Car insurance is more than just a legal requirement—it’s a crucial financial safety net that protects you from unexpected expenses due to accidents, damage, and liability. With the right policy, you gain financial security and peace of mind. Yet, choosing a provider isn’t easy; you must understand your needs, compare options, and select a policy that offers both comprehensive coverage and affordability. In regions like Southern Indiana, Illinois, and Kentucky, independent agencies such as Torian Insurance provide tailored coverage by partnering with multiple carriers, ensuring you get the best match for your needs.

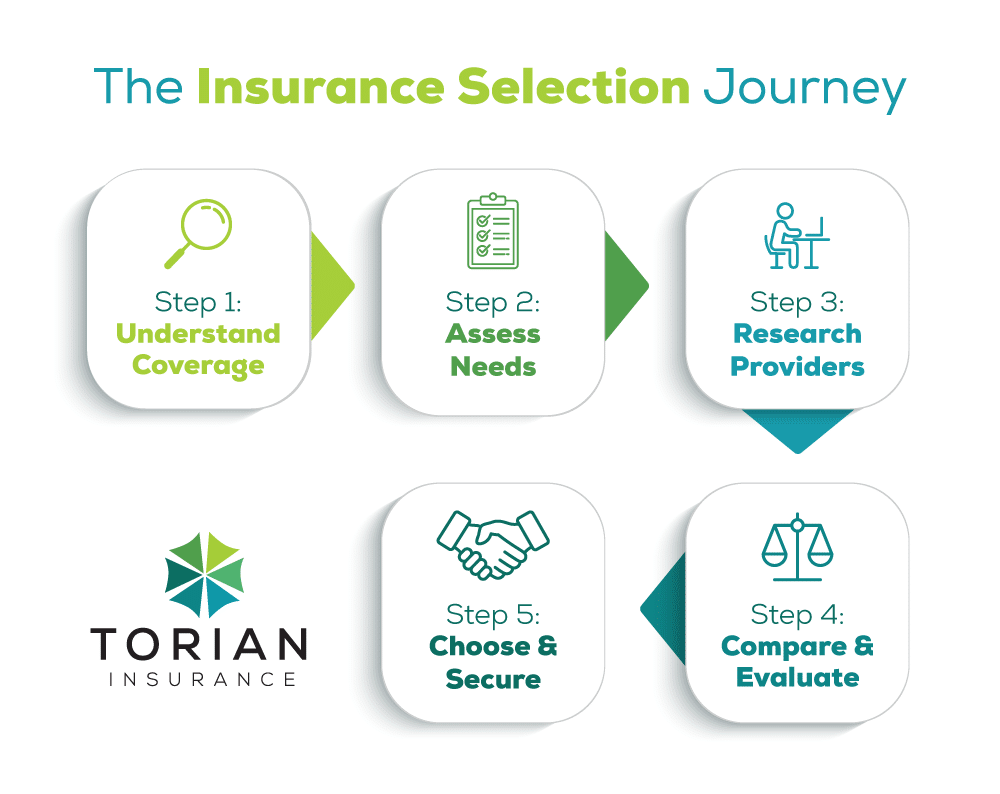

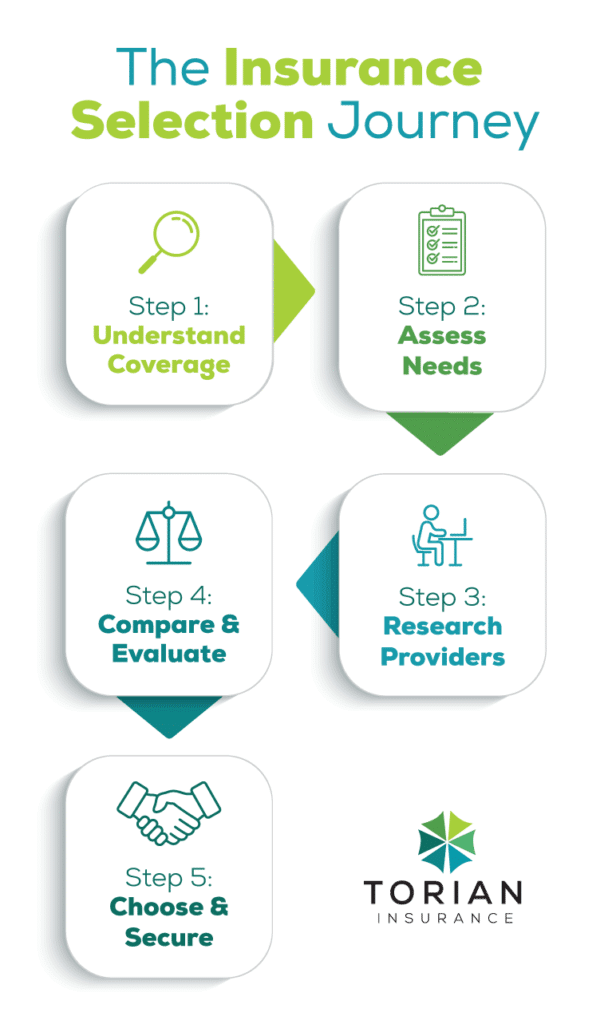

This guide outlines key steps to help you choose the right car insurance provider by understanding essential coverage options, assessing your personal requirements, and making a measured decision based on value and service.

Understand the Different Types of Car Insurance Coverage

Before choosing a provider, it’s essential to know what types of coverage are available and how they protect you:

Liability Coverage

Liability coverage protects you financially if you cause an accident. It is legally required in most states and covers two main areas:

- Bodily Injury Liability: Pays for medical expenses and lost wages for others injured in an accident you cause.

- Property Damage Liability: Covers the repair or replacement of damaged property, including vehicles and structures.

Opting for limits higher than the state minimum is strongly recommended for better protection in severe accidents. State minimums are often insufficient to cover the full costs of a serious accident, potentially leaving you personally responsible for significant expenses, including medical bills, property damage, and legal fees that exceed your coverage limits.

Comprehensive and Collision Coverage

These coverages protect your own vehicle:

- Collision Coverage: Covers repairs or replacement of your car after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision damages such as theft, vandalism, or natural disasters.

Although not legally required, these coverages are recommended for newer or higher-value vehicles, and they may be required by lenders.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if an at-fault driver lacks sufficient insurance. It helps cover expenses like vehicle repairs and medical bills when the other driver’s policy falls short or is absent entirely.

Personal Injury Protection (PIP) or Medical Payments Coverage

PIP and Medical Payments Coverage help with immediate medical costs following an accident:

- PIP(Personal Injury Protection): Can cover medical expenses, lost income, and additional related costs.

- Medical Payments Coverage: Focuses solely on immediate medical expenses for you and your passengers.

Understanding these options helps you create a policy that fits your specific needs and mitigates potential financial risks.

Assess Your Car Insurance Needs

Your ideal policy should reflect your driving habits, vehicle type, and personal circumstances.

Consider Your Driving and Vehicle Use

Examine your typical driving patterns:

- Frequency and Environment: Daily commuters or drivers in busy areas face higher risks than occasional drivers on quiet roads.

- Vehicle Value and Use: For new or high-value vehicles, comprehensive and collision coverage provide essential protection. Those using vehicles for work may require specialized policies.

Account for Local Requirements and Special Circumstances

Different states have varying legal requirements. Ensure your policy meets local standards and consider any unique factors, such as:

- Teen Drivers or Multi-Vehicle Households: These may affect premium costs and coverage needs.

- Changes in Lifestyle: Updates such as adding new drivers or changing driving habits mean your coverage needs might evolve over time.

By aligning your policy with these factors, you avoid overpaying for unnecessary coverage while ensuring you are adequately protected.

Research and Compare Insurance Providers

Once you’ve determined the necessary coverage, it’s time to narrow down your provider options.

Evaluate Reputation and Financial Stability

Research the reputation of potential insurers by:

- Reading customer reviews and ratings.

- Checking the financial stability of providers through established rating agencies. A provider with strong customer service and a solid financial stability is more likely to handle claims efficiently when needed.

Compare Quotes and Coverage Options

Request quotes from different providers for similar coverage, and compare:

- Premium costs versus deductibles.

- Additional benefits or discounts offered by each provider.

Take note that the cheapest option may not offer the necessary coverage. Look for a balance of cost, comprehensive coverage, and strong service.

Consider the Benefits of an Independent Insurance Agent

Working with an independent agent can streamline the process. Independent agents:

- Represent multiple insurance carriers, offering more options.

- Provide unbiased advice based solely on your needs.

- Offer personalized service and local expertise, ensuring your policy suits regional requirements and personal circumstances.

See how you can get better rates with an independent insurance agent.

Evaluate Policy Cost and Value

While cost is a key factor, value is determined by both the coverage you receive and the reliability of the provider.

Understand Premium Influences

Premium costs are affected by a variety of factors that help insurers assess risk:

- Driving History: A clean record with no accidents or violations typically leads to lower rates. Tickets or past claims can significantly increase premiums.

- Vehicle Characteristics: The make, model, year, safety features, and even the likelihood of theft for your vehicle can influence your premium. More expensive or high-performance cars generally cost more to insure.

- Location and Mileage: Where you live and park your car, as well as how much you drive, impacts your rate. Urban areas with higher traffic density, crime rates, or severe weather tend to have higher premiums than rural areas. Lower annual mileage can sometimes qualify you for discounts.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage begins) usually results in a lower premium.

- Age and Experience: Younger, less experienced drivers often face higher premiums than older, more experienced drivers, although rates can increase for very senior drivers as well.

- Coverage Levels: The types and amounts of coverage you choose directly impact your premium; more comprehensive coverage and higher limits mean higher costs.

Taking Advantage of Discounts: Don’t miss out on opportunities to lower your premium. Many insurers offer discounts for various reasons, such as:

- Bundling multiple policies (like car and home insurance).

- Having a safe driving record.

- Insuring multiple vehicles.

- Having safety features or anti-theft devices in your car.

- Being a good student (for young drivers).

- Completing a defensive driving course.

- Low annual mileage.

Balance Affordability with Adequate Coverage

Buying the cheapest policy may mean sacrificing essential coverage. Instead, focus on:

- Choosing a deductible that fits your budget. Understand how deductibles work in this guide to car insurance deductibles.

- Taking advantage of discounts, such as those for multi-policy bundles.

- Ensuring the policy covers all your risks without leaving gaps that could lead to expensive out-of-pocket expenses.

A well-rounded policy balances affordability with comprehensive protection, providing long-term security and value.

Importance of Customer Service and Claims Support

Effective customer service is critical, especially when you need to file a claim.

A Streamlined Claims Process

Look for providers that offer:

- 24/7 claims support.

- Simplified documentation requirements.

- Quick, hassle-free claims resolution.

A smooth claims process can reduce stress and get you back on the road faster after an accident.

While you hope you never need to file a claim, knowing the process can ease stress if an accident occurs. Typically, it involves:

- Reporting the Incident: Notifying your insurance provider as soon as possible after an accident or damage occurs, providing details and any gathered information (like photos or other parties’ contact/insurance information).

- Claim Investigation: The insurer assigns a claims adjuster to review the details, assess damages, and determine coverage.

- Repair Estimates: Getting estimates for repairs to your vehicle. Your insurer may have a preferred network or process for this.

- Settlement: Once the claim is approved and costs are agreed upon, the insurer pays for covered damages, minus your deductible.

A provider with efficient, accessible claims support can make a significant difference during this time.

Personalized, Local Support

Local insurers or independent agents bring additional advantages:

- They understand regional risks and can offer solutions tailored to those challenges.

- Their personalized approach ensures you’re treated as more than just a policy number.

- In-person assistance can make a significant difference during emergencies.

Choosing a provider with a reputation for excellent customer service and efficient claims handling is just as important as the policy details.

Don’t Set It and Forget It: Review Your Policy Annually

Car insurance isn’t a one-time decision. Your life, your vehicle’s value, and insurance options change over time. Make it a habit to review your policy at least once a year, or whenever you experience a significant life event such as:

- Buying a new or used car.

- Adding or removing drivers from your policy (like a teen driver getting their license or a child moving away).

- Moving to a new address.

- Changing your daily commute or annual mileage.

- Making significant modifications to your vehicle.

- Changes in your financial situation (e.g., purchasing a home or other assets that need protection).

An annual review with your agent ensures your coverage levels are still appropriate, you’re taking advantage of all eligible discounts, and you’re not paying for coverage you no longer need (like comprehensive/collision on an older, low-value car). It’s also a good opportunity to compare rates again and ensure you’re still getting competitive pricing and excellent service.

Your Path to Peace of Mind on the Road

Choosing the right car insurance provider is about securing dependable financial protection and peace of mind. By understanding the various types of coverage, assessing your individual needs, and comparing provider options based on value and service, you can make a well-informed decision. Independent agents, such as those at Torian Insurance, offer access to multiple carriers and personalized advice, ensuring your policy is precisely tailored to your situation.

Ready to secure car insurance that truly protects what matters most? Contact Torian Insurance to explore personalized options, competitive rates, and comprehensive support tailored for you and your community.