Safeguarding the physical assets that keep your business running is essential. Business property insurance, often called commercial property insurance, protects these assets—including your building, equipment, and inventory—from perils like fire, storms, or theft.

By covering repair or replacement costs, it provides a crucial financial safety net that enables your business to recover quickly and maintain operations after an unexpected disruption. A key benefit is its flexibility; because every business faces unique risks, working with an independent insurance agency is vital to ensure your policy is tailored to your specific vulnerabilities, leaving no critical gaps in your coverage.

What Business Property Insurance Covers (and What It Doesn’t)

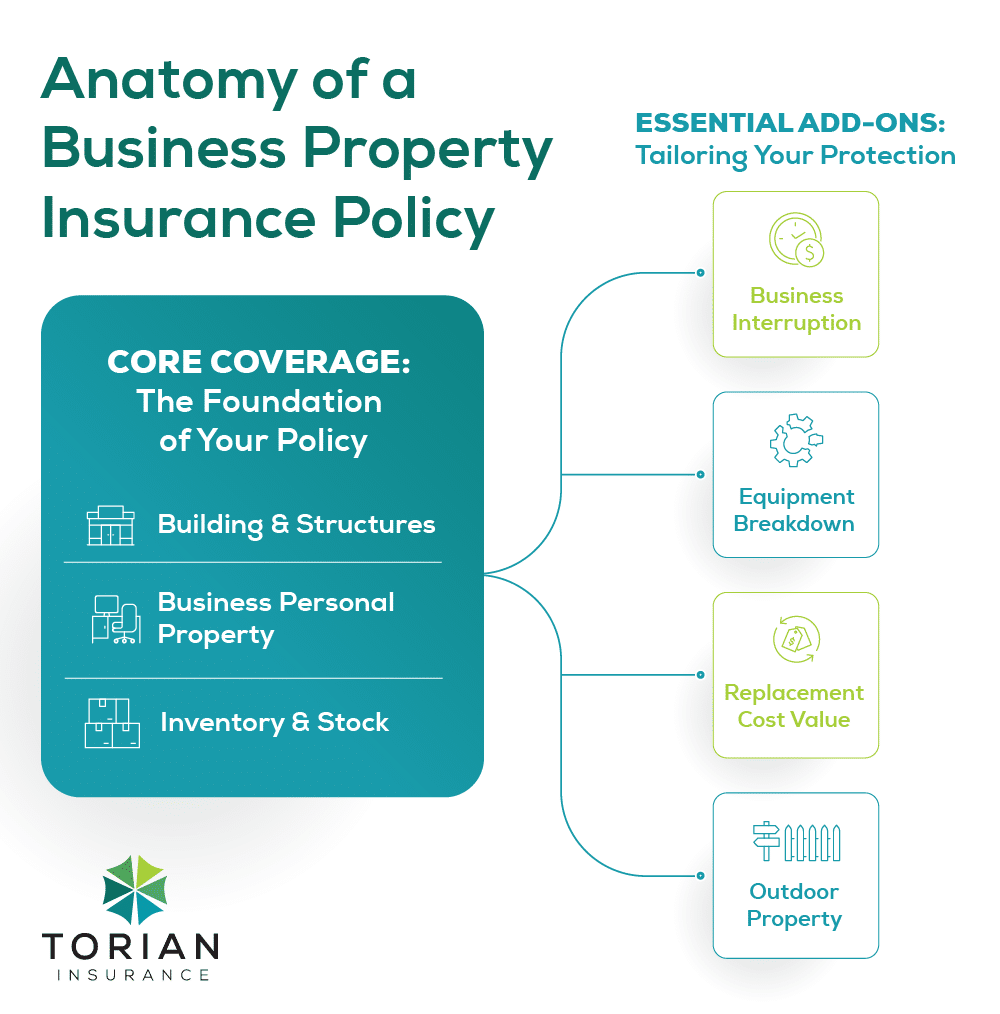

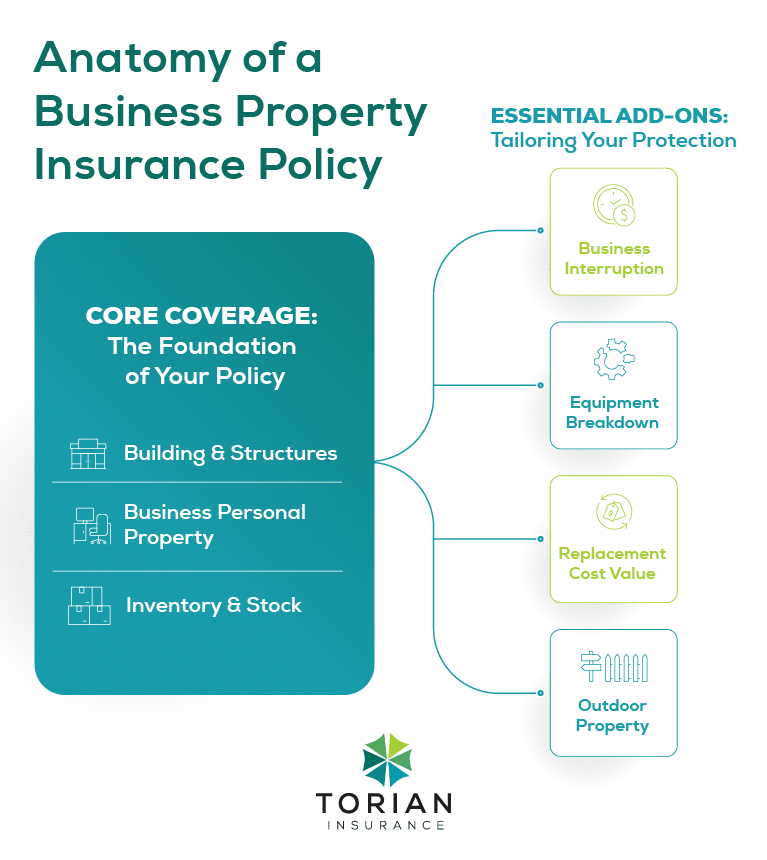

A solid business property insurance policy provides both standard and optional coverage that can be adapted to your risk profile.

Standard Coverage

Standard coverage typically includes protection for:

- Buildings: Covers damage to physical structures caused by hazards such as fires or storms.

- Inventory: Protects stock from theft or damage, essential for retail, wholesale, and manufacturing operations.

- Equipment and Furniture: Covers repair or replacement costs for essential operational items.

Additional Coverage Options

To address specialized risks, policies often allow for optional add-ons:

- Business Interruption Insurance – Provides lost income coverage and helps pay for ongoing expenses if an incident forces a temporary shutdown.

- Equipment Breakdown Coverage – Covers repairs or replacement expenses for key machinery in case of mechanical or electrical failure.

- Replacement Cost Coverage – Reimburses the expense of replacing items with new equivalents, rather than paying out depreciated values.

- Outdoor Assets – Safeguards elements like signage, fencing, and landscaping from damage due to weather or vandalism.

Common Exclusions

It is important to understand what is not covered by a standard policy:

- Wear and Tear: Routine maintenance and gradual deterioration are excluded.

- Intentional Damage: Damage caused deliberately by the business or its employees is not covered.

- Flood and Earthquake Damage: These catastrophic events are often excluded and require separate coverage.

Why This Coverage is a Non-Negotiable Asset

Protecting your physical assets is crucial for the sustainability and growth of your business, and business property insurance serves as the primary defense against the common hazards that can derail an otherwise successful enterprise. This coverage provides a critical financial safety net, secures operational continuity, and shields your business from the significant losses associated with these frequent risks:

1. Damage from Natural Disasters and Severe Weather

Unforeseen events like powerful storms, hurricanes, or fires can result in extremely expensive repairs to buildings or the total loss of essential equipment. With proper insurance, you are supported financially, allowing you to focus on restoring operations rather than dipping into your business’s capital or taking on debt. For example, a local bakery that experiences a kitchen fire can quickly replace damaged ovens and refrigerators with the help of its policy. While standard coverage typically addresses common weather-related incidents, it is important to note that catastrophic events like floods or earthquakes often require separate, specialized policies.

2. Losses from Theft and Vandalism

Criminal activities can result in significant financial and operational setbacks. A break-in could lead to stolen inventory, and vandalism can cause extensive damage to your property. Insurance helps cover the costs associated with both, providing the necessary funds to repair the property and replace stolen items. For instance, a warehouse facing a burglary that results in stolen inventory can recover the funds needed to replenish its stock and resume sales, safeguarding long-term operations and maintaining customer trust.

3. Disruptions from Equipment and Utility Failures

Unexpected failures in critical machinery or utility systems can bring daily operations to a sudden and complete halt, directly impacting your revenue stream. This is where securing business continuity becomes essential. An important policy add-on, business interruption insurance, covers lost income and ongoing expenses such as payroll and rent, helping your business stay afloat during the recovery period. Additionally, equipment breakdown coverage specifically helps repair or replace essential items after a mechanical or electrical failure, ensuring minimal disruption to your services.

It’s also worth noting that insurance premiums can vary based on factors such as your business’s location, claims history, and the nature of your operations. Being transparent about your activities can help ensure accurate pricing and appropriate coverage for these and other risks.

A Step-by-Step Guide to Securing the Right Policy

Selecting the most appropriate business property insurance requires a structured approach that balances comprehensive coverage with affordability. Following these steps will help you make an informed decision and ensure your business is properly protected.

Step 1: Assess Your Risks and Value Your Assets

The foundational step is to conduct a thorough risk assessment to identify the unique threats your business faces, such as its vulnerability to natural disasters, theft, or equipment failures. Simultaneously, create a detailed inventory of all physical assets, including buildings, equipment, furniture, and stock. Gather key documents like inventory records and equipment receipts to support your valuations. During this process, you must decide whether you need replacement cost coverage (which pays to replace items with new equivalents) or actual cash value coverage (which pays out a depreciated value). While it may cost more, replacement cost coverage is often recommended to avoid out-of-pocket expenses when restoring your operations.

Step 2: Consult an Independent Insurance Agent

With a clear picture of your assets and risks, the next step is to seek professional guidance. A knowledgeable independent insurance agent, like Torian Insurance, offers invaluable insights and unbiased advice. Because they work with multiple insurers, they can compare a wide range of policies and tailor options that address your specific vulnerabilities, helping you find the best value and minimize coverage gaps.

Step 3: Carefully Compare Policies and Coverage Options

Your agent will present several policy options. When evaluating them, pay close attention to three key aspects:

- Policy Limits: Ensure the maximum payout is high enough to cover a total loss of your assets.

- Deductibles: Understand how much you will have to pay out-of-pocket for a claim. A higher deductible can lower your premium but increases your financial responsibility in a disaster.

- Exclusions: Be crystal clear on what is not covered. Identify any gaps and consider supplemental policies (like flood insurance) or endorsements to address them.

Beyond the basics, compare optional add-ons like business interruption or equipment breakdown coverage, or consider a bundled solution such as a Business Owner’s Policy (BOP) if it aligns with your needs.

Step 4: Finalize and Regularly Review Your Policy

Once you select the best policy, review its terms thoroughly before finalizing the agreement. Protection doesn’t end there; insurance is not a “set it and forget it” purchase. Regularly reassess your coverage—at least annually or after any significant business changes like purchasing new equipment or expanding your facility—to ensure your protection keeps pace with your growth.

The Independent Agent Advantage: Your Most Valuable Asset in the Process

While the steps above provide a clear roadmap for securing business property insurance, the key to unlocking the best outcome at every stage is partnering with an independent insurance agent. Rather than being just one step in the process, they are the strategic asset that enhances the entire journey, from initial assessment to long-term protection.

1. Bringing Expertise to Your Risk Assessment and Policy Comparison

An independent agent’s local expertise and access to a broad range of insurance options are invaluable during the initial planning stages. They can help you identify risks specific to your industry and region that you might overlook (Step 1), ensuring your assessment is truly comprehensive. More importantly, their ability to source quotes from multiple carriers is what makes a true, unbiased policy comparison (Step 3) possible. They go beyond just price, helping you weigh the nuances of different coverage forms and endorsements to find the best value.

2. A Long-Term Partner for Ongoing Protection

Unlike a direct agent who represents a single company, an independent agent works for you. They focus on building a lasting relationship, which is critical for the final, ongoing step of policy management (Step 4). As your business grows, purchases new equipment, or expands, your agent provides impartial advice and ensures your coverage adapts with you. This long-term guidance ensures you are never left with dangerous coverage gaps and that your policy continues to serve your best interests year after year.

Ultimately, working with an independent agency transforms the process from a simple transaction into a strategic partnership, providing you with the confidence that your business is protected by a customized, competitive, and comprehensive insurance solution.

Frequently Asked Questions About Business Property Insurance

What Types of Businesses Should Have Business Property Insurance?

Any business with physical assets—be it a retail shop, restaurant, manufacturer, or office—should consider business property insurance. If your operations rely on property, equipment, or inventory, this coverage is essential.

How Much Coverage Do Small to Medium-Sized Businesses Need?

Coverage amounts depend on factors such as asset value, operational risks, and geographic location. An independent agent can help tailor the coverage to avoid underinsurance or overinsurance.

Can I Bundle Business Property Insurance with Other Coverages?

Many insurers offer bundled policies, such as a Business Owner’s Policy (BOP), which combines business property insurance with liability coverage. Bundling can simplify policy management and be more cost-effective, but always ensure the bundled options align with your specific needs.

Ensuring Long-Term Business Resilience Through Comprehensive Insurance

Protecting your business from unforeseen events is a critical aspect of maintaining long-term operational success. Business property insurance offers a financial safety net that mitigates the impact of unexpected damage, ensuring that your business can quickly recover and continue growing. By understanding the key components of coverage, identifying your unique risks, and partnering with an independent insurance agency, you can secure a policy that reflects the true needs of your operation.

Take the first step toward safeguarding your business. Reach out to Torian Insurance, a trusted insurance agency Evansville, IN, to schedule a consultation or request a personalized quote. Secure your future with a tailored insurance solution that keeps your business running, no matter what challenges arise.