Insurance fraud is a widespread issue that drives up premiums and affects everyone—from individual policyholders to large businesses. Fraudulent claims force insurers to tighten processes and ultimately lead to higher costs for honest customers. By learning to spot warning signs and remain vigilant, you can protect yourself from insurance fraud, safeguard your assets, and support a healthier insurance environment overall.

This guide outlines practical strategies for insurance fraud prevention. We explain the common types of fraud, highlight key red flags to watch for, and offer actionable advice for both personal and commercial insurance needs. Additionally, we discuss how independent insurance agents, like Torian Insurance, play a vital role in securing your coverage and providing customized solutions. As you read on, you will gain valuable insights into how both technology and proactive personal measures work hand in hand in this ongoing battle against fraud.

Understanding Insurance Fraud: Recognizing the Threat

Insurance fraud involves intentional deception to secure financial gain by exploiting policies designed to protect you. Fraud can occur in many forms, both complex and straightforward, and understanding these forms is the first step in prevention. Common types of insurance fraud include:

- Hard Fraud: The deliberate fabrication of a loss, such as staging a car accident or committing arson. This type of fraud usually requires extensive planning.

- Soft Fraud: Exaggeration of a legitimate claim, such as inflating repair costs or overstating damages. Although less overt, soft fraud remains illegal and pushes premiums higher for everyone involved.

- Application Fraud: Misrepresenting facts during the application process, such as omitting critical health information or property details to obtain a lower premium.

- Third-Party Fraud: Occurs when individuals who are not policyholders attempt to file a claim, such as orchestrating a slip-and-fall incident that might be covered under Business Liability Insurance.

Each type of fraud not only results in financial losses but also diverts resources away from legitimate claims. The broader impact contributes to systemic challenges within the insurance industry, affecting underwriting procedures, claims processing times, and regulatory policies.

The Ripple Effect: Why Fraud Impacts Everyone

Insurance fraud is far from a victimless crime. While it may seem targeted at a large insurance company, its consequences create a ripple effect that ultimately impacts every policyholder, family, and business in the community. Understanding these broad implications is the first step toward effective prevention.

For Personal Policyholders

- Higher Premiums for Everyone: When insurers pay out fraudulent claims, they absorb those losses by raising rates. A staged accident in your area can directly increase your own insurance bills.

- Stricter Claims Processes: To combat fraud, insurers often implement more rigorous and lengthy review processes, which can slow down legitimate claims for honest customers.

- Shared Financial Burden: Ultimately, the cost of dishonesty is passed down, forcing the entire community to shoulder the financial weight of a few fraudulent actors.

For Businesses

- Increased Operational Costs: Businesses face the dual threat of paying higher insurance premiums while also being direct targets for costly schemes.

- Direct Financial and Reputational Damage: Exaggerated workers’ compensation claims, false vendor invoices, or staged liability incidents can cause significant financial loss and harm a company’s hard-earned reputation.

- Vulnerability in Specialized Coverage: Even complex policies such as cyber insurance or professional liability are targeted, making fraud awareness a critical part of a company’s risk management strategy.

The Broader Societal Cost

- Diverted Resources: The time, money, and effort spent investigating fraudulent activity are resources that could have been used to support and pay legitimate claims more quickly.

- Erosion of Trust: Widespread fraud damages the fundamental trust between policyholders and insurers, making the entire system more difficult and stressful to navigate for everyone involved.

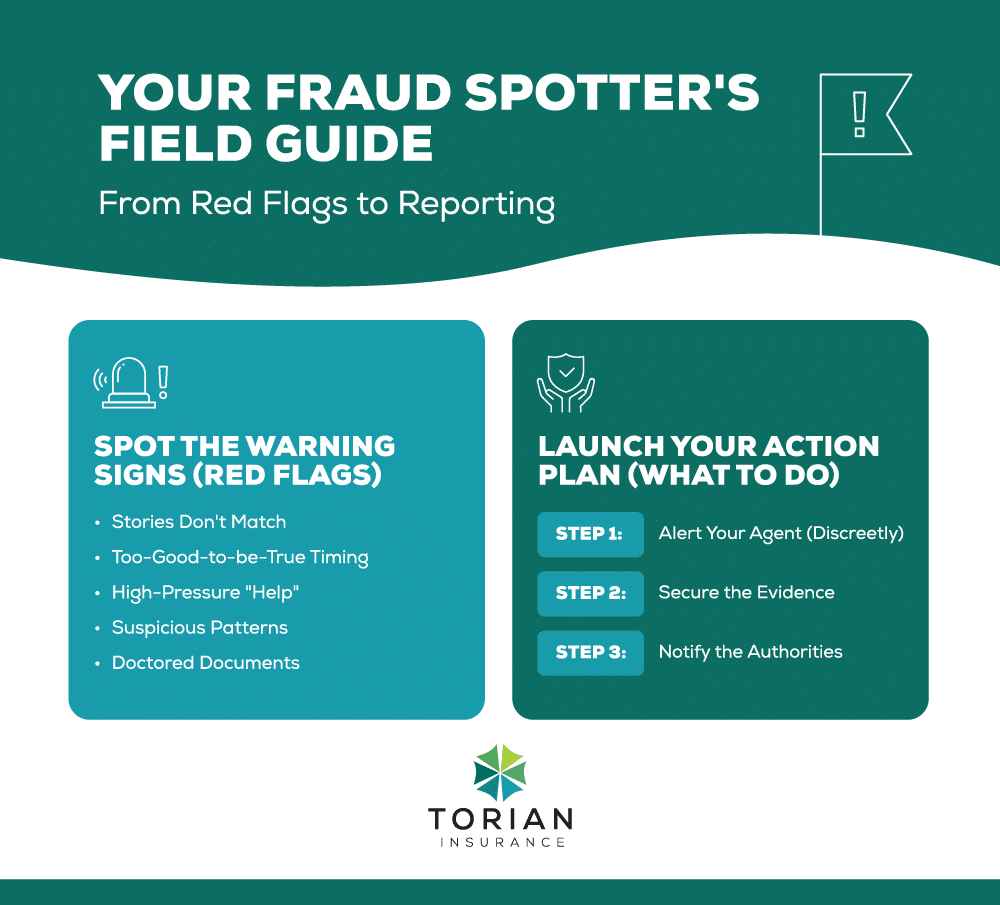

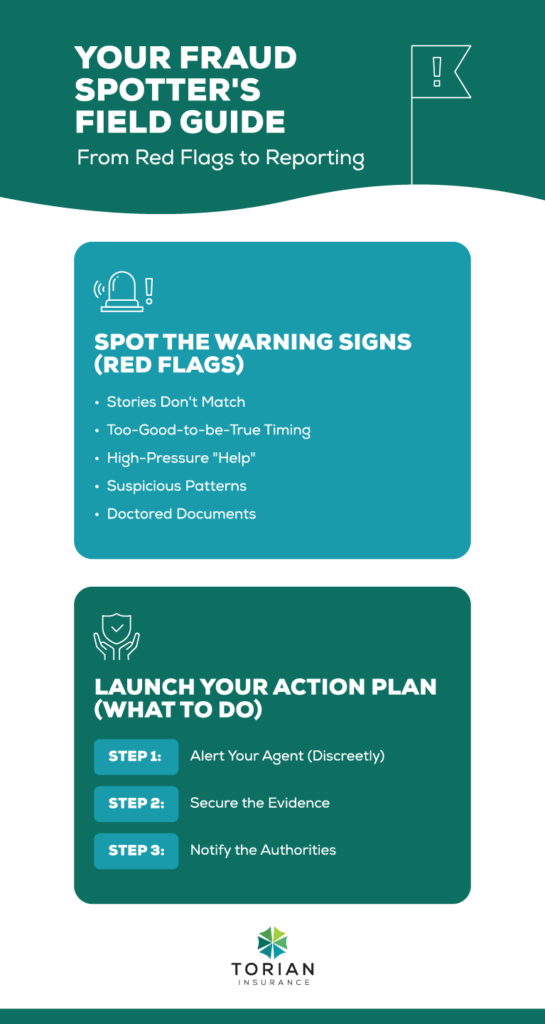

Identifying the Red Flags of Insurance Fraud

Recognizing warning signs is crucial to preventing fraud. Fraudulent activities often leave behind a trail of inconsistencies and dubious details, which may appear during various stages of a claim.

Warning Signs for Individual Policyholders

- Inconsistent Claim Details: Vague or conflicting information in documentation could hint at manipulated evidence.

- Quick Claims After Policy Start: Filing a significant claim immediately after purchasing a policy can be a red flag.

- Unsolicited Service Offers: Aggressive or unexpected offers from contractors or adjusters should be verified thoroughly.

- Pressure Tactics: Be cautious if someone insists on filing a claim immediately without adequate time for assessment.

Warning Signs for Businesses

- Repeated Claims: A history of multiple suspicious claims from the same department or individual can indicate organized fraud.

- Incomplete or Altered Documents: Falsified invoices or receipts that conflict with official records require careful review.

- Contradictory Reports: Discrepancies between witness accounts, repair estimates, and the reported incident may signal potential deceit.

- Unusual Patterns: Look for claims filed during hectic periods when oversight might be weaker.

Real-World Examples

- Staged Accidents: Fraudsters may deliberately cause a collision to file exaggerated damage or injury claims, sometimes leaving clues of a fabricated scenario.

- Bogus Damage Claims: Fraudsters might submit claims for events that occurred long before the policy was active.

- Inflated Invoices: Charging for unnecessary repairs or inflated treatments is a common tactic to receive higher payouts.

By staying alert to these red flags, you can help stop fraud in its tracks and ensure that only legitimate claims are processed. Continuous education and vigilance remain the strongest defenses against such deceptive practices.

Suspect Fraud? Here’s How to Report It

Recognizing a red flag is the first step. Taking decisive, informed action is the next. If you suspect you have encountered or become a victim of an insurance scam, it’s important not to confront the individual directly. Instead, follow these steps to report it safely and effectively.

Step 1: Contact Your Insurance Agent or Company

Your first call should be to your independent insurance agent or your insurance company’s dedicated fraud hotline. Share your suspicions discreetly and provide a clear, factual account of the situation. Insurers have Special Investigations Units (SIUs) staffed by professionals who are trained to handle these sensitive situations and investigate them thoroughly.

Step 2: Gather and Organize Your Documentation

Collect any evidence that supports your suspicion. Solid proof is critical for any investigation. This could include:

- Photos with timestamps

- Conflicting invoices or repair estimates

- Written correspondence (emails, letters)

- Detailed notes from suspicious conversations, including dates and times

Step 3: Report to Official Anti-Fraud Organizations

For an added layer of action, you can report your concerns to national and state authorities. The primary organization for this is the National Insurance Crime Bureau (NICB), a non-profit dedicated to combating insurance fraud and theft.

- You can file a confidential report online at NICB.org.

- Additionally, you can contact your state’s Department of Insurance, which regulates the industry and handles consumer complaints.

Your Proactive Fraud Prevention Playbook

Preventing insurance fraud isn’t about a single action but about building consistent, vigilant habits into your personal and professional routines. This playbook outlines the ongoing best practices that serve as your strongest defense against scams and fraudulent activity.

For Individual Policyholders

- Conduct Annual Policy Reviews: Meet with your insurance agent at least once a year. This ensures your personal information, contact details, and coverage levels are accurate and up-to-date, closing potential gaps that fraudsters could exploit.

- Maintain a Detailed Digital Inventory: Regularly update a comprehensive inventory of your belongings with photos, videos, receipts, and serial numbers. Storing this on a secure cloud service not only speeds up legitimate claims but also serves as powerful proof against inflated or fabricated loss claims.

- Be Skeptical of Unsolicited Offers: After an incident, be wary of unsolicited contractors, tow truck operators, or public adjusters who show up unannounced and pressure you to make quick decisions. Always take the time to independently verify their credentials and reputation.

- Leverage Security Technology: Smart-home devices, such as security cameras and leak detectors, do more than just deter crime. They provide timestamped, objective data that can validate the circumstances of a legitimate claim and protect you from liability in staged incidents.

For Business Owners

- Establish Strong Internal Controls and an Ethical Culture: Create a system of checks and balances. Require multiple approvals for significant transactions, conduct regular, unannounced audits, and foster a culture where integrity is emphasized. Ensure employees know the clear, confidential process for reporting suspicious activity.

- Protect Against Internal Threats: While external scams are a concern, a significant risk comes from within. To safeguard your assets from losses due to employee theft, forgery, or electronic crime, it’s crucial to have a dedicated policy. Implementing commercial crime insurance provides a critical financial backstop against these internal threats.

- Invest in Ongoing Employee Training: Your staff is your first line of defense. Conduct regular training to help them recognize the red flags of fraud—from falsified invoices to suspicious customer claims—and understand their role in preventing it.

- Thoroughly Vet All Vendors and Contractors: Before entering into a partnership, conduct due diligence. Verify the credentials, licenses, and track records of all third-party vendors to ensure you are working with reputable and trustworthy entities.

- Implement a Claims Monitoring System: Keep a detailed log of all claims filed. Regularly analyzing this data can help you uncover unusual patterns, such as a high frequency of claims from a specific department or individual, allowing for prompt investigation.

- Partner with Your Agent for Regular Risk Assessments: Work closely with your independent insurance agent to tailor policies to your unique operational risks. A proactive partnership helps close coverage gaps and ensures your policies are structured to minimize vulnerability to fraud.

The Role of Technology in Reducing Insurance Fraud

Modern technology provides robust tools for detecting and preventing fraud:

- Predictive Analytics: Advanced algorithms analyze claim histories and behavior patterns to flag suspicious activities early.

- Smart Devices: Home security systems, leak detectors, and similar devices supply real-time data that helps validate claims.

- Vehicle Telematics: Collecting driver behavior data can reduce investigation costs by identifying anomalies promptly.

- AI-Driven Detection: Artificial intelligence scans large datasets for patterns that suggest potential fraud.

- Blockchain Technology: A secure ledger system that records transactions, reducing the chance of tampering.

While technology offers key support, effective fraud prevention also requires ground-level vigilance and accountability.

The Role of Independent Insurance Agents in Fraud Prevention

Although technology is vital, independent insurance agents remain an essential line of defense. Agencies like Torian Insurance offer multiple advantages to clients looking for custom insurance solutions:

- Customized Coverage: Agents assess each client’s unique risks and design policies to avert potential loopholes.

- Proactive Fraud Education: Ongoing updates and tailored advice empower policyholders to protect themselves from insurance fraud effectively.

- Ongoing Support: Frequent policy reviews and rapid response to suspicious activity heighten overall protection.

- Trusted Relationships: Long-standing, community-oriented agencies often demonstrate a deeper commitment to transparency and service quality.

For more details on how independent insurance agents can simplify the process and provide various coverage options, see Bankrate’s overview.

A United Front: The Collaborative Fight Against Fraud

Effective fraud prevention is not the responsibility of a single entity but a unified effort that spans from national regulatory bodies to local community partnerships. This collaborative approach creates a multi-layered defense that protects consumers, strengthens the industry, and fosters a culture of integrity.

At the highest level, regulatory bodies, insurers, and industry associations work in concert to combat fraud. Regulators set baseline standards and enforce penalties for fraudulent activities, while insurance companies and industry groups share data to stay ahead of emerging schemes. This top-down collaboration results in better fraud detection tools, refined best practices, and a more secure and stable insurance environment for all policyholders.

This united front is just as critical at the community level. Engaging with trusted, homegrown insurance agents and local organizations fosters a transparent environment where policyholders feel comfortable asking questions and reporting anomalies. These community partnerships encourage educational events and workshops, providing residents and entrepreneurs with the tools to spot scams. As neighbors and businesses collaborate and share information about potential fraud patterns, they create a powerful local safety net that deters criminals and reinforces a culture of vigilance and honesty.

Protecting Your Financial Future: A Call to Vigilance Against Insurance Fraud

Insurance fraud threatens everyone’s financial security and erodes trust in the industry. Yet by staying proactive, recognizing the red flags, and working with dedicated independent agents, you can significantly reduce your risk. Take the time to review your policies, adopt home insurance tips, and collaborate with professionals committed to delivering custom insurance solutions.

For additional guidance on how to protect your assets or explore strategies to minimize exposure contact Torian Insurance for personalized support. Our team in Evansville, Indiana, is ready to help ensure you have the coverage you need to guard against fraud and secure long-term peace of mind.