Insurance is not just a financial product—it’s a means to secure peace of mind in today’s unpredictable world. It helps protect your family, home, and business by limiting the financial impact of unexpected events. This guide simplifies insurance by breaking down its history, key types, core principles, and practical steps for choosing the right coverage. As you explore these concepts, learn how independent experts at Torian Insurance have been adapting solutions for the community since 1923.

The History and Evolution of Insurance

Insurance began as simple risk-sharing among merchants and has grown into a sophisticated industry addressing modern challenges. Understanding its evolution helps clarify why insurance remains essential today.

Early Beginnings: Marine and Fire Insurance

- Marine Insurance: In ancient maritime trade, merchants pooled resources to recover losses from goods damaged or lost at sea.

- Fire Insurance: As cities grew, fire risks became more significant, prompting specialized coverage to help property owners rebuild after disasters.

The Industrial Revolution and Changing Needs

During the Industrial Revolution:

- Factories and machinery introduced new risks.

- Insurance expanded to cover workplace injuries, machinery breakdowns, and property damage.

- Coverage became essential for both recovery and operational sustainability.

Growth in the United States

In the United States, the insurance market grew alongside technological, transportation, and economic advancements. This growth led to:

- A wide range of customized policies covering homes, vehicles, businesses, and professional services.

- A focus on tailoring coverage to meet the complex demands of modern life.

Types of Insurance: Personal, Commercial, and Specialty

Insurance solutions are broadly grouped into three categories, each addressing different needs.

Personal Insurance

Personal Insurance protects individuals and families from everyday risks. Key products include:

- Home Insurance: Safeguards your home against destruction from fire, storms, or theft.

- Car Insurance: Covers damages, liabilities, and medical expenses associated with accidents.

- Life Insurance: Provides financial support for your loved ones in the event of your passing.

- Health Insurance: Helps manage rising medical costs, covering everything from routine checkups to emergencies.

These policies can be customized with the help of independent agents to match your lifestyle and priorities.

Commercial Insurance

Businesses require specialized policies to cover operational risks. Common commercial products include:

- Business Liability Insurance: Protects against lawsuits or accidents occurring on your premises.

- Commercial Property Insurance: Covers damage to business property such as buildings and equipment.

- Workers’ Compensation: Ensures benefits for employees injured on the job.

- Cyber Liability Insurance: Mitigates risks related to data breaches and cyberattacks.

Consulting with an independent agent can help tailor policies to address your business’s unique risks.

Specialty Insurance

For unique or uncommon risks, specialty insurance covers the gaps:

- Kidnap and Ransom Insurance: Supports individuals or businesses operating in high-risk areas.

- Vacation Rental Property Insurance: Offers coverage options not typically included in standard homeowners policies.

- Event Insurance: Protects against cancellations, damages, or accidents during special events.

7 Core Principles of Insurance

Understanding the foundational principles of insurance is crucial for making informed decisions about coverage. Here are the seven key principles:

1. Principle of Utmost Good Faith

This principle mandates transparency and honesty from both parties in an insurance contract. The insured must disclose all relevant facts that might affect the insurer’s decision, and the insurer must provide clear terms and costs. This commitment to utmost good faith is fundamental to every policy.

2. Principle of Insurable Interest

The insured must have a financial stake in the risk insured against. This ensures that insurance policies are taken only for legitimate financial interests, not speculative or gambling purposes.

3. Principle of Indemnity

Insurance should restore the financial position of the insured to what it was before a loss, without resulting in a profit. This prevents overcompensation and supports realistic coverage.

4. Principle of Contribution

If an individual holds multiple policies for the same risk, this principle ensures each policy contributes proportionally to cover the loss, preventing over-insurance and redundant payouts.

5. Principle of Subrogation

This principle allows the insurer to pursue a third party responsible for a loss after compensation has been paid. It helps recover costs and maintains fairness by ensuring the liable party bears the loss.

6. Principle of Loss Minimization

Both insurer and insured should work together to minimize the risk of loss or damage. The insured is expected to take reasonable steps to prevent or mitigate potential losses.

7. Principle of Causa Proxima (Proximate Cause)

When multiple perils contribute to a loss, the insurer determines liability based on the proximate cause—the most direct and dominant cause of the loss—ensuring clear and fair claim settlements.

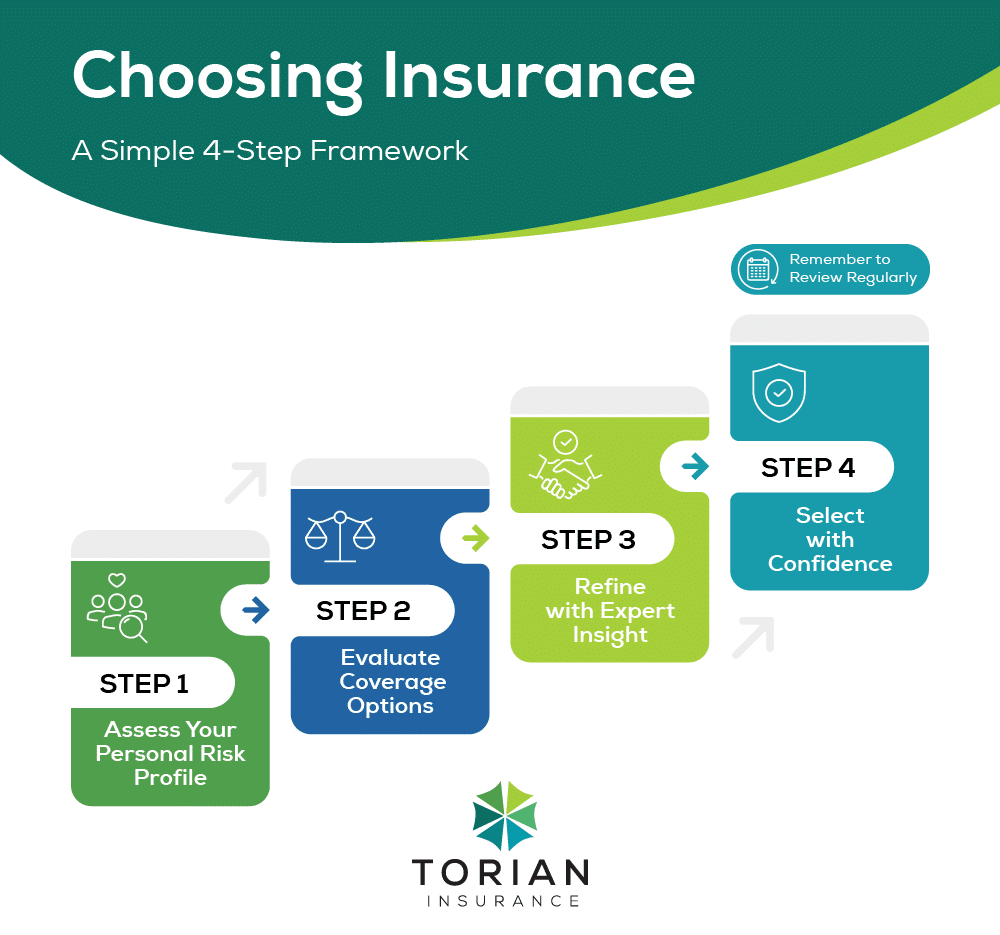

How to Choose the Right Insurance Coverage

Selecting the right insurance can be straightforward with a systematic approach. Follow these steps:

- Identify Your Risks: List potential risks—such as natural disasters for homeowners or cyber threats for businesses.

- Understand Your Needs: Consider which policies (e.g., Health, Home, Car) best address your unique risks.

- Set a Budget: Balance comprehensive coverage with affordability by evaluating premium costs, deductibles, and potential out-of-pocket expenses.

- Compare Options: Evaluate policy details, such as limits, coverage features, and exclusions, to determine the best value.

- Review Policy Exclusions: Identify any coverage gaps (for example, flood or earthquake risks) and consider supplemental policies if needed.

- Seek Expert Guidance: Independent agents, like those at Torian Insurance, offer local expertise and unbiased advice.

- Review Regularly: Update your policies after major life events to ensure your coverage stays relevant.

This method ensures your insurance coverage is comprehensive and tailored to your personal circumstances.

The Benefits of Working with Independent Insurance Agents

Independent agents differ from captive agents by offering a broader perspective and personalized service. Key benefits include:

- Access to Multiple Providers: They compare options across many insurers to ensure competitive pricing and comprehensive coverage.

- Personalized Service: Local expertise offers insights into community-specific challenges.

- Customized Solutions: Policies can be mixed and matched to address individual or business needs.

- Unbiased Advice: Independent agents work solely in your interest, ensuring their recommendations align with your needs.

At Torian Insurance, an independent approach ensures you benefit from a wide network of carriers and personalized recommendations, helping to match your coverage to your unique requirements.

Why Choose Torian Insurance

Torian Insurance has been a trusted partner in the community for over a century. Here’s why clients consistently choose our services:

- Deep Community Connection: Established in 1923, we are well attuned to the challenges faced in Southern Indiana, Illinois, and Kentucky.

- Tailored Solutions: Every policy is customized to fit individual needs—whether for life, home, or cyber liability insurance.

- Extensive Provider Network: As an independent agency, we have access to multiple carriers to secure the best possible coverage at competitive prices.

- Client-Centered Approach: We emphasize long-term security by fostering relationships that evolve with your changing needs.

- Century-Long Experience: Our longstanding legacy of innovation and community service underpins our commitment to protecting what matters most.

- Custom Insurance Solutions: We pride ourselves on providing coverage that caters to the unique circumstances of each client.

Ensuring Future Stability with Comprehensive Coverage

Insurance is a cornerstone of financial security, providing protection for your home, car, health, and business. With a clear understanding of its history, core principles, and various types, you are well-equipped to choose the right coverage that fits your lifestyle and needs. When you consider that about one in 20 insured homes in the U.S. files a claim each year, it becomes evident how crucial the right policy can be for safeguarding your future. Effective coverage goes beyond merely paying out after a loss; it stands as a vital tool for stability and continuity in times of crisis.

Ready to secure your future? Contact Torian Insurance today to explore custom insurance solutions designed to protect your unique needs. Let our experience, community roots, and dedication pave the way for the peace of mind you deserve.