Fundraising events provide vital resources for nonprofits, but unexpected challenges—such as injuries, property damage, or event cancellations—can jeopardize success. Securing proper fundraiser insurance safeguards your event, participants, and mission. This guide outlines key insurance considerations for nonprofits—from identifying risks to selecting appropriate coverage—and highlights the advantages of working with an independent insurance agency like Torian Insurance for a tailored plan.

Understanding the Risks of Fundraising Events

Fundraising events vary widely, and each type comes with unique risks. Crowded venues may increase the chance of accidents, while outdoor gatherings can face weather-related disruptions. Handling valuable items like auction prizes can raise the risk of theft, and serving alcohol introduces additional liabilities. Conducting a thorough risk assessment helps identify activities that may pose safety concerns and determines any special legal or insurance requirements. Proactive planning not only minimizes potential disruptions but also safeguards your organization’s reputation and resources for the long term.

Types of Insurance Required for Fundraising Events

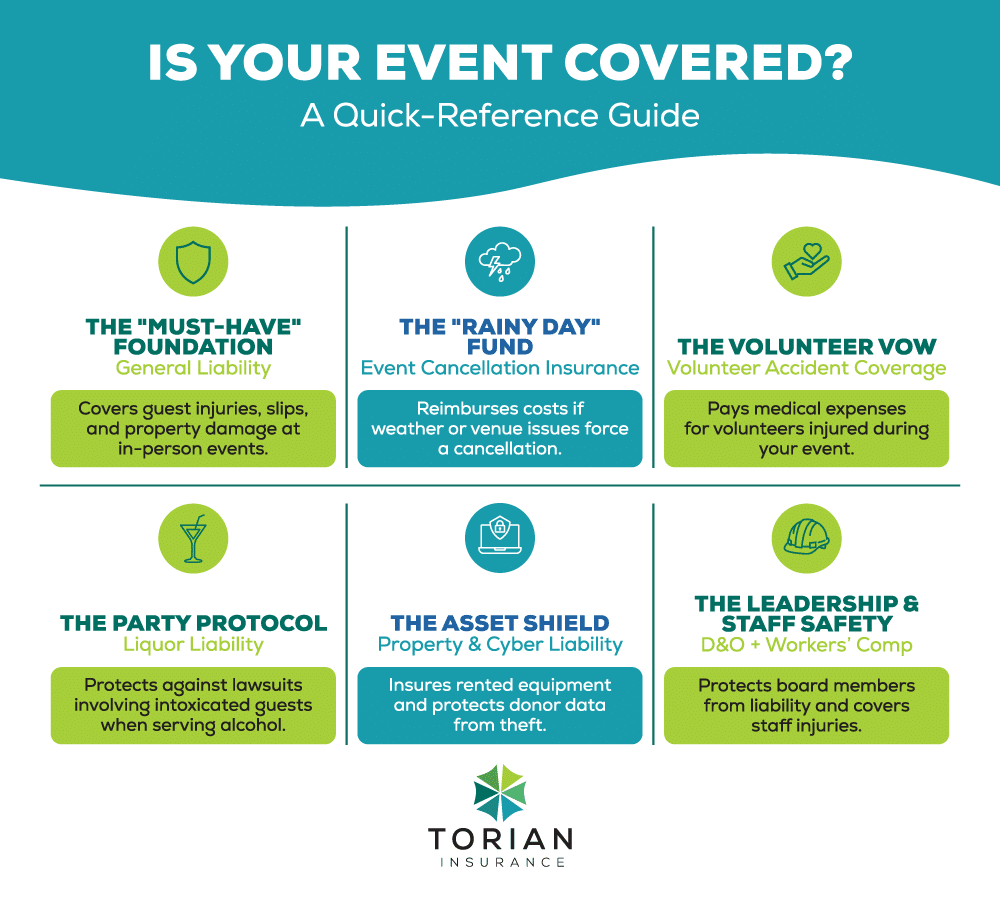

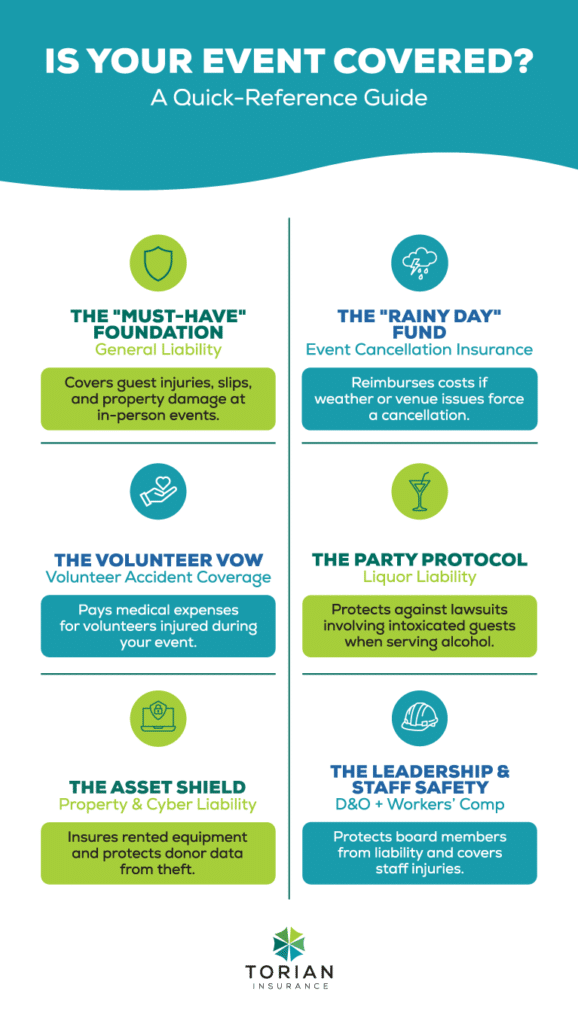

Selecting the right insurance policies is crucial for protecting your nonprofit. Below are essential coverage options and why they matter:

General Liability Insurance

One of the fundamental coverage options for fundraising events is general liability insurance. It can help cover injuries or property damage during your event, such as slips, falls, or accidental damage caused by attendees or volunteers.

Event Cancellation Insurance

Event cancellation insurance helps mitigate financial losses from sudden disruptions, such as severe weather or last-minute venue problems. It can reimburse the non-refundable costs of your event, allowing you to focus on rescheduling or redirecting funds without serious financial strain.

Liquor Liability Insurance

If alcohol is served, liquor liability coverage helps protect your organization against incidents involving intoxicated guests, including legal fees or injury claims. This protection is often required by venues or local laws, emphasizing the importance of addressing this risk proactively.

Volunteer Accident Insurance

Volunteers are vital contributors to many fundraising events. Volunteer accident coverage helps pay for medical expenses if a volunteer is injured while assisting at your event. By ensuring volunteers are protected, you demonstrate your organization’s commitment to their safety and wellbeing.

Property Insurance

If you use rented spaces or equipment, property insurance helps protect these items from damage or theft. It can also cover damages to rented venues, removing a potential liability from your organization’s shoulders.

Specialized Insurance for Nonprofit Organizations

Beyond event-specific policies, additional coverage may be needed to protect your organization’s overall operations:

Directors and Officers (D&O) Liability Insurance

D&O insurance protects board members and executives from personal liability related to governance decisions. This coverage can help pay legal fees or settlements that might arise from claims against organizational leadership, preserving your nonprofit’s resources.

Cyber Liability Insurance

As nonprofits increasingly rely on digital tools, cyber liability insurance is vital. It protects donor data and your operations against cyberattacks, security breaches, and data theft, ensuring your organization’s credibility remains intact.

Umbrella Policy

An umbrella policy provides extra liability coverage that goes beyond your primary policies. This can be especially beneficial for larger fundraising events or when activities involve a higher risk of injury or property damage.

Workers’ Compensation Insurance

If your nonprofit employs staff, it is essential to abide by state regulations regarding workers’ compensation. This coverage ensures medical bills and lost wages are covered if employees experience work-related injuries, maintaining staff wellbeing and keeping the organization legally compliant.

How to Assess Your Nonprofit’s Insurance Needs

Evaluate the specific requirements of each fundraising event to build a comprehensive coverage plan. Consider factors such as:

- Event size and scope, which may necessitate more robust protection for larger or more complex fundraising efforts.

- Venue details, including any unique risks for property damage or equipment theft.

- Alcohol and food service responsibilities that introduce additional liabilities.

- Vendor contracts that require certain types of insurance coverage.

- Applicable regional regulations ensuring your nonprofit meets all legal obligations.

Review vendor agreements and your existing insurance policies to identify any gaps. Use insights from comparable or past fundraising events to refine your approach and anticipate potential stumbling blocks. You can also explore resources from the National Council of Nonprofits to stay informed about regulations and best practices.

Common Insurance Mistakes Made by Nonprofits

Avoid these common pitfalls when planning your fundraiser insurance:

- Relying on generic policies that do not account for event-specific risks.

- Overlooking liquor liability coverage when alcohol is involved, which can lead to major legal and financial consequences.

- Assuming that vendors carry sufficient protection without verifying individual policies or coverage levels.

- Neglecting local or state requirements that may impose specific conditions on nonprofit events.

- Failing to update policies promptly after significant changes to event plans or details.

A frequent example of such oversights occurs when nonprofits evolve from small community gatherings to larger, regional events but fail to update their insurance portfolio, leaving major coverage gaps. In some cases, the organization discovers these shortcomings only when faced with an incident that triggers a claim. By addressing insurance needs proactively and engaging experienced advisors, nonprofits can prevent costly errors and protect their mission.

Best Practices for Securing Comprehensive Fundraiser Insurance

To protect your nonprofit’s events effectively and maintain a positive reputation in the community, consider these best practices:

- Plan early so you have ample time to identify risks, gather quotes, and finalize policies.

- Clarify coverage responsibilities among staff, volunteers, and external vendors to avoid confusion.

- Adapt your policies promptly if your event’s schedule, location, or activities change.

- Document all incidents and maintain organized records to simplify claims or reviews for future events.

- Implement clear safety and emergency procedures, and train staff/volunteers to identify and report hazards quickly.

Insurance Budgeting and Long-Term Planning

Developing a realistic insurance budget helps you balance limited resources while still protecting your nonprofit. Consider these strategies:

- Project event-specific costs: Estimate coverage needed for each event (e.g., general liability plus property insurance) so you know how much to allocate per fundraiser.

- Review insurance expenses annually: Look at all insurance-related costs at least once a year to spot trends, increases, or areas where coverage may need to expand or be adjusted.

- Watch for new or growing risks: If you add live entertainment, larger crowds, new venues, or higher-value equipment, plan for potential premium increases and additional coverage.

- Set aside funds for emerging exposures: Build room in your budget for new risks so you can add or adjust policies without impacting core programs or services.

- Share information with leadership: Regularly communicate the costs and benefits of key policies with your board and leadership team to support informed decisions about coverage levels.

- Connect budgeting to strategy: Use your insurance review to guide long-term planning for fundraising—prioritizing events and approaches that align with both your mission and your risk tolerance.

The Benefits of Partnering with Independent Insurance Agents

Navigating insurance can be complex—especially for nonprofits with diverse fundraising events. An independent agency like Torian Insurance simplifies the process by:

- Providing access to multiple insurers to help you find customized plans that match your specific needs and budget.

- Offering local expertise to ensure your policies meet any Southern Indiana, Illinois, or Kentucky regulations.

- Building lasting relationships, staying engaged with policy renewals, and guiding you through potential claims.

By partnering with Torian Insurance, you gain the advantages of an independent insurance agent with deep community roots and a broad market view. Their personalized support allows you to focus on what truly matters: your nonprofit’s mission and the communities you serve.

Ensuring Long-term Success with Comprehensive Fundraiser Insurance

Securing comprehensive fundraiser insurance safeguards your nonprofit against unpredictable risks and enables you to fulfill your mission with confidence. By assessing each event’s specific requirements and selecting appropriate coverage, you reduce financial setbacks and potential interruptions to your key initiatives.

With over a century of experience as a trusted independent agency based in Evansville, Indiana, Torian Insurance offers custom solutions to protect your organization and its events. Contact our team of insurance specialists today to secure the protection your mission deserves.