Life is full of uncertainties, and while we can’t predict the future, we can plan for it. Life insurance provides a safety net that helps your loved ones maintain their lifestyle if you’re not there to support them. Choosing the right coverage means ensuring that your family feels secure in challenging times.

How much life insurance do you need? A good starting point is 10x your annual income, but many families need a more accurate number based on real expenses and responsibilities. In this guide, you’ll learn how to estimate the right coverage using the DIME method (Debt, Income, Mortgage, Education), plus key factors like dependents, childcare costs, and existing savings. By the end, you’ll have a clear coverage range—and the next steps to choose a policy with confidence.

Why Life Insurance Matters

Life insurance is more than financial planning—it’s a commitment to protect the people who depend on you. In the event of your untimely passing, it helps cover everyday expenses, outstanding debts, and important milestones, ensuring your family can continue without drastic lifestyle changes.

Protecting Your Family’s Financial Stability

Without sufficient coverage, your family may struggle to replace lost income, handle daily expenses, or cover urgent costs such as final arrangements. Adequate life insurance eases these burdens and ensures continued stability.

The Impact of Insufficient Coverage

Consider a family losing their primary income earner without any financial backup. Bills accumulate, savings dwindle, and the family might face drastic measures such as selling their home or forgoing higher education. Life insurance prevents these outcomes by providing a financial cushion in the most critical moments.

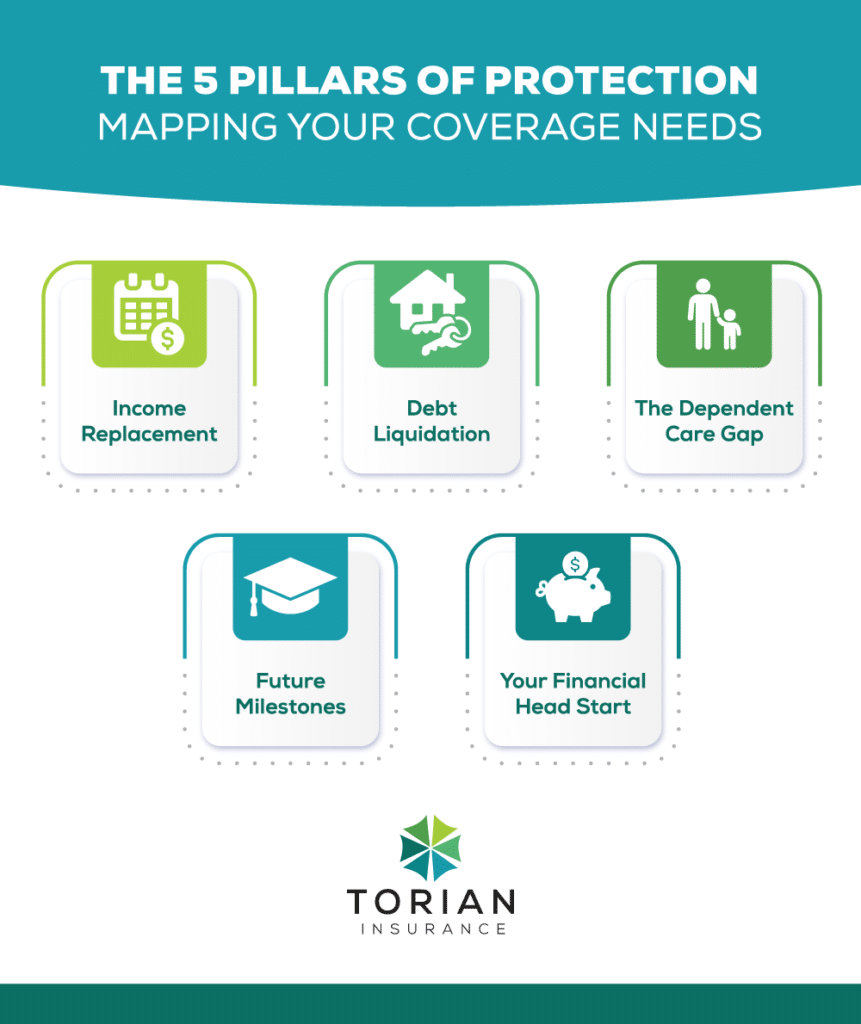

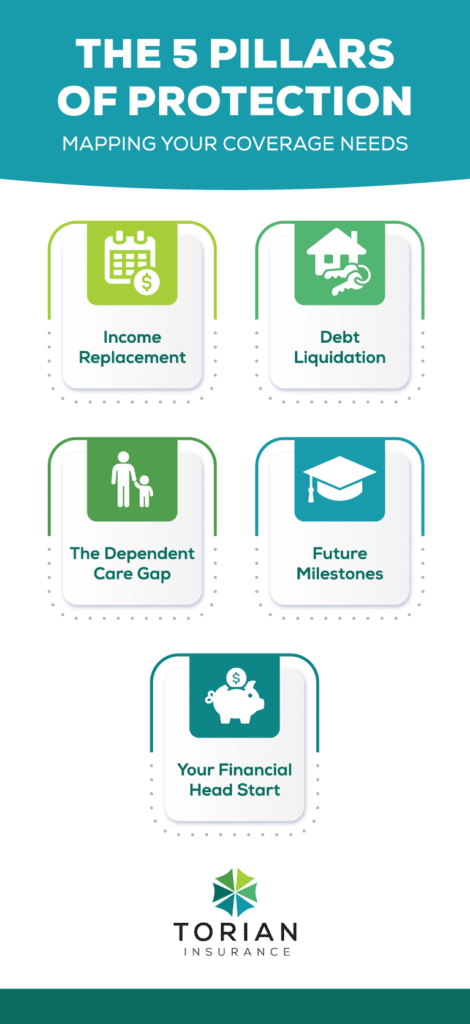

The Core Purposes of Life Insurance

Life insurance isn’t just about replacing income—it addresses a variety of financial needs that can arise during difficult times.

- Replacing Lost Income: Life insurance ensures the income supporting your family is replaced, covering everyday expenses and ongoing financial commitments. This is crucial not only for income earners but also for stay-at-home parents whose work has significant economic value.

- Paying Off Debts and Final Expenses: A good policy helps clear outstanding debts, including mortgages, auto loans, or credit card debt, so your family isn’t burdened with long-term liabilities. It can also cover final arrangements, easing the transition during a stressful time.

- Funding Future Goals: Beyond meeting immediate needs, life insurance can help with important long-term objectives such as covering children’s education or other family milestones over the years.

- Covering Medical and End-of-Life Costs: Some policies offer benefits that assist with medical and end-of-life expenses, ensuring that rising healthcare costs do not jeopardize your family’s future.

Key Factors That Determine Your Life Insurance Needs

Calculating your life insurance requirements starts with assessing your financial responsibilities and future goals.

- Income and Support Duration: Consider how many years your family will require financial support. This calculation should reflect both the loss of income and the ongoing needs of your dependents.

- Debts and Financial Obligations: Include all liabilities such as mortgages, auto loans, and credit card balances. Make sure your policy is large enough to cover these obligations, preventing any additional debt accumulation.

- Dependents and Their Needs: List all individuals who depend on you financially. Factor in daily living costs and any special expenses, including education needs or healthcare for those requiring ongoing support.

- Future Expenses: Account for future financial goals such as college tuition, significant life events, or retirement plans for your spouse. These considerations help you set a target for the necessary policy size.

- Existing Assets and Employer Coverage: Evaluate your current savings and investments, along with any employer-provided life insurance. These resources can partially offset the total amount needed from a personal policy.

Methods to Calculate Your Ideal Life Insurance Coverage

Finding the right coverage amount can seem daunting, but several methods simplify the process.

The 10x Income Rule

A common rule of thumb is that you should aim for coverage equal to 10x your income. This offers a quick estimate, though it may not account for every personal nuance.

The DIME Method

A more detailed approach is the DIME method:

- Debt: Total non-mortgage debts.

- Income: Your annual income multiplied by the number of years you want to provide financial support.

- Mortgage: Remaining balance on your home.

- Education: Estimated future education costs.

Adding these figures together can give a personalized estimate of the life insurance coverage you need.

Using Online Tools

Several online calculators and worksheets can further refine your estimate. They prompt you to input your income, debts, savings, and family size, providing a tailored recommendation.

By combining these methods, you can arrive at an estimate that best reflects your financial responsibilities.

Life Insurance for Different Life Stages

As your life evolves, so do your insurance needs. It’s important to adjust your coverage to match your circumstances.

- Early Career and Single Adults: Even if you’re young and single, consider a policy to cover any debts or unforeseen expenses. Buying early can secure lower premiums, providing benefits as financial responsibilities grow.

- Married Couples and Families: For those with dependents, life insurance becomes crucial to cover household costs, care expenses, and future educational needs. It ensures loved ones can maintain their standard of living if the unexpected occurs.

- Empty Nesters and Retirees: When children become self-sufficient and major debts decrease, your life insurance requirements might lessen. However, many people maintain coverage for final expenses or to support a surviving spouse and leave a legacy.

Common Life Insurance Mistakes to Avoid

Avoiding pitfalls is as important as choosing coverage. Here are key mistakes to steer clear of:

- Underestimating Your Needs: Relying solely on quick rules like “10x your income” can lead to insufficient coverage. Always factor in all financial obligations and long-term goals when estimating your policy size.

- Relying Only on Employer Coverage: Employer-provided life insurance is often limited and may end if your job changes. Supplementing it with an individual policy can better meet your long-term needs.

- Overlooking Non-Income Contributions: Even if a family member isn’t generating a paycheck, their household contributions have monetary value. Factor in any caregiving or domestic duties when determining your coverage.

- Delaying Coverage: Waiting can lead to higher premiums and potential health issues that make coverage more expensive. Early action locks in lower rates and ensures dependable protection.

- Failing to Update Your Policy: Significant life changes—such as marriage, the birth of children, or a new mortgage—require a review of your policy. Regular reassessment keeps coverage relevant.

Choosing the Right Life Insurance Policy

Selecting a policy requires understanding the available options and aligning them with your financial goals.

Term Life vs. Whole Life Insurance

- Term Life typically provides coverage for a specified period. It’s ideal for covering temporary needs such as income replacement or mortgage obligations. You might explore this coverage if cost-efficiency is a priority.

- Whole Life offers lifetime protection and includes a savings element that grows over time. If you want permanent coverage, you could consider this for a more comprehensive approach. Some whole life policies offer a cash value component that can be used during your lifetime.

Your choice depends on your financial objectives:

- During peak dependency years, term may be sufficient.

- For long-term protection and an investment element, whole life is appealing.

- Many families layer policies to tackle various coverage needs.

Working with an independent insurance agency can help in comparing options and identifying a policy that suits your budget and goals.

Frequently Asked Questions

Can I Have More Than One Policy?

Combining employer coverage with an individual policy or having multiple policies for different objectives is an option. This flexibility creates a more complete safety net for your loved ones.

How Can Life Insurance Support My Retirement Plans?

Certain permanent policies accumulate cash value, which can become a supplemental resource during retirement while still guaranteeing a death benefit for beneficiaries.

How much life insurance do I need if I have no kids?

You may still need coverage to pay final expenses, cover debts, or protect a spouse/partner who relies on your income. If no one depends on you financially and you have little debt, a smaller policy may be enough.

How much life insurance do I need with a mortgage?

Many people choose enough coverage to pay off the remaining mortgage balance, plus additional funds for income replacement and other debts so family members can stay in the home.

Is 10x income enough?

Sometimes, but it’s a rough estimate. It may miss things like childcare, college costs, and debt, or overestimate if you have significant savings. The DIME method is often more precise.

Do I need life insurance for a stay-at-home parent?

Often, yes. A stay-at-home parent provides services that can be expensive to replace, like childcare and household support. Coverage can help pay for those costs if the unexpected happens.

How much term length do I need (10/20/30 years)?

Pick a term that matches your biggest obligations. 10-year can fit short-term needs, 20-year is common for families with kids, and 30-year often works for younger families with long timelines (like a new mortgage).

What if my spouse also works?

Two incomes can reduce the amount needed, but not always. Consider whether your spouse could cover the household alone and whether costs like childcare would increase.

Does life insurance cover funeral costs?

Yes—benefits can typically be used for funeral and final expenses, along with other financial needs.

Can I change my coverage later?

Usually, but increases often require new underwriting and can cost more. Many people review coverage after major life events like marriage, kids, or a new home.

Next Steps: Get Started on Your Life Insurance Plan

Taking action is key to securing your family’s future. Here’s how to begin:

- Organize Your Financial Information: Gather details like income, debts, projected expenses, and long-term goals to get a clear picture of what you need.

- Compare Policy Options: Look beyond cost—assess the insurer’s reliability and how well their products align with your priorities. An independent agent can present multiple options to simplify this step.

- Seek Expert Guidance: Consult with knowledgeable professionals to design a plan specifically for you. Tailored coverage grows and adapts as your financial circumstances evolve.

- Act Now: The best time to secure a policy is today. Proactive planning guarantees that your loved ones remain protected, regardless of any future changes.

Protect Your Family with the Right Coverage

Life insurance is one of the simplest ways to protect the people who rely on you. When your coverage is sized correctly—taking into account your income, debts, mortgage, dependents, and future goals—you’re creating a plan that helps your family stay financially stable no matter what happens. If you’re not sure where to start, begin with a quick estimate using the 10x income rule or the DIME method, then refine it based on your real-world costs and existing savings or employer coverage.

At Torian Insurance, we’ll help you compare options and choose coverage that fits your goals and budget—without guessing or overpaying. Call us today to get a customized life insurance review and find the right policy for your family.