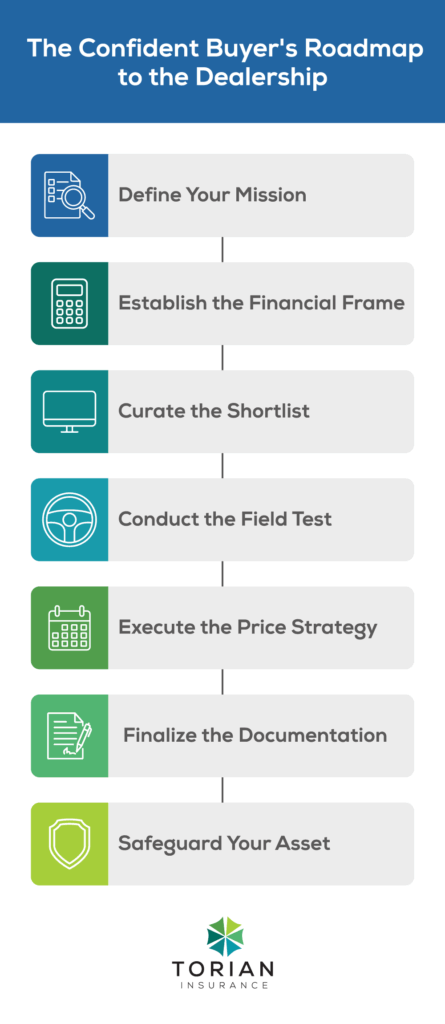

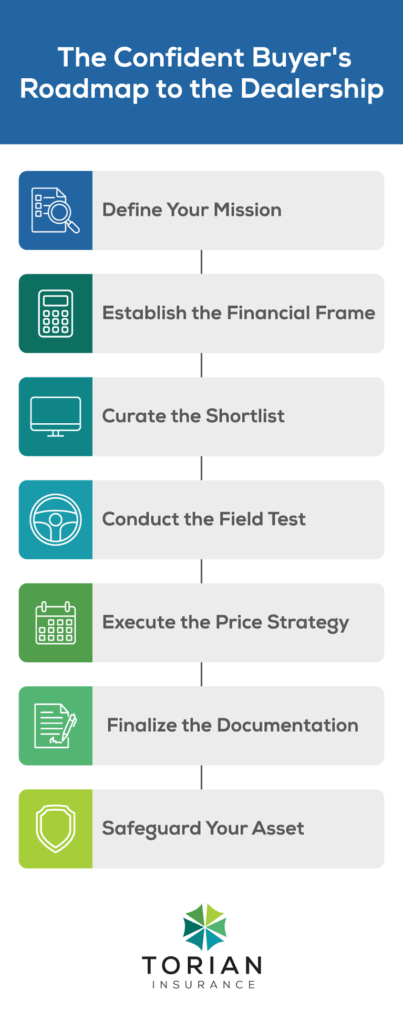

Buying a new car is an exciting milestone, but it can also be overwhelming if you’re unsure about the process. Whether you’re a first-time buyer or a seasoned shopper, this guide will empower you to make informed decisions. From assessing your needs to negotiating a fair price and securing the right insurance, we cover every essential step in the car-buying journey.

This guide is designed to help you align your car choice with your lifestyle, budget, and long-term goals. As you progress, remember that a critical part of any vehicle purchase is obtaining reliable insurance coverage. Torian Insurance, with its deep local roots and status as independent insurance agents, is dedicated to helping you protect your investment with tailored policies.

Assessing Your Vehicle Needs

Before visiting dealerships, the most important step is to clearly define what you need in a vehicle. A focused approach saves time, prevents impulse decisions, and ensures your final choice aligns perfectly with your lifestyle and budget.

First, consider how your vehicle will fit into your daily life. Answering these questions will help you narrow your search from hundreds of models to a handful of practical options:

- Who and what will you be carrying? Do you need extra space for a growing family, pets, or bulky cargo for work or hobbies? This will help you decide between an SUV, a sedan, a truck, or a van.

- What is your typical drive? Is fuel efficiency a top priority for a long daily commute, or do you need the power and capability of all-wheel drive for weekend adventures?

- What features are non-negotiable? Once you know the type of vehicle you need, list the essential features that will make your drive safer and more enjoyable:

- Safety: Prioritize modern systems like blind-spot detection and automatic emergency braking. Check sources like Consumer Reports for reliability data.

- Comfort: Consider climate control, adjustable seats, and other amenities crucial for your driving experience.

- Performance: Evaluate engine power and handling based on your typical driving conditions.

- Technology: Decide how important features like built-in navigation and smartphone connectivity are to you.

By distinguishing between essential “must-haves” and desirable “nice-to-haves,” you can focus your search on vehicles that truly fit your needs while staying firmly within your budget.

Deciding Whether to Lease or Buy a New Car

One of the first decisions is whether to buy or lease. Each has its advantages, so weigh your options carefully.

Advantages of Buying

- Equity: Once the loan is paid off, the car becomes an asset.

- Unlimited Mileage: There are no restrictions on how much you can drive.

- Customization: As the owner, you can modify the car as you wish.

- Long-Term Savings: Although monthly payments may be higher, owning the car can be less expensive over time.

Advantages of Leasing

- Lower Monthly Payments: Leasing can offer more affordable monthly options.

- Newer Models: Shorter lease terms allow you to drive the latest models.

- Warranty Coverage: Leased vehicles typically remain under the manufacturer’s warranty during the term.

- Tax Benefits: For certain business uses, there may be tax advantages.

Setting a Realistic Budget

Creating a realistic budget is crucial for ensuring your car purchase fits your financial circumstances. A well-planned budget covers both the upfront costs and ongoing expenses of ownership.

Calculating Upfront Costs

- Down Payment: A higher down payment reduces your loan amount and overall interest.

- Trade-In Value: Research your current car’s worth to negotiate confidently.

- Taxes and Fees: Account for sales tax, registration, and title fees when estimating your total cost.

Accounting for Recurring Expenses

- Monthly Payments: One of the top car financing tips is to ensure your payments fit comfortably within your income. Use tools like Bankrate’s Auto Loan Calculator to compare offers.

- Maintenance and Repairs: Even new cars require regular maintenance.

- Fuel Costs: Check AAA’s Fuel Cost Calculator to project your average monthly fuel spending.

- Insurance Premiums: Get quotes before finalizing the car purchase to understand how the vehicle affects insurance rates.

Budgeting Tips

- Secure loan pre-approval before dealership visits to define your spending limit.

- Stick to your budget by avoiding unnecessary upgrades.

- Factor in a buffer for unexpected expenses.

A realistic budget helps prevent overextension and ensures that your new car purchase is sustainable over time.

Researching and Narrowing Down Car Options

After determining your needs and budget, the next step is thorough research. This phase helps you narrow down the many available options to the best few that meet your criteria.

Methods for Effective Research

- Automotive Reviews and Ratings: Use sources like Kelley Blue Book and Edmunds for in-depth reviews and reliability data.

- Manufacturer Information: Check detailed vehicle specifications and available trim levels.

- Online Inventories: Local dealership inventories provide real-time availability.

- Price Comparisons: Utilize tools to compare market prices and fair values in your area.

Evaluating Key Vehicle Features

When comparing different models, consider:

- Performance and Efficiency: Compare fuel consumption, driving dynamics, and horsepower.

- Safety Technologies: Prioritize models with advanced safety systems.

- Comfort and Convenience: Look for interior quality and user-friendly controls.

- Long-Term Costs: Factor in depreciation, maintenance expenses, and fuel economy.

Creating a Shortlist

Concentrate on two or three models that best fit your lifestyle and budget. This focused approach makes the testing phase more manageable and effective.

The Art of Test Driving

A test drive is your opportunity to verify that a car meets your standards for comfort, performance, and functionality. It’s the final step in confirming that your research aligns with real-world experience.

Tips for an Effective Test Drive

- Test Multiple Models: Compare at least two or three vehicles on your shortlist to truly understand the differences in ride and handling.

- Simulate Your Daily Routine: Drive on familiar roads, including city streets, highways, and even into a tight parking spot, to see how the car performs in your typical environment.

- Examine Key Features: Interact with the infotainment system, adjust the seats, and test the usability of critical controls and technologies you’ll be using every day.

- Assess Comfort and Visibility: Pay close attention to seat comfort, cabin noise, the quality of the ride, and your visibility from the driver’s seat.

After each test drive, take a moment to jot down notes on the car’s performance and how well it aligns with your needs. This immediate feedback is invaluable when it’s time to make your final decision.

Best Time to Buy a New Car

Timing your purchase can lead to significant savings. Here are some key periods to consider for securing the best deal.

- End of the Month or Quarter: Sales teams may be more willing to negotiate as they try to hit quotas.

- End-of-Year Sales: From October through December, dealerships discount older models to make room for new inventory.

- Holiday Promotions: Major holidays often feature limited-time incentives.

- New Model Launches: Prior-year models frequently get price cuts right before next-year releases.

- Slow Sales Periods: Visiting showrooms on early weekdays or during the winter months may net you additional discounts.

By shopping during these strategic periods, you can often land a favorable offer.

Negotiating Car Prices with Confidence

Negotiation is a critical part of the car-buying process. Being well-prepared and informed boosts your confidence and helps you secure a price within your budget. This section addresses “Negotiating Car Prices” in a way that benefits you most.

Essential Negotiation Strategies

- Research Prices: Understand both the MSRP and dealer invoice price. Gather data on regional market values using resources such as Cars.com’s negotiation tips.

- Focus on Total Cost: Negotiate based on the full price of the car rather than monthly payments.

- Separate Trade-In Discussions: Negotiate your trade-in separately from the new car’s price.

- Be Prepared to Walk Away: If the deal doesn’t meet your expectations, be ready to leave.

- Ask About Incentives: Inquire about promotions, rebates, or discounts, and check NADA Guides for additional price reference points.

Finalizing the Negotiation

Once you reach an agreement, ensure all terms—including add-ons and fees—are clearly documented in writing. This step prevents misunderstandings and protects you from unexpected costs.

Exploring Car Financing Options

Financing your vehicle is an important component of the overall purchase. Understanding your options helps you choose a strategy that suits your budget and long-term plans, a crucial part of any list of car financing tips.

Financing Sources

- Dealership Financing: Offers convenience, often with promotional rates, but may include markups.

- Banks or Credit Unions: Typically provide competitive interest rates and transparent terms.

- Online Lenders: Offer a fast pre-approval process and the ability to compare multiple offers.

Key Factors in Financing

- Loan Term: Longer terms mean lower monthly payments but more interest paid over time.

- Interest Rates: Even a small difference in APR can lead to significant overall savings.

The Benefit of Pre-Approval

Obtaining pre-approval helps define your budget and strengthens your negotiating position at the dealership. It also provides a helpful benchmark when comparing financing offers.

Finalizing the Deal and Reviewing Add-Ons

When you are satisfied with the negotiated price and financing terms, finalize the deal by carefully reviewing all paperwork.

Key Aspects to Check

- Cost Breakdown: Confirm that the purchase price, taxes, fees, and trade-in allowances match your agreed terms.

- Loan Terms: Verify the interest rate, loan term, and monthly payment structure. The Consumer Financial Protection Bureau guide offers helpful information.

- Optional Add-Ons: Evaluate extended warranties or services. Only choose add-ons that provide clear value.

Final Inspection

Before taking delivery, inspect the vehicle for any damage or discrepancies, and ensure all promised accessories are included. A thorough final check can prevent future complications.

Secure the Right Insurance Before You Drive Away

Securing the right car insurance is not just the final step—it’s one of the most critical parts of protecting your new investment. Before you even get the keys, you need a policy in place that safeguards you, your passengers, and your vehicle from the unexpected. For a new car, this goes far beyond meeting the legal minimums.

Why Your New Car Needs More Than Basic Coverage:

- It’s a Legal Requirement: All states require a minimum level of liability coverage to protect other drivers in case you are at fault in an accident.

- It Protects Your Investment: A new car is a significant financial asset. Comprehensive and collision coverage are essential. Comprehensive covers non-accident-related damage (like theft, vandalism, or storm damage), while collision covers repairs to your vehicle after a crash.

- It’s Required by Your Lender: If you are financing or leasing your vehicle, your bank or leasing company will mandate that you carry both comprehensive and collision coverage to protect their investment until the loan is paid off.

- It Covers the “GAP”: A new car depreciates the moment you drive it off the lot. If your car is totaled, your insurance will pay its current market value, which may be less than what you still owe on your loan. GAP Insurance is a crucial add-on that covers this financial “gap,” so you aren’t left paying for a car you no longer have.

Beyond the Basics: Other Essential Coverages

A truly robust policy includes protection for common but often overlooked risks. An expert agent will also discuss options like:

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: What happens if you’re hit by a driver who has no insurance or not enough to cover your medical bills and vehicle repairs? This vital coverage steps in to pay for your expenses, protecting you from other drivers’ lack of responsibility.

- Personal Injury Protection (PIP): In certain states, PIP can cover medical expenses and even lost wages for you and your passengers after an accident, regardless of who was at fault. It provides a crucial financial safety net for your recovery.

The Smartest Way to Insure Your New Car

Don’t settle for a one-size-fits-all policy. As independent insurance agents, Torian Insurance can source quotes from multiple carriers to find a policy tailored to your specific vehicle and needs. We ensure you have the right protection, from liability limits to essential add-ons like GAP and UM/UIM coverage, all at a competitive price.

Protecting Your Investment: Post-Purchase Care

Once you’ve driven off the lot, the focus shifts from buying your new car to protecting it for the long term. A smart ownership strategy involves both diligent physical maintenance and comprehensive insurance coverage to safeguard your investment, ensure its longevity, and maintain its value.

Essential Vehicle Maintenance

Adhering to the manufacturer’s recommended service schedule is the best way to keep your car running smoothly and prevent costly issues.

- Routine Service: Prioritize regular oil changes, tire rotations, and brake inspections.

- Keep Detailed Records: Maintaining a log of all service and repairs can significantly boost your car’s resale value.

- Plan for the Unexpected: Set aside a dedicated fund for maintenance and unexpected repairs to avoid financial stress down the road.

Drive Forward with Confidence

Purchasing a new car is a milestone that combines personal preference with smart financial planning. By assessing your needs, setting a realistic budget, securing financing, and negotiating with confidence, you have taken all the necessary steps to make an informed decision.

But your journey doesn’t end when you get the keys. Your insurance needs aren’t static. Life events, vehicle modifications, or changes in your driving habits can all impact your coverage. A periodic policy review with Torian Insurance ensures your protection remains optimal and cost-effective, allowing you to adapt to changing circumstances with confidence.

Protecting your investment is just as important as making the right purchase. Torian Insurance is ready to help you find a policy tailored to your new vehicle and your future. Contact us today for a personalized quote and drive your new car with complete peace of mind.