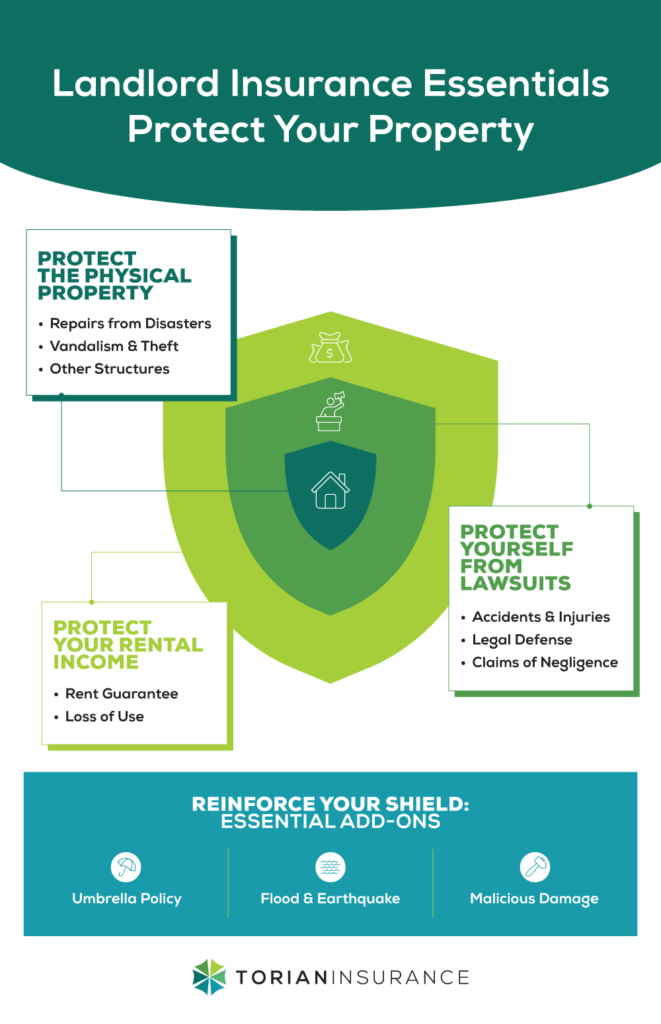

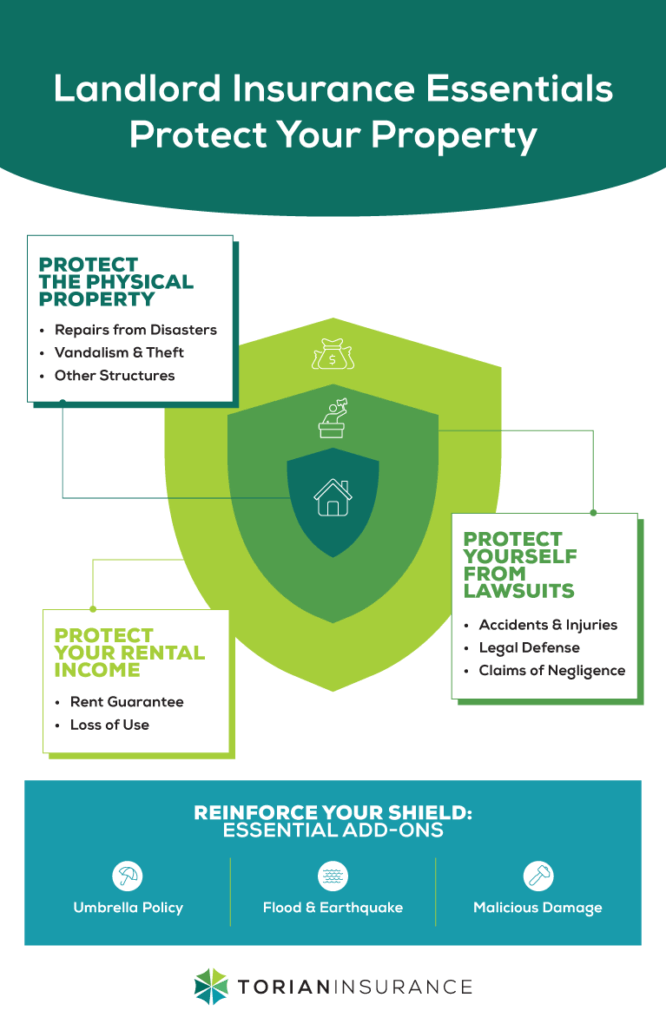

Renting out property is much more than collecting monthly rent. It involves managing property maintenance, ensuring tenant safety, and handling legal responsibilities. Standard homeowners policies do not address many risks unique to rental properties. Landlord insurance is specifically designed for rental situations, covering perils such as natural disasters, accidental damage, or tenant-related issues.

By understanding the different types of coverage and choosing the right combination, you can protect your investment and maintain a reliable income stream even when unexpected challenges arise.

Property Insurance for Landlords

Property insurance forms the foundation of a landlord’s risk management strategy. Unlike homeowners insurance, which covers owner-occupied residences, landlord-specific property insurance is designed to protect rental properties from a variety of potential damages.

Key Coverage Areas

- Fire, Severe Weather, and Natural Disasters: This coverage helps pay for repairs or rebuilding when your property is damaged by events such as fires, windstorms, or heavy hail.

- Vandalism and Theft: In cases of deliberate damage or theft, this policy covers repair or replacement expenses so you aren’t left with costly repairs out-of-pocket.

- Detached Structures: If your property has additional structures like garages, sheds, or carports, you might need extra endorsements to ensure these are covered.

- Landlord-Owned Items: Some policies allow coverage for appliances or furnishings you provide for tenant use. However, tenants should obtain their own policies to cover personal belongings.

By selecting appropriate property insurance, you can reduce repair costs and protect the very asset that generates your rental income.

Liability Insurance for Landlords

Liability insurance is your financial buffer against claims that can arise when someone—whether a tenant or visitor—is injured on your property. Even well-maintained properties can have unforeseen hazards, making this coverage essential.

What It Covers

- Injuries to Tenants or Visitors: If an accident occurs because of unsafe conditions (for example, a slippery walkway or poorly maintained stairs), liability insurance covers medical expenses, legal fees, and any claims or settlements that might result.

- Legal Defense Costs: If you are sued, this coverage takes care of attorney fees and other legal expenses, even if the lawsuit is ultimately unfounded.

- Claims of Negligence: Should a claim arise from inadequate maintenance or unresolved safety issues, liability insurance protects your personal and business assets from the financial fallout.

This type of coverage offers peace of mind by ensuring that a single accident does not lead to overwhelming expenses that could destabilize your finances.

Income Protection: Safeguarding Your Cash Flow

A landlord’s most critical asset, after the property itself, is the reliable rental income it generates. This cash flow covers the mortgage, taxes, maintenance, and hopefully, provides a profit. But it can be instantly jeopardized by two distinct scenarios: a tenant failing to pay rent, or the property becoming uninhabitable due to damage.

Specialized income protection policies are designed to safeguard your finances against both of these risks, ensuring your investment remains stable even when the unexpected happens.

1. Rent Guarantee Insurance: Protection Against Tenant Default

Even with meticulous tenant screening, financial hardships can lead to non-payment. Rent guarantee insurance is designed specifically for this risk, stepping in to cover your lost income when a tenant stops paying rent.

- Maintains Consistent Cash Flow: If a tenant defaults, this policy provides the rental income you’re owed, allowing you to continue covering your own expenses without disruption.

- Covers Income During Evictions: The legal eviction process can take months, creating a significant income gap. This insurance bridges that gap, reducing financial pressure while you resolve the dispute.

- Reduces Non-Payment Risk: It acts as a critical safety net against tenant financial hardship, non-compliance, or other situations leading to a failure to pay.

2. Loss of Use (or Rent Loss) Insurance: Protection Against Property Uninhabitability

Unlike Rent Guarantee insurance, which covers tenant default, Loss of Use coverage protects you when a covered peril makes your property uninhabitable. If a fire, severe storm, or major plumbing failure forces your tenants to move out during repairs, this policy compensates you for the lost income.

- Covers Lost Rent During Repairs: While your property is being rebuilt after an insured event, this policy reimburses you for the fair rental value you would have received, ensuring you don’t lose income while the unit is vacant.

- Ensures Business Continuity: It provides the financial stability needed to manage repairs and get your property back on the market without draining your personal savings.

- Tied to Property Insurance Claims: This coverage typically kicks in when you have a valid property insurance claim that has rendered the unit unlivable, working in tandem with your primary property policy.

Essential Supplemental Coverage

Beyond the essential coverages, several specialized policies can provide additional protection tailored to your unique situation.

Umbrella Insurance

Umbrella insurance offers extra liability protection above the limits of your standard policies. This cost-effective add-on steps in when claims exceed your typical coverage limits, providing a robust safety net.

Flood and Earthquake Insurance

Standard landlord policies rarely cover catastrophic events such as floods or earthquakes. If your property is in an area prone to these disasters, purchasing separate policies for flood or earthquake protection is a must.

Tenant-Caused Damage Coverage

While general property insurance may cover typical accidental damage, it sometimes does not address severe or intentional tenant-caused damage. Additional coverage can protect you from unexpected repair costs that go beyond normal wear and tear.

The interaction of these policies creates a comprehensive risk management strategy, with each coverage layer addressing specific challenges that landlords face.

The Landlord’s Insurance Playbook: A 3-Step Guide

Securing the right insurance isn’t a one-time task—it’s an ongoing strategy. A one-size-fits-all policy rarely provides adequate protection for the unique risks associated with your specific property. Follow this three-step playbook to build, implement, and maintain a comprehensive insurance plan that truly safeguards your investment.

Step 1: Assess Your Unique Needs

Before you can choose the right policy, you must first understand your specific risk profile. Every rental property is different, and your coverage should reflect its unique characteristics.

- Analyze Your Property: Consider the property’s age, condition, and construction type. Do you have additional structures like detached garages or sheds that need coverage? Are there specific features like a swimming pool that increase liability risk?

- Evaluate Your Location: Is your property located in an area prone to natural disasters like floods, hurricanes, or earthquakes? Standard policies often exclude these events, so you may need separate coverage.

- Consider Your Tenants: The type of tenants you have can influence your needs. Long-term family renters present different risks than short-term vacation renters or students.

- Review Your Financial Position: Evaluate your personal financial buffer. If you are less equipped to handle large, unexpected expenses out-of-pocket, you may want to opt for higher coverage limits and lower deductibles for greater peace of mind.

Step 2: Find the Right Insurance Partner

Choosing the right provider is just as important as choosing the right policy. Your goal is to find a partner who understands the nuances of rental properties and can offer tailored solutions.

- Work with an Independent Insurance Agent: Unlike agents who work for a single company, independent agents represent multiple carriers. They can provide unbiased advice, compare different policies on your behalf, and find the best combination of coverage and cost for your specific situation.

- Ask the Right Questions: When evaluating providers, don’t hesitate to ask detailed questions to ensure a good fit:

- What does your standard landlord policy include, and what specific add-ons do you recommend for my property?

- What is your claims process like, and can you provide insight into your reputation for handling landlord claims?

- Are there discounts available if I bundle multiple properties or different types of coverage (like property and liability)?

- Prioritize Customer Service: Select a provider known for responsive customer service and a strong local presence. A reputable partner with a proven track record will make a significant difference when you need to file a claim or adjust your coverage.

Step 3: Conduct an Annual Policy Review

Insurance is not a “set it and forget it” product. Your risks can change as your rental business grows and market conditions evolve. An annual policy review is an essential best practice to ensure your coverage remains adequate.

During your annual review, consider the following:

- Have you made any property renovations or significant improvements that might increase its value and require higher coverage limits?

- Have there been any changes in tenant demographics, local laws, or market conditions that could affect your risk profile?

- Are there new endorsements or bundled solutions available that could strengthen your protection or offer better value?

Maintain an open dialogue with your insurance provider. A yearly check-in ensures your coverage evolves with your needs, uncovering potential discounts and safeguarding your investment against any new or emerging risks.

Emerging Trends in Landlord Insurance

The insurance industry is changing rapidly, driven by digital advances. Innovations like digital risk assessments and online claims processing have made managing policies easier and more efficient. Landlords now benefit from mobile solutions that allow for:

- Real-time monitoring of policy details and coverage levels.

- Faster claims processing thanks to digital submission and tracking.

- Improved responsiveness to evolving risks, ensuring that coverage remains current with technological and market changes.

These technological trends not only enhance safety but also offer greater convenience and peace of mind.

Strategic Significance of Landlord Insurance for Long-Term Financial Security

Landlord insurance is more than just an expense—it’s a strategic investment in the enduring success of your rental property business. Whether it’s property coverage, liability protection, or income safeguarding through rent guarantee policies, the right mix of insurance policies can shield you from potentially devastating financial setbacks.

Every rental property has its unique characteristics and risks, and tailoring your insurance accordingly is key to optimal risk management. When you partner with trusted experts, you gain the support necessary to secure your financial future.

Take the proactive step today: contact Torian Insurance for a personalized review of your landlord insurance needs and discover tailored solutions designed to provide unwavering protection and peace of mind.