For businesses that partner with external professionals or independent contractors, understanding vicarious liability is crucial. Vicarious liability is a legal concept where your business can be held accountable for the actions or negligence of another party, even a non-employee. While often associated with traditional employer-employee relationships, this principle can extend to independent contractor arrangements, creating significant and often unexpected risks.

Recognizing when your business might be liable is the first step in avoiding severe financial, legal, and reputational damage.

This article breaks down the essentials of vicarious liability for independent contractors. We will explore the common exceptions that can expose you to liability, the practical steps to reduce those risks, and the critical role of tailored insurance in safeguarding your business.

By the end, you’ll have a clear roadmap to manage these relationships effectively, protecting your company from expensive lawsuits. In community-focused regions like Southern Indiana, Illinois, and Kentucky, a solid grasp of this issue is essential for your long-term success.

Implications of Vicarious Liability on Businesses

Liability claims stemming from contractor actions can produce far-reaching effects:

- Financial Impact: Court battles and settlements can be costly, with additional financial strain from increased insurance premiums and regulatory fines.

- Reputation Risk: In community-focused regions, any sign of negligence can damage a company’s name and reduce its appeal to clients and future contractors.

- Operational Disruptions: Managing legal disputes may drain attention and resources, causing project delays and reduced productivity.

- Insurance Challenges: A track record of liability claims can lead to difficult insurance renewals, higher premiums, or more restrictive terms.

- These implications underscore the value of a proactive approach. Identifying risk areas early and implementing mitigation steps helps protect both financial stability and brand reputation in the long run.

The General Rule: A False Sense of Security?

Typically, independent contractors are responsible for their own actions. This clear separation allows businesses to benefit from specialized skills without assuming payroll or employment risks. For example, if a contractor is hired to repair office infrastructure and an accident occurs, liability generally falls on the contractor.

This separation is further reinforced by legal frameworks distinguishing between the roles of employees and contractors. The IRS Independent Contractor Tax Center offers guidelines to help businesses confirm the correct worker classification.

However, maintaining this protective separation depends on granting contractors sufficient autonomy. Problems arise when a business exercises excessive control over the contractor’s methods, blurring the line between contracting and employment.

In such cases, a company may become accountable for the contractor’s mistakes, undermining the intended protection. Ensuring your contract language clearly states the contractor’s independence can be a significant first step in upholding this rule.

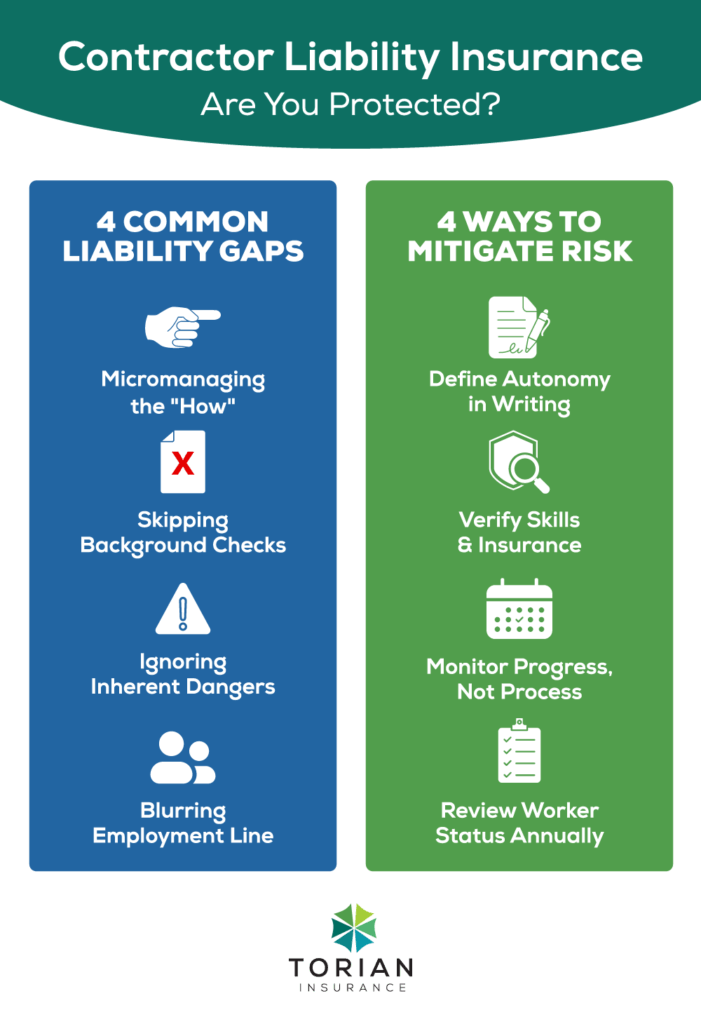

Four Ways Your Business Can Become Liable

While the general rule provides significant protection, several exceptions exist that can expose your business to liability:

Direct Control Over Contractor Actions

When a business directs the specific methods a contractor should use—even in minor aspects—it risks being treated as an employer. If a company mandates the exact tools or techniques used during a project, such control might change the contractor’s status to that of an employee. Maintaining clear boundaries is essential.

The Department of Labor Guidance on Misclassification emphasizes that oversight can quickly evolve into employer-like control if not carefully managed.

- Example: If a construction company hires a freelance electrician but requires them to follow the company’s step-by-step installation manual and attend mandatory daily check-ins, it could be held liable if the electrician’s work causes a fire.

Negligent Hiring and Oversight

Failure to perform adequate background checks or promptly address performance issues can lead to liability. Hiring a contractor with a known history of safety violations or subpar workmanship without proper vetting may result in claims if their negligence causes harm.

It is imperative to document due diligence efforts, and referencing the Indiana Department of Insurance coverage insights can help businesses identify the right coverage for such risks.

- Example: A property management firm that hires a security contractor without checking for a valid license could be held liable if the contractor assaults a tenant, as the firm failed in its duty of due diligence.

High-Risk or Non-Delegable Duties

Certain tasks, especially those involving public safety or hazardous conditions, inherently require more oversight. Even if performed by independent contractors, these non-delegable duties may impose liability on the business for ensuring safe practices. Areas like construction or heavy machinery operation demand extra caution. For guidance on safety standards, the CDC guidance on workplace safety measures can be a helpful resource.

- Example: A city that hires an independent contractor to manage a public fireworks display remains liable for any injuries to the crowd, as ensuring public safety is a duty that cannot be fully delegated.

Misclassification of Contractors

If a contractor meets the criteria of an employee—such as using only company equipment or working exclusively for one company—the risk of misclassification increases. Misclassification can lead to significant legal and financial consequences, including back pay and fines. The EEOC considerations on worker classification highlight common pitfalls in assigning worker status. Clearly defining roles in the contract, as well as periodically reviewing conditions, is critical to preventing such disputes.

- Example: A tech company hires a “freelance” developer who works 40 hours a week, uses a company-provided laptop, and works on a core, long-term project; if they are injured, they could be reclassified as an employee, making the company responsible for workers’ compensation.

Proactive Defense: Best Practices to Mitigate Risk

Though no strategy can eliminate risk entirely, adopting best practices can substantially reduce the danger of vicarious liability:

Conduct Thorough Due Diligence

Begin by checking qualifications, licenses, and past performance. Confirming that contractors hold relevant credentials and liability coverage can reveal potential red flags.

Draft Clear and Detailed Contracts

Contracts should specify the scope, deliverables, and timelines while explicitly affirming the contractor’s independence in execution. A well-drafted contract is the first line of defense in liability disputes. Periodic policy reviews with an independent insurance agency can further align contract terms with coverage limits.

Maintain Oversight Without Micromanagement

Set up regular check-ins or progress reports to stay informed without dictating methods. Striking this balance fosters mutual trust and helps ensure both parties adhere to project schedules. The U.S. Department of Labor advises on keeping documentation of oversight to demonstrate compliance in any dispute.

Address Issues Promptly

Document concerns about poor workmanship or unsafe practices as soon as they appear. Quick, decisive action demonstrates your commitment to upholding safety and compliance. Regularly revisiting procedures also encourages timely resolution of minor issues, preventing them from becoming major liabilities.

Regularly Review Worker Classifications

A contractor initially considered independent may, over time, transition into a role resembling an employee. Reviewing these arrangements periodically reduces the chance of inadvertent misclassification. The IRS Independent Contractor Tax Center provides checklists that can help business owners evaluate changes in working conditions.

Expanded Analysis: Understanding the Nuances of Vicarious Liability

The nuances of vicarious liability in personal injury cases extend beyond simple definitions. Courts often evaluate factors such as the level of independence granted, supervisory involvement, and the degree to which a contractor is integrated into the company’s daily operations. Even subtle differences in contract language can tip the balance toward liability.

For instance, if a business holds frequent on-site meetings with independent contractors and issues detailed instructions on daily procedures, a court might find the contractor functionally an employee. Business owners should keep abreast of legal standards and industry publications to stay informed of emerging risks and best practices.

Insurance Protection for Businesses Working with Independent Contractors

Even with robust risk management, unforeseen incidents can still occur. Adequate insurance coverage is crucial for dealing with the unexpected:

- Business Liability Insurance: This coverage addresses claims of property damage or bodily injury caused by a contractor’s actions. It cushions you financially against legal fees and settlements.

- Professional Liability Insurance: Vital in fields like consulting and IT services, this safeguards your business against negligence or errors in professional judgment. Should a contractor’s oversight cause financial harm to a client, professional liability policies absorb many legal and settlement costs.

- Addressing Worker Misclassification: If a contractor is misclassified and later deemed an employee, disputes commonly associated with employees—like wage or benefit claims—may surface. Insurance that covers these gaps can protect you from penalties and back pay obligations.

- Cyber and Data Breach Liability: Contractors frequently have access to sensitive data. A breach resulting from a contractor’s oversight can expose your business to substantial legal liabilities. Including cyber liability coverage has become increasingly important in an era of remote work and digital operations.

A Modern Challenge: Vicarious Liability in the Age of Remote Work

The rise of remote work adds complexity to the vicarious liability landscape. Long-distance contractors can still access critical data or interact with clients, leading to potential liabilities if a breach or error occurs. Companies must enforce cybersecurity protocols, outline clear responsibilities in digital collaboration, and perform regular audits.

Businesses should update contractor agreements to state precise data protection standards, ensuring that remote workers follow similar operational rules as on-site staff. Failure to do so can result in costly legal challenges and reputational harm if a data breach or misstep arises.

Torian Insurance and Tailored Liability Coverage

To successfully navigate the complexities of vicarious liability, it helps to partner with an insurance provider that understands your specific risks. Torian Insurance—an independent agency based in Evansville, Indiana—has built a strong reputation for offering personalized insurance solutions to businesses in Southern Indiana, Illinois, and Kentucky.

Their customized approach focuses on helping companies secure coverage that integrates business liability, professional liability, and employer liability, among other protections.

With extensive industry expertise and a commitment to local market conditions, Torian Insurance can thoroughly evaluate your risk profile and recommend the most appropriate coverage options.

Securing Your Business Against Vicarious Liability Risks

Vicarious liability for independent contractors can pose significant financial and reputational threats to businesses across Southern Indiana, Illinois, and Kentucky. Although current liability rules often favor companies that preserve the independence of their contractors, exceptions such as direct control, negligent hiring, high-risk duties, and misclassification can shift responsibility onto your organization.

Implementing best practices—thorough vetting, precise contract drafting, measured oversight, and regular worker classification reviews—can significantly mitigate these risks. Further, comprehensive insurance coverage remains indispensable. When backed by robust policies that address business liability, professional liability, and cyber threats, you gain financial safeguards and peace of mind.

Additionally, ongoing training sessions for staff and contractors can empower everyone involved to handle any operational challenges more proficiently while reducing potential liability concerns.

In today’s dynamic business climate, understanding vicarious liability is more critical than ever. To ensure your coverage remains aligned with your evolving needs, consult with Torian Insurance about customized solutions that protect both your bottom line and reputation. With the right risk management strategies and a dependable insurance partner, you can confidently pursue your core business goals while minimizing the unexpected challenges posed by vicarious liability.