Torian Insurance has been serving the community since 1923 as an insurance agency that remains locally owned and operated. Your home is one of your most valuable investments, and finding suitable coverage is key to safeguarding it. Whether you’re buying a first home, renewing a policy, or simply shopping for better protection, comparing home insurance quotes can save you money while providing comprehensive peace of mind.

Below, we explain how to compare home insurance quotes by evaluating coverage, costs, and options—and why working with independent insurance agents at Torian Insurance can streamline your search for custom insurance solutions.

Why Home Insurance Is Essential

Home insurance protects your property from unexpected losses such as fire, theft, and severe weather while providing liability coverage if someone is injured on your property. It also covers your personal belongings and may include additional living expenses if your home becomes temporarily uninhabitable.

For most homeowners, solid insurance is both a prudent financial safeguard and a mortgage requirement. Rather than viewing it as a formality, see it as a way to maintain long-term financial stability and peace of mind. According to the Insurance Information Institute’s 2022 Homeowners Fact Sheet, the national average cost of home insurance in recent years has risen due to changing weather patterns and the increased frequency of natural disasters. This underscores the importance of crafting a comprehensive policy that can adapt to evolving risks..

Understanding Your Home Insurance Quote: A Breakdown of Key Factors

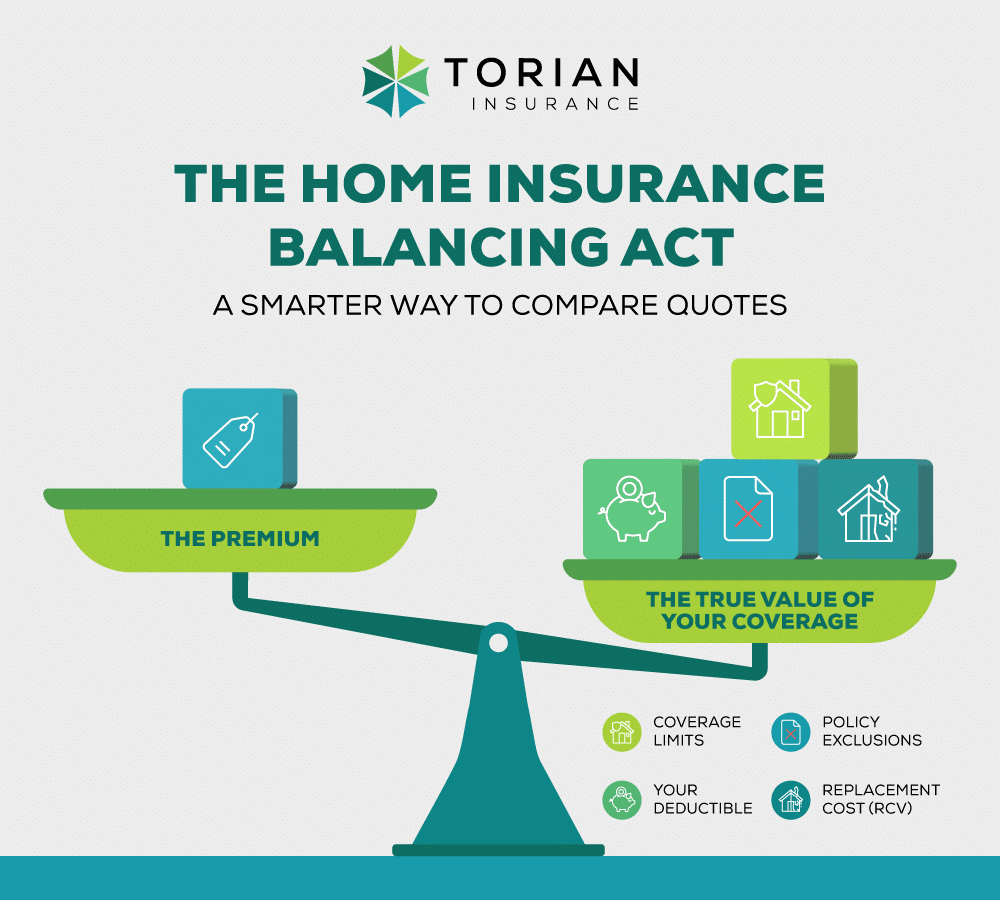

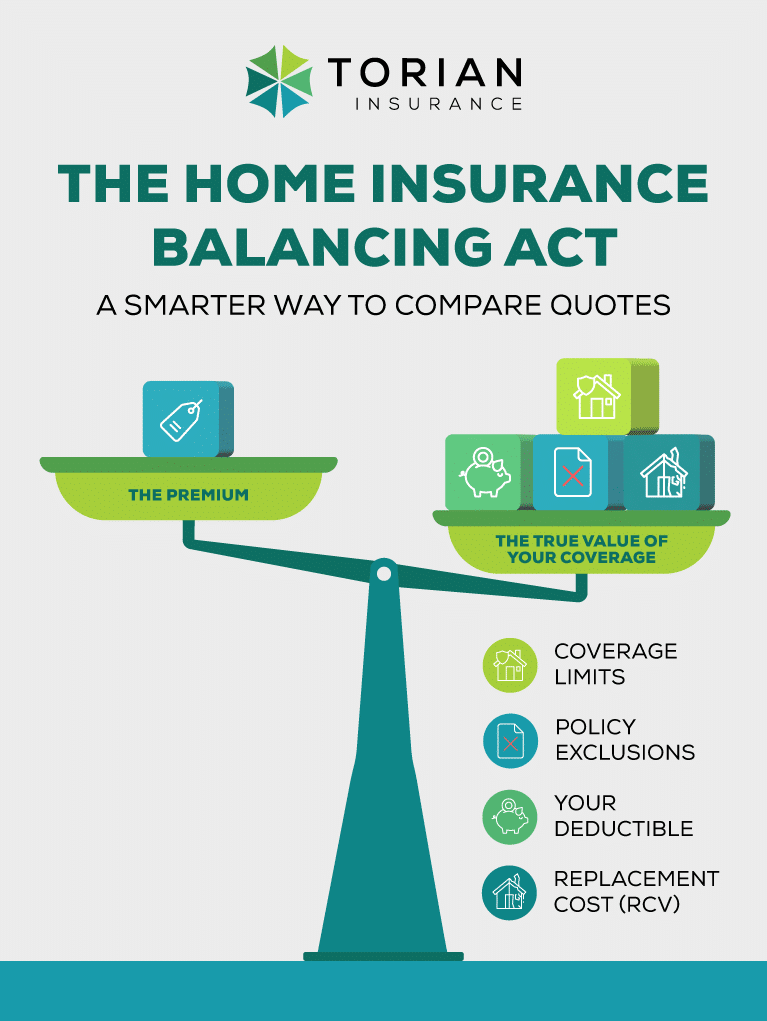

Choosing the right home insurance policy requires looking beyond the monthly premium. A truly great policy offers a balance of comprehensive coverage, manageable costs, and the flexibility to protect what matters most to you. To compare quotes effectively, you need to understand the key components that determine the quality of your protection.

Coverage Types

A standard home insurance policy is a package of different coverages. A quote will typically include:

- Dwelling Coverage: Protects the physical structure of your house.

- Personal Property Coverage: Covers your belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property.

- Loss of Use Coverage: Helps cover temporary living expenses (like a hotel or rental) if a covered event makes your home uninhabitable.

Coverage Amounts and Limits

Your policy will have a maximum limit for each coverage type. It is crucial to select limits that match your home’s full replacement value, not just its market price.

- Real-World Example: Protecting High-Value Items: Some homeowners accumulate valuable art collections or jewelry. If your standard policy has a sub-limit of $2,500 for jewelry, but your collection is worth $10,000, you are significantly underinsured. To solve this, you can add a “scheduled personal property” endorsement to your policy, which insures these specific items for their full appraised value.

Deductibles

A deductible is the amount you pay out-of-pocket on a claim before your insurance coverage begins. A higher deductible will lower your premium, but you must be financially prepared to cover that amount if a loss occurs. The goal is to find a sweet spot between a manageable premium and a deductible you can comfortably afford.

Exclusions and Optional Add-Ons

No single policy covers every possible risk. It’s critical to understand what your policy excludes so you can fill any gaps.

- Common Exclusions: Standard policies almost always exclude damage from floods, earthquakes, and general wear and tear.

- Real-World Example: Flood Concerns Near the Ohio River: Homeowners in Southern Indiana and Kentucky often live near waterways prone to flooding. A standard home insurance policy will not cover damage from rising water. To be protected, you must purchase a separate flood insurance policy, typically through the National Flood Insurance Program (NFIP). Without it, a flood could be financially devastating.

Replacement Cost vs. Actual Cash Value (ACV)

This is one of the most important distinctions in a home insurance policy.

- Replacement Cost (RCV): This coverage pays the full cost to repair or replace your damaged property with new materials of similar kind and quality, without deducting for depreciation.

- Actual Cash Value (ACV): This coverage pays for the replacement cost minus depreciation. For example, if your 10-year-old roof is destroyed, an ACV policy will only pay for the remaining value of that old roof, leaving you to cover the rest of the cost for a new one.

- Real-World Example: Rising Construction Costs: Imagine a severe storm destroys part of your roof. Due to recent supply chain disruptions, the cost to repair it has surged. A replacement cost policy would cover the full, inflated cost to make you whole again. An ACV policy would leave you paying a significant portion out-of-pocket, creating a major financial strain during a stressful time. Although RCV coverage has a higher premium, it offers far greater financial protection.

Your Smart-Shopping Playbook: 6 Steps to the Best Rates

Securing the best home insurance involves more than just picking the lowest price; it requires a strategic approach. Following this playbook will help you find competitive rates without sacrificing the quality of your coverage, empowering you to avoid common and costly mistakes.

Step 1: Look Beyond the Premium to Find True Value

The most common mistake homeowners make is focusing solely on the price tag. A low premium often masks insufficient coverage, high deductibles, or major exclusions that can leave you financially vulnerable when you need protection most. Instead of asking “What’s the cheapest policy?”, ask “What’s the best value for my needs?” A slightly higher premium for a policy with better coverage, like replacement cost value, can save you tens of thousands of dollars and immense stress in the long run.

Step 2: Compare Multiple, Apples-to-Apples Quotes

To truly compare your options, you must request quotes that have parallel coverage limits, deductibles, and endorsements. Don’t just look at the final price. Line up the dwelling coverage, personal property limits, and liability amounts for each quote to see how they stack up. If this process becomes overwhelming, consider working with an independent insurance agent who can do the comparison shopping for you.

Step 3: Maximize All Available Discounts

Insurers offer numerous discounts that can significantly lower your premium, but you often have to ask for them. When getting quotes, always inquire about potential savings for:

- Bundling Policies: Combining your home and car insurance with the same provider is one of the easiest and most significant discounts available.

- Home Safety Features: Having smoke detectors, a burglar alarm, deadbolt locks, or other security systems can lead to savings.

- Claims-Free History: If you haven’t filed a claim in several years, you may be eligible for a discount.

- Newer Home or Roof: A newer home or a recently replaced roof often qualifies for lower rates due to reduced risk.

Step 4: Maintain a Strong Credit Score

In many states, your credit-based insurance score is a key factor in determining your premium. Insurers use it to predict the likelihood of future claims. Routinely checking your credit report for errors and practicing good financial habits can translate directly into better insurance rates.

Step 5: Adjust Your Deductible Wisely

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. Raising your deductible from, say, $500 to $1,000 can reduce your annual premium. This is a smart move only if you are financially prepared to cover the higher out-of-pocket expense at a moment’s notice. Never choose a deductible so high that it would cause financial strain if you need to file a claim.

Step 6: Conduct an Annual Policy Review

Home insurance is not a “set it and forget it” product. Life changes, and so do your coverage needs. A common pitfall is failing to update your policy after major life events. Schedule a quick annual check-up with your agent to review your policy and make adjustments for:

- Home Renovations: If you’ve remodeled your kitchen or added a deck, the value of your home has increased, and your coverage limits should, too.

- New Valuables: If you’ve acquired expensive jewelry, art, or electronics, you may need to add specific endorsements to ensure they are fully protected.

- Changes in Regional Risk: Keep an eye on local trends that might require new types of coverage.

The Independent Agent Advantage: Why Local Expertise Matters

When comparing home insurance quotes, you can work with a captive agent who represents a single company or partner with an independent agent who works for you. An independent agent provides a wealth of expertise and strategic advantages that can lead to better coverage at a more competitive price, especially when they have deep roots in your local community.

Broad Access to Multiple Carriers for Customized Solutions

Unlike a captive agent who can only offer products from one company, an independent agent shops the market on your behalf. They have access to multiple insurance carriers and can compare dozens of policies to find the best fit for your specific needs and budget. This allows them to act as your unbiased advocate, tailoring a policy that covers everything from your primary home to high-value collectibles or even a vacation rental property.

Expert Guidance and Claims Support

Navigating the fine print of an insurance policy can be complicated. An independent agent serves as your expert guide, clarifying confusing terms, explaining what is and isn’t covered, and ensuring you understand the details before you sign. This partnership extends beyond the initial purchase; if you need to file a claim, they offer crucial support and advocacy, helping you navigate the process during a stressful time.

The Power of Local Knowledge

This is where a great independent agent truly shines. Insurance needs vary significantly by region, and an agent who lives and works in your area possesses invaluable local expertise. For homeowners in places like Southern Indiana, Illinois, and Kentucky, this is not a small detail—it’s a critical advantage.

A local agent inherently understands:

- Regional Risks: They know the specific weather patterns and common hazards of the area—from tornadoes and severe hailstorms to flooding risks near the Ohio River—and can recommend the precise endorsements you need.

- Local Requirements: They are familiar with state regulations and local building codes that might influence your required coverage levels, ensuring your policy is fully compliant.

- The Local Network: In the event of a claim, they often have established relationships with reputable local contractors, restoration companies, and emergency services, which can be a vital asset when you need help quickly.

Ultimately, a local independent agent offers more than just a policy; they offer a long-term, personalized relationship, adapting your coverage as your life changes and providing peace of mind that comes from knowing your home is protected by someone who truly understands your community.

How Torian Insurance Simplifies the Process

Torian Insurance leverages its longevity, community ties, and independent status to deliver personalized service and streamlined results:

- Extensive Provider Network: As an independent agency, Torian Insurance can compare policies across multiple carriers, giving you competitive rates and thorough coverage.

- Localized Knowledge: Specializing in Southern Indiana, Illinois, and Kentucky means their advice is grounded in proven regional experience, ensuring your plan addresses local hazards effectively.

- Personalized Customer Service: Agents at Torian Insurance build relationships with clients, frequently reviewing existing coverage to ensure it adapts to life changes while maintaining financial protection. In an evolving market, having a trusted advisor can save you from overpaying on premiums or, conversely, underinsuring your home.

Moreover, Torian Insurance understands that homeowners face a range of concerns, from safeguarding older properties with potential structural vulnerabilities to maintaining up-to-date coverage in newly built subdivisions. This nuanced perspective stems from a century of experience serving the community.

Securing Comprehensive Home Protection for Peace of Mind

Comparing home insurance quotes stands as an essential step for homeowners seeking security and peace of mind. By looking beyond premiums to coverage details, exclusions, and regional concerns, you’ll find a policy that offers both affordability and robust protection. Working with an agency like Torian Insurance ensures you benefit from comprehensive resources, independent advice, and true local expertise.

Ready to find a policy that safeguards your most valuable investment? Contact Torian Insurance today to discuss your home insurance needs, explore custom insurance solutions, and secure the best home insurance rates.