Purchasing insurance is the best way to protect cherished possessions and heirlooms. Most people carry multiple forms of insurance to cover their vehicles and homes, and a little more than half of Americans have a life insurance policy to protect their families financially in the event of an untimely death. However, when it comes to jewelry and other high-dollar items, it’s often necessary to purchase a valuable items insurance policy that’s specifically designed for collectibles, wedding rings, fur coats, watches, and other expensive objects.

Fortunately, instead of buying watch insurance, wedding ring insurance, and collectibles insurance separately, you can simply purchase a single valuable items insurance policy that’s customized for your unique possessions. Read on to learn more about valuable items and jewelry insurance, including how it works, what it covers, and what steps you should follow before buying a policy.

Doesn’t My Homeowners Insurance Cover My Jewelry and Valuable Items?

Although homeowners insurance will often provide a reimbursement for valuables lost due to a fire or theft, the total amount covered is often capped at a predetermined dollar amount. This can be a problem for homeowners whose valuables exceed the coverage limit or who own items that have increased in value since the date of purchase. In addition, there are several circumstances in which homeowners insurance is unlikely to provide any protection. For example, if you lose a wedding band in the backyard or notice your necklace was damaged following an earthquake, it will not be covered by a typical homeowners insurance policy.

To know exactly what your homeowners insurance covers and what it does not, it’s important to carefully review the covered perils outlined in your policy. The types of perils your homeowners insurance covers will depend on your provider. Some of the perils most commonly covered by homeowners insurance include:

- Losses due to riots, vandalism, or burglary

- Losses sustained from water damage caused by plumbing, heating, or air-conditioning leaks

- Losses from lightning strikes, windstorms, or hail

- Damages caused by smoke

In short, if your valuable items are lost or damaged due to a peril that’s not listed in your policy, the insurance company will not provide a reimbursement. This is where valuable items and jewelry insurance comes into play. With this form of coverage, your valuables will be protected against a greater number of perils, and the maximum payout for reimbursement will be higher than what’s offered in a standard homeowners insurance policy.

Be aware that valuable items and jewelry insurance may be purchased as a completely separate policy or added to your existing homeowners insurance policy to augment your current coverage.

Is It Worth Insuring My Valuables or Jewelry?

The easiest way to determine whether you should purchase a separate insurance policy to protect certain possessions is to ascertain the value of your items. If the estimated value of your jewelry, furs, rare coins, or stamps exceeds the coverage limit on your homeowners insurance policy, it’s worth exploring additional insurance options to protect your valuables.

Consider this example: Your current homeowners insurance policy covers up to $1,500 in jewelry, assuming the item is lost or stolen due to a covered peril. Following a theft, you discover that more than $3,500 in jewelry was taken from your home. While your homeowners insurance will reimburse you $1,500 to replace the stolen jewelry, there would remain another $2,000 in actual cash value that will not be covered. Not only that, but numerous exclusions to homeowners insurance also exempt coverage when losses are incurred due to certain causes.

For example, if several fur coats are ruined by water damage from a local flood, homeowners insurance is unlikely to provide coverage. However, if the water damage comes from a covered peril such as a leaky pipe or water heater, you’ll be eligible to file a claim up to the coverage limit.

If you own a family heirloom that carries a tremendous amount of sentimental and monetary value, it’s certainly worth considering additional coverage. With valuable items and jewelry insurance, you can protect items that are lost or misplaced as well. This may include accidentally dropping a wedding ring down the shower drain or losing a single stone on an engagement ring. In this example, a valuable items insurance policy would effectively work as a form of engagement ring insurance that offers expanded coverage beyond the constraints of your homeowners policy.

What About Renters Insurance?

Similar to homeowners insurance in many respects, the amount of coverage renters insurance provides for jewelry and other valuables will be limited to particular covered perils. Some covered perils with renters insurance may include theft, items lost due to a plumbing backup, and personal liability in case a guest at your rented property suffers an injury.

Coverage caps vary depending on the covered peril and the items in question. For those who own more than $2,000 in jewelry or other expensive valuables, basic renters insurance will likely be insufficient to fully cover the cost of replacing lost, damaged, or stolen items.

What Does Valuable Items and Jewelry Insurance Cover?

As the name suggests, valuable items and jewelry insurance covers a wide variety of personal belongings, including rare stamps, coins, fine silver, firearms, and expensive electronics. Unlike homeowners and renters insurance policies, which offer limited coverage for a handful of specific perils, valuable items insurance policies tend to cover a much broader spectrum of circumstances, such as misplacing a valuable item or losing an expensive bracelet while traveling. Some examples of covered perils may include:

- Dropping a ring down the bathroom or kitchen sink

- The family dog eating your diamond earring box

- Leaving an expensive watch at a restaurant while on vacation

- Losing jewelry on a boating trip

What Does It Not Cover?

Although valuable items and jewelry insurance protects you financially from a wide range of perils, there are certain circumstances in which damage or losses are not covered. Some examples of noncovered losses include damage sustained from regular wear and tear or deterioration. For instance, say you own an old luxury watch that suddenly stops working because of aging parts that need to be repaired. In this case, valuable items and and jewelry insurance won’t cover the cost of the repair bill.

Valuables insurance also won’t cover damage to belongings caused by insects or vermin. Another exclusion to coverage is inherent vice, an insurance term used to describe something in a piece of property that causes it to damage or destroy itself — for instance, storing fine art in a moldy, broken-down shed where the items become damaged by rain or rodents. Intentional damage caused by neglect is also not covered under valuable items and jewelry insurance. Other specific limitations may include:

- Stamps and coins: fading, creasing, denting, scratching, tearing, thinning, or damage sustained while being worked on

- Fine art: damage caused during repair, restoration, or retouching

- Bicycles: damage caused by rust, mechanical breakdown, service, or repair

- Musical instruments and cameras: when used for professional work

How Much Does It Cost to Insure My Jewelry and Valuables?

Although the cost of insurance premiums varies from provider to provider, most homeowners can acquire valuable items and and jewelry insurance for 1% to 2% of the items’ value. In other words, for a $15,000 necklace or diamond-studded watch, you can expect to pay between $150 and $300 every year for coverage. To find the best rates possible, it’s advisable to receive multiple quotes from several different companies.

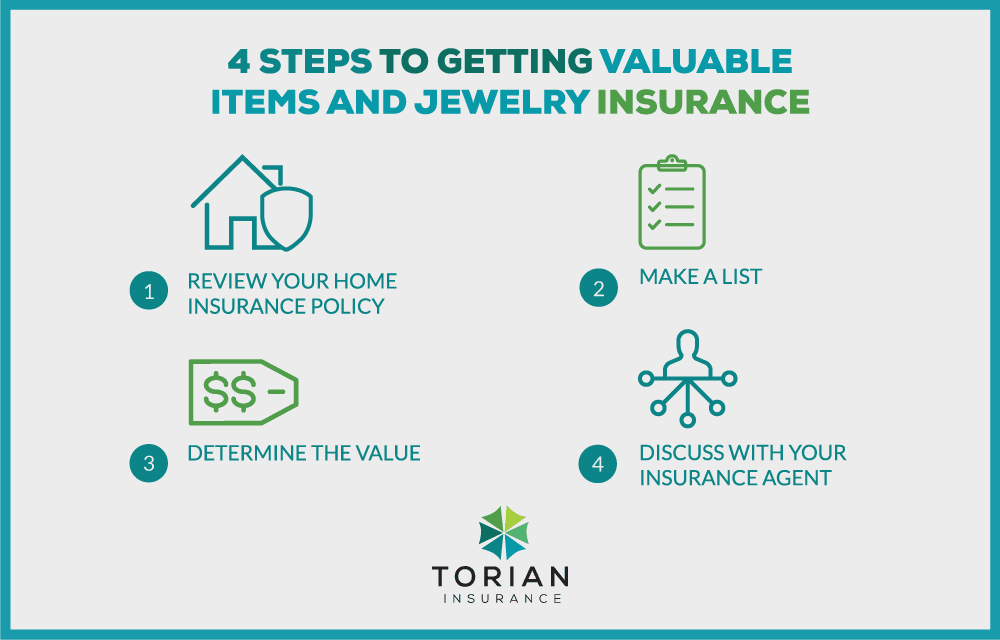

4 Easy Steps to Getting Valuable Items and Jewelry Insurance

Insuring your cherished belongings with valuable items and jewelry insurance is a fairly easy, straightforward process. Some people can find a policy that meets their needs in a single afternoon. Follow these four simple steps to obtain the right valuable items and jewelry insurance policy.

1. Carefully Review Your Homeowners Policy

The first thing you should do is check your homeowners policy’s limitations regarding lost or stolen items. Review how much protection the policy provides and determine whether you need additional valuable items insurance to cover potential replacement costs.

2. Make a List

Write a thorough and accurate list of all the valuable items you would like to protect. Some of these items may include jewelry, watches, engagement or wedding rings, fine art, electronics, silverware, expensive sports equipment, cameras, crystals, family heirlooms, and musical instruments. Take photos of all the items and write a brief description that includes important details about each of them. Critical details include the date of purchase, where the item was bought, and how much it cost. Any receipts or appraisals should also be gathered for record-keeping purposes.

3. Determine the Value

Find out how much each valuable item you own would cost if you had to replace it today. For jewelry or other expensive belongings that have unknown value, it may be worth it to have a professional appraiser do the work. Just be aware that some insurance companies require a written, formal appraisal to verify the value of your possessions.

4. Discuss It With Your Insurance Agent

Once you’ve documented and priced your items, it’s time to contact your insurance agent to explore the estimated cost of covering your valuables. It shouldn’t take long for your agent to generate a general ballpark figure based on the items’ estimated value.

If additional information or documentation on certain items is required, your insurance agent will notify you of what’s needed to receive a more accurate quote. Most of the time, it’s possible to simply send a photocopy, email, or fax of the appraisal to the agent.

An Insurance Agent Can Help You Through the Process

At Torian Insurance, we make it easy to insure your jewelry and other valuables for damage, loss, or theft. Our coverage will ensure your most cherished belongings are always protected, including expensive furs, art, jewelry, electronics, collectibles, and more. We’ll help customize a policy that suits your unique coverage needs. When you’re ready to discuss how valuable items and jewelry insurance can help give you peace of mind, contact our team at Torian Insurance to learn more.