Navigating the myriad of insurance options can be overwhelming. However, when it comes to safeguarding your most valuable assets, there’s something uniquely reassuring about partnering with a local insurance agency. Choosing Torian Insurance means receiving personalized protection tailored to your specific needs and the peace of mind that comes from working with a neighbor and community member.

Introduction to Local Insurance Agencies

A local insurance agency is more than just a business; it’s an integral part of the community fabric. Unlike large, bank-owned, or corporate insurance companies, local agencies are independently owned and operated within your region.

They understand the local landscape, the unique risks, and the specific needs of individuals and businesses in the area. In today’s insurance market, which highly values personalization and trust, local agencies play a crucial role in providing customized solutions that large corporations often can’t match.

The Importance of Personalized Customer Service

One of the most significant advantages of choosing a local insurance agency is the personalized customer service you receive. Personalized service means your insurance agent takes the time to get to know you, understand your circumstances, and tailor insurance solutions that fit your life perfectly. You only get the coverage you need without paying for anything that you don’t need.

At Torian Insurance, personalized attention is at the heart of everything we do. With over a century of experience, our agents are dedicated to building strong relationships with clients, ensuring they feel supported every step of the way. Whether you’re an individual seeking home insurance or a business owner needing comprehensive commercial coverage, we take the time to listen and provide options that make sense for you.

Local Expertise and Community Engagement

Working with a local insurance agency means working with individuals who have a deep understanding of the local market allows us to identify discounts and coverage options that might be overlooked by larger companies unfamiliar with the region.

Local expertise significantly enhances the value of the insurance solutions provided by a local insurance agency. Understanding the specific risks associated with your area—be it weather patterns, regional laws, or local economic factors—allows a local insurance agency to offer optimal coverage.

Additionally, by choosing a local business, you are supporting your local economy and contributing to the prosperity of your community. This can lead to more jobs and better services within your area.

Over 100 years of history have deeply embedded Torian Insurance in the community. We’ve weathered the same storms, celebrated the same triumphs, and grown alongside Evansville, Indiana and the surrounding regions. Our involvement extends beyond providing insurance services. For instance, Torian Insurance sponsors Leadership Everyone, a local organization dedicated to community service, demonstrating our commitment to fostering a vibrant community.

Customized Insurance Solutions for Individuals and Businesses

Everyone’s insurance needs are different. Whether you’re a homeowner, a car enthusiast, a business owner, or all of the above, your insurance should reflect your unique circumstances.

Personal Insurance Solutions

At Torian Insurance, we offer a wide array of personal insurance products that can be customized to suit your lifestyle. Some of those options include, but not limited to:

- Home Insurance: Protecting your home against damage and unforeseen events.

- Car Insurance: Coverage options for personal vehicles, motorcycles, and watercraft.

- Life Insurance: Ensuring your loved ones are taken care of in the future.

- Health Insurance: Comprehensive plans including health, vision, dental, and Medicare supplements.

- Specialty Insurance: Coverage for valuable items, jewelry, pets, and personal cyber protection.

These custom insurance solutions ensure that you receive coverage tailored to your specific needs, providing comprehensive protection without unnecessary expenses.

Business Insurance Solutions

For business owners, safeguarding your enterprise is paramount. We offer customizable business insurance solutions such as:

- Business Liability Insurance: Protection against legal claims and lawsuits.

- Commercial Property Insurance: Covering physical assets like buildings and equipment.

- Workers’ Compensation: Ensuring your employees are protected in case of workplace injuries.

- Professional Liability Insurance: Protection against claims of negligence or malpractice.

- Cyber Liability Insurance: Safeguarding your business against cyber threats and data breaches.

By tailoring insurance plans to specific client needs, we ensure that you only pay for what you need and have the peace of mind that comes with comprehensive protection.

Flexibility/ More Options

Local insurance agencies often offer more options and flexibility than large corporations. By working with multiple insurance carriers, independent agencies can provide clients with a variety of coverage options and pricing choices. This flexibility means clients can choose the coverage that best fits their budget without compromising on quality.

At Torian Insurance, we partner with a variety of reputable insurance carriers to offer our clients the best possible coverage options. We partner with a vast network of insurance providers to present clients with a range of coverage options and tailor each policy to meet specific needs and budget requirements.

Building Trust and Long-Term Relationships

Trust is the cornerstone of any successful relationship, especially in insurance. Clients need to know that their insurance agency will stand by them when it matters most. Local agencies build their business on relationships and word of mouth. They are often more invested in maintaining a good reputation within the community, which can translate into better customer service.

At Torian Insurance, building and maintaining long-term relationships is part of our legacy. We prioritize open communication, transparency, and integrity in all our interactions. Our team is dedicated to providing unbiased advice and policies that are truly in your best interest. This commitment is reflected in our proactive approach to policy reviews, ensuring that your coverage evolves with your changing needs. Our dedicated agents are always available to answer questions, provide guidance, and offer support, reinforcing the trust our clients place in us.

Accessibility

Being able to meet face-to-face with your insurance agent can lead to more efficient communication. In-person interactions can make complex insurance terms and conditions easier to understand and allow for quick resolution of issues.

In the event of a claim or an urgent question, a local agent is often able to provide quicker assistance. Their proximity allows them to be more responsive and hands-on than a distant, impersonal call center.

At Torian Insurance, we understand the importance of accessibility, especially in times of crisis. Our agents are available to meet in person, over the phone, or via email, making it easy to reach out when you need us. We also offer online services through our website, allowing clients to access critical information and manage their policies at their convenience.

Practical Tips for Choosing a Local Insurance Agency

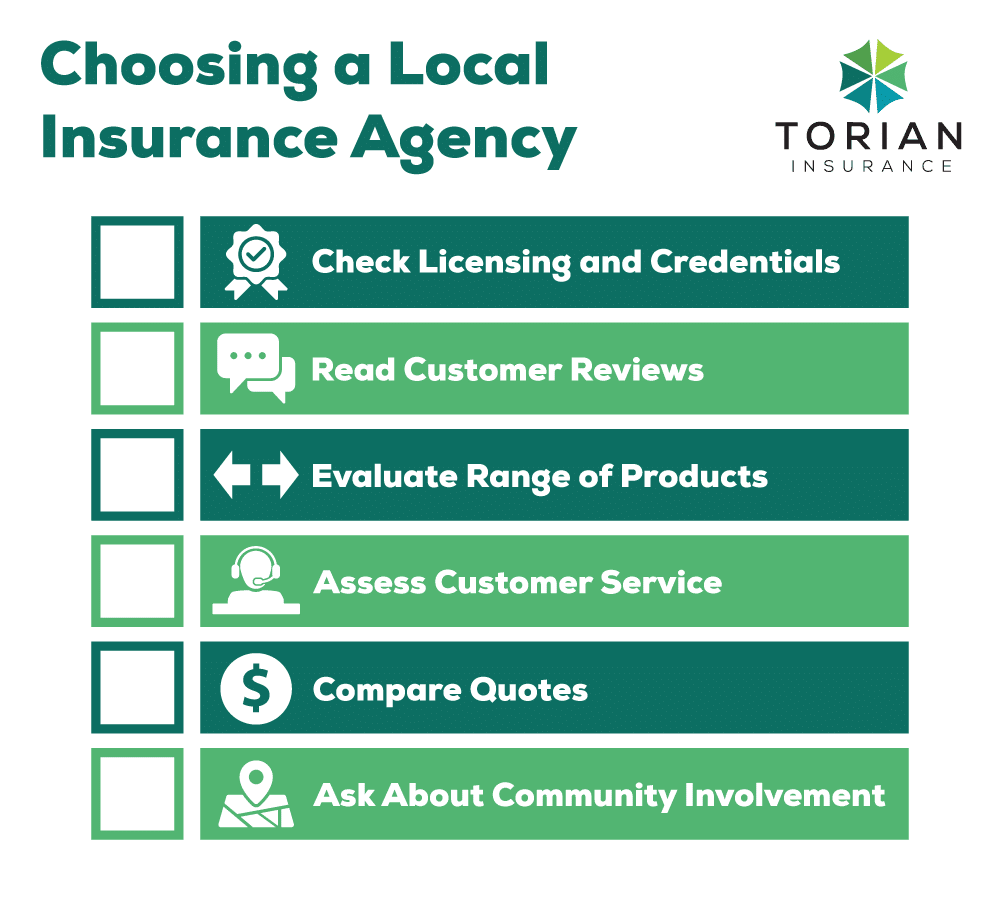

To help you make an informed decision when selecting a local insurance agency, consider the following tips:

- Check Licensing and Credentials: Ensure the agency is properly licensed in your state and has a good standing with regulatory bodies.

- Read Customer Reviews: Look for testimonials and reviews from current or past clients to gauge the agency’s reputation and service quality.

- Evaluate the Range of Products: Assess whether the agency offers a comprehensive range of personal insurance products or business insurance solutions that meet your specific needs.

- Assess Customer Service: Reach out to the agency to evaluate their responsiveness and willingness to answer your questions.

- Compare Quotes: Obtain quotes from multiple agencies to ensure you are getting competitive rates and the best coverage for your budget.

- Ask About Community Involvement: Agencies that are active in the community often demonstrate a commitment to local values and client relationships.

Following these steps can help you choose a local insurance agency that aligns with your needs and provides reliable, personalized service.

Trusted Choice Insurance Agency

A Trusted Choice Insurance Agency is part of a network of independent insurance agencies dedicated to advocating for the needs and interests of their clients. These agencies are committed to providing personalized and thoughtful service, ensuring that each client’s unique requirements are met with tailored solutions.

Being a Trusted Choice agency signifies a pledge to uphold high ethical standards and deliver responsive, knowledgeable customer service. These agencies are not limited to offering products from a single insurance company; instead, they have the flexibility to choose from a wide array of providers, enabling them to craft customized policies that offer the best coverage and value.

Working with a Trusted Choice Insurance Agency, such as Torian Insurance, brings numerous advantages. First and foremost, you benefit from a relationship-focused approach. These agents prioritize understanding your specific needs, evaluating various options, and providing expert advice on the best fit for your situation.

Their independence from any single insurer means they work for you, not the insurance company, ensuring that your best interests are always at the forefront.

Furthermore, their commitment to ongoing education and industry-leading practices keeps them at the cutting edge of the insurance field. This means you can rely on them for not only securing coverage but also for helping you navigate through claims or alterations to your policy. With a Trusted Choice agency, you gain a partner dedicated to protecting your assets and well-being through every stage of life.

Reap the Benefits of a Local Insurance Agency Today

Choosing a local insurance agency for personalized protection offers numerous benefits that large corporations simply can’t provide. From personalized customer service and local expertise to a wide range of tailored insurance solutions, local agencies like Torian Insurance are uniquely positioned to meet your needs.

With nearly a century of experience serving individuals and businesses in Southern Indiana, Illinois, and Kentucky, Torian Insurance is more than just an insurance provider—we’re a trusted partner in your community, committed to protecting what matters most to you.

Don’t leave your protection to chance or get lost in the shuffle of a big corporation. Contact Torian Insurance today for a free personalized consultation and secure your future now!

Watch the video below for more tips on shopping for the right independent insurance agent: