For homeowners, insurance is a crucial safety net, yet this net often has hidden gaps. Too often, these policy exclusions are only discovered during the worst possible time: after a disaster strikes. Imagine facing extensive basement flooding or damage from a sudden earthquake, only to learn your standard policy won’t cover the loss. These scenarios leave homeowners with unexpected financial strain for risks they thought were covered, turning a difficult situation into a devastating one.

For homeowners in Southern Indiana, Illinois, and Kentucky, proactive awareness is the first line of defense. This guide is designed to empower you by uncovering the most common exclusions and providing clear strategies to address these vulnerabilities. By understanding what your policy doesn’t cover, you can take control, customize your protection, and see why partnering with a trusted agency like Torian Insurance makes all the difference in safeguarding what matters most.

Understanding Homeowners Insurance Exclusions

While homeowners insurance provides vital protection, it isn’t all-encompassing. To manage risk and keep premiums affordable, policies include “exclusions”—specific situations or perils that are not covered. Knowing these limitations is the first step to ensuring you are truly protected.

What Are Exclusions?

Exclusions are specific risks, such as floods or general wear and tear, that your policy will not cover. They are clearly listed in your policy to manage risks that are considered either preventable (like neglect) or too catastrophic for standard coverage (like earthquakes).

Why Knowing About Exclusions Is Essential

Being unaware of these exclusions can have serious financial consequences. Misunderstanding your policy could mean facing the entire cost of repairs for common-but-excluded events, like basement flooding from a heavy rainstorm. Knowing your gaps is the only way to proactively fill them.

What Happens If You’re Unprepared?

The result of being unprepared is simple: you bear the full financial burden when you least expect it. Whether it’s structural damage from an earthquake or replacing stolen valuables that exceed your policy’s limits, the costs can be overwhelming. True peace of mind comes from knowing exactly where your coverage begins and ends.

Things Your Homeowner’s Insurance Might Not Cover

Most home insurance forms explicitly mention these perils. These may not be available in your basic insurance plan, but the coverage that isn’t included in an initial plan can be purchased separately.

Read on to learn about the events that aren’t always covered by standard homeowners insurance.

1. Events Resulting in Massive Destruction

As the name suggests, certain events like earthquakes, mudslides, floods, and sinkholes are some of the disasters that can cause significant damage to your home. Unfortunately, the perils and catastrophes of these events cover a significant geographical area. As such, these aren’t always included in the plan unless mentioned explicitly. However, there are sometimes exceptions — for example, if your house caught on fire due to an earthquake and your policy covers fire damage, you can claim the damage.

Similarly, your typical home insurance doesn’t include any financial damages caused by:

- Nuclear accidents

- Acts of war

- Damages caused by a government

Terrorist activity that has resulted in damages doesn’t fall under the category of an act of war, hence it’s possible that the plan you have includes the required coverage.

Certain counties in the United States offer coverage for these events with additional costs. Residents in Oklahoma and California might be inclined to buy such policies due to fracking practices in the region. Moreover, residents of Tennessee and Florida must invest in buying policies that cover damages caused by sinkholes.

2. Water-Related Damages and Mold

Depending on how water damages were caused, they may not be covered by standard homeowners insurance.Your insurance agent might recommend that the amount of coverage be increased if you have a basement since there is a higher chance of water-related damages for homes with basements.

Also talk with your agent about water backup coverage for instances that are sudden or accidental such as water backups caused by blocked drains, and clogged sewers. Burst pipes and ruptured water heaters, on the other hand, might qualify under the standard policy.

It’s also important to note that homeowners who live in high-risk areas for floods are required to buy flood insurance to qualify for a mortgage that’s backed by the federal government.

Water-related damages and mold go hand in hand. To claim the losses, you need to analyze the underlying cause of the damage. For instance, if the mold growth is due to a flood or a similar natural calamity, then your home insurance may not cover it. But if the underlying cause of mold is a covered peril such as a burst pipe, then insurance might cover the cost of the damage.

It’s important to take note of the early signs of mold and report them. Mold is usually avoidable by using mold cleaners, dehumidifiers, and bleach and chemicals in the bathroom. Having good rooftop maintenance helps as well.

3. Damage From Negligence and Poor Maintenance

Homeowners insurance is intended to cover sudden, unexpected incidents, not damage that results from a lack of upkeep or general wear and tear. Insurers consider routine maintenance the homeowner’s responsibility, and they often classify failure to address predictable problems as negligence. As a result, claims for damages that could have been prevented with reasonable care are typically denied.

This broad exclusion covers many common household issues that are considered the homeowner’s responsibility, such as:

- General Wear and Tear: An aging roof that has reached the end of its lifespan or rusty pipes that eventually leak.

- Pest Infestations: Damage from termites, bedbugs, roaches, or other pests, which are viewed as preventable.

- Lack of Upkeep: A dead or decaying tree branch on your property that falls and causes damage, if it was a known hazard you failed to address.

Even issues like overgrown trees can fall into this category. If a dead or decaying tree branch on your property falls during a storm and damages your home, the claim could be denied if the insurer determines you were negligent in not trimming or removing the known hazard. The guiding principle is that if a problem develops over time and could have been addressed earlier, the financial responsibility rests with the homeowner, not the insurance policy.

4. Pest Infestations

Infestations by termites, bedbugs, roaches, or other pests are almost always excluded from homeowners insurance policies. This is because pest infestations are considered to be a preventable maintenance problem.

It is the homeowner’s responsibility to take steps to prevent pests from entering the home and to address any infestations that do occur. This includes sealing cracks and holes in the foundation, keeping food in airtight containers, and regularly inspecting for signs of pests.

5. Damage by Canine

Sometimes an insurance company will dictate specific breeds of dogs as being aggressive and therefore out of bounds of the claim. So if you own a German shepherd, a pit bull, or a wolf breed, and it bites a passerby or guest, this might not necessarily be covered, depending on the policy. It is always best to inform your insurance agent if you own a breed that is considered aggressive.

Dog bites caused by breeds that aren’t classified as hostile are covered under your insurance as a liability. But if the claim exceeds the liability limit on the coverage, you’re required to pay the outstanding amount.

6. Valuables and Jewelry

If you have valuables that would be more susceptible to robbery it is a good idea to consider special coverage for those items. Standard policies have coverage limits on high-value items. You should talk with your agent about special coverage (riders or endorsements) for valuables such as:

- Family heirlooms

- Firearms

- Silverware

- High-end electronics

- Fine art or collectibles

Jewelry is a common valuable item to consider special coverage for. Some forms of insurance cover the loss of jewelry items but in most cases there is limited coverage under a standard home policy. Theft may be excluded but other types of claims might be covered. For example, if your jewelry is lost in a fire, the basic homeowners policy will cover that just as it would any piece of personal property that was lost, such as a couch or a television. On the other hand, if you lose your jewelry in a pool or if it falls off while you’re swimming in a lake or ocean on vacation—that loss won’t be covered under the standard policy. For instances like this you can purchase a separate policy called a “Personal Articles” policy to cover your treasured jewelry.

It’s important to inform your agent about your prized jewelry and valuables up front or as soon as you receive or purchase these items.

7. Damages from Vandalism On A Vacant Property

Vandalism is one of the perils that is covered in even the most basic policy. However, it is not covered on a vacant property. This means if your home has been vacant for 60 days or more, then a vacancy provision comes into play. Unoccupied homes, however, will be covered.

The rules on vandalism in general may vary from county to county and they may not always comply due to the nature of dwelling occupancy in home insurance policies. When insurance covers vandalism in policy, they may not always comply due to the nature of dwelling occupancy in home insurance policies.

For instance, if the homeowner has his or her personal belongings and furniture in the house, and he or she isn’t present, then insurance covers the vandalism. In this case, it’s still plausible that the homeowner may return, so the property is merely deemed unoccupied. But if the owner has no personal belongings in the house and hasn’t lived in the property for a period of time, then the house is deemed vacant. The duration varies in each county, but on average, six to eight weeks is how long it takes for a property to be classified as vacant.

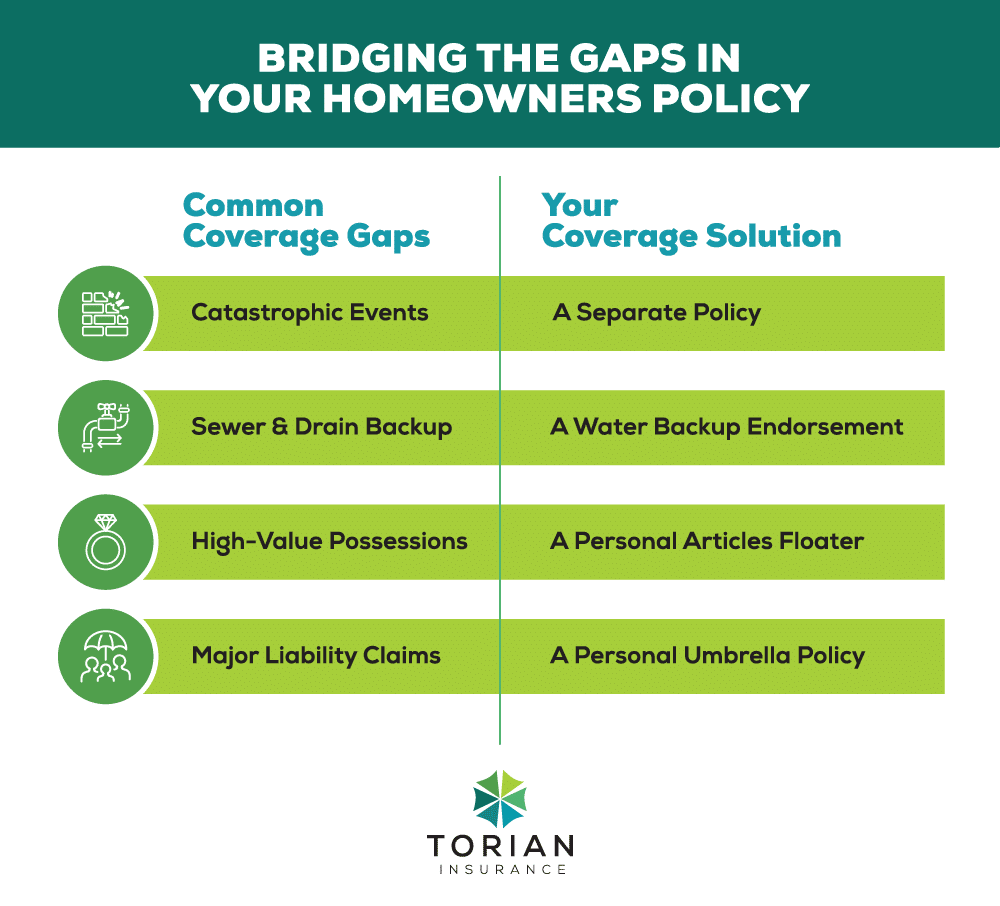

Strategies for Complete Coverage: How to Address Policy Exclusions

Knowing the potential gaps in your policy is the first step. The next is taking decisive action to ensure you are fully protected. While exclusions are standard, they don’t have to leave you vulnerable. By using the right strategies, you can build a comprehensive safety net tailored to your specific needs.

1. Customize Your Policy with Endorsements and Specialized Coverage

The most direct way to close a coverage gap is to add protection. For many common exclusions, insurers offer add-ons (called endorsements or riders) or separate, specialized policies.

- Flood Insurance: Standard policies do not cover flood damage. If you live in a flood-prone area, a separate policy through the National Flood Insurance Program (NFIP) or a private insurer is essential.

- Earthquake Insurance: For homeowners in seismic zones, a stand-alone earthquake policy is necessary to cover damage from earth movement.

- Water Backup Coverage: This crucial endorsement protects you from costly damage caused by backed-up sewers, drains, or sump pumps—a common exclusion.

- Scheduled Personal Property: If you own high-value items like jewelry, art, or firearms that exceed standard policy limits, this rider ensures they are covered for their full appraised value.

- Umbrella Insurance: This provides a vital extra layer of liability protection, typically $1 million or more, that kicks in after the limits on your home and auto policies have been exhausted. It acts as a crucial safety net to protect your personal assets from a major lawsuit resulting from an accident on your property.

2. Stay Proactive with Regular Reviews and Home Maintenance

Your insurance needs are not static. A proactive approach to both your policy and your property is key to preventing uncovered losses.

- Conduct Annual Policy Reviews: Life changes, and your insurance must keep up. Review your policy yearly or after any major event—such as a home renovation, a valuable purchase, or starting a home-based business—to ensure your coverage is still adequate.

- Practice Preventive Home Maintenance: Many policies exclude damage from negligence, wear and tear, or pests. By routinely inspecting your roof, trimming trees, and managing your plumbing and electrical systems, you can prevent issues that insurance won’t cover. Keep records of repairs and upkeep.

3. Partner with an Independent Insurance Agent

You don’t have to navigate complex policy language and coverage options alone. An independent agent is your most valuable resource. They work with multiple carriers to find the best solutions for your unique situation, helping you spot overlooked exclusions, recommend the right endorsements, and ensure you are getting comprehensive protection at a competitive price.

The Torian Insurance Difference: Tailored Coverage for Your Unique Needs

When it comes to managing exclusions and designing coverage that fits your life, Torian Insurance is your reliable partner. As a locally owned, independent insurance agency in Evansville, Indiana, Torian Insurance has served the community since 1923.

Expertise in Closing Coverage Gaps

Torian Insurance agents focus on helping you clarify and strengthen your policy. They pinpoint potential exclusions and propose the right endorsements or specialized coverage so you’re never caught off guard. Layering coverage appropriately is essential, and their experienced professionals guide you every step of the way.

Dedicated Personalized Service

At Torian Insurance, you’ll receive individualized attention. Whether you face flood hazards, want to insure high-value jewelry, or run a small enterprise out of your home, they’ll customize recommendations to match your situation.

Broad Access to Trusted Providers

Because Torian Insurance operates independently, its agents can connect you with a variety of insurance carriers for the most thorough and budget-friendly policies. Whether you need an endorsement for sewer backup or stand-alone earthquake coverage, they’ll help you find what suits your home and location best.

A Legacy of Trust and Community Commitment

For over a century, Torian Insurance has demonstrated its devotion to Southern Indiana, Illinois, and Kentucky. Building long-term client relationships is a top priority, and the agency is well known for delivering supportive, transparent advice. That local dedication shines through in every policy review, consultation, and claim.

With Torian Insurance, you’ll receive more than a policy—you’ll have a resource that cares about your well-being, understands the region, and ensures that your coverage aligns with your unique needs and priorities.

Frequently Asked Questions

What are the most common homeowners insurance exclusions?

The most common homeowners insurance exclusions are:

- Flood

- Earthquake

- Negligence and poor maintenance

- Pest infestations

- Damage by canine

- Valuables and jewelry

- Vandalism on a vacant property

Can I get coverage for excluded perils?

Yes, you can often get coverage for excluded perils by purchasing an endorsement or a separate policy. For example, you can purchase a separate flood insurance policy or an endorsement for earthquake coverage.

How can I find out what is excluded from my homeowners insurance policy?

The best way to find out what is excluded from your homeowners insurance policy is to read your policy carefully and to speak with your insurance agent.

Taking Action to Secure Comprehensive Home Insurance Coverage

Homeowners insurance provides essential protection, but standard policies come with notable exclusions. Knowing what isn’t covered—whether it’s flood, earthquake, wear and tear, high-value items, intentional damage, or sewer backup—lets you act proactively. By adding endorsements, purchasing specialized policies, staying ahead on maintenance, and scheduling regular policy reviews, you can create a more comprehensive safety net for your home.

Don’t wait until an uncovered loss occurs. Take action now to align your coverage with your current needs. Reach out to Torian Insurance today to schedule a personalized policy consultation. You can also learn more about our specialized personal insurance solutions to fill potential gaps in your current plan. With over a century of experience serving Southern Indiana, Illinois, and Kentucky, Torian Insurance is here to safeguard what matters most—your home, belongings, and financial security.