In the unpredictable world of business, having a safety net is not just a luxury; it’s a necessity. This is where business continuation insurance comes into play.

This type of policy is an essential component of any comprehensive business plan, providing a lifeline when unforeseen circumstances threaten the continuation of operations.

In this blog post, we will explore the concept of business continuation insurance, its importance, key components and considerations, and delve into the two main categories of business continuation insurance: Key Person Insurance and Buy/Sell Agreements.

This insightful discussion will enhance your understanding and guide you in understanding everything that goes into choosing the right policy for your needs.

What Is Business Continuation Insurance?

Business continuation insurance, sometimes referred to as business continuance insurance, is a type of insurance that safeguards businesses from potential disruptions that could lead to significant financial loss.

This insurance helps businesses navigate through unexpected circumstances such as the sudden death or incapacitation of a key person in the business, ensuring that the operations do not grind to a halt.

The insurance death or disability benefit would provide money to replace the income lost because the principal can no longer perform their daily duties. Or it could be used to bring in a new person to replace the deceased or disabled owner or a highly valued employee within the organization.

Having a robust business continuation insurance plan in place is a strategic move for business owners, as it adds a layer of financial security and ensures the survival of the business during trying times.

The Role of Business Continuation Insurance in Risk Management

Business continuation insurance plays a pivotal role in risk management strategies for businesses of all sizes. It serves as a safety net, providing financial support in case of unprecedented events that may cause significant disruption to the normal functioning of the business.

To illustrate this, consider a small family-owned business where the owner, who is also the primary decision-maker, passes away unexpectedly. Without business continuation insurance, the company may face a myriad of challenges, including financial instability, a leadership vacuum, and potential closure.

However, with a robust business continuation insurance plan in place, the financial impact of such an incident can be mitigated. The insurance payout can help cover immediate costs, buy out the deceased owner’s share, or even fund the search and training of a new leader, facilitating the continuity of operations.

2 Main Types of Business Continuation Insurance

Business continuation insurance will provide a death benefit or a disability benefit to a business in the event one of the owners would pass on or

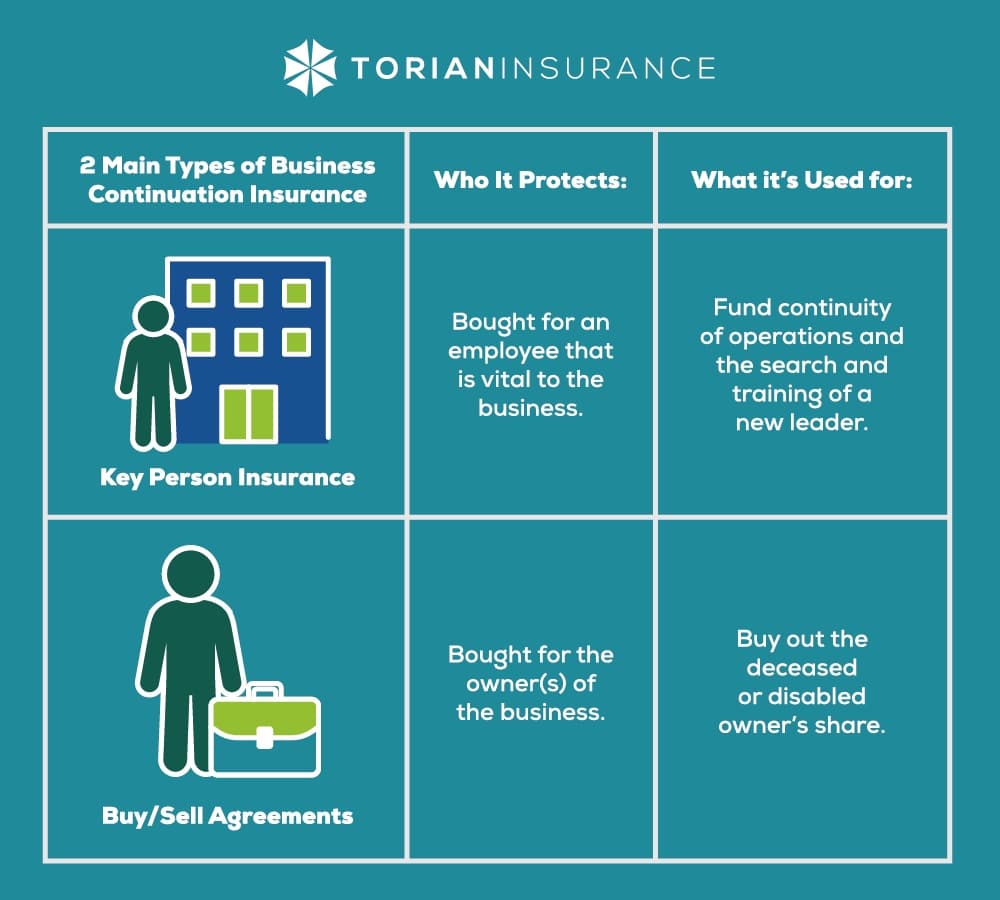

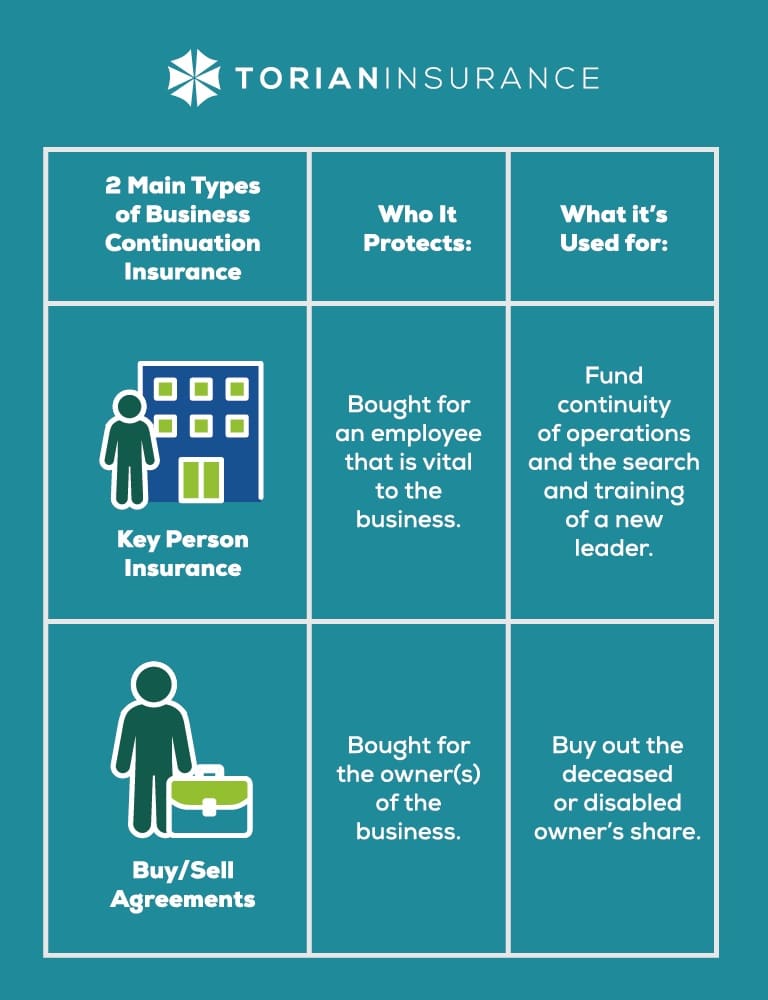

When it comes to choosing the right business continuation insurance, there are several types to consider but there are 2 main categories: Key Person Insurance and Buy/Sell Agreements.

- Key Person Insurance is typically bought for an employee that is vital to the business. The money is used to help replace that employee in the event of the employee’s death or to replace the lost income that the employee brings to the business.

- Buy/Sell Agreements are bought by the owners of the business. The money is used to buy out the deceased owner’s family and transfer the shares to the remaining owners or to a key employee who will be taking over the ownership.

Key Factors to Consider When Choosing Business Continuation Insurance

Determining the right business continuation insurance involves careful consideration of several key factors. An understanding of your business’s unique risks and needs is paramount. This includes factoring things like the overall nature of your business, its size, the industry you operate in, and the specific risks associated with your business model.

- The Nature and Size of Your Business will determine the type of coverage that best suits your needs. For instance, a small business will have different needs compared to a larger, more complex organization. Understanding the type of coverage you need will help you make an informed decision.

- The Financial Stability of Your Business is another crucial element. This involves assessing your business’s current financial health and its potential future profitability. It’s important to ensure that the chosen policy can adequately cover potential income loss and other unforeseen expenses that could arise during a business interruption.

- The Terms and Conditions of the Policy are a critical component. You must be clear on what is covered, what is excluded, and the specific terms of the payout. This will prevent any surprises when it’s time to make a claim.

- The Reputation and Reliability of the Insurer should not be overlooked. You want to ensure you’re partnering with a reputable insurance provider that has a track record of prompt and fair claim settlement.

Critical Components of Business Continuation Insurance

Business continuation insurance is essentially made up of two critical components: the Business Continuation Agreement and the Continuation of Business. Both components play a significant role in ensuring business continuity, and understanding them is key to creating a comprehensive business protection plan.

The Business Continuation Agreement

This is a legally binding document that outlines the procedure for transferring business ownership in the event of unexpected circumstances, such as the death or disability of an owner.

It plays an integral role in mitigating potential disputes among surviving owners or heirs, ensuring a smooth transition, and maintaining business stability. It can also specify the valuation of the business, funding sources for the buy-out, and the timing and terms of the buy-out.

The Continuation of Business

The continuation of the business, on the other hand, is all about ensuring that the business can keep its doors open and continue its operations uninterrupted in the event of a disruptive incident.

This component typically covers the financial resources necessary to cover ongoing expenses, such as payroll and rent, during a temporary shutdown or a gradual return to normal operations. It can also help to address the costs associated with temporary relocation, equipment replacement, or even public relations efforts to restore customer confidence.

Torian Insurance and Business Continuation Insurance

Torian Insurance has a long-standing reputation for providing comprehensive business continuation insurance solutions. With a deep understanding of the unique risks and challenges businesses face, our team of experts tailor insurance policies to meet specific needs, ensuring robust protection and continuity of operations.

Our range of business continuation insurance offerings not only covers the standard components but also includes additional features to provide holistic coverage. This can include funding for business buyouts in the event of a partner’s death or disability, to coverage for losses incurred due to business interruption.

Torian Insurance believes in providing more than just insurance; we strive to be partners in your success.

We work closely with business owners, helping them navigate through the complexities of insuring your business.

Make Informed Decisions About your Business's Future Security

Navigating the intricate world of business continuation insurance can be a daunting task. With the right knowledge, however, it can be a powerful tool to safeguard your business in times of crisis.

Remember, the right insurance policy can mean the difference between a quick recovery and an unfortunate business closure.

As an independent insurance agency with decades of experience, Torian Insurance is well-equipped to guide you through the process. Our team is committed to helping you understand and choose the most suitable business continuation insurance plan tailored to your specific needs.

Contact Torian Insurance today, and let’s start a conversation about protecting your business legacy.