Disasters—from storms and floods to fires and tornadoes—can cause devastating damage to homes, vehicles, and businesses. Navigating the insurance claims process during such challenging times can feel overwhelming. With proper preparation and reliable guidance, however, you can minimize frustration, secure the compensation you need, and expedite recovery. This guide provides actionable strategies for homeowners, renters, vehicle owners, and business owners in Southern Indiana, Illinois, and Kentucky to file disaster insurance claims confidently.

Understanding Disaster Insurance Claims

Disaster insurance claims are formal requests to recover financial losses resulting from catastrophic events. These claims help you access coverage for damages to property, belongings, or business operations.

Types of Disaster Insurance Coverage

- Personal Insurance: Homeowners and renters insurance typically covers perils such as fire or wind damage. However, additional policies—like flood insurance or earthquake insurance—may be required to fully protect against certain disasters. Many people also explore car insurance coverage options to safeguard their vehicles from disaster-related incidents. Similarly, advanced digital threats highlight the importance of personal cyber liability coverage in a connected world.

- Commercial Insurance: Business owners benefit from commercial property, liability, and business interruption insurance. Some businesses may also need specialized coverage to address unique risks. In today’s environment, business liability insurance protection is often essential for safeguarding your company’s finances. Additionally, certain industries may benefit from commercial umbrella insurance as a critical layer of protection when standard policy limits are exceeded.

Essential Terms to Know

Familiarity with these key terms improves your ability to file claims efficiently and ensures you understand the financial protections provided by your policy.

- Deductibles: The portion of damages you must cover before your insurer pays.

- Claim Limits: The maximum amount an insurer will pay for covered losses.

- Exclusions: Specific risks or incidents that are not covered by your policy.

- Independent Insurance Agents: Professionals who offer personalized guidance by comparing policies from multiple carriers and helping you identify coverage gaps.

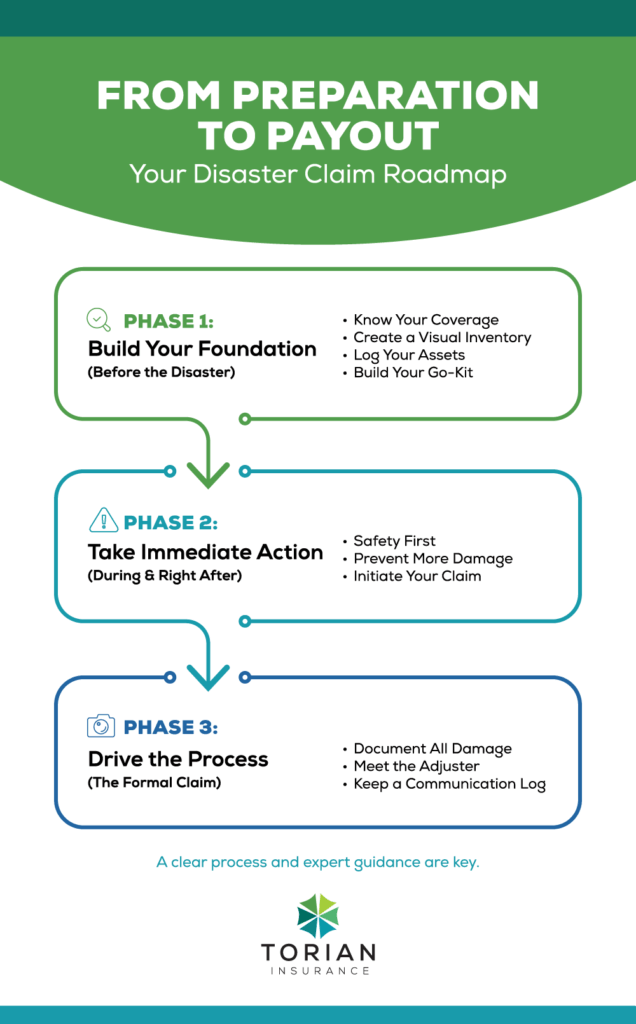

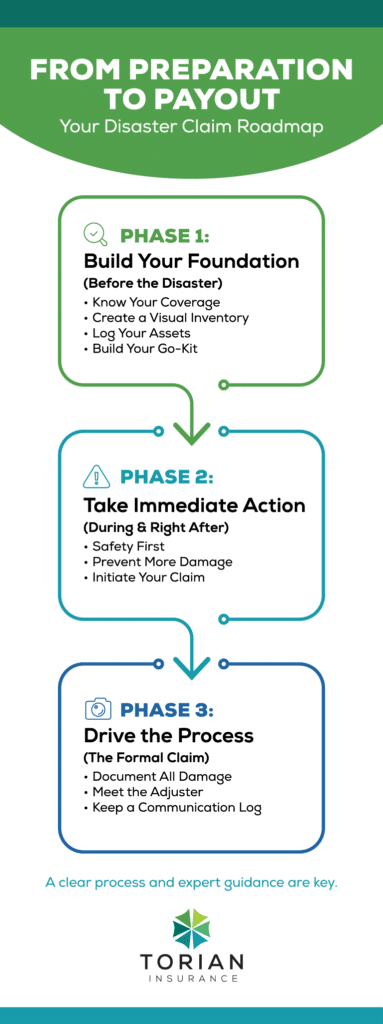

Your Disaster Claims Timeline: A Step-by-Step Guide

Navigating a disaster insurance claim is a process that begins long before a catastrophe and continues well after the storm has passed. By following this chronological guide, you can move through each phase with confidence, knowing you have taken the right steps at the right time.

Phase 1: Pre-Disaster Preparedness (The Foundation for Success)

Proactive preparation is the single most effective strategy for a smooth claims process. The work you do here is your foundation for a successful recovery.

- Review and Understand Your Insurance Policy: Don’t wait for a disaster to read your policy. Annually, review your coverage to ensure it aligns with your risks. Confirm whether you need supplemental policies (like flood or earthquake insurance), understand your deductible obligations, and be crystal clear on what is excluded.

- Pro Tip: Consulting an independent insurance agent can help you get better rates and identify hidden gaps in your coverage before it’s too late.

- Create a Detailed Asset Inventory: This is your most critical pre-disaster task. Document everything you own—from furniture and electronics to business equipment and inventory.

- How to Document: Create a list with descriptions, serial numbers, purchase dates, and estimated values.

- Visual Evidence: Take comprehensive photos and videos of your belongings, home, or business in their current state. Open drawers and closets to show the contents.

- Secure Storage: Save all documentation to a secure cloud service (like Google Drive or Dropbox) for easy access from anywhere.

- Organize Important Documents: Keep digital and physical copies of your insurance policies, property titles, financial records, and inventory in a fireproof, waterproof safe or box.

- Develop a Safety and Mitigation Plan: Establish evacuation routes for your family or employees, assemble a disaster kit with essential supplies, and consider fortifying your property with storm shutters or reinforced roofing. For various helpful information sheets refer to these resources from Ready.gov.

Phase 2: Immediate Response (During and Right After the Disaster)

Once a disaster strikes, your priorities are safety and damage control. The actions you take in these crucial first hours can significantly impact your claim.

- Prioritize Safety Above All Else: Follow all official evacuation orders and stay informed through reliable sources like the National Weather Service. Property can be replaced; lives cannot.

- Mitigate Further Damage (When Safe): If you can safely access your property, take reasonable steps to prevent the damage from getting worse.

- Examples: Cover a damaged roof with a tarp, board up broken windows, or shut off water to stop a leak.

- Common Pitfall: Neglecting Mitigation. Insurers expect you to take responsible steps to prevent further loss. Failing to do so can sometimes reduce your settlement. Keep all receipts for temporary repairs, as these are often reimbursable.

- Make First Contact with Your Insurer: As soon as you are safe, notify your insurance agent or carrier that you have been affected. This initial call gets the process started. You don’t need a full damage assessment yet; just provide your name, policy number, and a brief description of the event.

Phase 3: The Formal Claim Process (Documentation and Follow-Through)

With the immediate danger over, the focus shifts to formally documenting your losses and working with your insurer to reach a fair settlement.

- Conduct a Thorough Damage Assessment: Go through your property and meticulously document every single loss.

- Visuals are Key: Take extensive photos and videos of the damage from multiple angles—both wide shots and close-ups.

- Use Your Inventory: Compare the post-disaster damage to your pre-disaster inventory. This will be the backbone of your claim.

- Organize Your Documentation and Track Expenses: Gather all your visual evidence, your inventory list, and any receipts for temporary repairs or living expenses (like hotel stays) if your home is uninhabitable. Keep everything in one organized digital folder.

- Collaborate with the Insurance Adjuster: Your insurer will assign an adjuster to inspect the damage.

- Be Present: Attend the inspection to point out damages the adjuster might miss.

- Provide Evidence: Give the adjuster copies of all your documentation—do not hand over your originals.

- Ask Questions: Use this time to understand the next steps and the expected timeline for your claim.

- Maintain Clear and Consistent Communication: The claims process can take time. Keep detailed notes of every phone call, email, and conversation with your insurer, including the date, time, and person you spoke with. Follow up regularly to check on your claim’s status. If you face unreasonable delays or disputes, don’t hesitate to escalate the issue or lean on your independent agent for advocacy.

Managing the Stress of a Claim

Beyond the checklists and documentation, it’s crucial to acknowledge the human side of recovery. Filing a claim in the wake of a disaster is more than just a financial process; it’s an emotionally taxing journey. The process requires patience, so it is essential to prioritize your well-being by taking breaks and focusing on what you can control. Remember, you do not have to navigate this complex and stressful period alone. Lean on your family and community for support, and just as importantly, lean on your professional advocate. Your independent insurance agent is a vital part of this system, serving as an expert guide who can lift the administrative burden, manage communication, and fight for your best interests, allowing you to focus on what truly matters—your family and your recovery.

The Role of Independent Insurance Agents in Disaster Claims

Independent insurance agents offer invaluable assistance during the stressful aftermath of a disaster.

Personalized Support and Advocacy

They provide tailored advice by comparing policies and highlighting potential coverage gaps. Their expertise ensures that the claims process is navigated efficiently.

Regional Expertise

Local agents possess intimate knowledge of regional risks, enabling them to recommend appropriate coverage and timely solutions.

Comprehensive Coverage Coordination

Independent agents can coordinate multiple aspects of insurance—from personal to commercial—ensuring that all your assets are adequately protected. In some circumstances, specialized coverage like kidnap & ransom insurance can provide invaluable peace of mind. Many agents also assist with health insurance plans or life insurance solutions when rebuilding after a disaster.

Facilitation of Timely Adjustments

Agents often communicate directly with your insurer to help streamline the resolution process. Their role is crucial when discrepancies or misunderstandings arise, ensuring your claim is processed fairly and swiftly.

Advanced Resources to Strengthen Your Claim

Beyond the fundamental steps of documentation and communication, leveraging modern tools, understanding the claims environment, and tapping into community support can give you a significant advantage. These advanced resources can help streamline your process, protect your rights, and ensure you are prepared for the evolving landscape of disaster recovery.

Embrace Evolving Trends in Insurance Claims

The insurance industry is continuously adapting to new technologies and risks. Staying aware of these trends can help you navigate the process more effectively.

- Digital Claims Processing: Insurers are increasingly using digital tools for faster claim submission and real-time tracking. Embrace online portals and mobile apps to upload documents, communicate with adjusters, and monitor your claim’s progress, which can significantly speed up the timeline.

- Enhanced Transparency: Modern systems provide clearer status updates and timelines, reducing uncertainty. This transparency builds trust and helps you know where your claim stands at all times.

- Improved Fraud Prevention: Insurers now use sophisticated data analytics and AI to detect fraudulent claims. This makes providing thorough, accurate, and consistent documentation more critical than ever, as automated systems can flag incomplete or contradictory information.

- Adapting to Shifting Risk Profiles: With climate change altering the frequency and severity of disasters, insurers are constantly updating risk models. This may affect your policy, so it is crucial to stay informed about how new risks like wildfires or regional flooding could impact your coverage needs.

Navigate the Legal and Regulatory Landscape

Understanding the framework that governs your claim empowers you to be your own best advocate.

- Familiarize Yourself with Local Regulations: Insurance rules vary by state. A basic understanding of your state’s guidelines for claims processing times and settlement practices can be invaluable during negotiations.

- Know Your Rights as a Policyholder: Regulatory bodies exist to protect consumers. If you believe your claim is being unfairly delayed, denied, or mishandled, you have the right to file a complaint with your state’s insurance regulator.

- Keep Up with Policy Updates: Insurance companies periodically revise policy language. Regularly reviewing any updates or amendments sent by your insurer ensures you are arguing your case based on the most current terms and conditions.

Leverage Community and Digital Resources

You don’t have to go through the process alone. Modern tools and local support networks can provide a significant boost to your efforts.

- Tap into Community Knowledge: Local organizations, neighborhood associations, and online support groups often share firsthand experience and practical advice on disaster recovery. These groups may offer workshops or webinars on claims documentation and navigating local challenges.

- Use Digital Tools for Efficient Documentation: Streamline your evidence gathering with modern technology. Secure mobile apps are available that allow you to build detailed home inventories, capture high-resolution photos, and organize receipts directly from your phone, making it easier to share complete information with your insurer.

After the Claim: Rebuilding and Enhancing Your Preparedness

Recovery is not just about financial compensation; it’s an opportunity to improve your disaster preparedness.

Reassess Your Insurance Coverage

After your claim is settled, review your policy to identify any weaknesses or gaps. Adjust your coverage to better reflect your current risk factors and financial situation.

Learn from the Experience

Evaluate the challenges you encountered during the claims process. Improving documentation practices and communication can help streamline future claims. Reflect on any delays or issues, and update your emergency plan accordingly.

Enhance Your Preparedness

Invest in property upgrades and revisit emergency measures. Consider innovations like smart leak detectors, reinforced structural elements, or improved security systems to mitigate future risks. These proactive steps may not only reduce damage during subsequent disasters but also positively influence your insurance premiums and claim outcomes.

Ensuring Future Stability in a Changing World

Filing disaster insurance claims may seem daunting, but strategic preparation and the right support can protect your assets and expedite recovery. By reviewing your policies, diligently documenting damages, and leveraging expert guidance, you can navigate the claims process with confidence. Moreover, staying informed about regulatory developments and technological advancements can further empower you as you manage risks in a changing environmental landscape.

If you’re uncertain about whether your current policy adequately covers your risks, now is the time to seek personalized advice. Independent insurance agents, like those at Torian Insurance, offer the expertise needed to optimize your coverage and safeguard your future.

Reach out to a Torian Insurance expert today for a comprehensive policy review or disaster preparedness consultation, and take proactive steps to ensure you’re fully prepared for whatever challenges lie ahead.