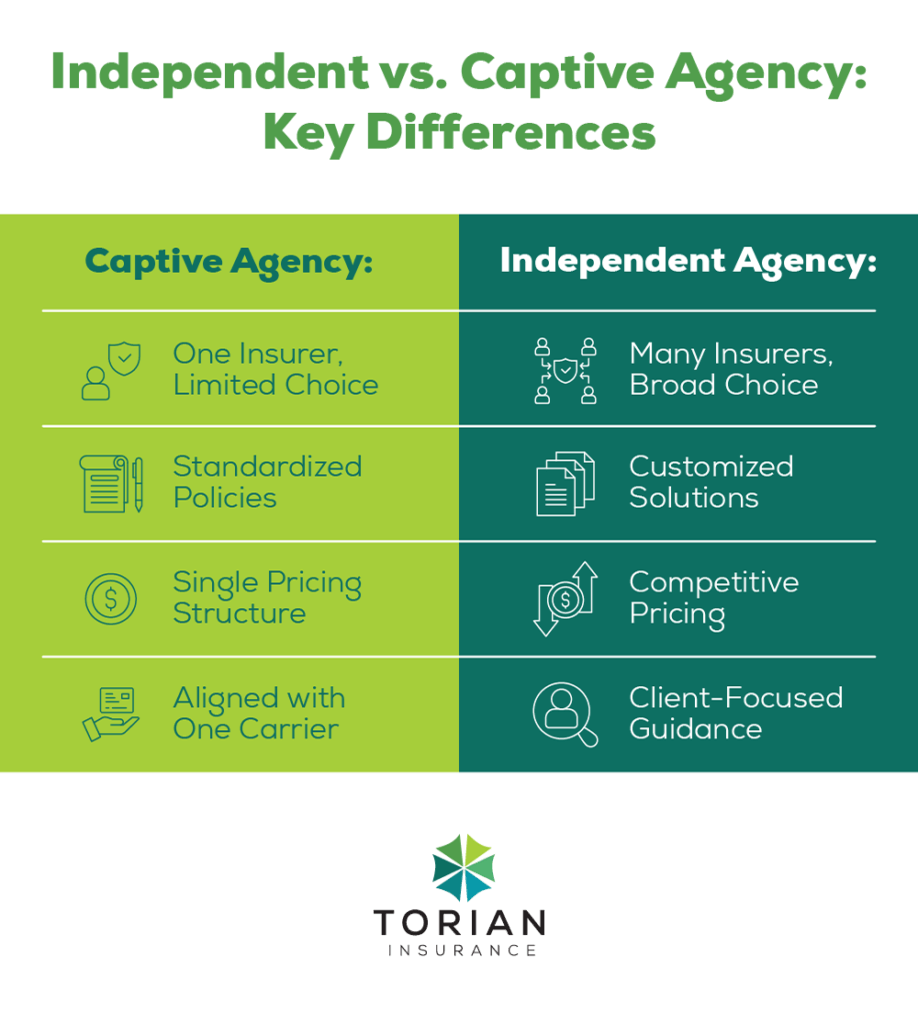

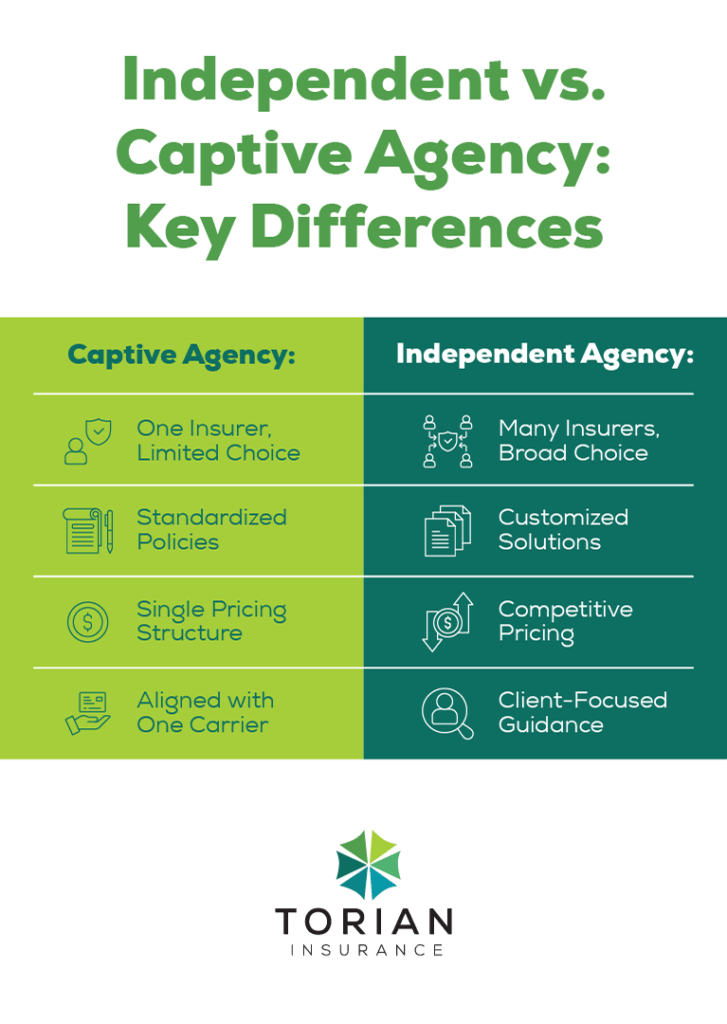

Understanding the Differences: Independent vs. Captive Insurance Agencies

It is important to understand what makes independent agencies unique compared to captive agencies. Here are the key differences:

Range of Options

- Captive Agencies: Work exclusively with one insurer, which limits their policy selections.

- Independent Agencies: Partner with many providers, offering a broader range of policies and greater flexibility.

Customization

- Captive Agents: Often provide standardized solutions that may not align with your unique needs.

- Independent Agents: Deliver policies that can be customized—from basic home or auto coverage to specialized options like high-value personal property or cyber liability.

Cost Benefits

- Captive Agents: Pricing options are limited to the single insurer they represent, lacking the ability to comparison shop across multiple carriers for potentially better rates.

- Independent Agents: With competitive pricing available from multiple carriers, independent agencies can help find budget-friendly solutions.

Advocacy

- Captive Agents: While they assist clients with claims, their primary role and allegiance lie with the single insurance company they represent, guiding clients within that company’s framework.

- Independent Agents: Strive to support you during claims disputes by guiding you through the process and helping work toward a fair resolution. However, while they advocate on your behalf, they also maintain relationships with various insurance carriers, which requires a balanced approach.

These differences emphasize that while captive agencies may offer simplicity, independent agents provide a more flexible, client-focused strategy with broadened coverage choices.

Benefits of Working with Independent Insurance Agencies

Choosing an independent agency means forming a relationship with a dedicated partner. Here’s why independent agents are a preferred choice:

Personalized Service

Independent agents offer one-on-one consultations to understand your specific needs. They:

- Listen carefully to your personal story.

- Customize policies to match your unique circumstances.

- Ensure you understand your coverage options with clear, jargon-free explanations.

This personalized guidance ensures that every detail—whether it’s protecting your home, covering a teen driver, or managing high-risk assets—is thoughtfully considered.

Diverse Coverage Options

Working with multiple insurers gives independent agents access to a wide array of policies. This advantage includes:

- Bundling solutions for individuals, such as combining homeowners, auto, and umbrella policies.

- Specialized plans for businesses that blend general liability with niche coverages like cyber insurance or product protection.

- Tailored solutions for unique needs, including vacation rental properties, valuable collections, or pet insurance.

This diversity ensures every aspect of your insurance needs is addressed without unnecessary overlaps or gaps. They can also provide guidance on more specialized options like business liability insurance and commercial insurance, ensuring your coverage evolves with your growing enterprise.

Expert Guidance and Advocacy

The complexity of insurance policies can be overwhelming. Independent agents:

- Explain policy features and clarify technical terms like deductibles and claim procedures in plain language.

- Serve as guides during the claims process, assisting you in navigating disputes and working toward a fair outcome. It is important to note that while they provide valuable advocacy, they also balance your interests with maintaining relationships across multiple carriers.

- Offer ongoing advice to adjust your coverage as your circumstances evolve.

This expert support, especially during challenging times, ensures you have a knowledgeable partner by your side.

Long-Term Community Focus

Local independent agencies are deeply invested in their communities. They:

- Understand local risks and challenges, such as regional weather patterns and economic trends.

- Offer prompt and personalized service, with intimate knowledge of regional regulatory environments and community concerns.

- Build lasting relationships that benefit both local customers and the community at large.

- Independent agencies frequently support local events, charities, and initiatives.

The genuine commitment of independent agents strengthens community ties, resulting in better recommendations and more responsive claim support.

Custom Insurance Solutions: Tailored Coverage for Your Unique Needs

Life isn’t one-size-fits-all, and neither are your insurance needs. As your circumstances evolve—buying a home, growing your family, acquiring valuable assets, or starting a business—your coverage should adapt right alongside you. This is where independent agents truly shine. They aren’t limited to a single company’s offerings; instead, they leverage their relationships with multiple carriers to design insurance solutions specifically tailored to you.

As life changes, your insurance should adapt too. Independent agents excel at designing policies that evolve with your needs. Consider these examples:

- Protecting Your Growing Home: From securing the right homeowner’s policy for your first house to adding endorsements later for significant renovations, a new swimming pool, or even specific risks like sewer backup or earthquake coverage (where available), an independent agent finds the carrier and specific coverage options that best protect your biggest investment at each stage.

- Adapting Auto Coverage: Adding a teen driver requires careful consideration of liability limits and potential discounts. Purchasing a classic car necessitates specialized agreed-value coverage. Running a home-based business might mean needing commercial use endorsements. Independent agents compare options from various insurers to find the optimal mix of protection and pricing for your specific vehicles and how you use them.

- Safeguarding Valuables: Standard home policies often have surprisingly low limits for high-value items like jewelry, art, firearms, or collectibles. An independent agent can identify these gaps and help you properly schedule these items through endorsements (riders) or separate policies, ensuring they’re adequately protected against loss, theft, or damage based on their actual value.

- Layering Liability Protection: As your assets and potential risks grow, basic liability limits on home and auto policies might not be enough. An independent agent can assess your overall exposure and recommend a personal umbrella policy. This adds a crucial extra layer of liability protection across your underlying policies – a vital customization for comprehensive peace of mind as your financial situation changes.

Ultimately, the power of customization means you’re not just buying a generic insurance product; you’re building a strategic safety net designed precisely for your specific life journey. An independent agent acts as your experienced partner, navigating the complex insurance landscape to ensure you have the right protection, tailored for when you need it most.

How to Choose the Right Independent Insurance Agency

When considering your insurance options, here are some practical tips for selecting the best independent agency for your needs:

- Evaluate Their Range of Offerings: Confirm that the agency provides a broad spectrum of personal and commercial insurance products, ranging from home and auto to specialty policies.

- Research Their Reputation and History: Look for agencies with a strong track record and positive client feedback. Longevity in the market is often a strong indicator of reliability.

- Assess Their Commitment to Personalized Service: Ideally, the agent should take time during consultations to understand your situation, clearly explain your options, and tailor recommendations accordingly.

- Inquire About Their Claims Process: A smooth, supportive claims process is crucial. Ask about how they assist clients during claims to ensure you are well supported when needed.

Keeping these points in mind will help you choose an independent agency that meets your unique needs and offers the dedicated support you deserve.

Future Trends and the Role of Technology

Technology continues to reshape the insurance industry, and independent agents are adept at integrating modern tools while preserving personal service.

Embracing Digital Transformation

Independent agencies now incorporate digital platforms to improve efficiency while maintaining the personal touch. For example, online dashboards enable clients to view policies, file claims, or receive updates in real time. Digital tools complement personal consultations, streamlining routine processes.

Enhancing Data-Driven Personalization

With advanced data analytics, agents can offer more precise risk evaluations, tailor policies based on emerging trends and individual client data and provide proactive recommendations as your needs evolve.

Balancing Technology with Personal Interaction

Even as digital tools become more sophisticated, the value of human advice remains undisputed. Independent agents bridge the gap between technology and personalized customer care and ensure digital convenience is paired with expert guidance and attentive support.

This combination of modern tools and traditional service underscores the strength of independent agencies—offering both innovation and reliability.

Additional Considerations for Independent Insurance Agents

A significant aspect often overlooked is the educational role that independent agents play by empowering their clients to make informed decisions. Through regular updates on policy changes, emerging insurance products, and evolving industry regulations, independent agents become trusted advisors who continue to provide value long after a policy has been issued.

By offering client workshops, one-on-one consultations, or comprehensive follow-ups after claims, these agents ensure that policyholders remain well-informed and confident in their coverage choices. This ongoing dialogue helps prevent future coverage gaps and reinforces that the relationship between an agent and client is dynamic and supportive.

Furthermore, independent agents often collaborate with local community organizations to host informational sessions on topics like disaster preparedness and risk management practices. These events not only raise awareness but also enrich the community’s overall resilience. This integrative approach solidifies the pivotal role of independent agents in both personal finance and communal well-being.

Connect with an Independent Agent Today

Choosing an independent insurance agency means partnering with experts who are dedicated to protecting your interests while offering customized, flexible coverage solutions. Their personalized service, diverse range of options, and commitment to the local community distinguish them from one-size-fits-all offerings.

Torian Insurance, with its long-standing reputation and community-focused approach, exemplifies how independent agencies can deliver tailored coverage that grows with you. Whether you are seeking specialized life insurance, guidance on disability insurance, or a review of your entire portfolio, now is the time to experience insurance solutions designed specifically for your needs.

Contact us today to discover how these services safeguard what matters most to you and help build a secure future.