Navigating insurance costs can feel overwhelming. You may come across advertisements promising “lowest rates,” yet when you gather actual quotes, premiums can differ significantly. Why such large variations? Are you paying more than you should? And how can you lower your premiums while still getting the right coverage?

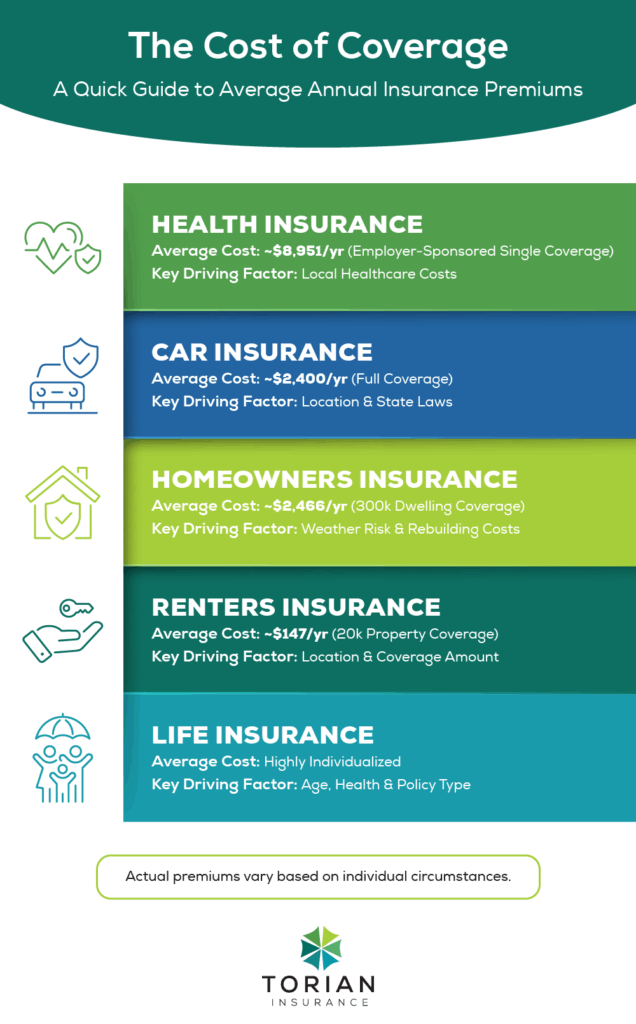

In this article, we will look at the average insurance costs for five essential types of insurance—health, car, homeowners, renters, and life insurance—and explore the key factors behind these premiums. We will also highlight how working with an independent agency, like Torian Insurance, can help you find customized, cost-effective solutions that meet your unique needs.

Understanding Why Insurance Costs Matter

Insurance protects your finances and personal assets, but premiums can strain your budget if you’re not prepared. Knowing the average rates and the variables influencing them can give you better leverage when shopping for a policy. Where you live, your demographics, and general underwriting practices can all affect how insurers price these plans.

Staying informed not only helps you negotiate for the best deal but also ensures your coverage matches your current circumstances. This knowledge can prevent both underinsurance (leaving you vulnerable to major financial losses) and overinsurance (paying for unnecessary coverage). An independent agent specializes in offering custom solutions that align with your goals and financial constraints.

Health Insurance Premiums

Health insurance is often a substantial expense for individuals and families. On average, employer-sponsored plans cost about $8,951 per year for single coverage and $25,572 for family coverage. Note that this figure reflects only premiums; deductibles, copays, and other out-of-pocket costs add to your total expenditure.

Key Factors Driving Costs

Health Insurance rates depend on several elements:

- Local healthcare access and the cost of medical services.

- The prevalence of chronic conditions in your area.

- Whether the plan is through an employer or purchased independently.

Some states exhibit higher premiums than others. For instance, in certain markets where healthcare costs are high, a single-coverage plan might approach $9,800 per year. On the lower end, single coverage in other regions can hover closer to $8,500. During open enrollment, it is wise to reevaluate your coverage, keeping changes to your personal health needs and local market conditions in mind.

Car Insurance Rates by State

Car insurance is vital not just as a legal requirement in most states, but also as a safeguard against significant financial losses. High-traffic urban areas, places prone to severe weather, and areas with a large number of uninsured drivers typically see steeper premiums. Nationally, the average annual premium for a full-coverage policy hovers around $2,400, although your rate depends on individual factors like your driving history, vehicle type, and ZIP code.

Primary Influences

Several aspects shape Car Insurance rates:

- Accident rates and overall traffic density.

- Climate and natural disaster risks.

- Mandated insurance minimums and state laws.

For example, Florida is known for elevated insurance premiums, partly due to Florida’s no-fault law. According to Bankrate’s analysis of Florida car insurance, full-coverage policies can average around $3,864 per year. Conversely, states like Maine, Texas, and California see differing rates based on regional factors — for example, Maine’s full-coverage premiums average around $1,631 per year, while Texas averages about $2,601 and California approximates $3,108 per year.

Illustrative Comparison: Sample Car Insurance Premiums by State

Below is a simplified text-based snapshot showing approximate yearly costs for full coverage in several states. Actual quotes vary based on personal factors, so consider this just a quick visual reference:

- Florida: around $3,864

- Maine: around $1,631

- Texas: around $2,601

- California: around $3,108

These figures highlight how location can significantly affect what you pay.

Homeowners Insurance Costs

Protecting your residence is crucial. For a property with $300,000 of dwelling coverage, homeowners insurance rates vary widely depending on factors like location and rebuilding costs. According to Bankrate’s analysis, the average reaches an average of roughly $2,466 for $300,000 worth of coverage.

Risk and Rebuilding Factors

Homeowners Insurance premiums often rise in areas prone to:

- Hurricanes, tornadoes, wildfires, or other disasters.

- Higher rebuilding costs (including labor and materials).

An important step is matching your policy’s coverage limit to your home’s replacement cost, not just its market value. If you’ve made improvements or renovations, re-evaluate your coverage levels. Staying current on rebuilding expenses reduces the chance of being underinsured in a worst-case scenario.

Renters Insurance Coverage: Affordable Safeguards

Renters insurance, often overlooked, provides robust protections for your belongings at a very affordable price. It runs an average of about $147 per year based on a policy with $20K of personal property coverage, according to MoneyGeek’s findings. Despite the low cost, it can save you thousands if your property is damaged or stolen.

What a Standard Policy Covers

- Personal belongings against theft, fire, and certain water damages.

- Liability protection if a guest is injured in your rental.

- Additional living expenses if a covered event displaces you temporarily.

Notably, your landlord’s insurance typically covers only the building structure, not your personal items.

Life Insurance: Coverage Tailored to Your Needs

Life insurance is meant to secure the financial future of your dependents in the event of your passing. Premiums are highly individualized, determined by age, health status, and desired coverage level. Term life coverage is often more affordable than permanent insurance, but the “ideal” policy depends on your unique situation.

Key Influencers

When selecting a policy, assess what your family may require to maintain their lifestyle, pay off debts, or fund future expenses. If you need assistance in reviewing carriers and their offerings, our team can help you compare multiple options.

Regional Insurance Insights for Indiana, Illinois, and Kentucky

Living in the Southern Indiana, Illinois, or Kentucky regions carries its own set of unique insurance considerations. While these states may not experience the same frequency of hurricanes or tropical storms as coastal areas, seasonal storms and changing weather patterns still pose risks to homes, businesses, and automobiles. Here are several region-specific insights:

- First, the Ohio River Valley and surrounding areas can be prone to flooding and occasional severe thunderstorms. If you own a home along low-lying areas or near riverbanks, you might need supplemental flood coverage because standard homeowners insurance does not typically include flood protection. This additional policy can be crucial in mitigating losses from water damage.

- Second, winter storms can drive up claims for roof damage or burst pipes. In particular, Indiana residents living in rural or exposed locations often pay slightly higher car insurance and homeowners insurance premiums if they are far from emergency services. Taking precautions—like winterizing your home or installing weather-resistant roofing—can help reduce long-term costs.

- Additionally, agricultural and rural enterprises in Illinois and Kentucky frequently require specialized commercial insurance coverage to protect heavy machinery and storage facilities. These policies can vary greatly based on the total acreage, the type of crops or livestock involved, and the commercial vehicles in use. By customizing coverage with an independent agent, farm owners can ensure they only pay for what they need without overlooking vital protections.

- Finally, population density also plays a role. Larger cities in Indiana, such as Evansville or Indianapolis, may see higher car insurance rates compared to more rural communities. This discrepancy reflects traffic congestion, theft risks, and the potential for more frequent accidents within urban centers. Keeping a clean driving record and taking advantage of discount programs can help moderate these expenses.

Overall, while Southern Indiana, Illinois, and Kentucky do not always top the national lists for the highest or lowest insurance premiums in America, they have distinct regional factors that influence varied pricing. Staying aware of localized risks, from flood plains to severe winters, enables you to tailor your coverage more effectively. Regular policy reviews ensure you remain prepared for changing seasonal patterns, infrastructure developments, and local market shifts.

Your Action Plan for Lower Premiums and Smarter Coverage

The most common insurance mistake is setting a policy and forgetting it, which often leads to overpaying for outdated coverage. By being proactive, you can avoid costly pitfalls and ensure your protection aligns with your life. This checklist will help you manage costs and coverage with confidence.

- Conduct an Annual Policy Review. Life changes, and your insurance should too. Set a yearly calendar reminder to review your policies. Major events like moving, getting married, or renovating your home can alter your needs, and an annual check-in prevents you from being over or underinsured.

- Compare Multiple Carriers. Loyalty doesn’t always guarantee the best price. The insurance market is competitive, so the carrier that was cheapest last year might not be today. Periodically gathering quotes from different insurers ensures you’re still getting a competitive rate.

- Bundle Your Policies for Significant Discounts. Insurers often provide a substantial discount (up to 25%) when you buy multiple policies from them, such as home and auto. Bundling is one of the easiest ways to lower your total insurance costs while simplifying payments.

- Strategically Adjust Your Deductible. Raising your deductible—the amount you pay out-of-pocket on a claim—will lower your premium. For instance, increasing a deductible from $500 to $1,000 can lead to noticeable savings. Just be sure to select a deductible you can comfortably afford on short notice.

- Ask for Every Available Discount. Insurers offer a wide range of discounts that many people overlook. Don’t wait for them to be offered; ask directly about potential savings for having a clean driving record, installing a home security system, being a good student, or belonging to certain professional groups.

- Improve Your Personal Risk Profile. Insurers reward lower risk with lower rates. Maintaining a clean driving record is key for auto insurance. For life and health policies, improving your health by quitting smoking or managing a chronic condition can lead to significant long-term savings.

- Understand Your Policy’s Exclusions. A costly pitfall is not knowing what your policy doesn’t cover. Read the fine print to understand exclusions and conditions. For example, standard homeowners policies rarely cover floods or earthquakes, so you may need separate coverage if you live in a high-risk area.

- Use Expert Guidance. You don’t have to navigate this alone. An independent insurance agent is an invaluable ally who can compare policies from dozens of carriers for you. They help identify coverage gaps, find discounts, and ensure you get the best value, saving you time and preventing costly mistakes.

Emerging Trends in Insurance Costs

Rapid technological and economic changes continue to impact insurance. Telematics in car insurance rewards careful drivers with lower premiums; some health insurers offer discounts for meeting activity goals via wearable devices. Meanwhile, severe weather events cause insurers to adjust how they assess risks and price policies.

Changes in construction costs, supply-chain disruptions, and shifts in economic policy can all influence premiums. Keeping in regular contact with an expert—such as an independent insurance agent—can help you adapt to these developments. You can also explore best practices recommended by the Independent Insurance Agents guide from the National Association of Insurance Commissioners to stay informed about consumer rights and policy structures.

Navigating Insurance Costs with Confidence

Comparing your insurance costs to national and state averages can help you identify opportunities for improvement. Whether you need coverage for health, car, homeowners, renters, or life insurance, being proactive about your policy options can lead to substantial savings. Bundling policies, increasing deductibles, and carefully evaluating coverage needs are just a few strategies for driving down costs.

Ready to see how you can save? Contact Torian Insurance today for customized guidance. We’ve specialized in community-focused coverage for over a century, offering the personalized touch only an independent agency can provide. Reach out now for a free, no-obligation consultation and discover how you can protect your assets affordably and confidently with Torian Insurance.