Choosing between term vs. whole life insurance can feel overwhelming, but the right policy is essential for protecting your family’s finances. The right coverage can help your loved ones pay off debts, cover everyday expenses, and maintain their standard of living if you pass away unexpectedly.

For families in Southern Indiana, Illinois, and Kentucky – communities Torian Insurance has served since 1923 – the biggest question is usually which type of life insurance fits their budget, goals, and stage of life. Term life insurance offers affordable, time-limited protection, while whole life insurance provides lifelong coverage and builds cash value.

In this guide, you’ll learn how term vs. whole life insurance works, the key pros and cons of each, and real-world scenarios where one (or a combination of both) may make the most sense.

What Is Term Life Insurance?

Term Life Insurance provides coverage for a specified period – commonly 10, 20, or 30 years. If the insured passes away during that term, beneficiaries receive a death benefit. However, once the term expires, the policy ends unless renewed or converted. Because there is no cash-value component or savings aspect, Term Life Insurance generally has lower premiums than permanent policies.

You can select the length of term based on how long you expect to have significant financial obligations. For instance, a family might choose a 20-year policy to match their mortgage duration or to coincide with their children’s school years. During that coverage window, if the primary breadwinner unexpectedly dies, the policy benefit helps offset the loss of income or pay off substantial debts.

Term Life Insurance may be a good fit if you have short-to medium-range goals and want the flexibility to allocate more resources to other financial priorities, such as saving for retirement or education funds. It can also be an excellent introduction to life insurance because of its straightforward structure and relatively affordable monthly payments.

Who Can Benefit from Term Life Insurance?

Term Life Insurance suits a range of situations, including:

- Individuals with large debts, like a mortgage, who want coverage until those obligations are paid.

- Newly married couples or young families seeking an affordable way to protect loved ones during key earning years.

- People requiring robust coverage for a set term, perhaps to align with specific milestones like finishing college tuition payments for children.

- First-time buyers who want a simpler policy model before transitioning to a more permanent solution later.

What Is Whole Life Insurance?

Whole Life Insurance is a permanent coverage product that extends throughout your lifetime, provided you keep paying the premiums. Unlike term coverage, a portion of the premium goes into building a cash value over time. This cash value growth acts like a steady savings component, which you can often borrow against or withdraw if needed for emergencies or supplemental retirement income.

Because Whole Life Insurance guarantees a death benefit and accumulates cash value, premiums are higher than for a term policy. Still, many individuals value its predictability – including fixed premiums and guaranteed protection – and the potential for long-term financial benefits. The policy’s ability to accumulate cash value can be especially appealing to those who consider life insurance an integral part of their overall wealth-building or retirement strategy.

Who Should Consider Whole Life Insurance?

Whole Life Insurance works best for those who:

- Want guaranteed, lifelong coverage and do not wish to re-qualify later in life.

- Prefer building a financial asset in the form of cash value.

- Need a policy for estate planning purposes, such as managing potential estate taxes and ensuring liquidity for heirs.

- Desire a fixed premium and a stable, predictable policy over time.

Pros and Cons of Term Life Insurance

Advantages of Term Life

- Lower Premiums: Premiums for term policies tend to be more economical than those of permanent alternatives, making Term Life Insurance a budget-friendly choice for families juggling several financial responsibilities at once.

- Simplicity: Term policies are relatively easy to understand. Since they focus almost entirely on providing a death benefit without any investment or savings feature, there is minimal complexity.

- Flexibility in Coverage Amount and Term: Depending on your needs, you can choose coverage amounts that align with your debt obligations, projected income replacement needs, or other financial goals. The available lengths of coverage can often match typical financial time frames (such as a 15-year mortgage or an 18-year plan for childcare and educational expenses).

- Potential Conversion Options: Some term policies allow you to convert to a permanent life insurance policy without undergoing a new medical exam if you do so within a specified time frame. This conversion option can be valuable if your needs evolve or if you develop a health condition down the line that could make acquiring a new policy cost-prohibitive.

Disadvantages of Term Life

- Coverage Expires: Once the term ends, the policy ceases unless you renew it. Renewal typically comes with significantly higher premiums, especially if you are older or have developed health concerns. In some cases, you may need to purchase a new policy altogether, which results in higher costs.

- No Cash Value: Term policies do not build savings or investment value over time. If the policyholder outlives the term, no payout or return of premiums occurs.

- Premiums May Increase with Renewal: While initial rates can be low, they generally jump if you renew the policy after your original term. Health factors, age, and other risk considerations can make subsequent coverage rates much higher.

Pros and Cons of Whole Life Insurance

Advantages of Whole Life

- Lifetime Protection: As long as you pay the required premiums, your policy remains active for your entire life. This helps ensure that no matter when you pass away, your beneficiaries receive a death benefit.

- Cash Value Accumulation: Whole Life Insurance builds a reserve of cash value that grows at a steady rate over the life of the policy. This reserve can be accessed through loans or partial withdrawals for various financial needs.

- Predictable Premiums: Your premium amount is set when you purchase the policy and remains unchanged. This makes budgeting and long-term financial planning easier, especially for individuals who prefer a consistent monthly or annual payment schedule.

- Estate Planning Benefits: The death benefit can help your heirs settle outstanding obligations and potentially cover any estate-related costs. While whole life coverage is not the only tool in an estate plan, it can be a valuable component for ensuring debts or taxes do not deplete other assets left behind.

Disadvantages of Whole Life

- Higher Premiums: Because of its permanent coverage and cash value feature, Whole Life Insurance costs more. This can make it challenging for younger families on tight budgets to maintain.

- Complexity: The savings and investment elements often require more oversight and understanding. If you are unaccustomed to financial products with multiple components (like cash value accumulation), navigating the details can be challenging.

- Potentially Modest Returns: While cash value grows predictably, the rate of return may be lower than what you could potentially earn through other investments. This gap might be an important consideration if your priority is maximizing investment performance rather than long-term insurance stability.

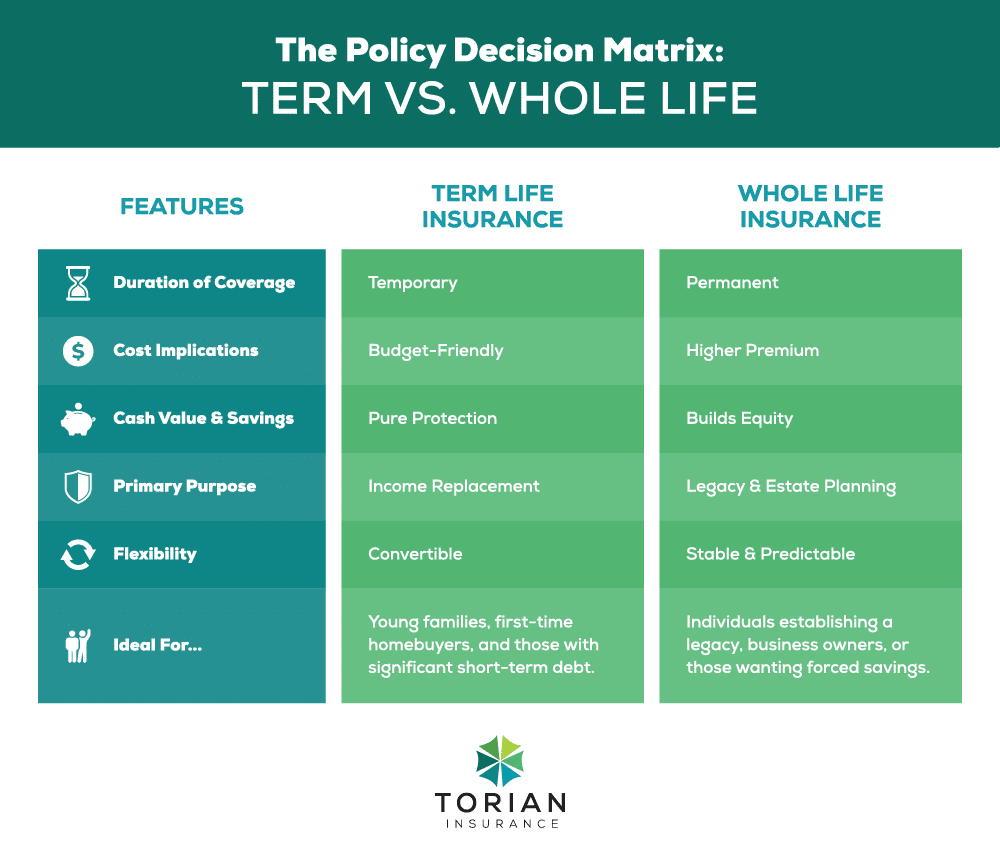

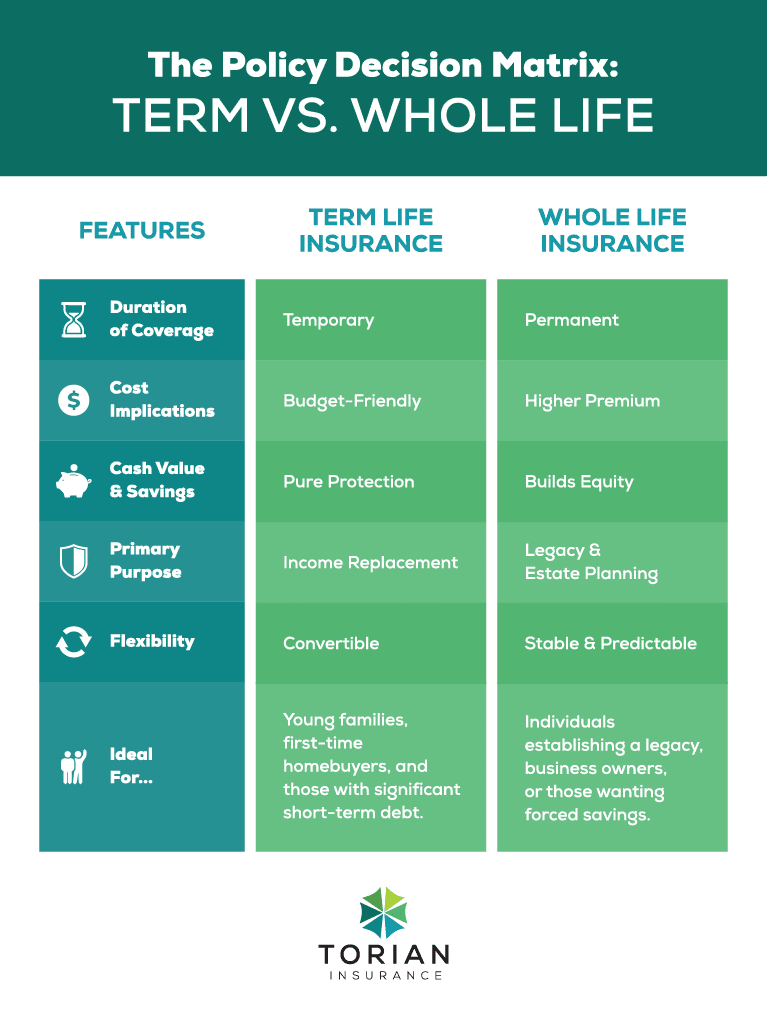

Key Differences Between Term and Whole Life Insurance

Duration of Coverage

- Term Life: Offers coverage for a set period, which is ideal if you have time-bound financial obligations such as a mortgage or dependents who will need support until they reach adulthood.

- Whole Life: Provides coverage that spans your entire lifetime, ensuring a guaranteed death benefit no matter when you pass away, as long as you keep up with premiums.

Cost

- Term Life: Usually more affordable, making it a popular choice for younger individuals or families balancing multiple expenses.

- Whole Life: Generally more expensive, reflecting the policy’s permanent coverage and cash value feature.

Cash Value Component

- Term Life: No accumulation of savings – purely a protective measure.

- Whole Life: Builds cash value over time, which can be borrowed against or withdrawn under certain conditions.

Policy Flexibility

- Term Life: May allow policy conversion to a permanent option, though coverage will likely be more expensive at renewal if you keep it as a term policy.

- Whole Life: Guarantees a lifetime of coverage and stable premiums but typically requires a more substantial, long-term financial commitment.

Practical Scenarios for Choosing Between Term and Whole Life

When Term Life Insurance Makes Sense

- Young Families on a Budget: A couple just starting out might need extensive coverage to protect against loss of income but can only afford lower monthly payments. Term Life provides a substantial death benefit at a manageable cost.

- Covering Large Debts: If you have a sizable mortgage or educational loans, Term Life ensures those obligations won’t fall on your family if you pass away unexpectedly during the payoff period.

- Shorter Time Horizons: Certain life events – such as covering your business loans – might only require insurance for a limited duration, making term coverage a targeted and cost-effective choice.

When Whole Life Insurance Is Beneficial

- Estate Planning Objectives: If managing potential estate liabilities is a priority, a permanent policy can help address those costs, ensuring other assets remain intact for your beneficiaries.

- Desire for Cash Value: Some individuals appreciate the forced savings mechanism inherent in Whole Life Insurance, using it as an additional resource for emergencies or retirement.

- Stable, Ongoing Coverage: Those who want a single, lifelong policy may prefer whole life. It eliminates the need to renew or re-qualify and offers financial predictability.

- Business owners and succession planning: Whole life can help fund buy-sell agreements, pay off business debts, and provide liquidity so partners or heirs can keep the business running or transfer ownership smoothly.

Re‑Evaluating Your Insurance Needs Over Time

Your ideal mix of term and whole life insurance can change as your family grows and your finances evolve. Early in your career or when juggling job changes, term life may be the most practical choice because it delivers strong coverage for minimal cost. As your income increases, debts decrease, or you start thinking about retirement and legacy planning, you may decide to add whole life coverage or convert part of an existing term policy.

For example, a couple who purchased a 20‑year term policy in their late twenties might realize they need additional or different coverage once they have children or start a business. Regular check‑ins – every three to five years, or after major life events – can help ensure your coverage still matches your goals. Working with a licensed professional who understands both term and whole life options can make it easier to adjust your strategy without leaving gaps in protection.

Layering or Combining Coverage Strategies

In some cases, combining different types of life insurance policies – often referred to as a layered approach – can offer a strategic solution. For instance, you might purchase a term policy to handle immediate, high-priority responsibilities such as childcare and mortgage payments, while simultaneously investing in a smaller whole life policy to secure lifelong protection. Over time, the cash value from the permanent component can provide benefits above and beyond the immediate coverage a term policy might offer.

This blended strategy can be especially valuable for individuals balancing multiple financial goals. By allocating a portion of your budget to term coverage and another portion to permanent coverage, you can fine-tune how much protection you hold at any given stage.

Understanding Policy Riders and Additional Benefits

Another way to tailor your life insurance plan is by incorporating policy riders that expand or adjust your coverage. For example, a waiver of premium rider may keep your coverage active if you become unable to work due to disability, while an accelerated death benefit rider enables you to access a portion of your policy’s death benefit early if you develop a qualifying medical condition. Additional benefits like accidental death coverage can also be added to address more specific risks.

Riders typically come with added costs, so it’s crucial to determine whether they genuinely meet your needs. A comprehensive review with an experienced insurance professional can help you assess which additions offer real value for your household and which might be unnecessary expenses.

How Torian Insurance Can Help

At Torian Insurance, we’ve been helping individuals, families, and business owners across Southern Indiana, Illinois, and Kentucky choose the right life insurance since 1923. As an independent, locally owned agency, we compare policies from multiple carriers and explain the differences in plain language, so you’re not locked into a one‑size‑fits‑all solution. Whether you’re leaning toward term, whole life, or a combination, we’ll help you match coverage to your budget, goals, and stage of life.

FAQs About Term vs. Whole Life Insurance

Is term or whole life insurance better?

Neither is universally “better” – it depends on your goals and budget. Term life is usually best for affordable, high coverage over a set period. Whole life is better if you want lifelong coverage, predictable premiums, and cash value you can access over time.

What is the biggest difference between term vs. whole life insurance?

The biggest difference is how long coverage lasts and whether it builds savings. Term life covers you for a specific number of years and does not build cash value. Whole life lasts your entire lifetime (as long as premiums are paid) and includes a cash value component that grows over time.

Can I start with term life and switch to whole life later?

Often, yes. Many term policies include a conversion option that lets you change some or all of your coverage to a permanent policy – such as whole life – without a new medical exam, if you do so within a set timeframe. This can be helpful if your budget is tight now but you want long-term protection later.

Is whole life insurance worth the higher premiums?

Whole life can be worth the cost if you value guaranteed lifelong coverage, stable premiums, and the ability to build cash value. For others, especially those focused on maximizing pure protection at the lowest cost, term life may be a better fit. A licensed agent can help you compare options based on your situation.

How much life insurance coverage do I need?

A common starting point is 7–10 times your annual income, but the right amount depends on your debts, number of dependents, income, and long-term goals. It’s important to consider mortgages, college costs, everyday living expenses, and any legacy you’d like to leave.

Can I have both term and whole life insurance at the same time?

Yes. Many people use a large term policy for temporary needs (like raising children and paying off a mortgage) and a smaller whole life policy for lifelong coverage and legacy planning. This blended approach can balance cost with long-term security.

Making the Right Life Insurance Decision

Choosing between term vs. whole life insurance comes down to your budget, time horizon, and long-term goals. Term life typically offers the most coverage for the lowest cost during your highest‑need years, while whole life provides lifelong protection and cash value that can support estate or legacy planning. For many people, the right answer is a thoughtful combination of both.

You don’t have to make this decision alone. Our licensed agents at Torian Insurance have been helping families and business owners across Southern Indiana, Illinois, and Kentucky compare term and whole life options for over a century. We’ll walk you through your coverage needs, explain the pros and cons in plain language, and present quotes from multiple carriers so you can choose with confidence.

Ready to see which option fits you best? Contact Torian Insurance today to schedule a no‑obligation consultation or request a personalized life insurance quote. Let’s build a protection plan that supports your family, your goals, and your peace of mind.